- Germany comes clean about its gold… or does it?

- What’s missing from the Bundesbank’s “full disclosure”

- Bearish news for crude…

- … but crude prices don’t follow the script

- What “everyone knows” about the gold in Fort Knox… the accuracy of forecasts… one of the oldest questions in the newsletter biz asked anew… and more!

Score one for transparency? Germany’s central bank, the Bundesbank — possessor of the world’s No. 2 gold reserve, behind America’s — has issued a 2,300-page inventory of all its gold bars.

Score one for transparency? Germany’s central bank, the Bundesbank — possessor of the world’s No. 2 gold reserve, behind America’s — has issued a 2,300-page inventory of all its gold bars.

We need to backtrack: In January 2013, the Bundesbank announced it wanted to bring home the 45% of its gold reserves held at the Federal Reserve Bank of New York. The overseas storage was a legacy of the Cold War — safekeeping in the event of a Soviet invasion.

The New York Fed said, in essence, “Sure, you can have the gold back. We’ll have it all shipped to you by 2020.” Naturally, this aroused suspicion that maybe the gold isn’t there. Those suspicions were heightened when the New York Fed shipped back only a token quantity over the subsequent two years — 90 metric tons, out of more than 1,500.

Come June of last year, Germany called off the repatriation effort. As we said at the time, it appears the only reason the effort was launched in the first place was to mollify a party in Chancellor Angela Merkel’s governing coalition… and that party subsequently dropped out of the coalition.

So why the transparency now, all of a sudden? Credit goes in part to a fellow named Peter Boehringer, keeper of a “repatriate our gold” blog and author of a book called Bring Our Gold Home.

So why the transparency now, all of a sudden? Credit goes in part to a fellow named Peter Boehringer, keeper of a “repatriate our gold” blog and author of a book called Bring Our Gold Home.

“Trust in the Bundesbank has suffered,” Boehringer tells the Reuters newswire. “The Bundesbank must prove that the gold is there.”

Evidently, the German establishment doesn’t look on Boehringer too kindly. More from the Reuters dispatch: “‘There were a lot of conspiracy theories about the gold not being there,’ said Guntram Wolff, a German who heads Brussels think tank Bruegel, pointing to ‘disenchantment’ among ordinary Germans who have seen the value of their savings dwindle.”

Well, it’s good to know ordinary Germans have something in common with ordinary Americans…

But does the list really resolve anything? Yes, the list is 2,300 pages. Yes, it lists the location, inventory number, weight and fineness of every bar in the Bundesbank’s possession.

But does the list really resolve anything? Yes, the list is 2,300 pages. Yes, it lists the location, inventory number, weight and fineness of every bar in the Bundesbank’s possession.

OK, but what about the serial numbers?

And that’s just for starters. “Has anyone actually seen the bars?” Byron King muses via email this morning. “Picked them up? Weighed them? Measured the exact dimensions? Assayed them? Who quality assures the assayer? Are the bars somehow legally encumbered, due to being loaned or otherwise pledged? There’s a difference, of course, between ownership and control.”

Which brings us to a point Jim Rickards made last year in his second book, The Death of Money: “It is more convenient for the Deutsche Bundesbank to have its gold in New York, where it can be utilized in gold swaps and gold leases, as part of central bank efforts to manipulate gold markets.”

As a reminder, the manipulation works like this: Central banks lease gold bars to commercial banks… which then proceed to sell the bars to private buyers in Asia. The bars, meanwhile, never leave the vault.

If serial numbers were on the list, it’s conceivable someone in China might notice something awry: “Hey, wait — I thought I owned serial number 002483 sitting at the New York Fed.”

Now, that could get ugly in a hurry.

To the markets… and gold is holding onto most of yesterday’s gains. At last check, the bid was $1,147.

To the markets… and gold is holding onto most of yesterday’s gains. At last check, the bid was $1,147.

The major U.S. stock indexes are a mixed bag. Tech issues are the biggest losers this morning, and that’s sent the Nasdaq down a quarter percent.

Crude is holding onto a good chunk of yesterday’s big gains. At last check, a barrel of West Texas Intermediate is down 34 cents at $48.19.

