- Fed guarantees a gnarly reality for savers

- Zach Scheidt on Wall Street acronym TINA…

- … and some first-rate value stocks

- Under the microscope: First-time unemployment claims

- The dollars-and-cents cost of civil unrest

- (Chuck E. Cheese) ticket shredder goes, “Brrr”

- A reader reports on world improvers (“from Bill Gates’ backyard”)… Another on the business owner’s “risk no one is talking about”… And more!

If you’d retired in the year 2000 with a $1 million portfolio, you could have put the entire amount in 2-year U.S. Treasury notes and generated more than $65,000 a year in income.

If you’d retired in the year 2000 with a $1 million portfolio, you could have put the entire amount in 2-year U.S. Treasury notes and generated more than $65,000 a year in income.

If you were to retire today with a $1 million portfolio and do the same thing, your annual income would be… a paltry $1,400.

And even if you were to commit to 30-year Treasury bonds instead of 2-year notes, you’d still generate only about $14,000 a year. Ditto if you opted for a 5-year CD — and that’s if you did some serious shopping around.

And this ugly reality for savers will be the rule for at least the next three years.

And this ugly reality for savers will be the rule for at least the next three years.

After we went to virtual press yesterday, the Federal Reserve issued its every-six-weeks policy statement. No surprise, it’s keeping the benchmark fed funds rate near zero.

Also no surprise, the Fed made official its new policy of keeping the rate near zero until there’s evidence of a tight job market and inflation “is on track to moderately exceed 2% for some time.”

➢ For reference, the Fed’s preferred measure of inflation is currently 1.3%. Any resemblance to your own cost of living is purely coincidental.

But the “dots” did throw a curveball. The dots are a scatterplot chart showing where all 17 Fed governors and regional Fed presidents believe interest rates will be in the future — based on their projections for unemployment and inflation.

All 17 are figuring on rock-bottom rates through next year… and 13 of them believe those rates will be in place through 2023.

Which brings us to a trendy acronym on Wall Street — TINA, short for “There is no alternative.” No alternative to stocks if you’re trying to generate investment income.

Which brings us to a trendy acronym on Wall Street — TINA, short for “There is no alternative.” No alternative to stocks if you’re trying to generate investment income.

Recall that the Fed did much more than slash the fed funds rate to near-zero as the pandemic and lockdowns set in. “The Fed also spent hundreds of billions of dollars to buy Treasury securities, mortgage-backed securities and corporate bonds,” our income specialist Zach Scheidt reminds us.

“All of this buying naturally drove prices for these investment choices higher. And when prices for bonds move higher, it naturally means that the yield you can get on these bonds moves lower. And in this case a lot lower!”

Result: “Today, American investors are challenged by negative real interest rates,” Zach goes on.

Result: “Today, American investors are challenged by negative real interest rates,” Zach goes on.

“In other words, the interest you receive from just about any ‘safe’ bond investment will be less than the rate of inflation. So you’re actually guaranteed to lose value if you invest today.

“That’s where TINA comes in. Thanks to all the money the Fed has plowed into different areas of the bond market, investors have no alternative to investing in the stock market.

“So TINA naturally causes investors to allocate most of their capital to the stock market. And this trend will continue for as long as the Fed keeps manipulating the bond markets.”

To no small degree, it’s the TINA trade that drove the Nasdaq and the S&P 500 from their panic lows in March to record highs last month.

To no small degree, it’s the TINA trade that drove the Nasdaq and the S&P 500 from their panic lows in March to record highs last month.

Along the way, we pointed out how it was the biggest and trendiest tech stocks that drove these broad gains.

“But over the last two weeks, we’ve seen a shift,” says Zach. “Some of the biggest stocks like Amazon, Alphabet and Tesla have begun to pull back.”

Don’t get the wrong idea. That doesn’t mean the TINA trade is dead. “With bond prices too high and negative real interest rates still frustrating investors, we have no alternative than to invest in stocks.”

But here’s what’s changed: “Now that the big mega-cap stocks have become more expensive, investors are looking for better places to put their money to work,” Zach explains.

