- Down the garden path with de-dollarization

- The Fed creates a yield desert…

- … and gold leaves bonds in the dust

- The Golden State’s basket-case unemployment

- Regulation Nation (Trump foiled again)

- Thai protesters on the government’s hamster wheel

- A reader on Kodak’s moment… Another takes on congressional Roth raiding… And The 5 gives a reader a headache

On the long road to de-dollarization, China and Russia just reached a milestone.

On the long road to de-dollarization, China and Russia just reached a milestone.

“In the first quarter of 2020, the share of the dollar in trade between the countries fell below 50% for the first time,” says a story on the website of RT — Russia’s English-language news channel.

That’s down from 90% only four years ago. And much of that drop has come in just the last two years — from 75% to 46%.

It was in May 2014 we first took note of the term “de-dollarization” in Russian media. Increasingly, nations around the world are looking to bypass the dollar when trading with each other.

Little wonder when China, Russia and another dozen or so countries — making up a quarter of the globe’s population — are subject to U.S. sanctions or some other form of economic punishment.

Or as Russia’s foreign minister Sergei Lavrov described de-dollarization in January, "an objective response to the unpredictability of U.S. economic policy and the outright abuse by Washington of the dollar's status as a world reserve currency."

So there’s some context for Goldman Sachs’ outlier report this week that the dollar’s reserve-currency status is under threat — conveying a spidey-sense among the global elites that’s manifesting itself in record gold prices.

Meanwhile, gold is turning the heads of “pension funds, insurance companies and private wealth specialists,” according to a Bloomberg dispatch.

Meanwhile, gold is turning the heads of “pension funds, insurance companies and private wealth specialists,” according to a Bloomberg dispatch.

“Managers who run long-term portfolios worth trillions of dollars are taking interest in gold as they search for returns in a yield-starved investing landscape… With $15 trillion in [global] debt offering negative yields and the Federal Reserve likely holding rates near zero for the foreseeable future, some on Wall Street are questioning the wisdom of owning bonds and looking elsewhere for assets to hedge against equity volatility.”

That landscape will be only further starved for yield going forward. Yesterday during his every-six-weeks press conference, Federal Reserve chairman Jerome Powell promised all of the Fed’s rescue programs will “remain in place and be available as long as they are needed.”

That landscape will be only further starved for yield going forward. Yesterday during his every-six-weeks press conference, Federal Reserve chairman Jerome Powell promised all of the Fed’s rescue programs will “remain in place and be available as long as they are needed.”

By the way, are we the only ones who think Powell’s Zoom-style virtual press conferences give him, well, sort of a hostage-y look?

Hey, what if he’s blinking, “We’re doomed, buy gold!” in Morse code?

Back to the Bloomberg piece: “Gold ownership among the professional class is viewed to be low. The total value of investor positions in gold futures and exchange-traded funds is equivalent to just 0.6% of the $40 trillion in global funds, according to UBS Group AG strategist Joni Teves. That position could easily double without the allocation looking extreme, she wrote in a note.”

Exactly. Here’s a chart we shared last month. At 0.6%, the number has barely moved since 2016, the last time the chart was updated.

It’s still lower than in 2012, never mind the dizzying manic heights of 40 years ago when people were lining up around the block in Manhattan to buy bullion.

But don’t take it from us. Take it from Geraldine Sundstrom, an expert at Pimco — the $1.9 trillion-strong asset management firm renowned for its bond strategies.

“We need to… look for safe haven beyond government bonds. Given Pimco’s view that rates will be kept very low for years to come, causing depressed levels of real yield, gold feels like an appropriate diversifier.”

The stock market is falling out of bed today for no obvious reason.

The stock market is falling out of bed today for no obvious reason.

Oh, the financial media are giving it their best shot — they always do. Here’s a Wall Street Journal alert on your editor’s iPad: “The Dow industrials fell about 500 points as the latest economic data showed the extent of damage wrought by the pandemic.”

Nice try, no cigar. First-time unemployment claims this week rang in a hair higher than expected, but not much. The bigger problem is that on our every-Thursday little chart of horrors, a curve that you don’t want flattening… has flattened.

