- Two seemingly unrelated headlines…

- … and the end of health care as we know it

- What if we paid for groceries the way we pay for health care?

- Can you keep your doctor when this trend collapses in less than 20 years?

- Waiting on the Fed… Chevy Citation bashers emerge… what was the real “pregnant roller skate”?… and more!

CNBC spit out the following two headlines moments after the close yesterday. They appeared as alerts on your editor’s iPad like so…

CNBC spit out the following two headlines moments after the close yesterday. They appeared as alerts on your editor’s iPad like so…

- “$1 of Every $5 Spent in U.S. Will Be on Health Care”

- “Gilead Sciences Earnings: $3.15 a Share, vs. $2.71 a Share Expected.”

The juxtaposition was not intentional. But it might as well have been.

Which makes today as good a time as any to thrash out a few things that have been on your editor’s mind. These thoughts don’t yet form a coherent whole. But boiled down to the essence, it’s this…

Sometime in the next 20 years, you’ll no longer be able to get treatment for chronic disease in the manner in which Americans have become accustomed.

Sometime in the next 20 years, you’ll no longer be able to get treatment for chronic disease in the manner in which Americans have become accustomed.

We’re talking conditions like heart disease, stroke, cancer, diabetes, obesity and arthritis. The money just won’t be there. Not if costs continue to rise at their current clip.

And Obamacare is only a small part of the story. This is a situation that’s been building for decades.

Before we go any further, ponder this: Under normal conditions of capitalist advancement, you get progressively better results for progressively lower cost.

Before we go any further, ponder this: Under normal conditions of capitalist advancement, you get progressively better results for progressively lower cost.

In 1955, for example, you could get a 24-inch black-and-white TV for $249.50.

1955 Magnavox TV ad as annotated by the tvhistory.tv site.

Even using the government’s heavily gamed inflation numbers, that’s $2,227 in today’s money.

Today, you can get a 48-inch flat-screen color TV — twice the diagonal size, but even better because you get a movie-style aspect ratio — for $379.

But the modern American health care system does not operate under normal conditions of capitalist advancement. It is a government-protected cartel operated for the benefit of insiders.

Which is why health care is on pace to eat up $1 out of every $5 spent in the United States by 2024.

Which is why health care is on pace to eat up $1 out of every $5 spent in the United States by 2024.

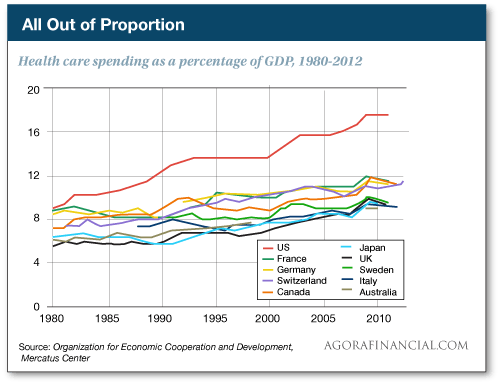

So say the actuaries at the Centers for Medicare and Medicaid Services in a report released yesterday. To be precise, health care spending will account for 19.6% of GDP by 2024. In 2013, it was 17.4%.

The percentage had leveled off in the aftermath of the “Great Recession.” Now it’s poised to jump again. And long before today, it was completely out of whack with the rest of the developed world.

Yeah, we know. These are government projections, so they’re suspect. And as we’ve discussed on many an occasion, GDP is a pointless statistical abstraction.

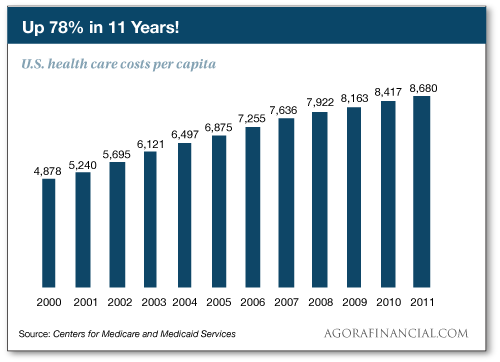

So let’s leave GDP out of it. Look instead at the per capita cost of health care…

Back to the actuaries’ projected increase: They attribute it to the growing number of people with health insurance under Obamacare, stronger economic growth and the legions of aging boomers going onto Medicare.

