July 31, 2013

- You can’t stop gold smuggling — you can only hope to contain it: Strange tales from the Indian “love trade”

- The speculators versus the “commercials”: Two experts help you choose sides in a golden battle

- The recession? It wasn’t so bad. The recovery? It’s even better: New fantasy numbers from the feds, and how they got there

- The flu that kills one out of three people it strikes… and Ray Blanco on the company that could stop it in its tracks

- What’s worse than subsidies to farmers? Subsidies to dead farmers… More reader back-and-forth on the future of our conferences… an urgent message if you have a Gmail account… and more!

“I just ask them to moderate gold purchases. If they are buying 20 grams, I ask them instead to buy 10 grams.”

“I just ask them to moderate gold purchases. If they are buying 20 grams, I ask them instead to buy 10 grams.”

India’s finance minister Palaniappan Chidambaram knows he’s fighting a losing battle. The rupee is getting crushed in the foreign exchange market, sending India’s current account deficit soaring. Chidambaram’s solution: Make gold imports more difficult.

India’s import tax on gold was 2% in early 2012. It’s been steadily increased to 8%.

And still Indians want gold. “Imports were low in June,” he said this morning, “but in July it has turned again… in July, the imports have risen; therefore, those measures [to contain imports] continue.” Curiously, he did not specify the import numbers.

And that’s just the stuff being imported legally.

And that’s just the stuff being imported legally.

Over the last two months, the Indian government has seized 150 gold shipments totaling more than 16,000 ounces. In one case, related last week in Vancouver by Sprott’s David Franklin, old-style tube TVs were outfitted with capacitors made of gold.

“Unless you have specific information, you can’t catch such consignments,” an official with the Directorate of Revenue Intelligence tells The Times of India. “Who would break open a TV and look at the capacitor of its picture tube for smuggled gold? Though we have had good success, we believe a lot of consignments are finding their way into the country.”

And as Indian festival season is just around the corner, Chidambaram is reduced to begging his countrymen to “moderate” their gold purchases. Heh…

Gold demand across Asia could provide a “sturdy price floor,” according to a report from UBS.

Gold demand across Asia could provide a “sturdy price floor,” according to a report from UBS.

“Most of local market participants we spoke with in China were of the impression that so long as gold prices are deemed attractive, physical demand will be strong,” analyst Joni Teves writes.

“People want to own gold,” she explains. “There may be many different reasons behind this desire, but one thing is clear — the strong affiliation toward the yellow metal in the East, embedded in culture and tradition over time, is not to be underestimated.”

That’s the “love trade” Vancouver regular Frank Holmes talks about.

“In China,” says Teves, “banks are setting up and/or growing gold accumulation plans offered to the public. Better and easier access to gold via banks’ growing networks combined with strong appetite from retail customers have driven the tremendous appetite from China this year.”

“We’re going to watch who loses the most when gold moves to the upside, which…is virtually inevitable,” says Don Coxe.

“We’re going to watch who loses the most when gold moves to the upside, which…is virtually inevitable,” says Don Coxe.

Mr. Coxe spent decades with BMO Financial Group and now runs his own firm. In a recent client webcast, he describes a battle royale in the gold market. “We’re seeing the gigantic [long] positions that have been taken in the futures markets… [by] the speculators [who] were wiped out, and what we have [now] is the largest short position in history on gold in the futures market.”

Those are the speculator types. Meanwhile, the “commercials” — mostly dealers and miners — have significantly trimmed the short positions they use to hedge themselves.

“So you have those who know best are no longer short, as a matter of pure business principles, because they see that this just doesn’t make sense, and those who are pure speculators — with the biggest short position in history… I don’t think it’s a matter of if, but when, that we’re going to see an upside breakout in gold.”

“The commercials are the least net short than they have been in more than 11 years,” adds Steve Briese, who tracks these figures for a living in a publication called Bullish Review of Commodity Insiders.

“The commercials are the least net short than they have been in more than 11 years,” adds Steve Briese, who tracks these figures for a living in a publication called Bullish Review of Commodity Insiders.

As noted in a recent Barron’s column, Briese’s analysis of these numbers means the commercials “have not been this bullish since gold prices were under $300.”

Ignore Briese at your own risk: Drawing on these commercial short figures, he issued a strong buy recommendation in early 2011, when gold hovered near $1,400. By August of that year, he issued a strong sell at $1,897… and gold topped at $1,921 on Sept. 6.

Now he’s calling for a rebound to $1,550.

[Ed. Note: If you’re thinking you might like to capture some of that upside for yourself, our friends at the Hard Assets Alliance are making it easier than ever. They’re offering free storage from now through year-end 2013. With a choice of six storage vaults around the world, it’s an ideal way to achieve that “geographical diversification” Doug Casey talks about.

But you’ll want to move quickly: The free storage offer comes off the table at midnight tonight. Be advised we may be compensated once you fund your account… but we wouldn’t back the Hard Assets Alliance unless we believed they’ll do right by you.]

It’s Day 3 of gold’s slow-motion decline, but it’s still holding the line on $1,300. At last check, the bid was $1,308.