But here’s what’s changed: “Now that the big mega-cap stocks have become more expensive, investors are looking for better places to put their money to work,” Zach explains.

“And many smaller companies still have plenty of room for growth!

“As investors shift their focus to stocks that give them more profit for their capital, value stocks are starting to surge. And there are hundreds of great stocks to choose from!”

Among those Zach offers up for your consideration: NortonLifeLock (NLOK) in technology… Pulte Corp. (PHM) among the homebuilders… and Caterpillar Inc. (CAT) among old-school industrial names.

“Despite the recent pullback in the market, TINA is alive and well,” Zach sums up. “There really is no alternative to investing in the market right now. And fortunately, there are plenty of great companies you can pick that will help protect and grow your wealth through this uncertain period.”

To the markets today… where it’s those big tech names taking the biggest hit.

To the markets today… where it’s those big tech names taking the biggest hit.

At last check, the Nasdaq is down the most among the major U.S. indexes — slipping about 1.4% and back below 11,000. The S&P 500 is down about 1% at 3,350… while the Dow is holding up best, down less than 1% to 27,792.

Gold fell down overnight and can’t get up. As we write, the bid is $1,936. Silver took an even bigger slide, now $26.42. Crude is back below $40.

The day’s economic numbers are a mixed bag, starting with the little chart of horrors…

First-time unemployment claims fell a bit last week, but not enough to really show up on the chart. The number is still higher than the pre-pandemic record set nearly 40 years ago.

Elsewhere, housing starts and permits for August both came in lower than expected. However, that might well be a reflection of supply shortages — the corona-crud has disrupted the flow of lumber, siding and roofing supplies — rather than a lack of demand for new construction.

We also got a so-far-in-September number this morning, with the “Philly Fed” survey of mid-Atlantic manufacturing registering 15.0; anything above zero represents growth, and there’s been four straight months of growth now.

The riots this summer have generated record losses for the insurance industry.

The riots this summer have generated record losses for the insurance industry.

Per the Axios website, “A company called Property Claim Services (PCS) has tracked insurance claims related to civil disorder since 1950. It classifies anything over $25 million in insured losses as a ‘catastrophe,’ and reports that the unrest this year (from May 26 to June 8) will cost the insurance industry far more than any prior one.”

The estimate is wide — $1–2 billion. But the final figure will likely eclipse the previous record set by the 1992 Rodney King riots in Los Angeles — $1.4 billion in 2020 dollars.

Of course, that was confined to one city, which remains a stark reminder of how extreme that episode was 28 years ago. This year, the trouble was spread across 140 cities in 20 states.

From a strictly dollars-and-cents perspective, natural disasters are much more costly. Hurricane Isaias, which swept up the East Coast last month, will cost at least $3 billion in insured losses… while the Western wildfires so far this season are at $1.5 billion and rising.

Hold this thought: We’ll get back to the topic of insurance in today’s mailbag…

Now for a first in bankruptcy history…

Now for a first in bankruptcy history…

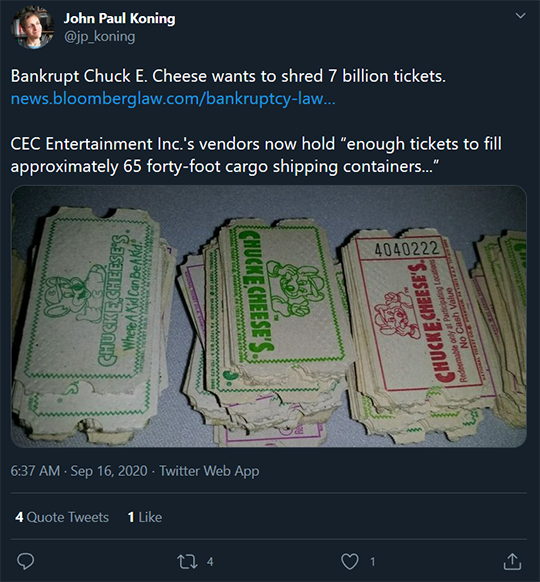

As you might have heard, the lockdowns pushed the Chuck E. Cheese chain into reorganization back in June.

