- Picking apart the #ZombieBudget

- 52% Medicare Part B premium increase averted — with a huge caveat

- One disease that could bankrupt America… and one treatment that could save it

- Guenthner assesses gold’s rally… Rickards surveys the “war on gold”

- The rising cost of higher ed as experienced by one family

Say this much for the zombie budget: There is a fix for what we called “the Medicare screw job of 2016.”

Say this much for the zombie budget: There is a fix for what we called “the Medicare screw job of 2016.”

Late last night, White House and congressional negotiators came to terms on a budget deal. It would avert any more shutdown showdowns until the next president takes office in early 2017.

The term “zombies” applied to the financial and economic sphere is an invention of Agora Inc. founder Bill Bonner. In the last 12 hours, it’s caught fire on Twitter with the hashtag #ZombieBudget…

… although it appears to be less a spontaneous phenomenon of the grassroots than a concerted push by The Heritage Foundation.

We won’t take up much of our 5 Mins. today rehashing the particulars; you can read those anywhere. Republicans get the military spending increases they want. Democrats get the social spending increases they want.

Fiscal restraint? What’s that?!

Still, a handful of items did catch our eye, because they tie into other themes we’ve covered in our virtual pages:

Still, a handful of items did catch our eye, because they tie into other themes we’ve covered in our virtual pages:

- A looming crisis in Social Security disability — the disability trust fund was set to start paying out more than it was taking in next year — has been postponed. Eligibility requirements will be tightened, allegedly saving $5 billion

- Some oil will be unloaded from the Strategic Petroleum Reserve. The stated reason is to raise revenue. On the other hand, “The SPR has been regularly toyed with to affect oil prices over the years, and its impact has at times been substantial,” Jim Norman wrote in his 2008 book The Oil Card. If oil prices are being deliberately suppressed to stick it to the Russians, as happened in the 1980s, a release of SPR oil can only help in that regard

- Through a little-used parliamentary maneuver, the Export-Import Bank will be raised from the dead. Congressional authorization for this outrageous exercise in corporate welfare expired over the summer… but the zombie budget revives a government agency critics rightly call the “Bank of Boeing.”

And yes, the looming 52% Medicare Part B premium increase has been averted — at a price.

And yes, the looming 52% Medicare Part B premium increase has been averted — at a price.

We gave you a heads-up about this in early September. Because the government says there’s been no inflation this year — oy — there will be no cost-of-living adjustment for Social Security next year. And under the law, most Medicare recipients wouldn’t have their Part B premiums raised, either.

But under a quirk in that law, some Medicare recipients would have had their premiums raised a lot to cover Medicare’s relentlessly rising costs. The burden would’ve fallen hardest on people who’ve not yet begun taking Social Security benefits.

Anyway, the budget deal puts an end to all that. But don’t cheer too loudly. To make up for the shortfall, payments will be cut — again — to doctors and other providers.

So your premiums won’t increase… but your doctor might stop accepting Medicare patients. Besta luck!

About those relentlessly rising costs: Back in June, we told you how the Centers for Medicare and Medicaid Services projected that health care would consume $1 out of every $5 spent in the United States by 2024.

About those relentlessly rising costs: Back in June, we told you how the Centers for Medicare and Medicaid Services projected that health care would consume $1 out of every $5 spent in the United States by 2024.

And that’s a government projection… so you can safely bet it’s on the low side.

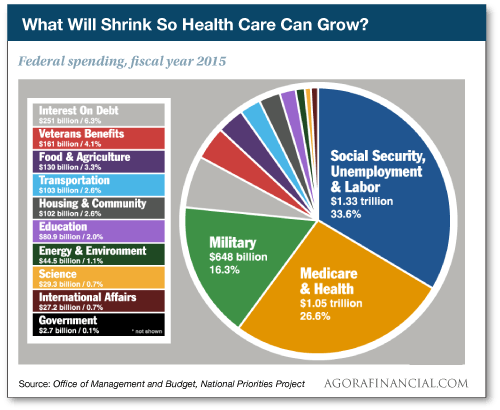

Meanwhile, the percentage of the federal budget devoted to health care doubles every 20 years or so. In 1970, health care took up 6.2% of federal spending. By 1990, 12.4%. Now it’s approaching 27%.

