- A Canadian “Florida Man” stand-in

- Musk hypes Tesla’s Battery Day event (insane!)

- Ray Blanco: “99.99% of investors are unaware” of this

- White House jihad against TikTok

- Rural America’s slow crawl out of pandemic hell

- From the mailbag: Toe to toe with the insurance industry (style points awarded)… Badgers vs. Wolverines?… And more!

From the Department of People Who Don’t Grasp the Concept: “A Canadian man has been charged with dangerous driving,” reports the BBC, “for allegedly taking a nap while his self-driving Tesla car clocked up more than 90 mph.”

From the Department of People Who Don’t Grasp the Concept: “A Canadian man has been charged with dangerous driving,” reports the BBC, “for allegedly taking a nap while his self-driving Tesla car clocked up more than 90 mph.”

It happened in July, about 60 miles south of Edmonton, Alberta. Prosecutors upped the charges on the 20-year-old driver this week.

“Police said both front seats were fully reclined, and the driver and passenger were apparently asleep when they were alerted to the incident.”

Lights and siren? Forget it. As other vehicles moved out of the way, the Tesla sped up.

Look, ma, no hands! [Image from Alberta Royal Canadian Mounted Police]

"I've been in policing for over 23 years, and the majority of that in traffic law enforcement, and I'm speechless,” Sgt. Darri Turnbull tells a Canadian TV network.

As for not grasping the concept: “Tesla cars currently operate at a level-two Autopilot,” the Beeb says, “which requires the driver to remain alert and ready to act, with hands on the wheel.”

Full autonomy? Tesla founder Elon Musk says that’s later this year.

In the meantime, we’re four days away from “Battery Day” — an event Musk has successfully hyped into his version of a new iPhone release.

In the meantime, we’re four days away from “Battery Day” — an event Musk has successfully hyped into his version of a new iPhone release.

“Tesla Set to Unveil New Million-Mile Battery” was the Yahoo Finance headline a full two months ago. More recently, Barron’s had this: “Why Tesla’s ‘Battery Day’ Is Even More Important Than Its Latest Earnings.”

Yesterday, Musk himself weighed in on a preview story posted at a Tesla fansite…

But what “insanity,” exactly, does Musk have up his sleeve?

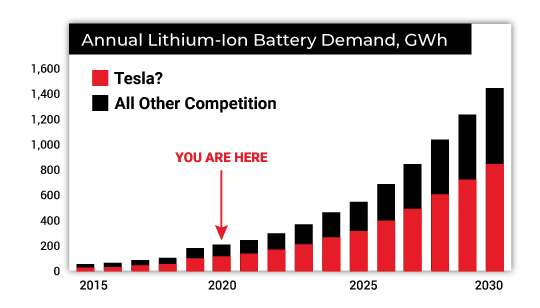

Context: “By the year 2030, leading market research says that global lithium-ion battery demand will be more than 10 times what it is now,” says our science-and-wealth maven Ray Blanco.

Context: “By the year 2030, leading market research says that global lithium-ion battery demand will be more than 10 times what it is now,” says our science-and-wealth maven Ray Blanco.

Perhaps you saw this chart Ray shared in an email we sent you yesterday. If you missed it, you missed out…

Little wonder, then, that “Wall Street analysts have put price targets through the roof,” says Ray, “due to the ‘game changing’ battery technology developments expected at the Battery Day event.

“But while the media have been hyping up Tesla and the million-mile battery, I believe they are missing a crucial component to the story,” Ray goes on — “a component I bet 99.99% of investors are unaware of.

“But while the media have been hyping up Tesla and the million-mile battery, I believe they are missing a crucial component to the story,” Ray goes on — “a component I bet 99.99% of investors are unaware of.

“I believe the key to Tesla’s million-mile battery is a patent that Elon doesn’t own. Instead, it’s held by a tiny $2 company.”

You read that right. Two bucks a share. For a $500 stake, you could buy 250 shares. Or you could buy one share of TSLA this morning for $444. Just sayin’.

Musk does his big reveal at 4:30 p.m. EDT on Tuesday. But 24 hours earlier, Ray is going to make his biggest call in the decade that he’s been a part of our team.

“When,” he asks, “was the last time you got into a tech trade right before a big announcement sent your trade rocketing higher?”