Another major factor: Spending on prescription drugs, which grew 12.6% last year alone, “partly as a result of expensive new treatments for hepatitis C,” says the report.

Which brings us to the quarterly numbers for Gilead Sciences (GILD) — the maker of that expensive new treatment for hepatitis C.

Which brings us to the quarterly numbers for Gilead Sciences (GILD) — the maker of that expensive new treatment for hepatitis C.

As you could glean from the headline earlier, the numbers were phenomenal. As we write this morning, GILD is up more than 4%. It’s nearly doubled in the last two years.

Credit most of that to Gilead’s hepatitis C drug Sovaldi. It sold $10.3 billion of Sovaldi last year — at a cost of $1,000 a pill, or $84,000 for a 12-week course.

That’s in the United States. In Egypt, Gilead charges $900 for course of treatment.

“Gilead deserves a reasonable return on their investment,” allows Steve Miller, chief medical officer at Express Scripts, writing last year at Forbes. On the other hand, “Hepatitis C patients in the U.S. are mostly uninsured, underinsured and/or incarcerated. Medicaid, the VA and our prison system bear the brunt of the cost impact, and by extension, so do all of us as taxpayers.”

It’s not just drugs. It’s everything in health care that operates in this extortionate manner.

It’s not just drugs. It’s everything in health care that operates in this extortionate manner.

In 2011, New York Daily News reporter Beverly Weintraub had a scare — her teenage son choked on a piece of turkey. He spent four hours in the emergency room — at a cost of $22,214.92.

Well, that’s what the hospital billed Aetna. Aetna paid only $2,885.67 — an amount to which the hospital agreed. Weintraub’s out-of-pocket was about $800.

“The rates that insurance companies pay,” Weintraub wrote after much investigation, “are negotiated based on what they believe a hospital’s true costs are. But then those rates are jacked up an average of 30-50% to make up for money that hospitals lose in treating patients who don’t have private insurance — which is the majority of them. So to make up the difference, they overcharge patients who are insured. This practice is called cost-shifting.”

“What’s missing from this complex web,” Weintraub adds, “is any hint of what the services a patient received actually cost.”

“What’s missing from this complex web,” Weintraub adds, “is any hint of what the services a patient received actually cost.”

That’s by design. For perspective, here’s an analogy from the financial blogger Karl Denninger — who’s done yeoman’s work in recent years on health care.

“You walk into a grocery store. You get to the checkout counter and present your basket of groceries. The checkstand operator asks you to swipe your card first, before ringing them up, and the store’s computer checks both your available credit line and bank balance.

“It then decides what the basket of groceries on the belt is ‘worth’ to you and what you can afford, setting a multiplier that results, if you happen to have a lot of money (or credit), in a price that is 10 times as much as the person behind you pays.

“Oh, and to keep you from figuring it out, the checkstand doesn’t display any prices either; you find out how much your card was hit for your groceries only after you leave the store.”

And then there’s the cost to the taxpayer: The actuaries’ report says by 2024, nearly half of all health care spending will be covered by federal, state or local government. That’s up from 43% last year.

And then there’s the cost to the taxpayer: The actuaries’ report says by 2024, nearly half of all health care spending will be covered by federal, state or local government. That’s up from 43% last year.