Which brings us to a question our fearless leader Addison Wiggin posed a while back: “Assuming you’re 55 now, health care spending will eat up half the federal budget by the time you’re 75. Now, looking at a pie chart of the current federal budget, what categories do you think will have to give way to make room for all that health care spending?

“If you haven’t already figured it out,” said Addison, “that’s a trick question. Something in the system is going to break long before health care spending eats up half the federal budget.”

A major contributor to the growing cost curve is treatment for Alzheimer’s disease.

A major contributor to the growing cost curve is treatment for Alzheimer’s disease.

“The Alzheimer’s Association has published data suggesting the total costs of treating Alzheimer’s in America today are over $226 billion,” says Ray Blanco of our science-and-wealth team.

“By 2050, when up to 14 million Americans are predicted to have some form of the disease — and when America will have over 80 million citizens over the age of 65 — the yearly Alzheimer’s care costs to society could eclipse $1.5 trillion. That’s per year.

“That’s 2½ times the yearly U.S. defense budget in today’s dollars. Or almost as much as the yearly cost of Social Security, Medicare and Medicaid… combined.

“That’s the total yearly health care cost of one disease… just a generation from today.”

Little wonder Ray says, “If we don’t fix Alzheimer’s now, the disease threatens to destroy the entire country.”

As it happens, science is on the verge of bending that cost curve.

As it happens, science is on the verge of bending that cost curve.

“Analysts at UBS have predicted an effective new drug at stopping, reversing or even slowing down AD symptoms would be worth $67 billion a year,” Ray goes on.

“That projection would make a blockbuster Alzheimer’s drug one of the most successful drugs in history right out of the gate.

“And that’s exactly the kind of drug we might have on our hands today.”

In less than two weeks, the CEO of a tiny company will make a presentation at a medical conference. “He will release full Phase 2A clinical trials data and preliminary 2B data on his company’s Alzheimer’s drug.”

Already, the early Phase 2A results have “shaken Alzheimer’s research to its foundation,” says Ray. “Fuller 2B data could do the same, pave the way for wide Phase 3 study and ignite a mega-run in interest for this company’s stock.”

Ray has much more in this report he’s just released — there’s no long video to watch.

If stock traders are excited by news of the budget deal, they’re not showing it.

If stock traders are excited by news of the budget deal, they’re not showing it.

The major U.S. indexes are all down, but not by much. The S&P has shed four points as we write, resting at 2,067.

Crude, however, is getting slammed again with word of the planned drawdown in the Strategic Petroleum Reserve — down 2% and now threatening the $43 level.

Treasury yields are ticking down, the 10-year at 2.03%. Gold is flat at $1,166.

Gold remains in a bear market, in the candid assessment of Greg Guenthner.

Gold remains in a bear market, in the candid assessment of Greg Guenthner.

If you’re a newer reader, you should know Greg called gold’s bear market in February 2013 — when the Midas metal was still at $1,650.

Yes, it’s staged an impressive rally since early August. “But we need to look at this rally through a long-term lens,” he wrote in this morning’s Rude Awakening.

“And what you’ll quickly notice is that what gold is experiencing so far is a bear market rally.

“While I think gold could see a move to somewhere between $1,200-1,250,” Greg concludes, “we don’t yet know if this is the long-term bottom everyone’s been searching for just yet.

“For all of the back-and-forth action we’ve seen over the past few months, the market has not given the all-clear signal on gold as a longer-term trade.”

Here comes a new “war on gold,” warns Jim Rickards. “Major bank gold dealers are being told that gold is no longer a ‘good asset’ for regulatory purposes.”

Here comes a new “war on gold,” warns Jim Rickards. “Major bank gold dealers are being told that gold is no longer a ‘good asset’ for regulatory purposes.”

