- A little-discussed factor that worsens a financial crisis

- The Chinese stock market and Humpty Dumpty

- Why a U.S. stock correction would be welcome now

- Is the next housing slowdown upon us?

- The solar-powered, Wi-Fi-enabled trash bin… a reader’s regrets about The 5… the cruelly mocked hatchback… and more!

“Look at banking, look at the recent decisions about the Greek crisis,” says neuroscientist Russell Foster. “We see major discussions going through the night which have a massive impact, and decisions are being made when skills are very impaired.”

“Look at banking, look at the recent decisions about the Greek crisis,” says neuroscientist Russell Foster. “We see major discussions going through the night which have a massive impact, and decisions are being made when skills are very impaired.”

We hadn’t thought about it till we saw the professor’s remarks in the London Telegraph yesterday. In short, he says if you get by on only four or five hours’ sleep, your brain functions no better than it would if you were drunk. Pull an all-nighter and you might as well be under the table.

We’ve had sleep on our minds lately, prompted by colleague Brad Lemley — the lead health researcher for our Laissez Faire unit. And since finance is our beat, we’ve been thinking especially about sleep and money.

Maybe lack of sleep is too facile an explanation for the idiotic kick-the-can solution developed for Greece earlier this month. But then we started thinking about the, well, erratic behavior of certain figures during the Panic of 2008.

Remember when Treasury Secretary Hank Paulson would give a Sunday night news conference just before the Asian markets opened, and by midmorning Monday the Dow had shed another 300 points? How much sleep did he miss those weekends?

“I shoulda stood in bed!”

Granted, there’s nothing you or I can do about how much sleep the global elites get as they make momentous decisions.

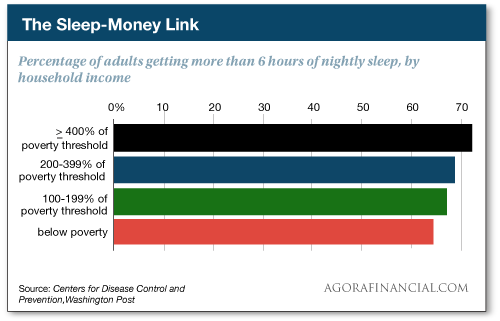

But your own sleep is more within your control. And there’s a statistical correlation between the amount of sleep you get and the amount of money you make.

But your own sleep is more within your control. And there’s a statistical correlation between the amount of sleep you get and the amount of money you make.

Researchers at the Centers for Disease Control and Prevention pulled apart 35,000 responses from something called the National Health Interview Survey. Turns out only two-thirds of people below the poverty line ($29,440 for a family of four) get at least six hours of sleep a night. The numbers steadily improve as household income grows.

The researchers were careful not to draw any conclusions about the numbers. The media, not so much. “Poorer people are probably more likely to work multiple jobs or be forced to commute long distances,” says a typical account.

No doubt there’s some truth to that. But generalizations are a dangerous thing, and we daresay the flip side is just as valid: The more sleep you get, the better you function on the job and the more valuable you are to your boss, your customers, etc.

“Lack of sleep damages a whole host of skills,” says Professor Foster, the neuroscientist — “empathy, processing information, ability to handle people, but right at the top of the chain you get overly impulsive, impaired thinking, because of this problem.”

“Lack of sleep damages a whole host of skills,” says Professor Foster, the neuroscientist — “empathy, processing information, ability to handle people, but right at the top of the chain you get overly impulsive, impaired thinking, because of this problem.”

Even an occasional poor night’s sleep can set you up for trouble the next day. It’s with that in mind that Brad Lemley prepared a FREE special report, The Missing Link to Getting a Good Night’s Sleep. There you’ll learn about the importance of the “sleep gateway”… and how you can train your mind and body to pass through this gateway every night with ease.

Today’s the last day you can snag this report. Again, it’s free — no strings attached — so what do you have to lose, other than your exhaustion? Drop us your email address and we’ll have the PDF file in your inbox only moments later.

For the moment, the major U.S. stock indexes have arrested their five-day slide. The Dow is up microscopically at 17,457 and the S&P 500 at 2,070. Gold sits where it did about 24 hours ago, at $1,095.