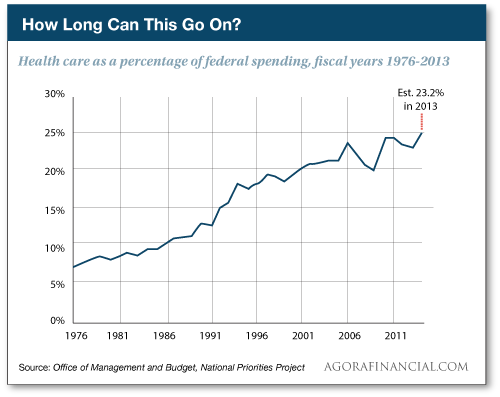

In 2011, the Congressional Budget Office projected federal health care spending would double by 2022.

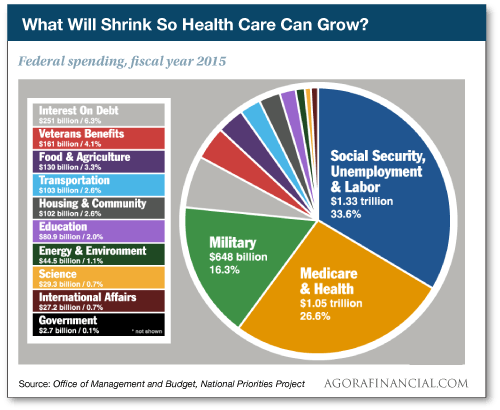

“But for better perspective,” our executive publisher Addison Wiggin wrote in 2011, “examine how much health care spending comprises the entire federal budget.

“From 6.2% of total federal spending in 1970, it became 12.4% by 1990,” wrote Addison. “And health care’s portion of the federal budget has very nearly doubled again.”

With this number too there was a “Great Recession” hangover… but if the Medicare and Medicaid actuaries are right, the trajectory is sure to take off again. By some estimates, health care is already approaching 27% of all federal spending.

So the percentage doubles every 20 years or so. “Assuming you’re 55 now,” said Addison, “health care spending will eat up half the federal budget by the time you’re 75. Now, looking at a pie chart of the current federal budget, what categories do you think will have to give way to make room for all that health care spending?

“If you haven’t already figured it out,” said Addison, “that’s a trick question. Something in the system is going to break long before health care spending eats up half the federal budget.”

Which brings us back where we started: 20 years hence, you won’t be able to count on the health care system to treat chronic disease as aggressively as it does now.

Which brings us back where we started: 20 years hence, you won’t be able to count on the health care system to treat chronic disease as aggressively as it does now.

What the new system looks like, we don’t quite know. Our friend Jud Anglin from the Laissez Faire Club is convinced Obamacare is the prelude to a single-payer system like Canada’s.

Looking at all the numbers above, that might be — God help us — the least-worst outcome.

If you face the potential for a chronic health condition in the future, you’d do well to think about what you can do to prevent the onset of that condition — or, if it’s too late for that, what you can do to keep it from worsening. Medical miracles might not be there to save you otherwise.

Oh, and you might want to buy some GILD shares too. They’re still a favorite of our Rick Pearson, contributor to Mayer’s 100x Club and editor of our Catalyst Trader service. It won’t be able to charge Americans $1,000 per pill forever… but the madness of the current health care system still has legs for now. You might as well profit from it.

To the markets — where the major U.S. indexes appear set for a second day of gains. As we write, the S&P 500 has recovered the 2,100 level.

To the markets — where the major U.S. indexes appear set for a second day of gains. As we write, the S&P 500 has recovered the 2,100 level.

Gold continues to tread water just below $1,100. Crude is scrambling its way back toward $50.

Traders await the latest policy statement from the Federal Reserve, due around the time this episode of The 5 hits your inbox. Might be fun to see how they continue to talk up the possibility of a near-term increase in the fed funds rate, even as the economic numbers look mediocre. We’ll follow up tomorrow.

“Ha, I bought one brand-new,” reads the first of many reminiscences about the Chevrolet Citation — did I ever open a Pandora’s box with my asleep-at-the-wheel story the other day — “and it was the worst car for reliability that I ever owned.

