- After 15 months and nearly $140,000 of research…

- … we have the blueprint for stocks that turn every $10,000 into $1 million

- Surprise! The “recovery” is even weaker than first thought

- Fed tries to have it both ways: Jim Rickards on Yellen and co.’s dilemma

- Less-than-luxury accommodations for the 2016 Olympics… two areas where health care costs have fallen… if auto insurance worked like health insurance… and more!

“A 100-bagger is a stock where every dollar invested turns into $100,” Chris Mayer reminds us. “That means a $10,000 investment turns into $1 million.”

“A 100-bagger is a stock where every dollar invested turns into $100,” Chris Mayer reminds us. “That means a $10,000 investment turns into $1 million.”

We first told you about Chris’ pursuit of these extraordinary stocks eight months ago. At long last — today — you have the chance to see the fruits of his labors.

“It sounds like an outrageous quest with a wildly improbable chance of success,” Chris told us last December, “like setting out to draw a royal flush in poker. And I would probably have agreed with you not so long ago. But then I started to dig in and study the 100-baggers of history.”

The objective: Find out what the 100-baggers of the recent past have in common… and use that knowledge to identify the 100-baggers of the future.

Chris’ most startling finding: You don’t have to be an expert market timer — buying these stocks at the bottom.

Chris’ most startling finding: You don’t have to be an expert market timer — buying these stocks at the bottom.

“You often have years to buy them,” says Chris. You could buy any time during a five- or 10-year stretch and still wind up with a 100-bagger. “It would’ve been impossible not to… if you just held on.”

With much help, and at considerable expense — more about that later — Chris and a research team identified 365 of these 100-baggers going back to 1962.

The top performer: Kansas City Southern. “That’s a railroad stock,” Chris says. “It’s up more than 16,000-fold since 1974. A $10,000 investment there turned into $160 million in 40 years. I would never have guessed a railroad stock would top the list.

“There is good diversity in the 100-bagger population. There are retailers, beverage makers, food processors, tech firms and much more.”

“Anyone can invest in a 100-bagger — and many ordinary people have,” Chris says in the first chapter of his new book on the subject. (More about how you can get a copy momentarily.)

“Anyone can invest in a 100-bagger — and many ordinary people have,” Chris says in the first chapter of his new book on the subject. (More about how you can get a copy momentarily.)

“Anyone can find them — or find close-enough approximations. After all, who is going to complain if you only turn up a 50-bagger, or even a 10-bagger? Heck, most investors I know are delighted when they double their money in a few years.

“Studying some of the great successes and the principles behind 100-baggers will help in the effort to find winning stocks today — not only 100-baggers.”

So you don’t need a 35-year time frame, or even 15 years, to get meaningful results following the 100-bagger template. And if you do want to think long term — the legacy you’ll leave your children and their children — you now have the ideal starting point.”

When we first told you about this project in December, Agora Financial had already dropped $50,000 on the research.

When we first told you about this project in December, Agora Financial had already dropped $50,000 on the research.

The tab only grew. “In total,” says our fearless leader Addison Wiggin, “we’ve spent $138,545 and had six analysts work full-time researching 100-baggers, including a professional statistician on retainer to crunch data.”

And now it’s time to let you in on the results. It’s time to show you which companies achieved this extraordinary milestone… and how you can identify the 100-baggers that can fund your retirement, your heirs, your legacy.

Chris has put it all together in a new book with the refreshingly straightforward title 100-Baggers: Stocks That Return 100-to-1 and How to Find Them.

For the moment, we’re making this book available only to Agora Financial readers. We figure it’s the least we can do to thank you for your patronage.

And despite our sunk costs, we won’t ask you to pay retail. Heck, we’ll send you the book FREE as long as you can spot us the shipping and handling. Just go to this page, plug in the password “100x” and you’re in.

Click here and enter the password “100x” for access to your FREE copy.

The major U.S. stock indexes are giving back some of their gains from the last two days — all of them down about a third of a percent as we write. The S&P 500 clings to the 2,100 level.

The major U.S. stock indexes are giving back some of their gains from the last two days — all of them down about a third of a percent as we write. The S&P 500 clings to the 2,100 level.

Treasury yields are backing down, the 10-year at 2.28%.Gold remains mired a few bucks below $1,100 as the dollar index clocks in at 97.6.