For the moment, the major U.S. stock indexes have arrested their five-day slide. The Dow is up microscopically at 17,457 and the S&P 500 at 2,070. Gold sits where it did about 24 hours ago, at $1,095.

The Federal Reserve’s Open Market Committee (FOMC) begins one of its periodic two-day meetings today. Tomorrow afternoon, the assembled worthies will issue their latest proclamation and traders will parse it for any indication of how soon they’ll start to raise the fed funds rate from the near-zero levels where they’ve sat since December 2008. Will it be mid-September? Late October? Mid-December?

We’ll stick with the call of our own Jim Rickards, one he made late last year — no increase during 2015.

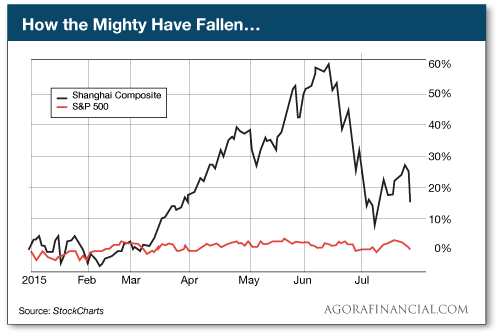

“The sense of calm Chinese officials tried to instill in the markets was nothing more than a mirage,” says Greg Guenthner of our trading desk.

“The sense of calm Chinese officials tried to instill in the markets was nothing more than a mirage,” says Greg Guenthner of our trading desk.

As mentioned yesterday, the Shanghai Composite tumbled 8.5% yesterday. Today was substantially better, in the sense that the drop was “only” 1.7%.

“The truth is you can’t stop folks from panicking,” says Greg — affirming a viewpoint we’ve shared with you during July. “If they want to sell, they’ll find a reason (and a way) to do it. Even the most powerful party official can’t stand up to a falling market.

“We don’t know how the China crash will ultimately play out here in the States,” Greg goes on. “But right now, the ‘check engine’ light is flashing for U.S. stocks.

“We don’t know how the China crash will ultimately play out here in the States,” Greg goes on. “But right now, the ‘check engine’ light is flashing for U.S. stocks.

“Yes, the S&P 500 is still less than 3% from its all-time highs. But more and more leaks are springing up.

“The major averages only suffered modest losses yesterday, but nearly 75% of stocks ended the day lower. And that’s a problem. As I’ve been saying for weeks now, the biggest theme for U.S. stocks has been the lack of participation when the market rallies. Fewer and fewer stocks are generating most of the market’s gains.”

That said, “a correction — not an outright crash like we’re seeing in China — wouldn’t be so horrible for U.S. stocks at this stage of the game,” Greg concludes.

“Instead of a torturous, sideways grind, we might actually see a flush lower that shakes out weaker hands and hits the reset button on the countless stocks stuck in no man’s land this year.”

Maybe the reflation of the housing bubble is running out of gas. The Case-Shiller home price index slipped a bit in May. (There’s a nearly two-month delay in this figure.)

Maybe the reflation of the housing bubble is running out of gas. The Case-Shiller home price index slipped a bit in May. (There’s a nearly two-month delay in this figure.)

Case-Shiller’s average fell 0.2% for the month. The year-over-year increase was 4.9% — little changed from the previous month. April’s figures were revised down, and not by a little.

Of the 20 metro areas tracked by the index, 12 have now registered two straight months of decline — including red-hot San Francisco.

“Price weakness in this report points to price concessions,” says a dry Bloomberg summary, “which likely helps explain the solid strength of existing home sales in May and June.” Hmmm…

In a separate report out this morning, the U.S. homeownership rate has fallen to 63.4%. That’s the lowest since — gulp — 1967.

In a separate report out this morning, the U.S. homeownership rate has fallen to 63.4%. That’s the lowest since — gulp — 1967.

Behold, more evidence of how solar power has crossed a huge threshold and become economical to produce.

Behold, more evidence of how solar power has crossed a huge threshold and become economical to produce.

Meet Bigbelly — a solar-powered, Wi-Fi-enabled trash bin: It’s popping up all over the five boroughs of New York after an auspicious debut in cities overseas.

“The solar-powered receptacles compact trash as it comes in so that it has to be emptied less often,” explains a report at the TreeHugger site. “Sensors detect when the bins reach capacity (or when they’re particularly smelly) and then the bins communicate with local waste management organizations to alert them that they need to be emptied.”