Crude is holding onto a good chunk of yesterday’s big gains. At last check, a barrel of West Texas Intermediate is down 34 cents at $48.19.

The Energy Department issued its weekly inventory numbers this morning. Inventories rose 3.1 million barrels, to 461.0 million barrels. That’s a substantial move in the oil world. Under normal circumstances, you’d expect the crude price to be down a lot more than it is today.

Which serves to highlight a lesson our income specialist Zach Scheidt learned from his mentor years ago at a hedge fund in Atlanta…

“It’s not the news that matters… It is the market’s reaction to the news that really matters.”

“It’s not the news that matters… It is the market’s reaction to the news that really matters.”

“When a news item hits the tape and the market reacts the opposite way you might expect, well, that’s something worth taking notice of!” says Zach.

Crude is making its second counterintuitive move like this in three days. “Over the weekend,” says Zach, “Saudi Arabia announced that next month they would be selling crude oil to Asian and U.S. markets at a discount.

“As the world’s largest oil exporter, Saudi Arabia can drive global prices higher or lower because they’re the biggest seller. So when the country announced that they would be reducing prices on oil next month, one would expect oil prices to decline.”

Didn’t happen, though. “Monday morning as the markets opened, crude oil futures were trading higher by about $1.00 per barrel. This is a great example of a situation where it’s not the news that counts. It’s the market’s reaction to the news that we should be paying attention to.

“It looks like traders are focusing on other issues, such as slowing production in the U.S.,” Zach goes on.

“It looks like traders are focusing on other issues, such as slowing production in the U.S.,” Zach goes on.

“Below is a chart that shows how much oil is being produced in the U.S. compared with last year. As you can see, we’re now approaching the same level as last year, which means less supply is hitting the market. (Remember, when you have less supply of a commodity, the price will, naturally, rise.)

“Another thing to keep in mind is that the number of active rigs drilling for oil in the U.S. just hit its lowest level in five years. With fewer rigs drilling for oil, traders expect production levels to continue to contract — that means less supply of oil in the U.S. — and likely higher prices.”

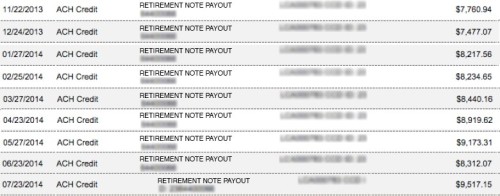

Yesterday, Zach encouraged his premium subscribers to collect $200 in income by following not the news, but the energy market’s reaction to it. This morning, he urged them to lay on an energy trade good for $600 in income.

It’s all part of Zach’s “retirement loophole” strategy. We’ve told you about it before. But Zach is offering up a new twist. Because his strategy has generated a 98.44% success rate, he’s convinced our publisher to back it up with a guarantee.

“I’m so confident that my strategy can help you make at least $1,000 per month,” says Zach, “that I want you to try just one recommendation to prove it. And if you don’t make money — I will send you a check to cover all your losses!”

Click here to learn more about Zach’s one-of-a-kind guarantee…

Before the mailbag, one more thing about national gold reserves. On Monday, a reader brought up the question as it pertains to the United States — is the gold in Fort Knox really there?

Before the mailbag, one more thing about national gold reserves. On Monday, a reader brought up the question as it pertains to the United States — is the gold in Fort Knox really there?

“Reminds me of a time I visited the Pentagon,” says Byron King, “for a meeting with high-level Air Force officials about how to develop synthetic jet fuel.

“I was in a well-appointed conference room in the E-Ring, along with high-end USAF bigwigs. We were talking all about hydrocarbons and refining processes, flight tests and engine qualifications, as well as research programs and funding patterns — because progress follows funding.

“At one point, one of the participants stated that ‘We could talk more about [an issue], but it gets into classified material.’ Then he added that ‘most people probably could figure it out, though…’

“I decided to have some fun with this. I casually commented along the lines of, ‘Yes, I know what you mean. After all, there are really only two truly well-kept secrets in all of American government.’

“Everyone in the room went quiet and stared at me.

“Y’know,’ I said… ‘there’s that secret program about how we’ve been harvesting technology from crashed space alien UFOs out in Nevada; and the other is that there’s no gold in Fort Knox.’