Last week, the head of the London Bullion Association said new liquidity rules for European Union banks could raise their gold-trading costs by 300% — effectively driving them out of the market.

The new rules are all part of “Basel III” — a set of voluntary guidelines most of the developed world’s banks plan to follow so they can survive a bank run during a financial crisis. The guidelines were developed by the Switzerland-based Basel Committee on Banking Supervision.

“The rules treat physically traded gold the same as other commodities,” says a Reuters story, “meaning banks trading the metal would have to carry more cash and cash equivalents as a proportion of their gold exposures to act as a buffer if there is an adverse move in the gold price.”

Jim adds some color: “The only good assets left are government bonds. The banks will fall into line to protect their profit margins.” They’re already moving, even though the rules don’t kick in till 2019.

If you have an eye toward the very long haul, Jim says gold’s current price is mighty attractive.

“Why are you not posting the date of The 5 Min. Forecast or other items you post online?” a reader inquires.

“Why are you not posting the date of The 5 Min. Forecast or other items you post online?” a reader inquires.

“It would be helpful to have that info posted on the issues, alerts or 5 Min. Forecast so if a hard copy is printed for future reference that it records the date it was published. Pretty solid value for your subscribers.”

The 5: Agreed… and it’s there.

But we concede that after we spiffed up our website last May, it’s in a rather small font and might be easy to miss. Just look right below the title of the post.

“I do not remember ever hearing you say anything about the community colleges,” writes one of our regulars on the recurring topic of student debt (and the side topic of luxury dorms).

“I do not remember ever hearing you say anything about the community colleges,” writes one of our regulars on the recurring topic of student debt (and the side topic of luxury dorms).

“When I started TCU in 1953, the bulk of the housing on campus was surplus GI wooden barracks buildings from dismantled basic training facilities for WWII. They were good enough when I returned from the military in 1959 to enroll me at the same tuition prices from 1953.

“The community colleges, I eventually learned, were costing a quarter of the state schools such as UT Austin, which was roughly half what TCU charged. The college name on your diploma is what the personnel manager sees. He really doesn’t pay any attention to the four-eight years in community colleges when you were working your way through. And you were probably a better employee for working your way through.

“I was reading somewhere a month or so back about some little airheaded girl that went to the three most expensive colleges in America, all the way to a Ph.D., because she knew the government would forgive her debts at some point.

“My wife and I both worked our way through with a wee bit of parental financial help. Our son and daughter both worked and saved and finally made it through. Daughter got a BS in psychology from Kansas State on her own, but while she was living at home, we paid her way through the local community college. Because I had told the son when he was 5 that if he made straight As, he could go to any school he wanted, he got a BS in communications from SMU back in 1989.

“He played all high school sports except tennis and golf while he worked, saved and took college courses in high school (to allow him to get out of SMU in three years) and still graduated valedictorian. I heard at the graduation that he had also been the class clown.

“We gave him $70,000 cash. He worked mostly as a waiter and made the rest. And if I remember correctly, it was around $37,500 a year (now I understand it is $37,500 per semester at TCU.) After graduation, he called me to pick him up at the airport, and he came home for two months until the city of Plano gave a police academy placement. And after joining Plano police force, he went on with their help and got his master’s from UT Arlington.”

The 5: Community college is still an affordable alternative. Your editor might have gone the community college route in the mid-’80s, but I was able to test out of a year’s worth of coursework at an in-state university.

As a result, I could take 300-level courses required for my major 18 months before community college transfers my age, and I could enter the workforce full time a year sooner. Costwise, I imagine it all shook out in the end. Loved those proficiency credits!

Best regards,

Dave Gonigam

The 5 Min. Forecast

P.S. “After Saturday, Nov. 7,” says the aforementioned Ray Blanco, “the entire investing world is going to split into two groups.

“Those who were in ahead of time. And those who missed out.”

We wouldn’t want to see you in the second group. Much more from Ray right here.