The big economic number of the morning is the overhyped GDP — which clocked in below expectations.

The Commerce Department says “the economy” grew an annualized 2.3% during the second quarter. Whoops, the “expert consensus” among dozens of economists polled by Bloomberg was 2.6%.

All the numbers going back to 2011 have been revised as well. The 0.2% decline we had in the first quarter of this year? It’s a 0.6% increase now! But most of the revisions went the other way — the meager 2.2% growth of 2013 is now an even more meager 1.5%.

Whatever. We pass this along only because traders pay attention to it, not because it makes any difference to your quality of life. And any impact on your portfolio is so roundabout as to be meaningless.

Oh — Federal Reserve policymakers also pay attention to it. Not that this morning’s number changes anything about when they might or might not raise the fed funds rate from near-zero.

And on that subject, the Fed is once again trying to have it both ways.

And on that subject, the Fed is once again trying to have it both ways.

The Fed’s Open Market Committee wrapped up two days of meetings yesterday. From The Wall Street Journal: “The Federal Reserve kept rates near zero but cited progress in the U.S. job market, a sign it remains on course to raise interest rates in September or later this year.”

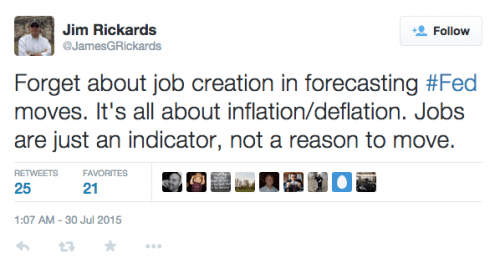

Our Jim Rickards, tweeting from the Sprott-Stansberry Natural Resource Symposium in Vancouver, doesn’t buy it…

“It’s hard to see how Janet Yellen and her Fed colleagues can possibly raise rates in this environment,” Jim elaborates.

“It’s hard to see how Janet Yellen and her Fed colleagues can possibly raise rates in this environment,” Jim elaborates.

“This conundrum of tough talk and weak data puts leveraged corporations between a rock and a hard place. On the one hand, if Yellen does raise rates, leveraged companies will find their interest costs go up, and their ability to roll over junk debt in the middle of a bond market massacre is problematic.

“On the other hand, if Yellen does not raise rates, it means that the economy is weaker than expected, and core business revenues will contract as consumers hunker down for a new recession.”

Jim’s bottom line: “The economy is rolling over, and Yellen won’t raise rates for the foreseeable future.” And beware companies with a heavy debt load.

Rio de Janeiro is already running out of accommodations for the 2016 summer Olympics… and some of the city’s infamous shantytowns known as favelas are opening their doors.

Rio de Janeiro is already running out of accommodations for the 2016 summer Olympics… and some of the city’s infamous shantytowns known as favelas are opening their doors.

“Clinging, seemingly precariously, to the city’s steep mountainsides, the chaotic, crammed masses of DIY houses have a justified reputation for violent crime orchestrated by drug gangs,” says an account at the BBC’s website.

No matter: “We’re almost full [for the Olympics], and we don’t know if we’re going to want more people than those who have already closed the deal,” says Dario Schaeffer, manager of a guesthouse in the Babilonia favela overlooking Copacabana beach.

The BBC informs us a government policy known as “pacification” — which had some unpleasant connotations in Vietnam, but that’s neither here nor there — has cleaned up some of the favelas since 2008. “Under pacification, soldiers and marines supported by tanks and helicopter gunships are continuing to go into favelas to drive out the gangs, seize control and bring law and order.”

The Cantagalo favela: “Ipanema beach is only steps away!”

[Photo by Wikimedia Commons user Hmaglione10.]

With the gangs gone, bed-and-breakfasts are opening up. Mr. Schaeffer’s rooms start at 160 Brazilian reais — less than $50 at the current exchange rate. “There were shootings and drug trafficking on this road [in the past],” he says, “but now everything is peaceful, and it’s probably safer here than in Copacabana.”

“Not ‘everything’ in health care has been subject to stratospheric cost increases,” reads the first of several emails reacting to yesterday’s episode.

“Not ‘everything’ in health care has been subject to stratospheric cost increases,” reads the first of several emails reacting to yesterday’s episode.

“The two main areas of care not covered by insurance or government aid — Lasik vision surgery and plastic surgery — have seen steady cost declines over the past two decades.