“Ha, I bought one brand-new,” reads the first of many reminiscences about the Chevrolet Citation — did I ever open a Pandora’s box with my asleep-at-the-wheel story the other day — “and it was the worst car for reliability that I ever owned.

“Basically, I felt like GM lied to me about the amount of research and time they put into the car. The front-wheel drive was constantly in need of repair. End result: I’ve never bought another GM car, and I loved my Camaros, GTOs and El Caminos in the ’60s. Just sayin’.”

“I am not sure where this ‘Chevy Citation was a very good design’ came from,” adds another, “but a vehicle that only goes 120,000 miles in my book is not a good-valued vehicle.

“I am not sure where this ‘Chevy Citation was a very good design’ came from,” adds another, “but a vehicle that only goes 120,000 miles in my book is not a good-valued vehicle.

“I buy vehicles that get 200,000-300,000 miles, and I have a truck that still runs with over 800,000 miles.”

“After the lead was removed from gasoline, an engine that goes at 127,000 miles is just crap,” says a third. “I personally put 495,000 on a 1983 BMW 320i (with NO major engine work, just maintenance) and know for a fact that it got to 600,000 before my mechanic lost track of it.

“After the lead was removed from gasoline, an engine that goes at 127,000 miles is just crap,” says a third. “I personally put 495,000 on a 1983 BMW 320i (with NO major engine work, just maintenance) and know for a fact that it got to 600,000 before my mechanic lost track of it.

“I am presently at 442,000 on my 1993 BMW 325iS (bottom end only, did smoke an exhaust valve at about 310,000). And the 1993 gets fuel consumption comparable to present offerings, while I drive about 25,000 miles per year… Handles beautifully when speed is in triple digits passing junk on Interstate 5, but unfortunately, Autobahn behavior is frowned upon.”

“I couldn’t help think about the original Toyotas, which came to the East Coast in about 1970,” writes a fourth. “We called them pregnant roller skates, which somehow seemed appropriate for high schoolers at the time.

“I couldn’t help think about the original Toyotas, which came to the East Coast in about 1970,” writes a fourth. “We called them pregnant roller skates, which somehow seemed appropriate for high schoolers at the time.

“I didn’t own one of those, but subsequently, I have owned eight Toyotas, both trucks and cars, and I don’t think I sold any of them with less than 200,000 miles, and every one was running almost like new — and there weren’t any major repairs that I can remember, either (except for a computer chip problem on a Previa — a la ‘the loaf of bread’). Detroit should have gotten the hint decades ago.”

The 5: Funny, we thought the term “pregnant roller skate” applied to the AMC Pacer…

Bad ’70s flashback [Wikimedia Commons photo by Triskel99].

… although Urban Dictionary seems to think it also applied to the original VW Beetle. Who knows?

Best regards,

Dave Gonigam

The 5 Min. Forecast

P.S. We recently updated the results of a six-month investigation into a growing trend here in America…

In short, a savvy group of Americans have figured out a way to legally piggyback “Canadian Social Security.”

And these folks are now collecting monthly “benefit” checks from $400-4,700 as a result.

For example, Sara Yaeger — a secretary from Texas — is now collecting $2,900 per month in “benefits”… And Carol Alderman, a widow with two children, averages more than $1,200 in “benefits.” (You can click here to see more incredible stories.)

So what is “Canadian Social Security”?

It’s an “old age” benefit program just like we have here in the states… only (from what we’ve discovered) it’s far superior.

For example… while the U.S. Social Security program is set to be bankrupt by 2032…

Funding for the Canadian version is set to QUADRUPLE by the year 2040.

But here’s the kicker…

What we discovered is that you don’t need to live in, work in or even visit Canada to begin receiving “benefits” by piggybacking the program.

And you can collect thousands in additional retirement income without affecting your regular U.S. Social Security benefits!

You can read our full investigation… and see if you qualify to begin receiving “benefits”… by clicking here.