It’s Day 3 of gold’s slow-motion decline, but it’s still holding the line on $1,300. At last check, the bid was $1,308.

Meanwhile, the Dow has rallied to record highs as traders anticipate the latest “policy statement” from the Fed later this afternoon. As we write, the Dow is closing in on 15,600.

Meanwhile, the Dow has rallied to record highs as traders anticipate the latest “policy statement” from the Fed later this afternoon. As we write, the Dow is closing in on 15,600.

Already in the rearview mirror this morning are rosy numbers on private-sector employment and GDP.

The Commerce Department’s first guess at second-quarter GDP rang in at an annualized 1.7%. Anemic, but a fair amount better than the “expert consensus” was counting on.

The Commerce Department’s first guess at second-quarter GDP rang in at an annualized 1.7%. Anemic, but a fair amount better than the “expert consensus” was counting on.

On the other hand, the first-quarter figure got a surprise revision to the downside — from 1.8% to 1.1%. Yuck.

Around here, we consider GDP a nigh-useless metric — for reasons we’ve laid out on several occasions. And as of this morning, it’s even more hinky.

Every few years, the Commerce Department changes the way it calculates GDP… inevitably to make it look better. At the height of the dot-com bubble in 1999, for instance, the statisticians reclassified software purchases by businesses as “investment” (good for GDP!) and not “expenses” (very bad for GDP!).

This time, research and development costs are getting the same treatment. Even sillier, pensions are now being counted as they accrue, instead of when they’re paid out. So the money a company or government agency is salting away for a 45-year-old worker is now counted basically as if it were the worker’s current income. That has the effect of goosing not only GDP, but also the bogus “savings rate.”

As Chris Mayer, our most trenchant critic of GDP, would say, “You can’t make this stuff up.”

The revisions go all the way back to 1929… but the biggest impact is on the “Great Recession” and its aftermath…

As suspect a figure as GDP is in the first place, John Williams at Shadow Government Statistics nonetheless calculates it the way the government did in the 1970s.

By that reckoning, the U.S. economy has been shrinking ever since July 2000 — except for three quarters of infinitesimal growth in 2004.

“The virus kills one in three confirmed cases,” our tech arbiter Ray Blanco writes of the avian H7N9 flu virus.

“The virus kills one in three confirmed cases,” our tech arbiter Ray Blanco writes of the avian H7N9 flu virus.

“This is a very deadly strain.”

As we mentioned in June, the medical journal Cell released a study explaining how H7N9

potentially had only a few mutations to go to reach pandemic status.

“In fact, as I write,” says Ray, “I am reading of a new case being reported in the northern part of the country. China’s National Health and Family Planning Commission reports 132 H7N9 cases so far, along with 43 deaths.”

Ray brings this up because of a company he has been tracking since June based on its revolutionary treatment of H7N9.

“I also noted,” Ray goes on, “that this company’s new H7N9 vaccine was already entering animal testing — only weeks after the first reported human case.”

“I also noted,” Ray goes on, “that this company’s new H7N9 vaccine was already entering animal testing — only weeks after the first reported human case.”

Last week, the company announced the results: “They are, to put it mildly, extremely encouraging,” says Ray. “When tested in mice, this company’s H7N9 vaccine generated protective responses in all vaccinated animals.”

Impressive: “For the first time,” a company statement elaborates, “a vaccine shields animals from sickness and death against the newly emergent H7N9 flu virus.”

How does the vaccine work? Through DNA molecules shaped into rings called plasmids.

How does the vaccine work? Through DNA molecules shaped into rings called plasmids.

“These plasmids,” Ray explains, “are engineered by this company to contain code for manufacturing antigens.

“When introduced to a human cell, these plasmids migrate toward its nucleus. Once there, the cell’s own biological machinery reads that code and manufactures the antigens. The antigens are eventually released into the body, where they produce an immune response. The immune system remembers these antigens, and if infected by viruses that have them, immediately begins to attack.”

[Ed. Note: As you can probably imagine, this biotech company’s stock flew through the roof when the news hit. Though this company still has plenty of room to run, Ray has another virtually unnoticed discovery up his sleeve that could have the potential to eventually wipe out nearly all diseases on Earth — and make you extremely wealthy. Click here for Ray’s latest report.]

A $32 million oops…

A $32 million oops…

From 2008-2012, Reuters reports, “the U.S. Agriculture Department paid out $32 million in soil conservation payments and crop insurance aid to dead farmers…

“In a report, the Government Accountability Office (GAO) said two USDA agencies did not routinely check master lists compiled by the government to assure payments go only to living recipients. Contracts with USDA often are voided by death, but payments can flow to heirs for work already performed.”

This issue is nothing new: A 2007 GAO report outlined $1.1 billion in farm payments over six years to dead farmers.

The USDA claims, of course, that the problem was not as broad-scale as the auditors make it out to be.

But hey, no worries: The payments add to GDP!

“I would love to attend the Vancouver event,” a Reserve member chimes in on the event’s uncertain future, “but my schedule is too busy to take the three-four days off and go out there. It is also not close to where I live, New Jersey.

