- “15-minute city” or a Trojan horse?

- The S&P 500 can’t master this key level

- How to play AI — whether it’s a bubble or not

- King of the castle: For only $37,000 (and change)

- The reception our makeover is getting.

![]() Control Freaks and “15-Minute Cities”

Control Freaks and “15-Minute Cities”

The “green” agenda is nothing if not ambitious.

The “green” agenda is nothing if not ambitious.

“Those yelling the loudest about climate change,” says Paradigm’s Jim Rickards, “want to destroy the oil and natural gas industry, destroy nuclear power plant construction, shut down coal-fired plants, end coal mining, mandate electric vehicles (EVs) on very short deadlines and eliminate gas stoves in your kitchen, fireplaces and even outdoor barbecues.”

We kid… but the stakes are enormous.

Case in point: “The 15-minute city.”

Case in point: “The 15-minute city.”

“The greenies,” says Jim, “want to mandate ‘15-minute cities’ where you can walk everywhere in town within 15 minutes, which means you won’t need your car to visit a doctor, dry cleaner, grocery store, pharmacy or any of the other locations we routinely visit for errands and necessities.

“That may sound attractive if you chose it voluntarily. That’s not what the greenies have in mind. They want 15-minute cities as a Trojan horse to eliminate automobiles entirely and force you to ride bicycles or use public transportation. In the end, you’ll need a permit to fly to another city.

“The permits will be rationed and you’ll have to put yourself on a waiting list until your turn. You can pay for your ticket with the new central bank digital currency (CBDC), assuming your social credit score is high enough and you didn’t vote for the wrong candidate in the last election.

“In short, the climate change agenda is not about climate change. It’s about total political and economic control of the population.”

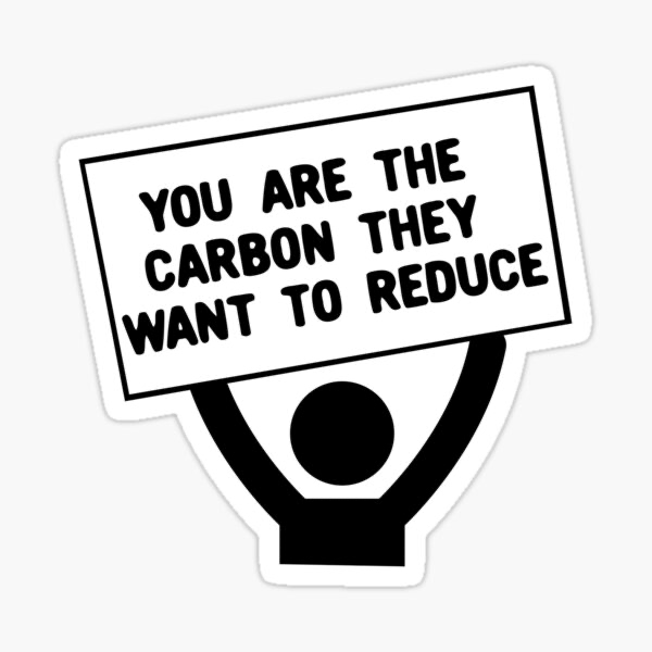

Dystopian, right? But as I’ve been saying since 2015, it’s not about “carbon” or even about “climate” — it’s about control.

Or as many a meme has been saying in more recent years…

The good news is that “as decades roll by and scare stories are discredited time and again, public skepticism will rise and the alarmists will lose credibility,” says Jim.

The good news is that “as decades roll by and scare stories are discredited time and again, public skepticism will rise and the alarmists will lose credibility,” says Jim.

“The danger is that alarmists may pass legislation, limit choices and impose costs in the name of climate change before the public catches on to the scam. At that point, the economic damage becomes semi-permanent even if alarmism fades.”

That’s a bad scenario. A better scenario — one posited by the Substack writer who goes by the pseudonym Doomberg — is that people’s tolerance for a rickety power grid and costly transportation is limited.

Americans by and large like it when the lights turn on and they can raise kids in single-family homes and they can take a long trip using the Interstate Highway System. It’s inevitable that they’ll start pushing back as those things become less attainable. The only question is what’s the pain point at which a critical mass of people says “no” and the control agenda is forever discredited.

But that’s in the future: Of more immediate concern is how the White House is manipulating fossil-fuel supply in the Strategic Petroleum Reserve. Jim Rickards has been warning for several days now about a scheme he believes is nothing less than a ruse to “steal” the 2024 election. And a key turning point comes just before the clock strikes midnight tonight.

Jim is keen to help you prepare… and to profit. Follow this link and he’ll lay out everything that’s at stake.