“The room was totally silent. People kind of looked at each other, stunned. You could hear a pin drop… And I mean onto the carpet.

“Then… [an Air Force bigwig] leaned forward against the table, looked at me and said… ‘Really? There’s no gold in Fort Knox?’”

“Very interesting!” a reader writes after our musings about gold leasing on Tuesday. “But not very smart for the investors who think they own it. Seems like gold ‘ownership,’ unless it is physical, is just another fiat by a different name. Fractional reserve, anyone?

“Very interesting!” a reader writes after our musings about gold leasing on Tuesday. “But not very smart for the investors who think they own it. Seems like gold ‘ownership,’ unless it is physical, is just another fiat by a different name. Fractional reserve, anyone?

“But here’s a novel idea: Since gold is mined, refined and then stored at great expense in an underground vault to stay put — why not leave it in the ground in the first place? There is no more safe place for it.

“Use the proven reserve certificate to back up any sales or leases of that gold. If it stays put anyway, what difference whether it stays in the ground or is held in a guarded vault? Gold is gold.”

The 5: Don’t give the central banks any more ideas!

Be a heck of a scheme to enrich the gold mining companies, though…

“Whether David Stockman proves accurate or not, there is always an agenda for him to make money,” a reader writes after we laid out some of the reasons we’re joining him in a partnership.

“Whether David Stockman proves accurate or not, there is always an agenda for him to make money,” a reader writes after we laid out some of the reasons we’re joining him in a partnership.

“His track record stinks so far. Why don’t you let some of his predictions come true before you promote him?

“We all know the Federal Reserve is morally bankrupt. But predicting what will happen is another story, and he is not credible this far. I was talking to an economist for the Citadel Group last week. He says any prognosticators have about a 50% accuracy rate. Which to you and me is a coin flip.”

The 5: Citadel? You mean the joint where Ben Bernanke is an adviser? Alrighty, then…

“Look, I know you guys make money off of duffers like me selling your newsletters,” a reader writes. “I get it.

“Look, I know you guys make money off of duffers like me selling your newsletters,” a reader writes. “I get it.

“But in the past three days, I have received 28 ‘fear & doom’ letters, etc. — each trying to sell me one more of ‘fear & doom’ publication. A friend commented to me yesterday that if the guys behind these letters were really as good as they say they are and if the ‘secrets’ they hold back from us are really as good as they say they are, then they all would be in the Caribbean retired and sipping pina coladas all day long!

“So send me a ticket! Tell me the cost to purchase the ‘slot’ next to you right upfront and guarantee it with hard collateral and I’ll buy in.

“As I hit the ole send button, I am seriously doubting that anyone will take the time to read this email and honestly consider the issues I have raised in it. I suppose there is not much else to do but wait and see!”

The 5: Ah, the old “If you’re so smart, why aren’t you rich?” inquiry. We can’t speak for our competitors, but…

Many editors choose to join our growing flock for the freedom to speak their mind. Remember, they’re often refugees from Wall Street — keen to escape the culture where they’re always answering to someone, be they clients or advertisers or boards of directors.

As we said last year, Wall Street encourages a culture where if you’re not looking over your own back, you’re kissing someone else’s backside. If the analyst thinks the stock or other security his firm is flogging is junk, he has to hold his tongue.

All those problems go away if he comes to work for us: He’s beholden to no one. He can speak his mind. He can live where he likes. Subscription revenue (from people just like you) is our industry’s bread and butter… so if the editor speaks his truth and that truth resonates with his subscriber base, he’ll have a long and prosperous career in financial publishing.

Too, many editors like to share their ideas with an audience… and we offer them the platform to do so.

As for the 28 offers you’re getting in your inbox… perhaps you should be more selective about the e-letters you sign up for.

You might even want to thin the existing list. We certainly hope ours makes the cut…

Best regards,

Dave Gonigam

The 5 Min. Forecast

P.S. How does one person — his name is Mike, if you’re curious — get all this cash deposited directly into his bank account?

Click here to find out! Hint: not from real estate, stocks, bonds, annuities or any kind of traditional investment.