- Robinson Crusoe’s cabin… and Russia’s cheese-crushing stunt

- Umm, about those “good” job numbers today…

- Why the job numbers don’t point toward a September rate increase

- Is the stock market chop a prelude to a drop?

- Clearing the blockages for a constipation treatment — a $6 billion blockbuster?

- Readers’ favorite new parlor game — second-guessing the IMF and the Fed!

“It is too bad that Robinson Crusoe succeeded in putting out the fire that endangered his cabin. He has lost an invaluable opportunity for labor; he is less rich.”

“It is too bad that Robinson Crusoe succeeded in putting out the fire that endangered his cabin. He has lost an invaluable opportunity for labor; he is less rich.”

So wrote the French political economist Frederic Bastiat in Economic Harmonies, a work published shortly before his death in 1850. (His more famous work The Law appeared the same year.)

In earlier writings, Bastiat also drew on Crusoe — only in this instance, Crusoe is building his cabin. Lacking a saw, he expends much effort with an axe to create planks of wood just the right size.

One day, a plank washes ashore that’s already perfectly shaped for his purposes. But instead of looking upon its arrival as a godsend, Crusoe flings the plank back into the sea. After all… if he were to use it, he’d have less work to do.

Bastiat was making a point about protectionism: “It is nonetheless the same line of reasoning that is adopted by every nation that protects itself by interdicting the entry of foreign goods. It kicks back the plank that is offered it in exchange for a little labor, in order to give itself more labor.”

Which brings us to events in Russia this week…

Which brings us to events in Russia this week…

That’s a bulldozer destroying cheese from the West that was intercepted at the border. Russia slapped a ban on Western farm products last year in response to economic sanctions imposed by the United States and the European Union.

It was a spectacle President Vladimir Putin timed to coincide with the first anniversary of the ban. “One steamroller took an hour to crush 9 tonnes of cheese,” reports the BBC. “Another consignment was due to be burnt. Boxes of bacon have been incinerated. Peaches and tomatoes were also due to be crushed by tractors.”

Food inflation in Russia is already running at 20%.

Your editor has taken a bit of flak the last 18 months for pointing out certain inconvenient facts about the new Cold War — facts that Western leaders and the mainstream media would rather bury.

But by the same token, we don’t hold any brief for Putin around here. The cheese-crushing stunt is economic folly on the same scale as Crusoe flinging that perfectly formed plank back into the waves.

Along with the Western sanctions, it also brings to mind a saying attributed to Bastiat — although it doesn’t turn up in his writings. “When goods don’t cross borders, armies will.”

To the unemployment numbers, it being the first Friday of the month.

To the unemployment numbers, it being the first Friday of the month.

We’re getting weary of this charade. No longer does the mainstream view these numbers through the prism of whether people who want jobs are finding them. Instead, they’re viewed through the prism of how soon the Federal Reserve might start raising the fed funds rate.

In any event, the wonks at the Bureau of Labor Statistics conjured 215,000 new jobs during July. The unemployment rate held steady at 5.3%. “If the August employment report a month from now looks this good,” says a summary from Econoday, “a rate hike at the September FOMC will be a lock.”

Really? Even though another 144,000 people departed the labor force for good, and it’s a safe bet most of them didn’t retire with a gold watch and a guaranteed pension? The labor force participation rate remains stuck at 38-year lows of 62.6%.

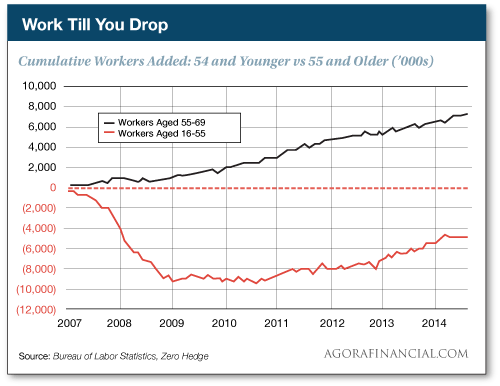

And no, it’s not because more boomers are retiring. We keep harping away on this because the mainstream keeps insisting it’s the case. In reality, the 55-and-over workforce has grown steadily since 2007… while the under-55 workforce is smaller by 5 million.

Meanwhile, the real-world unemployment rate calculated by John Williams at Shadow Government Statistics ticked down slightly to 23.0%. The number has oscillated around this level for three years now.