If you said, “never,” now’s your chance to change that — when Ray holds a confidential briefing for our readers this Monday at 4:30 p.m. EDT.

You don’t have to sign up for access. We’ll send you a couple of reminders between now and then, and a link to watch the briefing live.

In the meantime, you can check out this special web page for his “10X Announcement Summit.”

The major U.S. stock indexes are adding to yesterday’s losses.

The major U.S. stock indexes are adding to yesterday’s losses.

At last check, the Dow is down fractionally, back below 27,900. The S&P 500 is off a half percent at 3,340. The Nasdaq is once again taking the biggest hit — of more than three-quarters of a percent, below 10,900.

With that, the Nasdaq is now below its 50-day moving average. “If we see another sharp leg lower,” says Greg Guenthner of our trading desk, “it wouldn’t be out of the question to see a retest of the breakout to new all-time highs back below 10K. That would be an ugly move… a correction of about 18% from the Sept. 2 highs.”

No guarantees, but it’s a distinct possibility.

Gold is clambering back from its latest beatdown, the bid above $1,950. But silver’s been knocked back below $27 again.

To the extent there’s trader chatter about anything, they’re trying to make heads or tails of the latest decree from Washington, D.C. — and sussing out what it means for the freedom to pursue commerce…

On the surface, D.C. has decreed that smartphone users will be banned from downloading the TikTok and WeChat apps as of Sunday.

On the surface, D.C. has decreed that smartphone users will be banned from downloading the TikTok and WeChat apps as of Sunday.

TikTok is the video-sharing app that’s enormously popular with the kids. WeChat is how anyone in America keeps up with family, friends or colleagues in China — it’s like Facebook, PayPal, WhatsApp and more rolled up into one.

When last we visited this saga on Monday, Oracle was going to take a stake in TikTok — but apparently China-based ByteDance would still be the controlling owner, and we wondered whether that would make the deal a no-go for Team Trump. Guess we know the answer now.

Presumably it will require cooperation from Apple and Google to take TikTok out of their app stores this weekend. No one even asked for their input, it seems.

From the beginning, the White House’s jihad against TikTok has struck us as a cynical China-bashing campaign stunt.

From the beginning, the White House’s jihad against TikTok has struck us as a cynical China-bashing campaign stunt.

Of course, they dress it up as a “national security” thing. The Commerce Department decree this morning says TikTok “collects vast swaths of data from users, including network activity, location data and browsing and search histories” and “is subject to mandatory cooperation with the intelligence services of the [Chinese Communist Party].”

Yeah, and?

“One can imagine how such information might be abused by a government interested in monitoring its own citizens,” writes Julian Sanchez of the Cato Institute, “but it’s harder to articulate any coherent reason Midwestern teens posting cat videos should be fearful that Maoists are scrutinizing their system settings or geotags.”

Now get this: Under the decree, a full ban on TikTok — wiping it from smartphones altogether — doesn’t occur until Nov. 12. That would be after Election Day — meaning young voters would no longer have an outlet to express their wrath at the government arbitrarily taking away one of their favorite pastimes.

Now get this: Under the decree, a full ban on TikTok — wiping it from smartphones altogether — doesn’t occur until Nov. 12. That would be after Election Day — meaning young voters would no longer have an outlet to express their wrath at the government arbitrarily taking away one of their favorite pastimes.

And so we’re sure the president views today’s decree as just another negotiating tactic. Art of the deal and all that.

But what he doesn’t understand — or maybe he does, which is even more discomforting — is that it’s not much of a “negotiation” when one of the parties has the power of the state to back it up.

The other U.S.-based parties like Oracle (Walmart, too) — to say nothing of third parties like Apple and Google — know in the back of their minds that if they don’t agree to the final terms dictated by Washington, armed federal agents could bust through their doors any moment and potentially Waco their asses.

Something to keep in mind the next time the president complains about the threat of “socialism” from his opponent…

The rural American economy is steadily climbing out of the lockdowns but is nowhere near pre-pandemic levels.

The rural American economy is steadily climbing out of the lockdowns but is nowhere near pre-pandemic levels.

It’s been eons since we checked in with the Rural Mainstreet Index, compiled by Creighton University economist Ernie Goss. Every month, Goss surveys bankers in rural sections of 10 states stretching from Illinois west to Wyoming.