And they look sturdy enough that they can’t be easily knocked over…

Even more impressive — the bins’ solar capacity also powers free Wi-Fi hot spots.

“Two of the smart bins in Manhattan were converted to act as hot spots this winter and they provide Wi-Fi at 50-75 megabits per second, which is fast enough to download an HD movie in just nine minutes,” says TreeHugger. “Now several hundred of NYC’s smart bins will be transformed into hot spots as soon as the mayor’s office signs off on it, but likely this fall.”

True, the free Wi-Fi part is also funded by display advertising. But the point is that none of this would have been possible a few years ago, when a typical solar panel cost more than $3 per watt. Now it’s less than a buck a watt.

As a reminder, Matt Insley of our energy team believes the solar sector will get a huge boost a week from Thursday — when two major industry reports are set to be issued.

“It’s not just a handful of people that have the potential to get rich here,” says Matt. “This $3.7 trillion opportunity could make A LOT of investors A LOT of money… and I want you to be one of them.” You can see Matt’s full presentation at this link.

“I regret,” reads a short email in our inbox, “that my subscription is being used solely to pitch me new ways for you to make money.”

“I regret,” reads a short email in our inbox, “that my subscription is being used solely to pitch me new ways for you to make money.”

The 5: Solely?

Our longstanding policy is that the analysis you get in The 5 is free. The actionable recommendations and ticker symbols you have to pay for.

I had our crack customer service team look you up. You should be getting plenty of actionable recommendations in your subscriptions to Jim Rickards’ Strategic Intelligence and Penny Stock Fortunes. If you think you’ve been missing your monthly issues and weekly updates, you should get in touch with our folks right away — and they’ll look into it.

Think of The 5 as your window into everything else the Agora Financial team is working on in addition to your paid subscription. If you click on the links, that’s great. But even if you don’t, we hope you learn something new each day.

“Even if it is entertaining, you have all wasted WAY MORE money hammering away about $10 for a 10-ounce silver bar!” a reader writes — perhaps signaling the theme is finally, mercifully, playing itself out.

“Even if it is entertaining, you have all wasted WAY MORE money hammering away about $10 for a 10-ounce silver bar!” a reader writes — perhaps signaling the theme is finally, mercifully, playing itself out.

“I would have bought it anyway for the novelty of it. Even if it turns out to be fake, you had at least that much fun value with it and it’s yours to bring out in a few years to have more fun with (or maybe fool someone else into buying it from you!).”

“The Chevy Citation was a very good design,” recalls one of our regulars — affirming that you never know how a remark your editor makes in passing might resonate.

“The Chevy Citation was a very good design,” recalls one of our regulars — affirming that you never know how a remark your editor makes in passing might resonate.

“I had a Citation hatchback that I loved in many ways. Drove very well. It hauled me and a significant other to places like the Canadian Maritimes, etc., bench front seat and all (we could sit together — very hard to do with buckets).

“Also hauled lumber, wallboard and other materials when I rebuilt my kitchen. Over 120,000 on it when the engine died. Would have bought another, but not made anymore by then.”

The 5: Mine made it to 127,000. And while it had a bench seat, it was also a manual. Strange. The bench seat probably kept costs down, though.

It’s funny how people mocked hatchbacks 30-odd years ago. But yes, they were enormously useful.

And if you think about it, they paved the way for the Subaru Outback and other vehicles driven today by insufferable hipsters…

“You guys are soooo stinking funny!!!!” reads a short email.

“You guys are soooo stinking funny!!!!” reads a short email.

“I would read you guys just for the comic relief if it wasn’t for the fact I’m a rotten capitalist pig hoping to make a quick buck off the backs of the huddled masses yearning to be free from work!!!”

The 5: Reading your missive literally, we’re experiencing brain lock: If the “huddled masses” are yearning to be free from work, how do you propose to make a quick buck off them?

Best regards,

Dave Gonigam

The 5 Min. Forecast

P.S. Final reminder: Brad Lemley’s short but information-packed report The Missing Link to Getting a Good Night’s Sleep is available only through midnight tonight. And it’s free — no obligation on your part. All we ask is that you give us your email address, and we’ll send it to your inbox right away. Here’s where to act.