- Crude falls, airlines profit, our readers collect

- Will the sixth time be the charm for the S&P 500?

- China tumbles 8.5% in a day… and it was totally predictable

- Gold struggles to retain $1,100, but along comes a contrarian indicator

- One business’ way-too-early holiday display… the “real” price of housing… an obvious threat to sound sleep that you can easily correct… and more!

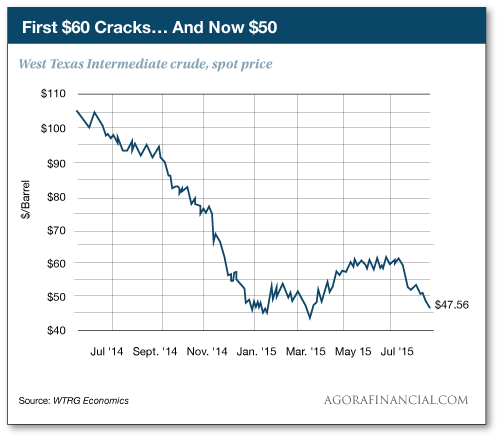

So much for $50 oil. The spot price for a barrel of West Texas Intermediate crashed through that level on Friday… and continues to sell off this morning. As we write, the price is $47.56.

So much for $50 oil. The spot price for a barrel of West Texas Intermediate crashed through that level on Friday… and continues to sell off this morning. As we write, the price is $47.56.

It’s at this moment we recall what hedge fund manager Erik Townsend said here in The 5 earlier this month, when crude was still $52.81. If crude inventories continue to build — and the latest figures stand at 80-year highs for this time of year — the industry might well face a storage crisis going into fall. Don’t rule out $40 crude by October.

It’s falling crude prices that are central to one of the more sophisticated plays by our income investing specialist Zach Scheidt.

“For the last few months, airline stock investors have been focused on the wrong thing,” Zach explains.

“For the last few months, airline stock investors have been focused on the wrong thing,” Zach explains.

“Instead of recognizing that lower fuel prices mean huge cost savings for the airlines, investors have been worried about a price war that would slice into their profits.”

But those worries were put to rest when Southwest Airlines (LUV) reported its quarterly numbers last Thursday. Turns out Southwest grew its profits despite the hand-wringing over a price war.

“Here’s the thing,” says Zach: Prices are supposed to drop when fuel costs drop significantly. And even if prices drop, airlines can still grow their profits if their costs drop even more. That’s exactly what’s happening.

“Southwest just proved the airline industry is in good shape. The company grew profits by a full 47% over last year. And investors are once again buying airline stocks, pushing shares higher.

“Now airline stocks can trade around the one metric that truly matters: fuel costs,” Zach goes on.

If you know a thing or two about the airline sector, you might be thinking: Yeah, but how can you turn that into income?

If you know a thing or two about the airline sector, you might be thinking: Yeah, but how can you turn that into income?

And it’s true. As a group, the airlines pay miserable dividends: American, 1%. Southwest, 0.9%. Delta, 0.8%. United hasn’t paid a yield since 2008.

But on Friday, Zach’s premium subscribers had the chance to pocket an instant $400 payout from the airline sector, taking advantage of his “ultimate retirement loophole.”

So far during the month of July, they’ve had the chance to collect $2,060. Zach aims for a minimum $1,000 this month, and he’s already doubled his target… and four full trading days remain in July.

You can see for yourself how easy it is to collect these payouts and start pocketing them for yourself when you click here.

The major U.S. stock indexes got slammed hard at the start of trading this morning — but as we write, the damage looks less severe.

The major U.S. stock indexes got slammed hard at the start of trading this morning — but as we write, the damage looks less severe.

Small caps are taking it the hardest, the Russell 2000 down three quarters of a percent. But the S&P 500 is down only a quarter-percent, at 2,075.

The proximate cause of the early-morning panic was an 8.5% sell-off overnight in China.

The proximate cause of the early-morning panic was an 8.5% sell-off overnight in China.

There was no obvious trigger for the sell-off: Figures showed profits at Chinese industrial firms during June fell 0.3% from a year ago. Big whoop.

Chalk it up, perhaps, to a collective loss of confidence in the Chinese government’s measures to arrest a 30% drop in the Shanghai Composite Index going back to mid-June. Those measures included a ban on short selling.

Today’s drop was all but inevitable. Earlier this month, we cited a well-founded rant by money manager Barry Ritholtz. It’s worth revisiting this morning. “Short sellers are typically the first to buy during a crash. Why? They have no risk in making the buy, as they are closing out an existing position. Thus, they act as a floor under a falling market.