![]() Stock Market Gets a JOLT

Stock Market Gets a JOLT

Whelp, the key level of 4,200 on the S&P 500 wasn’t able to stick. Is it because the job market is still super-strong?

Whelp, the key level of 4,200 on the S&P 500 wasn’t able to stick. Is it because the job market is still super-strong?

In recent months, Wall Street has been paying closer attention to a metric from the Labor Department called JOLTS — short for “job openings and labor turnover.” A high number of job openings means that employers are having trouble filling available positions and the labor market is tight.

The April figures are out this morning, revealing 10.1 million job openings — way more than expected. In fact, the number is higher than the highest guess among dozens of economists polled by Econoday.

So yes, the labor market is still tight. Thus, the futures market now assigns a 71% probability the Federal Reserve will jack up short-term interest rates two weeks from today — bringing the fed funds rate to 5.5%. Once more, so much for a “pause.”

The point is that higher rates translate to less EZ money sloshing around Wall Street…

… which translates to a stock-market sell-off today. At last check, all the major U.S. indexes are in the red by about three-quarters of a percent.

… which translates to a stock-market sell-off today. At last check, all the major U.S. indexes are in the red by about three-quarters of a percent.

The S&P 500 has shed 33 points, resting for the moment at 4,172. Once again, the 4,200 level has proven to be a powerful ceiling.

Precious metals are steady as she goes — gold at $1,964 and silver at $23.47. Crude is sinking further — now $68.54, back to early-May lows.

![]() How to Play AI — Whether It’s a Bubble or Not

How to Play AI — Whether It’s a Bubble or Not

“Every bubble needs a catalyzing moment,” says Paradigm chart hound Greg Guenthner.

“Every bubble needs a catalyzing moment,” says Paradigm chart hound Greg Guenthner.

As he sees it, the reaction to Nvidia’s quarterly numbers last week might be the catalyst for an AI bubble. As we mentioned at the time, NVDA jumped 25% in a day on the back of its forecast that AI will drive more demand for the company’s chips.

“Occasionally,” says Greg, “you’ll see a thinly traded microcap double overnight due to unexpected news. Or maybe a stock will rocket higher following a buyout. But to see NVDA — which was already a top-10 stock by market cap — soar nearly 30% after hours following a guidance raise is total insanity.”

Even though NVDA is pulling back 4.5% amid today’s sell-off, it’s still up an eye-watering 165% year-to-date.

Is this just the beginning — not just for NVDA but for all the other AI-adjacent mega-caps like Microsoft and Alphabet? To say nothing of the AI-focused small fry like C3.ai?

“We won’t know until we have the benefit of hindsight,” says Greg — “but in order to profit from these emerging trends, you need to know roughly where we are in these market cycles, as well as how similar scenarios have typically played out in the past.” So follow along…

“It’s hard to believe, but NVDA was not a stock anyone wanted to own last year,” Greg reminds us.

“It’s hard to believe, but NVDA was not a stock anyone wanted to own last year,” Greg reminds us.

“In fact, NVDA lost almost 70% of its value from its apex in late 2021 until it bottomed out in early Q4 2022. Crypto mining had tanked, demand for the company’s higher-priced units was soft and (most importantly) no one wanted anything to do with tech stocks.”

And now? “In a vacuum, nothing is fundamentally different with the company. And the stock is expensive by almost any metric we can concoct. Instead, investors’ perceptions of NVDA and its potential are the main forces at work here.”

➢ This illustrates an important point I can’t emphasize enough: Of course NVDA is wildly overvalued right now. But assets that are overvalued can become even more If it were a just world, NVDA would trade for a fraction of its current share price. But it’s not always a just world and you can’t afford to act as if it is. (If you’re already independently wealthy and content to sit on your gold or Bitcoin indefinitely, feel free to ignore me.)

So what’s next for AI? Greg has no desire to call either the start or the end of a bubble — that’s a fool’s game.

The wise approach right now is to watch “for a rotation into the smaller names when NVDA begins to consolidate its earnings bump. I suspect traders will be itching to dive into the next hot AI stock as soon as NVDA slows down, fueling a rotation into other names in the space.

“We should also watch to see how NVDA and some of the other big-name players in the space digest their respective gains. Sideways corrections — rather than sharp pullbacks — would indicate the underlying trend remains strong.

“If that’s the case, buying bounces off support will be a great way to get involved without chasing any of the big gaps higher.”

![]() The Ultimate Fixer-Upper

The Ultimate Fixer-Upper

It’s a bargain, but it needs work: You can buy your own island castle on 40 acres for a mere $37,000 — as long as you’ve got another $15 million to drop on upgrades.

It’s a bargain, but it needs work: You can buy your own island castle on 40 acres for a mere $37,000 — as long as you’ve got another $15 million to drop on upgrades.