“I would love to attend the Vancouver event,” a Reserve member chimes in on the event’s uncertain future, “but my schedule is too busy to take the three-four days off and go out there. It is also not close to where I live, New Jersey.

“In addition, I have family in the South and in San Diego, plus two kids in college, so if I do travel, it would be to visit family. Now, if there were 1-2 day events on the East Coast or closer to me, I would love to attend.”

“So why would I go to Vancouver for four days minimum?” a reader adds. “It’s costly, and I’d have to leave my farm when the timing for harvest is critical.

“So why would I go to Vancouver for four days minimum?” a reader adds. “It’s costly, and I’d have to leave my farm when the timing for harvest is critical.

“I could afford to go in October, but that’s not when the fat cats prefer to go on their jaunts. October can be a serious time for the financial markets. So that’s just the way things are. Meantime, you go have fun while I work, and I’ll have fun while you guys try to solve the world’s financial woes. Good luck in that, by the way.”

“Been to three Symposiums in the past,” writes a Reserve member, “and although overwhelmed with information, they were all extremely valuable and stimulating.

“Been to three Symposiums in the past,” writes a Reserve member, “and although overwhelmed with information, they were all extremely valuable and stimulating.

“Hope you continue with current four-day format. Would have made it this year, but had business priorities on scheduled dates. Ordered the digital package, but nothing beats being there. It’s the granddaddy of investment conferences as far as I’m concerned.”

“I would vote for multiple regional two-day seminars,” a reader writes, “that would allow more people to afford to take the time off and attend.

“I would vote for multiple regional two-day seminars,” a reader writes, “that would allow more people to afford to take the time off and attend.

“Swallow your pride and believe that probably only 50% of what you think is critical is actually actionable by us average Joes — two days is fine. My experience in the seminars that I’ve attended is that I am happy if I can go home with two-three actionable items.”

“A two-day conference closer to home,” suggests a reader, “would offer an opportunity for those who can’t get four days off or afford the cost of traveling to Vancouver.

“A two-day conference closer to home,” suggests a reader, “would offer an opportunity for those who can’t get four days off or afford the cost of traveling to Vancouver.

“Why don’t you have both?”

“Maybe I’ve missed this,” chimes in another, “but has anyone suggested ‘minis’ as additions to the Vancouver event?

“Maybe I’ve missed this,” chimes in another, “but has anyone suggested ‘minis’ as additions to the Vancouver event?

“Have the ‘biggie’ for the people who can attend and the minis for the people who have constraints. Maybe people attending the minis will see the value in ‘moving up’ to Vancouver when they are able.

“Pick a December time in maybe Las Vegas and Orlando to take advantage of weather conditions. The minis could be used as ‘updates’ to the bigger event. And families wouldn’t have to stay indoors because it’s too cold. This timing would allow for children to be away from school. The presenters could also bring family and enjoy the trip.”

The 5: Thanks again to everyone for the voluminous and engaged, indeed passionate, feedback. We’re reading every reply. Addison expects to make an announcement late this week or early next… so stay tuned!

Cheers,

Dave Gonigam

The 5 Min. Forecast

P.S. Last call: The Hard Assets Alliance offer of free precious metals storage for the rest of 2013 expires tonight at midnight. Here’s where to take advantage.

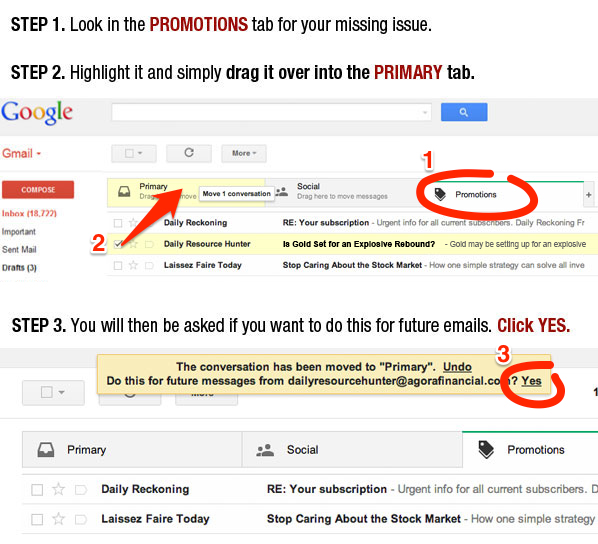

P.P.S. If you have a Gmail account, Google recently “moved your cheese.” And you might not be getting The 5 on a reliable basis.

See, they divided your inbox into three sections. That means you may find your 5 Min. Forecast issue under the “Promotions” tab.

That’s not where it belongs!

So if you want to make sure you’ll keep getting The 5 in your inbox, please select the latest edition of each mailing from Agora Financial you receive and drag it to the “Primary” tab. When asked to do this for future messages from The 5 Min. Forecast, click “Yes.”

It’s easier to show this than to tell… so the graphic below illustrates this procedure.

As for why Google took this step, you’ll have to take it up with them…