- The immorality of billionaires, according to Ocasio-Cortez

- The real number of “ultra high net worth” individuals

- What makes billionaires tick, according to Altucher

- How to follow billionaire money for generational wealth

- Stock market hits a speed bump (is that all it is?)

- Um, about those falling mortgage rates helping housing… AOC in the mailbag: What is “socialism,” anyway?

OK, let’s see if we’ve got this right: Being a billionaire isn’t immoral per se, but a system that makes it possible to be a billionaire is.

OK, let’s see if we’ve got this right: Being a billionaire isn’t immoral per se, but a system that makes it possible to be a billionaire is.

At least that’s our takeaway from a viral MLK Day interview with Rep. Alexandria Ocasio-Cortez (D-New York) — the leftist sensation sweeping the nation, as we described here last Thursday. (More reader reactions from our overstuffed mailbag are below.)

“I do think,” she said, “a system that allows billionaires to exist when there are parts of Alabama where people are still getting ringworm because they don’t have access to public health is wrong.”

False choice fallacy, anyone? In AOC’s world, wealth is a zero-sum game, apparently.

“I don’t think that necessarily means that all billionaires are immoral,” she went on. “It is not to say that someone like Bill Gates, for example, or Warren Buffett are immoral people. I do not believe that.”

Of course not! As we pointed out Thursday, Buffett advocates higher income tax rates precisely because billionaires can structure their affairs in a way that their income is never classified as “income.”

Still, the billionaires have to at least pretend they’re alarmed.

Still, the billionaires have to at least pretend they’re alarmed.

Many of them are gathered this week for the World Economic Forum — the power elite’s annual shindig in Davos, Switzerland.

According to Bloomberg, Ray Dalio — head of the world’s biggest hedge fund, Bridgewater — is anticipating “the beginning of thinking about politics and how that might affect economic policy beyond [this year]. Something like the talk of the 70% income tax, for example, will play a bigger role.”

Dalio didn’t mention AOC by name, but he didn’t have to; a 70% tax on any income over $10 million is one of her signature issues.

Lost in the buzz over AOC’s billionaire-bashing is how few billionaires there are in the first place.

Lost in the buzz over AOC’s billionaire-bashing is how few billionaires there are in the first place.

How many, you ask?

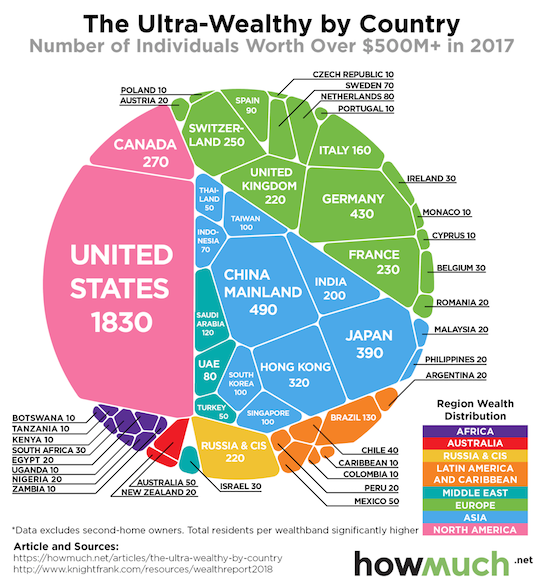

Heck, let’s lower the bar. Let’s talk about half-billionaires — people with a net worth of $500 million or more. In elite parlance, that’s “ultra high net worth.”

According to the 2018 edition of the Knight Frank Wealth Report, they number only 6,610. Of that total, more than a quarter — 1,830 — reside in the United States.

The website called How Much visualizes it like so…

Hmmm… For all the wealth being created in the developing world, look at all the pink and green there. Well over half of the ultra-high-net-worth people — 57.2% — are still concentrated in North America and Europe.

Our own James Altucher is not a billionaire. But he knows a lot of them, and he knows what makes them tick.

Our own James Altucher is not a billionaire. But he knows a lot of them, and he knows what makes them tick.

Why isn’t James a billionaire himself? “There are many aspects of what it takes to be a billionaire,” he says. “I can do some of those things but others I have no interest in. For instance, I don’t like to meet other people. I like to sit at home and write. Writers rarely become billionaires.”

Still, James met plenty of billionaires from his hedge fund and venture capital days. And he’s interviewed still more of them for his podcast.

“I’ve probably studied billionaires more than anybody else,” he says. “So I feel I can teach what it takes even if I can’t DO what it takes.” He’s even working on a book called Think Like a Billionaire.