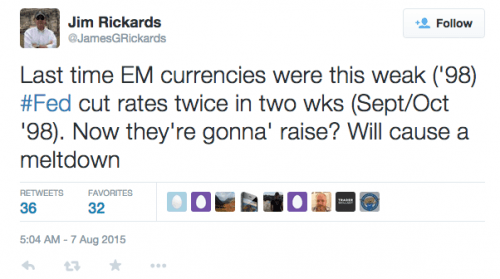

For the record — and Econoday’s assertions notwithstanding — Jim Rickards is sticking with his call on what the Fed will do in September. Not with the dollar so strong relative to emerging-market currencies…

For the record — and Econoday’s assertions notwithstanding — Jim Rickards is sticking with his call on what the Fed will do in September. Not with the dollar so strong relative to emerging-market currencies…

The market reaction to the job numbers has been muted…

The market reaction to the job numbers has been muted…

- The major U.S. stock indexes are all down about a half percent. The S&P 500 sits at 2,074 — about 4% below its all-time record close on May 21

- Treasury yields are in retreat, the 10-year back to 2.19%

- ●Gold is making another halfhearted run toward $1,100 — the bid $1,097 at last check. Silver’s up 2%, only pennies below $15

- Crude remains mired below $45, at $44.34.

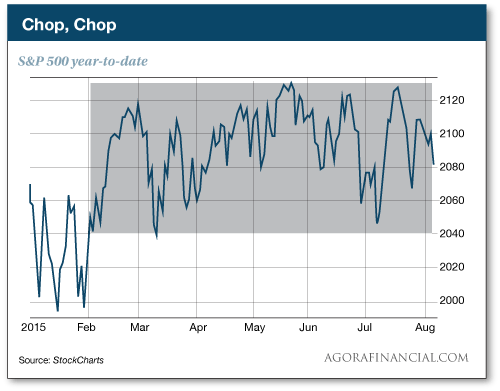

“The S&P 500 is trapped in its longest consolidation period in 65 years,” says Greg Guenthner of our trading desk. Talk about choppy action on the chart…

“The S&P 500 is trapped in its longest consolidation period in 65 years,” says Greg Guenthner of our trading desk. Talk about choppy action on the chart…

“According to Price Action Lab, the 4.75% range that has hugged the S&P since late February is the largest consolidation period in the market since the 1950s.”

Meanwhile, 113 of the S&P 500 stocks are now in a bear market — that is, 20% below their 52-week highs.

Still, “it’s difficult to get too bullish or bearish without a break one way or the other,” says Greg. The “tell” will be the action in small-cap stocks… and the Russell 2000 is in danger of breaking below a support level that’s held for nearly six months.

“Up to 63 million North Americans have this health condition,” says our Ray Blanco on the science-and-wealth beat. He’s talking about… constipation.

“Up to 63 million North Americans have this health condition,” says our Ray Blanco on the science-and-wealth beat. He’s talking about… constipation.

And many of those 63 million suffer from something called “chronic idiopathic constipation” or CIC — which is a fancy way of saying the trouble has no obvious cause.

“The way the vast majority of people deal with chronic constipation now is by using over-the-counter treatments,” Ray tells us. “There is, however, growth in the number of prescriptions that are being filled for drugs to treat the condition. That’s because new and better drugs are coming on the market.”

In fact, “Constipation reminds me of heartburn” says Ray. “Once, people would just take antacids. Then new wonder drugs emerged, generating billions in yearly sales.

“In 2013, for example, AstraZeneca’s Nexium generated $6 billion in global sales. It managed this feat despite the fact that other drugs of the same class had gone generic and over the counter.”

Ray has his eye on the Nexium of constipation treatments.

Ray has his eye on the Nexium of constipation treatments.

“It’s showing every sign that it will eventually give the prescription constipation drug market a ‘run’ for its money,” Ray wrote his FDA Trader readers yesterday. “Last week, the company reported preliminary data for a second trial in patients with CIC. The data show a statistically significant improvement on an FDA-approved endpoint versus placebo, which is durable overall response.” And it’s safer, to boot.

The second trial comes on the heels of a successful first trial that wrapped up in June. Ray’s readers are already up 134% on this pick… and he figures it has another 50% to go.

