- The toxic codependent relationship of Trump and the media

- Did gold really fall because of nerves over Trump’s speech?

- Rickards on Trump, the dollar and gold

- Biotech is back, baby!

- Repealing Obamacare: It’s “complicated,” but you can take matters in your own hands

- Repeating the first-30-days national debt feat, and other reader fantasies

This is getting tiresome. Do the media have to view everything through the prism of Trump now?

This is getting tiresome. Do the media have to view everything through the prism of Trump now?

After we went to virtual press yesterday, gold gave up about half of the gains it had racked up since last Thursday. The Financial Times immediately began the hand-wringing: “Gold’s almost 10% advance this year will be in jeopardy should U.S. President Donald Trump’s key address to Congress on Tuesday reignite the dollar rally and prospect for higher interest rates.”

Trump and the media have a toxic codependent relationship. As a result, Trump has become an intrusive presence in our homes and our lives. The other day, my wife recalled an old Saturday Night Live sketch — likening Trump to John Belushi’s character as a houseguest who overstayed his welcome with Jane Curtin and Bill Murray…

A few weeks ago, the president basked in this phenomenon. “One of the things that I heard this morning in watching the news was that — amazingly, it’s never happened before — that politics has become a much bigger subject than the Super Bowl. This is usually Super Bowl territory, and now they’re saying that the politics is more interesting to people.”

How profoundly depressing. Government should be small and inconspicuous, freeing us up to think more about our families, our neighbors, our spiritual existence — and, yes, the Super Bowl.

But on this day, we’re sucked in regardless: The conventional wisdom contaminating the FT’s gold-Trump story is such that we’re compelled to respond and shoot it down.

“What’s the best way to forecast markets in the age of Trump?” asks Jim Rickards rhetorically.

“What’s the best way to forecast markets in the age of Trump?” asks Jim Rickards rhetorically.

“The answer is don’t try to forecast the next policy move. Focus instead on the reaction functions. This method resembles martial arts. Your opponent may come at you from the left or right. In either case, don’t resist your opponent’s thrust. Instead, dodge the attack and watch your opponent stumble as a result.”

Jim points us to the following Wall Street Journal excerpt based on a recent interview with Treasury Secretary Steve Mnuchin…

Mr. Trump has expressed frustration that other countries — most notably China — have used weak currency policies to boost exports. The comments during his campaign and since his election carried with them an implication that the new administration might favor a weaker currency to support the U.S. trade position.

Mr. Mnuchin avoided taking confrontational positions on the dollar. He said the strong U.S. dollar was a reflection of confidence in the U.S. economy and its performance compared with the rest of the world and was a “good thing” in the long run.

“So which is it?” says Jim. “A strong dollar or a weak dollar?

“So which is it?” says Jim. “A strong dollar or a weak dollar?

“Trump has complained bitterly about China, Japan and Germany being currency manipulators. At the same time, he has spoken positively about possible rule-based appointees to the Federal Reserve, including Kevin Warsh and Dr. Judy Shelton. The problem is that all rule-based methods of monetary policy point to higher rates, which will make the dollar stronger despite Trump’s complaints. Again, which is it? A strong dollar or a weak dollar?”

It pays to examine both outcomes — and identify an asset that will prosper regardless.

It pays to examine both outcomes — and identify an asset that will prosper regardless.

“If Trump pursues a weak dollar policy,” Jim tells us, “that has clear inflationary consequences, which is good for gold and the euro.

“On the other hand, if Trump pursues a strong dollar policy, that will almost certainly lead to a Chinese maxi-devaluation and to an emerging-market dollar-denominated debt crisis. That could be a short-run head wind for gold, but as crisis conditions take hold, gold will benefit from a flight to safety.

“The point is we can foresee higher gold prices under both strong and weak dollar scenarios. The result is the same — although the paths are different based on initial conditions.

“You should be like the martial artist who foresees how an opponent can stumble regardless of the direction of the initial thrust.”