One thing James says billionaires are very good at is anticipating the near future.

One thing James says billionaires are very good at is anticipating the near future.

We’re not talking about decades-long visionary stuff. We’re talking one to five years out. “They make accurate predictions about the near future and then build businesses around that future,” James says.

“Jeff Bezos saw that things would be sold online. So he created the biggest online retailer in the world.

“Sam Walton saw that big-box stores with easy-to-access distribution centers would replace small mom and pop stores in every community, so he started the Walmart chain.

“Henry Ford saw that the principles of the Industrial Revolution could be applied to making automobiles, so he invested in the assembly line for the fast construction of cars.”

The flip side of that nimble anticipation is that “Billionaires don’t get rich by creating something 100% new,” James adds.

The flip side of that nimble anticipation is that “Billionaires don’t get rich by creating something 100% new,” James adds.

“Mark Zuckerberg created the 10th social network. But the first with verified identity.

“Jeff Bezos created probably the 50th e-commerce company but the first that spread to other areas (he started with books, then clothes, then electronics, food, etc.).”

Steve Jobs didn’t develop the “graphical user interface” for computers — pointing at stuff with a mouse instead of typing out inscrutable command lines. It was Xerox that came up with the original GUI.

But Jobs figured out how to make it sell to a critical mass of customers in the 1970s. From there, Apple rose to become the world’s biggest company and Jobs died in 2011 with a net worth of $10.2 billion.

Billionaires are also very good at anticipating “superconvergence” events of the sort that we described here with James’ help on Friday.

Billionaires are also very good at anticipating “superconvergence” events of the sort that we described here with James’ help on Friday.

A quick reminder: Superconvergence is when technology starts changing consumer habits permanently… at the same time a financial catalyst gives that technology a massive tail wind.

To James’ mind, the last superconvergence event came in the early 1980s — as the home computer was coming into its own and the Reagan administration’s tax cuts and deregulation were flooding the markets with cash.

Result? Apple Computer shares doubled in a three-year span after going public in December 1980. And if you held on for the long term, a mere 100 shares at the IPO price of $22 a share turned into a $1.3 million fortune.

Superconvergence events don’t happen often. But James believes the next one is upon us — thanks to a host of breakthroughs including artificial intelligence and blockchain technology at the same time the Trump administration dusts off Reagan’s tax-cuts-and-deregulation playbook.

Superconvergence events don’t happen often. But James believes the next one is upon us — thanks to a host of breakthroughs including artificial intelligence and blockchain technology at the same time the Trump administration dusts off Reagan’s tax-cuts-and-deregulation playbook.

In other words, James says you could be on the cusp of generational wealth — and in a very short time. With the companies on his radar, he’s thinking as much as 10 times your money this year alone.

It’s an opportunity that might not come along again for 35 or 40 years. And James is ready to get you started during a special online event in less than 48 hours — this Thursday at 1:00 p.m. EST.

Response so far has taken us by surprise, so we can’t guarantee how long the available slots will stay open. Secure your slot now by following this link.

The stock market is taking a spill this morning — the Dow down about 250 points at last check, to 24,458.

The stock market is taking a spill this morning — the Dow down about 250 points at last check, to 24,458.

When a move like this takes place, mainstream financial media run down a multiple-choice menu of potential “reasons.” For the last several months, the menu has been…

- “Fears the global economy may be slowing down”

- “Concerns about U.S.-China trade tensions”

- “Worries over Federal Reserve policy”

This morning, CNBC opted for (A) — perhaps because over the holiday weekend, China’s GDP number registered its weakest reading since 1990.

The fact the stock market has had four “up” weeks in a row and might be due for a good one-day pullback? Much too prosaic an explanation.

Whelp, our Mike Burnick figured we were overdue…

Since the market bottomed on Christmas Eve, “the buying has been nearly one-sided, with stocks gaining ground on 12 of the last 17 trading days!” says Mike

Since the market bottomed on Christmas Eve, “the buying has been nearly one-sided, with stocks gaining ground on 12 of the last 17 trading days!” says Mike

“Internally, this rally has been very healthy, with the number of advancing versus declining stocks surging higher as new highs on the NYSE are now beating new lows, for the first time since September.

“Also last week, all the major indexes traded above their 50-day price moving averages for the first time since December. The Dow and S&P 500 have now retraced half of the October–December sell-off.”

Mike still believes stocks are set for a big run this year. But short term, the market got way “overbought.” Look for some choppy sideways action before the next move higher.