The total this week was 1.434 million. For perspective, a normal week in a healthy economy is about 300,000.

Meanwhile, the Commerce Department says U.S. GDP during the second quarter collapsed 9.5% from a year earlier — which works out to an annualized decline of 32.9%. Horrendous, and a postwar record by a mile… but actually not as bad as expected.

We’re not going to dwell on GDP today. As we’ve long said, it’s a meaningless statistical abstraction that has squat to do with your standard of living. It’s even less meaningful now. All the wealth of the country is still there — the factories, mines, power plants, storefronts, vehicles and so on. It’s just that our political masters won’t allow us to put them to productive use.

In any event, the safety trade is in play…

In any event, the safety trade is in play…

- The Dow is down more than 1% as we write at 26,230

- The S&P 500 is down a little less than 1% at 3,230 (still holding the line on 3,200)

- The Nasdaq is holding up best, down about a third of a percent at 10,505

- Treasury prices are rallying, sending yields plunging; at 0.55%, a 10-year note is its lowest since the insanely volatile days of March.

Gold, alas, is not benefiting from the safety trade — down nearly $30 from yesterday’s close, the bid now $1,940. And we wouldn’t be surprised to see still more churn before the next leg up.

Silver’s taking an even bigger hit, down nearly 5% at $23.13.

All of this could change on a dime tomorrow; most of the biggest tech names report their numbers after the closing bell today.

Because California state government isn’t already enough of a basket case, it might step in to replace the feds’ soon-to-expire $600 a week in extra unemployment benefits.

Because California state government isn’t already enough of a basket case, it might step in to replace the feds’ soon-to-expire $600 a week in extra unemployment benefits.

The program expires tomorrow; most recipients have already collected their last check. “Without a congressional extension, the average jobless payment in California will be reduced to about $338 a week,” says the San Francisco Chronicle.

Of course, Sacramento doesn’t have the money to pull this off… and unlike Washington, it can’t print the funds to do so. The lawmakers floating this proposal “outlined a host of unconventional accounting moves that could bring in the extra money,” the paper continues, “many of which involve borrowing against expected future revenue."

Future revenue? What future revenue?

We throw up our hands…

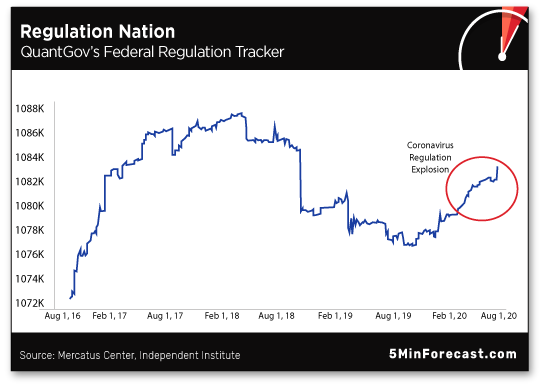

Go figure: The pandemic has thrown the Trump administration’s deregulation efforts into reverse.

Go figure: The pandemic has thrown the Trump administration’s deregulation efforts into reverse.

Economists with the “QuantGov” project at George Mason University’s Mercatus Center have a tool they call the Federal Regulation Tracker. And it finds that from March 3–July 10… a total of 3,881 net new restrictions were added into the Code of Federal Regulations.

Some perspective from Craig Eyermann at the Independent Institute: “What’s surprising about the new surge in federal regulations is that the majority of new restrictions have not been issued by the agencies playing the most significant roles during the coronavirus pandemic.”

Indeed, nearly half the new rules come from… the EPA. Meanwhile, the three agencies most responsible for various “stimulus” efforts — the Fed, the Treasury and the Small Business Administration — account for only 17%.

In our daily quest for money-related “quirk,” we present the following verbatim…

In our daily quest for money-related “quirk,” we present the following verbatim…

“BANGKOK (Reuters) — Hundreds of Thai protesters sang a Japanese cartoon jingle on Sunday with lyrics mocking the government as hungry hamsters feasting on taxpayer cash, part of a new protest movement by youth who say they are using whimsical tactics for serious ends.”