Brough Lodge is located in the Shetland Islands, 110 miles off the coast of Scotland. It was built in 1820 by a businessman named Arthur Nicolson, “based on architecture he had seen while travelling in France, Switzerland and Italy,” according to the BBC.

The castle stayed in the family until 2007 — when upkeep proved to be too much for the last Nicolson heir. She transferred ownership to a trust.

No castle is complete without folly towers, a courtyard and walled gardens — and Brough Lodge has all of them [Brough Lodge Trust photo]

The Brough Lodge Trust is counting on a “philanthropic entrepreneur” to take the joint off its hands — and to perform the upgrades on its terms.

“Their proposals would retain the existing building,” says the Beeb, “as well as creating 24 bedrooms and a restaurant…

“As well as enjoying sweeping views of the North Sea, guests at Brough Lodge would have the opportunity to do yoga and textile classes, and experience Shetland traditions of knitting and weaving.”

No matter who emerges as a buyer, one thing’s for sure: Between the cost of heating this pile of rocks and the cost of transportation to get there… this venture will be anything but “carbon neutral.”

![]() A Sigh of Relief

A Sigh of Relief

We were heartened to open the mailbag this morning to see the reception our makeover is getting.

We were heartened to open the mailbag this morning to see the reception our makeover is getting.

“It isn’t so bad at all!” writes one of our regular readers after I said, “OK, this isn’t so bad now, is it?”

“I kinda like it, and I’m an old fart. Rock on.”

“Dave, great job!” says another. “Like many others, I’m skeptical of change for change’s sake. After reading yesterday’s issue, I’m much relieved! It appears you’ve done a cosmetic update, while keeping everything we all love about your daily email. Keep it up!”

We had a couple of readers who couldn’t resist getting off a choice one-liner…

We had a couple of readers who couldn’t resist getting off a choice one-liner…

“Changing The 5 Min. Forecast to 5 Bullets? I’m, well, triggered…”

Adds another: “I like the new format. I was concerned the ‘facelift’ would be a Joan Rivers moment, but all is well. :-)”

“While I haven’t been a reader since the beginning, as others have mentioned, it’s been over a decade. I love the new design — more concise and to the point.

“While I haven’t been a reader since the beginning, as others have mentioned, it’s been over a decade. I love the new design — more concise and to the point.

“However, I know the REAL reason you decided to change the format — you simply got tired of all those readers who complained of false advertising since they couldn’t finish reading the newsletter within the titled ‘5 minutes’… And now, this may be the last time you need to hear about it, ha!”

Adds a reader who’s been with us from the beginning: “One plus of the new format — there won’t be any more petulant complaints about not being able to finish reading the report in five minutes. I’m a very slow reader. I don’t think I ever finished a report in less than about 10 minutes. But I always found the time well spent.”

A couple more random comments: “Glad you and Emily are continuing your involvement. Looking forward to many more great mailings.”

And: “Always love The 5 (and we can keep calling it that, yay).”

Dave responds: You’re welcome to do so, and we won’t stop you, but the problem was best illustrated by another reader who wrote in to say: “Isn’t the change at least partially because Fox News’ most popular show now bears the name The Five?”

It was problematic in a way. This e-letter’s forerunner was affectionately called The 5 from the beginning in 2007.

But anyone who came aboard in the last decade was liable to think we were sponging off Fox’s cachet — even though The Five came into being four years later in 2011 (and only because Roger Ailes and Glenn Beck had a falling-out and suddenly there was a huge hole in Fox’s schedule).

A final thought from a longtimer: “I would just hope that the plan to focus on five issues does not preclude the occasional single-issue in-depth report when the occasion calls for such.”

A final thought from a longtimer: “I would just hope that the plan to focus on five issues does not preclude the occasional single-issue in-depth report when the occasion calls for such.”

Dave responds: Yes, we’ll still do the occasional deep dive — a single topic split into five logical sections.

And if you noticed yesterday, we squeezed in eight topics — with three of them under the category of “Miscellaneous money stuff.” See what we did there?

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom’s 5 Bullets

P.S. Hey, here’s a sixth topic today, a random note from the annals of de-dollarization…

South Africa’s government will grant diplomatic immunity to Vladimir Putin so he can attend the BRICS summit in Johannesburg this August — the summit where a BRICS super-currency will be high on the agenda.

Without that immunity, South Africa would be obligated as a member of the International Criminal Court to arrest Putin.

No word yet on how Washington plans to respond to this development, but we can’t help pondering the irony: Could South Africa once more be subject to U.S. sanctions not for the scourge of apartheid, but for failing to toe the D.C. line on Ukraine?