“The strongest collapse in U.S. equities took place after the SEC banned short selling in September 2008.”

Back to the U.S. market: The S&P 500 bounced off support in the first hour of trading. So the primary uptrend going back nearly four years remains in place — that’s the solid blue line on this chart going back the last 12 months.

Back to the U.S. market: The S&P 500 bounced off support in the first hour of trading. So the primary uptrend going back nearly four years remains in place — that’s the solid blue line on this chart going back the last 12 months.

Of more significance to Jonas Elmerraji at our trading desk is the dashed blue line near the top. For the fifth time in five months, the index hit a ceiling at 2,125 a week ago today. Could a sixth try mark a breakout? “Things start to get interesting if the S&P can move materially above 2,125,” says Jonas.

“Expect earnings to remain a major market-moving factor in the next month or so. At this point, 185 S&P 500 components have reported their numbers to Wall Street for the second quarter — and 75% of those reporting companies have bested analysts’ best-guess numbers. That’s a pretty solid beat rate, and it could help take out some of that selling pressure up at 2,125.”

Gold raced past $1,100 again late Friday afternoon but can’t hold it this morning. At last check, the bid was $1,097.

Gold raced past $1,100 again late Friday afternoon but can’t hold it this morning. At last check, the bid was $1,097.

The bargain gold price has breathed life into moribund sales of U.S. Gold Eagles. So far in July, 266,500 ounces of gold coins have exited the U.S. Mint’s doors.

The bargain gold price has breathed life into moribund sales of U.S. Gold Eagles. So far in July, 266,500 ounces of gold coins have exited the U.S. Mint’s doors.

That’s already the highest monthly total since April 2013. Not coincidentally, that’s the month when gold tumbled $200 in a week.

Silver Eagles, you wonder? As we mentioned on July 8, sales to the Mint’s dealer network have been suspended thanks to high demand. It was supposed to be for only two weeks, but two stretched into three and three is about to become four. To be continued…

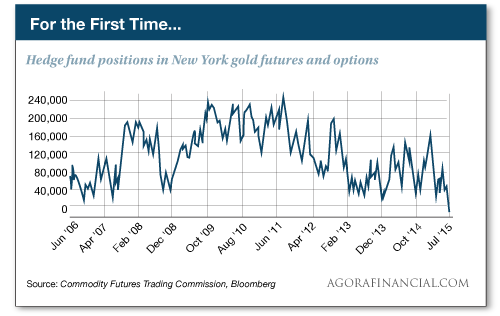

Here’s a contrarian indicator gold bugs might like: Hedge funds have collectively gone bearish on gold for the first time on record.

Here’s a contrarian indicator gold bugs might like: Hedge funds have collectively gone bearish on gold for the first time on record.

Figures from the Commodity Futures Trading Commission show hedge funds and other speculators are net short 11,345 contracts in futures and options for the week ended last Tuesday.

That’s never happened before… although we caution the records go back to only 2006.

[Ed. note: As irony would have it, gold’s five-year low — and the return of sub-$50 crude — coincides with this year’s Sprott-Stansberry Natural Resource Symposium. No fewer than three Agora Financial editors are on the bill — Jim Rickards, Byron King and Chris Mayer.

Resource-world luminaries like Eric Sprott, Doug Casey and Brent Cook will also be there — not to mention Agora Inc. founder Bill Bonner. The genial Rick Rule of Sprott USA will preside over it all. And we’ve swung it so that even if you can’t be there — you can look in on the event as it’s happening.

That’s right — live streaming direct from Vancouver to your desktop. The event gets underway tomorrow… so you’ll want to hop on this today.]

From England comes word of a likely record for an early holiday display by a business.

From England comes word of a likely record for an early holiday display by a business.

And no, it doesn’t appear to be a joke. An outlet of the Harvester restaurant chain in the city of Milton Keynes has indeed put up its Christmas tree in July.

The Twittersphere was duly outraged within hours of the tree going up a week ago yesterday. “I saw a waitress and said to her instantly, ‘You can’t be serious?’”

They were serious. As a spokeswoman explained to the local newspaper, “Our team at the Harvester Fountain have got into the Christmas spirit a little early this year. Although we realize not everyone wants to think about preparations quite yet, some of our guests do like to get their Christmas booking plans underway, even in July.”

The tree came down three days after it went up — ostensibly because of “team training” for the holidays. Uhh, whatever you say…

Thus the saying ‘I wouldn’t touch it with a 10-foot pole,’” a reader writes after Byron King’s report from the solar-powered mausoleums of New Orleans on Friday. “It comes from the long pole used to scrape the ashes after a year and a day in the mausoleum.”