[Ed. note: If gold prices are headed higher under either scenario, a well-chosen junior gold stock could multiply your money many times over in a brief stretch of time. Jim and his team have identified a leading candidate… with explosive potential only three weeks from now. See why Jim’s so excited when you follow this link.]

How about that? Gold’s already recovered most of those losses from yesterday that got the Financial Times all hot and bothered.

How about that? Gold’s already recovered most of those losses from yesterday that got the Financial Times all hot and bothered.

At last check, the bid has recovered to $1,257. And you can’t chalk up that move entirely to dollar weakness; the dollar index is off only modestly at 100.9.

The major U.S. stock indexes are yet again moving microscopically; the Dow has shed two points as we write and rests at 20,835. That said, we’re the last to dismiss the possibility of a teensy reversal of that move so the media can tout A RECORD CLOSE BY THE DOW FOR 13 STRAIGHT DAYS!

The day’s economic numbers are underwhelming. The Commerce Department took its second guess at fourth-quarter GDP; it came in below expectations at an annualized 1.9%. The trade deficit came in bigger than expected at $69.2 billion; imports surged, exports shriveled.

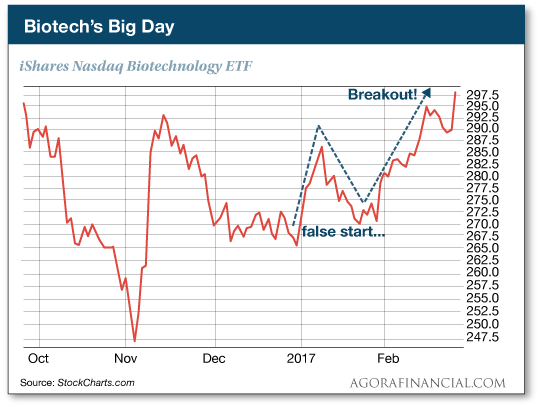

“After 18 months of pain, biotechs are back in action,” says Greg Guenthner in today’s Rude Awakening.

“After 18 months of pain, biotechs are back in action,” says Greg Guenthner in today’s Rude Awakening.

“Health care and biotech stocks were the strongest names on the market during the first week of January. But they weren’t ready for prime time just yet. After a few more weeks of consolidation, we finally have the breakout we’ve been waiting for…

While the Dow crept up by an infinitesimal degree yesterday, the iShares Nasdaq Biotechnology ETF (IBB) leaped nearly 3%, to a 2017 high.

“While the rest of the stocks on the market were stuck on pause yesterday,” says Greg, “130 biotechs gained at least 5% on the day. Twenty-four of these gained more than 10%. Even the down-and-out biotechs locked in nasty downtrends enjoyed a reprieve.

“Make no mistake,” he concludes — “this biotech rally is as broad as it is powerful.”

“Nobody knew that health care could be so complicated,” said the president yesterday — as the prospect of Obamacare reform slipped further and further into the future.

“Nobody knew that health care could be so complicated,” said the president yesterday — as the prospect of Obamacare reform slipped further and further into the future.

That’s what he said during a meeting with Republican governors and insurance executives. Confidence-inspiring, no?

Did he not realize while campaigning that the Affordable Care Act ran to 1,990 pages — plus 20,000 pages of associated regulations? Repeal it with no replacement and there’d be headlines about “X Million Americans Lose Health Coverage” just in time for the 2018 midterms.

But hey, “nobody knew.”

Wanna bet by the time the process is all over they’ll have to pass a bill so we can all find out what’s in it?

In the meantime, the repeal-and-replace bill championed by House Speaker Paul Ryan is getting catcalls from the GOP rank-and-file.

In the meantime, the repeal-and-replace bill championed by House Speaker Paul Ryan is getting catcalls from the GOP rank-and-file.

The Freedom Caucus and the Republican Study Committee — which together comprise more than 170 House members — have declared their opposition. “It would take less than two dozen defections among Republicans to sink the repeal effort,” says Time, “assuming Democrats vote as a bloc.”

[Heh. David Stockman’s analogy about congressional Republicans as a “circular firing squad” looks more apt by the day.]