Elsewhere, gold is stuck in the low $1,280s. Crude, increasingly prone to wild and incoherent swings, is down 3% at $52.18.

Elsewhere, gold is stuck in the low $1,280s. Crude, increasingly prone to wild and incoherent swings, is down 3% at $52.18.

The one economic number of the day was a disappointment, but not exactly a surprise: Existing home sales fell 6.4% in December, despite mortgage rates that fell most of the month.

The one economic number of the day was a disappointment, but not exactly a surprise: Existing home sales fell 6.4% in December, despite mortgage rates that fell most of the month.

For the post-2008 economic expansion, it’s abundantly clear that the housing market peaked last spring.

No, that doesn’t signal an imminent bear market or recession. Once again, as the old market pros will tell you… market tops are a “process,” not an “event.”

To the mailbag, where AOC is still the hot topic: “I can’t square it in my mind how all these socialists have to do is look at history (or the current poster child, Venezuela) to see that socialism has never worked.

To the mailbag, where AOC is still the hot topic: “I can’t square it in my mind how all these socialists have to do is look at history (or the current poster child, Venezuela) to see that socialism has never worked.

“Now this ignorant nut job wants America to lose 20 years on some socialist experiment that is guaranteed to fail?

“We cannot afford this stupidity in America now.”

The 5: Define “socialism.”

The classic definition is indeed what’s practiced in Venezuela right now — state ownership of the means of production.

But we haven’t heard AOC or any of these other self-professed “democratic socialists” say a thing about that. Basically they want to move in the direction of a European-style welfare state. That has its own problems — witness the yellow-vest protests in France — but at least, for the most part, there’s food on the store shelves. Can’t say that about Venezuela.

Along those same lines, we got a really long and thoughtful letter about AOC and Scandinavia’s welfare-state model.

Along those same lines, we got a really long and thoughtful letter about AOC and Scandinavia’s welfare-state model.

Unfortunately, it was so long it will have to wait for another day. It really deserves the room to breathe.

In the meantime…

“I am curious that of all the subjects you write about, we don’t hear more about the jubilee debt forgiveness holiday,” writes our final correspondent.

“I am curious that of all the subjects you write about, we don’t hear more about the jubilee debt forgiveness holiday,” writes our final correspondent.

“Some politician someday is going to figure out how to eat this cake and have it too. Maybe a Trump/Ocasio-Cortez bipartisan debt jubilee is not all that unthinkable. For all of the debt-laden populace, a debt forgiveness jubilee would be apparent Nirvana, however bittersweet.

“Trump could choose AOC as his running mate, and together in true bipartisan form, they could forgive all of the bank loan debt, student loan debt, any loan debt in existence and guarantee a historic second term.

“Then the government could turn around and tax the beneficiaries of their plan on the amount of debt forgiven. Like all newly minted bankrupts, these debt-free entities would be prime targets of the banks, flush with fed funds ready to loan and start the cycle all over again. Since it’s just funny money anyway, what’s the harm?

“Let’s clear the decks and start this Ponzi musical chairs dance again from the beginning. And let the best man/bank/gubmint win.”

The 5: Don’t give them any ideas!

Or did we plant the seed with that mocked-up Trump/Ocasio-Cortez bumper sticker?

They really are two sides of the same coin, as that meme suggested. As noted above, AOC views wealth as a zero-sum thing: If someone is poor, you solve it by taking from the rich. Trump, meanwhile, seems to view “winning” only through the lens of someone else “losing.”

Then again, it shouldn’t be surprising the zeitgeist has given rise to this zero-sum mentality, whether of the left-wing or right-wing variety. The “free market” has been so thoroughly corrupted by the crony-capitalist culture well represented in Davos — bankers, defense contractors, health care executives and many others lining their pockets with the connivance of government — that “win-win” seems like an illusion…

Best regards,

Dave Gonigam

The 5 Min. Forecast

P.S. I suppose that brings us back to the billionaires we started with today.

Some of them acquired their wealth ethically. Some of them are snakes. But as James Altucher would tell you, all of them have a vision — a knack for anticipating where the marketplace is moving in a near-term time frame between one and five years.

You want to know where their money is going… and do your best to follow their lead. Especially now at this “superconvergence” moment James is describing, something we haven’t seen since the early Reagan years. It’s a once-in-40-years shot at building generational wealth.

And James will lay out his strategy to seize the moment during a special online event this Thursday at 1:00 p.m. EST.

That’s less than 48 hours from now… so we can’t guarantee how much longer slots will be open for this limited-access event, only for Agora Financial readers like you. Click here right away to secure your space.