Ray has his eye on several stocks with even bigger potential — including the one with a promising cancer treatment we mentioned three weeks ago. The key date to watch is Nov. 11 — for reasons you’ll understand when you look at this.

“I’m starting to think we just saw a fascinating game of financial chicken played out on the world stage,” a reader writes of this week’s developments.

“I’m starting to think we just saw a fascinating game of financial chicken played out on the world stage,” a reader writes of this week’s developments.

“IMF chief Christine Lagarde is on record as opposing any U.S. rate hikes this year for fear it will do severe damage to the world economy. Earlier this week, one of our Fed governors (Dennis Lockhart) said it was time to raise rates in September.

“With the general consensus being China’s inclusion in the SDR basket will mark the end of reserve currency status for the U.S. dollar, perhaps Lagarde has traded an extra year with no Chinese participation in the basket for an extended period of no interest rate raises in the U.S. My tinfoil hat is in the shop at the moment, so I can’t blame it for this one.”

“I think the reader in yesterday’s 5 is onto something with regard to the announcement by the IMF regarding the renminbi’s inclusion in the SDR basket. It may indeed be so that large currency players have more time to load up, or as an IMF official put it [as reported by the Xinhua News Agency]:

“I think the reader in yesterday’s 5 is onto something with regard to the announcement by the IMF regarding the renminbi’s inclusion in the SDR basket. It may indeed be so that large currency players have more time to load up, or as an IMF official put it [as reported by the Xinhua News Agency]:

‘“This was mainly in response to feedback from SDR users” because it’s not easy for them to rebalance their reserve holdings on Jan. 1, 2016, [a senior official] said, adding that SDR users also need more time to rebalance their positions if a new currency is added to the basket.’

“It was also interesting to note what China’s chief economist at UBS stated:

‘We still think it is highly likely that RMB will be included — though, for technical reasons, the actual date of inclusion may be extended to Sept. 30, 2016, to give reserve managers time to adjust.’

“Then we have what this guy, David Dollar, said. (Interesting surname for someone with a World Bank and U.S Treasury background): ‘“I think China’s own plans for reforms are probably sufficient to include the RMB in SDR this year.”’

The 5: That might well be how it’s shaping up. Jim Rickards points out there’s a difference between the “decision” date and the “effective” date. “Extending the date of the old basket does not set timing of the new basket decision.”

So they’re keeping their options open and playing mind games with traders. As central banking types are wont to do…

“To the reader who says health insurance increases the cost for everybody — what country does this reader live in?”

“To the reader who says health insurance increases the cost for everybody — what country does this reader live in?”

“In the USA, we no longer have health insurance. To be an insurance product, you have to have underwriting requirements and policy limits. The Affordable Care Act took away underwriting requirements (providers have to take all comers regardless of pre-existing conditions) and lifetime limits (providers had either $1 million or $2 million limits).

“Now there are no limits. If an individual runs up $1 billion in expenses, the health care provider is responsible. This is the reason for so called ‘death panels’ and, of course, government subsidies.”

The 5: We think the reader was saying health insurance as it’s functioned the last several decades raises costs for everyone.

There’s really no doubt about that, thanks to schemes like the “uncompensated care pool” and “PPO repricing” — which came along well before Obamacare.

“I think you do an awesome job with The 5 Min. Forecast,” writes our final correspondent. “I look forward to it every day. As soon as it comes, I am reading it. Keep it coming, please!! Thank you.”

“I think you do an awesome job with The 5 Min. Forecast,” writes our final correspondent. “I look forward to it every day. As soon as it comes, I am reading it. Keep it coming, please!! Thank you.”

The 5: At the risk of sounding a little ungrateful… we get suspicious of assertions that aren’t backed up with any specifics. Even the assertion lavishes praise on us!

Have a good weekend,

Dave Gonigam

The 5 Min. Forecast

P.S. “Chris, congratulations on writing an excellent book,” writes a happy reader of Chris Mayer’s 100 Baggers: Stocks That Return 100-to-1 and How to Find Them. “You have supplied me with many stories, and your latest effort is well done. Thank you!”

We still have a few hardback copies of 100 Baggers reserved for Agora Financial readers. And it’s available FREE, as long as you can cover our shipping and handling costs. Within a few days, we’re going to order a second run, but we’ll be making that one available to the general public.

To grab your first-run copy while it’s still available, just enter the password “100x” at this page for access.