“On a related note, I had a gap of nearly a year in medical coverage between early retirement and eligibility for Medicare. Naturally, I became quite health-cost conscious during that time. Since I was visiting an oncologist for follow-up checks on a little bout of colon cancer, I needed semiannual blood panels for which my private insurer had been paying the hospital oncology lab $1,600 a pop.

“I asked my oncologist if I had to get the tests done at the hospital’s lab, and he said, no, an independent lab would be fine. So I found a lab a mile from the hospital that did the tests for a total of $135 (even saving me $25 over my former $160 copay).

“It turned out that my ‘private insurer’ was only serving as the administrator for my company’s self-insurance plan, and they were paid on a percentage of what they handled dollarwise, so they had no incentive to try to save money — quite the contrary! (And on top of that, my doctor, upon hearing that I was uninsured, knocked his costs to me down by billing me for ‘brief,’ rather than ‘intermediate,’ visits.)”

The 5: Sounds like the scam of “PPO repricing” — explained here by Addison Wiggin two years ago.

“What if we paid for automobile maintenance and repair the way we pay for health care?” writes a reader one-upping the grocery analogy from yesterday.

“What if we paid for automobile maintenance and repair the way we pay for health care?” writes a reader one-upping the grocery analogy from yesterday.

“There would be no incentive for careful treatment of the machine and, thus, more frequent transmission, engine, brake and tire repairs due to full throttle starts and stops, all covered with a deductible/copay for those insured.

“Oil changes would be considered preventive medicine (a la an annual physical exam) and would be fully covered. However, only a small percentage of owners would bother, instead waiting for a full engine replacement.

“Body repairs may be considered cosmetic surgery.

“Bottom line: The costs associated with automobile ownership would increase rapidly for the company as a whole, and certainly for those who had previously been prudent automobile owners and drivers.”

“This entitlement mentality is killing our country,” says yet another reader. “Too many people think that those of us who have a little more had it handed to us through luck.

“This entitlement mentality is killing our country,” says yet another reader. “Too many people think that those of us who have a little more had it handed to us through luck.

“They have no concept of working hard to get an education, finding a job, working hard and doing your best so you get promoted, or generally following the so-called ‘rules’ of being successful, which include living within your means, saving some for the proverbial rainy day and investing wisely. And they certainly don’t understand those who start their own business and what that entails.

“When you can obtain quality health care overseas for a fraction of the price, it certainly begs the question of how many people in the USA have their hand in the health care till. I suppose the only recourse we have is to buy stock in that industry. Clearly, the concept of self-sufficiency and working for what you get is a thing of the past. God help us.”

“What a wonderful line this is,” a reader reacts to this remark of ours yesterday: “Under normal conditions of capitalist advancement, you get progressively better results for progressively lower cost.”

“What a wonderful line this is,” a reader reacts to this remark of ours yesterday: “Under normal conditions of capitalist advancement, you get progressively better results for progressively lower cost.”

“Things have gotten so badly out of whack in the world of money,” our reader continues, “I would bet most people have forgotten about the above statement. Time was the concept was taken for granted, was part of what made our system of prosperity the powerhouse it once was.

“Now we are a nation of kept people who have prostituted ourselves for a handout. Having lost our dignity, we beg for more handouts and greater circuses in the form of movies that will satisfy our lost self-image.

“The days of reckoning will see us swept off the face of the earth for a new beginning. Hang in there, Bill Bonner. Your 40-plus years of preaching in the desert are almost over.”

The 5: While we’re on the topic… we had electronic gremlins that deleted an important and revealing factoid from yesterday’s episode: The 24-inch black-and-white TV you could buy in 1955 for $250 would cost $2,227 in today’s dollars. And that’s using the official CPI numbers.

That was a big expenditure. I’m too young to remember my family’s first TV, but my siblings aren’t. To this day, there’s a dispute about where they watched the landmark live telecast of Peter Pan starring Mary Martin — at home, or at a friend’s house because Dad hadn’t yet sprung for a TV in 1955. Heh…

Best regards,

Dave Gonigam

The 5 Min. Forecast

P.S. With all the commotion in Greece and China and everywhere else these days, you might have missed this when we sent it out the other day.

If you have ANY money in the markets right now… on Nov. 11, 2015… you will want to be ready.

Put this critical date on your calendar right away… and click here to find out how to make your preparations.