Thus the saying ‘I wouldn’t touch it with a 10-foot pole,’” a reader writes after Byron King’s report from the solar-powered mausoleums of New Orleans on Friday. “It comes from the long pole used to scrape the ashes after a year and a day in the mausoleum.”

The 5: You are correct, sir. In fact, Byron quipped to us about how for a long time he wouldn’t touch solar stocks with a 10-foot pole. A decade ago, they looked a lot like dot-com stocks circa 1999… and they were all but destroyed during the panic of 2008.

“The economics of solar have become attractive,” he says now. “Compare it to what I explained about how a body decomposes inside a solar-powered New Orleans mausoleum. You might have to get over the initial queasiness, but when something works, it works.”

As a reminder, our energy team sees a huge catalyst that could propel solar stocks skyward come Thursday, Aug. 6 — only 10 days from now. Get the story right here.

“Has anyone done any simulation to see what the real price levels should be for goods and services after reflecting this artificial market environment that we live in due to Fed policy?” reads a reader query.

“Has anyone done any simulation to see what the real price levels should be for goods and services after reflecting this artificial market environment that we live in due to Fed policy?” reads a reader query.

“You sort of got there last week with housing. However, it would be interesting to see the whole picture and trickle this fully through the whole economy, or at least through to anything that is interest rate sensitive, which I guess is just about everything, because it seems most people put their groceries on credit cards these days.”

The 5: What do you mean “real price levels”? The average price of an existing home at $236,400 is as real as it gets for anyone signing the papers at that price.

But yeah, we get what you’re driving at. We know from the experience of the past century a house “should” cost at most about two times household income, but now it’s about 4.6 times. And that “should” figure is based simply on Americans’ collective experience with the 30-year mortgage — which is itself the product of a major government intervention decades ago.

While we’re at it, chew on this: What would be the “real price” of a college education if it weren’t for the crack cocaine of student loans? Is there even a way to measure it — other than, say, taking what tuition was 40 years ago and adjusting for CPI?

“The person who mentioned how to test for specific gravity did not give the proper method,” a reader writes as our silver bar thread stretches into (yet) another week.

“The person who mentioned how to test for specific gravity did not give the proper method,” a reader writes as our silver bar thread stretches into (yet) another week.

“From Wikipedia: ‘Specific gravity is the ratio of the density of a substance to the density (mass of the same unit volume) of a reference substance. Apparent specific gravity is the ratio of the weight of a volume of the substance to the weight of an equal volume of the reference substance.’”

In the same vein, another reader reminds us, “Tungsten has almost the same specific gravity as gold. So that immersion in water trick does not work.”

Ah yes, we recall the tales of tungsten-filled gold bars that turned up in Hong Kong in 2009. Good point…

“You could have spun out on U S. 41 north of Terre Haute wide awake!” a reader quips after your editor described falling asleep at the wheel one night as a young adult. “That’s just one of many sorry highways in Indiana.

“You could have spun out on U S. 41 north of Terre Haute wide awake!” a reader quips after your editor described falling asleep at the wheel one night as a young adult. “That’s just one of many sorry highways in Indiana.

“The state highway department is one of the most inept road departments in the continental U. S. I’ve lived, worked and/or had business in 27 states. Indiana and Illinois are the two worst when it comes to highways.”

The 5: Heh — my recollection of that highway is much better than yours. But my recollection of the Chevy Citation is also better than most other people’s who’ve owned one.

There’s a saying in pop psychology about how it’s never too late to have a happy childhood. I guess it can apply to any time of your life…

Best regards,

Dave Gonigam

The 5 Min. Forecast

P.S. Fair warning: If you’re about to retire or are already retired, you should know about a dangerous new deal being negotiated in Washington, D.C., right now.

Some of the most “powerful” men and women in finance (ha!) have recently met behind closed doors to work out the details… and they constructed a deal that could ruin the lives of millions of Americans.

This meeting has never been discussed in the mainstream media. Our guess is the “authorities” wanted to keep this under wraps to prevent a general panic.

Luckily, our inside man, Jim Rickards, was in Washington at the time the deal was being discussed.

Because of Jim’s own experience with the CIA and banks on Wall Street, he knows many of the government officials in the discussion on a first-name basis.

You’ll never believe what the U.S. government is up to now. Well, maybe you will… but it’s still shocking, even to us.