Meanwhile, as we mentioned in passing yesterday, many everyday taxpayers — people who are too busy to follow politics as closely as the president likes — are under the impression that Obamacare’s already been repealed.

“There’s been a little bit of education necessary for taxpayers because some heard that Obamacare went away,” Mark Steber of the Jackson Hewitt tax-prep firm tells Politico.

Look, we’ve been telling you since the first of the year that if you’re waiting for the White House and Congress to fix Obamacare, you’ll be waiting a long time. And we’ve also been telling you how you can take matters into your own hands — joining an “underground” health care system that’s saving people like you up to $11,172 or more every year in insurance premiums… while taking back control of all your health care decisions.

You can check out that system right here and take action now. Or you can keep waiting. It’s up to you.

“Had to comment on Trump reducing the deficit by $12–33 billion his first month,” a reader writes after yesterday’s episode.

“Had to comment on Trump reducing the deficit by $12–33 billion his first month,” a reader writes after yesterday’s episode.

“I will happily take any reduction in the deficit, especially if he were able to do this or more every month of his term (I assume this was a complete surprise to him and he had no idea what the deficit did his first month).

“But I just had to provide a brief perspective.

“A billion seconds is 31.7 years. A trillion seconds is 31,700 years!

“It’s a first step, but there’s a long, long way to go.

“I do like the fact that he has proposed cutting the EPA and State Department to fund increased military spending. Go to a flat tax with absolutely no deductions for anything, and completely do away with the IRS.

“Finally, I’d love to see legislation passed that places all political pensions a risk of clawback if the deficit is not reduced by 1% per year. I can dream, can’t I?”

“Dave,” writes another regular, “Jim Rickards has been sounding the alarm that China will do a ‘maxi-devaluation’ of their currency if The Donald follows through with his promise to label them as a currency manipulator.

“Dave,” writes another regular, “Jim Rickards has been sounding the alarm that China will do a ‘maxi-devaluation’ of their currency if The Donald follows through with his promise to label them as a currency manipulator.

“In an interview with Reuters late last week, President Trump popped off this comment: ‘Well, they, I think they’re grand champions at manipulation of currency. So I haven’t held back.’ He followed up that statement with ‘We’ll see what happens.’

“We sure will, now that the genie is out of the bottle! It’s game on. Got bullion?

“Thanks again for the great work you and your team do.”

The 5: And there are other new developments on the gold front. Jim just recorded a short video update that’s worth a look.

“Regarding warfarin and feral hogs,” writes a reader about Texas’ plan to get wild pigs under control: “My cardiologist just prescribed warfarin for me. Is he trying to tell me something?

“Regarding warfarin and feral hogs,” writes a reader about Texas’ plan to get wild pigs under control: “My cardiologist just prescribed warfarin for me. Is he trying to tell me something?

“I mean, I already know that I am open season for politicians, but I thought that meant I was to be done in via pocketbook assassination.”

Writes another: “Warfarin is derived from snake venom.

“Cull the herd via hunting — don’t poison it! Too many downrange effects. Only a bureaucrat could think of something this lame.”

The 5: Sounds as if the plan’s going ahead: “To limit exposure of nontarget species such as deer, raccoons, birds and others that might ingest the baits,” says the Houston Chronicle, “protocols for distributing it mandate use of a specially designed feeder with a heavy ‘guillotine’ door that must be lifted to access the bait. Feral hogs have little trouble using their stout snouts to lift the door, while the door’s weight and mode of operation stymies most other wildlife.”

We shall see…

Best regards,

Dave Gonigam

The 5 Min. Forecast

P.S. Our team recently uncovered compelling evidence suggesting that in up to 96% of cases…

GOLD may be the “magic bullet” for detecting and surviving cancer!

This electron microscope photo shows a critical part of this new gold-based oncology protocol…

We’ll bring you more on this development later in the week. But if we’ve already piqued your curiosity, you can get a fuller explanation — plus details on how you could score HUGE profits as this breakthrough unfolds — just click here.