Here in September, “Chuck E. Cheese’s parent company asked a bankruptcy court to approve settlements to destroy 7 billion paper Prize Tickets that have built up in the company’s supply chain as a result of the Covid-19 pandemic,” says the Bloomberg Law site.

Yes, that’s enough tickets to fill 65 shipping containers.

While some Chuck E. Cheese locations have reopened, “the pandemic also prompted the company to accelerate the use of contactless e-tickets,” says the article.

In its court filing, CEC says it has a choice — spend $3.28 million to cycle the paper Prize Tickets through the supply chain or spend a million less to just shred them.

The next hearing in the case is set for Monday. Some document-destruction firm out there is due to land a fat contract soon…

“I'm all in favor of improving the world — as long as it improves for me,” writes a reader in response to yesterday’s 5. (He says he’s located in “Bill Gates’ backyard.” Heh…)

“I'm all in favor of improving the world — as long as it improves for me,” writes a reader in response to yesterday’s 5. (He says he’s located in “Bill Gates’ backyard.” Heh…)

“Thing is, when people talk about improving the world, they usually have wildly different ideas of what that means. I want to improve the world that my social class lives in. I don't worry about improving it for people like Jeff Bezos, although somehow that seems to happen anyway.

“And when the people who attend events like the WEF talk about improving the world, I get the feeling that, by and large, it means improving the world for them and their peers. And I have to agree with you: That thought doesn't give me the warm fuzzies.”

“Insurance: The risk no one is talking about,” reads the subject line of a reader’s comprehensive email.

“Insurance: The risk no one is talking about,” reads the subject line of a reader’s comprehensive email.

“I keep running into red flags that lead me to believe that the insurance industry could be the source of a lot of pain at some point in the future. Being but one simple man, I have decided to reach out to you guys who are much better connected and see if you are smelling any smoke or am I just a nervous nellie? Let me tell you what has me wondering.

“My broker, who has been in the industry for over 30 years, has been telling me the big insurers have been experiencing record losses over the last few years due to a number of catastrophes that have taken place in various places around the world. She also advises that Covid has resulted in billions in claims (not settled yet) for business interruption coverage.

“I’m an owner of a small business (~$10 million of sales annually) that provides technical/engineering services as well as field maintenance/repairs to large industrial clients. Our insurance policies were due at the end of July. Our insurance provider refused to renew our professional liability coverage and my broker had a very difficult time placing this coverage with another provider despite the fact we’ve never filed a claim. In total our premiums have more than doubled in two years!

“We’ve got a sister company (similar size) in a different but related field now in the same situation. The professional liability coverage expired at the end of August and their insurer declined to renew. I’ve got two brokers working this issue and we’ve only been able to find one insurer willing to offer coverage and it is three times last year’s premium! The story we are receiving is that the insurers are refusing to cover anything they deem as remotely risky.

“These are just two anecdotes but I can tell you I’m hearing similar stories from many others.

“Here’s what I’m positing: A) Either we will see an insurance company or companies go tilt, which would be very, very bad, or B) some businesses will not be able to get insurance coverage either because the insurers refuse to provide coverage or it becomes cost prohibitive.

“I can tell you I’m worried about B right now because professional liability coverage is a requirement in almost all of our contracts… if we don’t have it, we have to close the doors.

“You guys are smarter than me, so tell me, can I sleep easy at night or should I be worried?”

The 5: This is one of those instances where the crowdsourcing power of The 5’s readership might lend as much useful insight as anything else. If you’re a business owner, or an insurer, tell us what’s happening in your world.

We know this much with certainty: Three more years of rock-bottom interest rates (see above) guarantee that insurers won’t earn squat on the fixed-income portion of their investment portfolio — you know, where they plunk down your premium payments.

It’s also bad news for all those state and local government pensions, many of them badly underfunded already. But that’s a whole ’nother can of worms…

Best regards,

Dave Gonigam

The 5 Min. Forecast