Seriously, if you expect to receive any Social Security benefits when you retire… or if you’re already collecting benefits, we urge you to click on the following link immediately.

Click here to see all the details.

We touched a nerve last Thursday with our item showing how a poor night’s sleep can undermine your ability to make sound financial decisions — making you more optimistic than you should be.

Turns out one of the biggest threats to a good night’s sleep lies no further away than your bedside lamp. Colleague Brad Lemley, lead health researcher for the Laissez Faire Club and editor of Brad Lemley’s Natural Health Solutions has just discovered some startling facts about Americans’ sleeping habits…

Is your smartphone causing high blood pressure, diabetes and depression?

by Brad Lemley

There’s now a device on nearly every nightstand in America.

And these devices are causing a national health epidemic…

Sleep Deprivation

One in three Americans sleeps less than six hours a day, raising the risk for an entire gamut of health problems.

What’s the biggest contributing factor to this health epidemic?

Any device that emits blue light… computers, televisions, tablets, and, yes, even smartphones.

You see, before the invention of electric lighting, the sun was our major source of light. People spent their evenings in relative darkness, maybe with candles for light for a few hours after sundown.

Now, in just about every corner of the world, our evenings are glaring as bright as midday.

But we’re paying a price for basking in all that light. At night, light throws the body’s biological clock — known as the circadian rhythm — out of sync.

And the No. 1 thing that suffers is your sleep.

But here’s the good news: Not all light is the same. Which means you can still keep the lights on at night, as long as they’re the right kind.

Blue wavelengths are good during the day hours because they amp up our attention, reaction times, and mood. But this same blue light is the most disruptive at night.

With the increased popularity of portable electronics — smartphones, tablets, and laptops — as well as energy-efficient lighting, most Americans now have more exposure to blue light at night than ever.

Any light can hold back your secretion of melatonin, the sleep hormone. But blue light suppresses it more powerfully.

As Harvard researchers reported:

“Harvard researchers and their colleagues conducted an experiment comparing the effects of 6½ hours of exposure to blue light to exposure to green light of comparable brightness. The blue light suppressed melatonin for about twice as long as the green light and shifted circadian rhythms by twice as much (three hours versus 1.5 hours).”

Think losing a few hours of sleep here and there is no big deal? Think you can get by and function OK with occasional nights of poor sleep… or not enough sleep?

Think again. Sleep is one of the KEYS to optimal health. It’s just as important as diet and exercise.

In fact, research from Harvard Health shows that lack of sleep can cause cancer, diabetes, heart disease, depression, and obesity.

So what’s the big takeaway?

If you want to stay healthy and get enough sleep, stay away from devices that emit blue light at least two hours prior to bedtime. Dim red lights are the best for preserving melatonin levels. Pop a red Christmas bulb into your bathroom’s nightlight. You can also purchase special glasses that block blue wavelengths. And keep your bedroom as dark as possible.

We’re on a mission to help you get the sleep you need for optimal health. That’s why we just released our latest report…

The Missing Link to Getting a Good Night’s Sleep

If you even only OCCASIONALLY need a little help getting a good night’s sleep, you’ll want to see the research we’ve uncovered on safe and natural ways to get better sleep.

Just a few of the things you’ll discover are…

- The importance of the “sleep gateway”… and how to pass through it effortlessly every night to ensure you get deep and restful sleep

- How you can use Thomas Edison and Salvador Dali’s secret to make sure you enjoy deep, restful, refreshing sleep… every single night (and maybe even boost your brainpower!)

- Do THIS and your mind and body will finally be in tune with the natural progression of sleep stages… and your sleep problems will be a thing of the past

- Try THIS proven secret from Japan and enjoy what could be the best night of sleep you’ve had in years

- How your brain wave state determines whether you sleep like a baby… or toss and turn all night. And, more importantly, how you can quickly and easily switch your brain to the state that GUARANTEES you’ll sleep soundly all night.

This new report is a $20 value… but you can get it immediately, along with our five-part email series “Safe & Natural Secrets to Sound Sleep,” absolutely FREE by clicking here…

As soon as you do that, you’ll discover some simple tips, tricks, and secrets for better sleep that WORK like crazy!

Sincerely,

Brad Lemley

Editor, Brad Lemley’s Natural Health Solutions

P.S. The Missing Link to Getting a Good Night’s Sleep is 100% complimentary.

There’s nothing to buy.

Since lack of proper sleep is now an EPIDEMIC, I want to get this new report into your hands as soon as possible.

Click here now to get your copy of The Missing Link to Getting a Good Night’s Sleep... 100% FREE.