We read the whole story and still have no idea what it’s about, but the protesters seem to have their hearts in the right place and we wish them well. Moving on…

“I’m just curious about the Kodak announcement,” a reader inquires.

“I’m just curious about the Kodak announcement,” a reader inquires.

“It appears that there was a lot of unusual trading before the announcement. What are your thoughts and what should or can the SEC do about it?”

The 5: Well, the announcement came Tuesday, and there was a huge increase in KODK’s trading volume Monday. You can read articles about that anywhere.

But even before that volume spike, “Somebody knew something,” says our trading veteran Alan Knuckman.

As it happens, Alan has access to a data tool that detects intriguing market activity well before it shows up in records of the sort easily accessed by reporters.

Turning that data into actionable information for our readers is an ongoing project. Stay tuned…

“My concern focuses on your concern about Roth confiscations,” a reader and longtime attorney writes after our main topic yesterday.

“My concern focuses on your concern about Roth confiscations,” a reader and longtime attorney writes after our main topic yesterday.

“Your scenarios notwithstanding, it is all about legitimate power and the people’s accumulated knowledge.

“FDR did not have authority when he confiscated gold coins and bullion, but people complied — months before Congress ratified the executive order.

“And the EO lied that its purpose was to reissue more gold coinage to increase circulation; instead, gold was revalued without compensation.

“Our U.S. Constitution has a ‘contracts’ clause, as resistance against retroactivity and confiscation without just compensation.

“That is one reason why companies, and why Trump recently suggested governments, go into bankruptcy — because that is the only, so far, way to break pension plan contracts, however fairly or unfairly created, unless an Obama shows up to subvert bankruptcy, e.g., GM, and force negotiation.

“I will be nimble and take my chances with a Roth, fight to be grandfathered (I have acted daily in reliance on law) and know Congress is slower than I; just watch out for the first time official congressional discussion of a confiscation-type bill is documented — the most retroactive Congress can be under precedents.”

The story of gold confiscation is more complex — and interesting — than the standard telling.

The story of gold confiscation is more complex — and interesting — than the standard telling.

It’s not as if G-men were going house to house in 1933 carrying out FDR’s orders. No, people had already voluntarily surrendered their gold years earlier.

Our Jim Rickards described the process here in 2016: “Banks slowly took the coins out of circulation (the way cash is going out of circulation today), melted them down and recast them into 400-ounce bars. Nobody is going to walk around with a 400-ounce bar in her pocket.

“Then they said to people, in effect, ‘OK. You can own gold, but it’s not going to be in the form of coins anymore. It’s going to be in the form of these bars. By the way, these bars are very expensive.’ That meant you needed a lot of money to have even one bar, and you weren’t going to take it anywhere. You were going to leave it in a bank vault.”

Americans were lured down the garden path with the promise of convenience. Why lug around those $5, $10 and $20 gold coins when you had those handy paper “gold certificates”?

So by 1933, there was no need for G-men to go house to house. The same thing is going on now with physical cash; why fool around with coins and notes in an age of electronic ease?

Anyway, you’re right about how Congress would have to act before any changes to the Roth IRA of the sort we described yesterday — which means you’d have a heads-up and time to act. No reading of the Constitution, no matter how loose, would allow for executive action on tax matters.

If the executive branch tries to pull off something like that on its own, that would mean the constitutional order is far, far more tenuous than it is now — even by the extreme standards of the present day.

“Oh my God, you gave me a headache,” a reader writes — also about gold and Roths.

“Oh my God, you gave me a headache,” a reader writes — also about gold and Roths.

“I know all this could and is happening but how do we fix it as a country out of control?”

The 5: That’s way beyond our remit here. The best we can do is offer you guidance about the things that are within your control. Sauve qui peut, as our fearless leader Addison Wiggin is fond of saying…

Best regards,

Dave Gonigam

The 5 Min. Forecast

P.S. Huh, gold is back to $1,950 — a level that’s held fast most of this week. More tomorrow…