Like many similar economic indicators, 50 marks the dividing line between expansion and contraction. In February, the reading was 51.6. By April, it collapsed to 12.1.

Yesterday, Goss released the August figure — 46.9. A decent recovery, but it’s been seven straight months of below-50 readings.

The good news: Nearly a quarter of the bankers surveyed say their local economies are back to pre-pandemic levels.

The weird news: Fewer than 40% of the survey respondents say the CARES Act and PPP programs made a meaningful difference in their local economies.

Hmmm… Coincidentally or not, yesterday the White House announced $13 billion in additional aid to farmers.

“There is no doubt the insurance market has hardened this year for just the reasons your reader said,” reads the first of several emails responding to yesterday’s 5.

“There is no doubt the insurance market has hardened this year for just the reasons your reader said,” reads the first of several emails responding to yesterday’s 5.

“There are too many claims and not enough premium and return on it. Increased claims are partially caused by ‘ambulance chasing’ attorneys demanding and getting wildly inflated amounts from liberal juries, and knowing this, the majority of insurance companies only look to settle.

“Therefore, a vast number of claims with very little merit get settled for stupid amounts as a ‘business decision’ and they don’t even think about fighting. Is it any wonder that every billboard you see and every advertisement on daytime TV is for an attorney?

“Until we get tort reform and losing attorneys start to be responsible for the other parties’ fees, this system of legal extortion will not change, and everybody is paying for this in their renewals.

“Our insurance costs on a $1.5 billion business just increased by 45%. We are told that it is because of ‘severity’ of auto claims. Even though we have very few ‘major’ claims!”

“I have small-business insurance,” another reader writes; “it goes up almost like clockwork every two–three months.”

“I have small-business insurance,” another reader writes; “it goes up almost like clockwork every two–three months.”

“Will some insurance companies go under for taking on too much risk? Almost certainly,” ventures one of our longtimers.

“Will some insurance companies go under for taking on too much risk? Almost certainly,” ventures one of our longtimers.

“Most won’t and will simply raise rates. Businesses will either pay up and raise their own prices or go out of business.

“I’d pay up. You will too. You can always get insurance, or re. It’s just a question of how much. You will pass it along to your customers and so on. This is but one trickling stream that will lead to the inflation the Fed wants — and it is likely to become a torrential river before it’s over.

“But the bigger picture and investment implications are consistent with what my thesis has been pointing to for some time, inflation/devaluation of the dollar. I know! Duh! Right?

“Anyway, money flows where it’s treated best, and the 10-year Treasury, isn’t it at 0.67%? So where does money flow? Well, the dividend is still 2.8 times greater in the S&P 500 than the 10-year, so the markets probably have a lot more (volatile) upside than where they are currently. Think of the Roaring ’20s, part deux.

“As you pointed out, the insurance companies can’t live on Treasuries. So where do they go?

Stocks (probably for a while longer), along with gold/mining stocks, Bitcoin, timber and other hard assets.

“So I expect insurance companies, along with pensions, hedge funds, sovereign wealth funds, central banks, university endowments and the last holdout, Berkshire Hathaway, to continue to sell dollars and buy heavily into gold and Bitcoin, and to a lesser extent the other less liquid asset classes mentioned. This river of gold/Bitcoin buying is also a trickle that will likely become a torrent before it is over. Simply the inverse of inflation.

“The Fed has gently and lovingly pulled out its bazooka and helicopters and told all of us, including insurance companies, who are no dummies, what it plans to do — blow our heads clean off if we hold cash (I’m paraphrasing).

“Kind of like Dirty Harry when he holds the gun to the criminal’s head and tells him he has to ask himself the question, ‘Do I feel lucky? Well! Do ya!?’

“Trivia: Dirty Harry’s gun was empty when he asked the question.

“Dirty Jerry’s bazooka most definitely is NOT empty.”

The 5: Heh. Fed chairman Jerome Powell’s nickname is Jay, not Jerry, but we’ll award you style points regardless…

“‘Go Badgers’?” a reader inquires after we mentioned the resumption of Big Ten football next month. “Don't you mean Wolverines?”

“‘Go Badgers’?” a reader inquires after we mentioned the resumption of Big Ten football next month. “Don't you mean Wolverines?”

The 5: Current residency notwithstanding…

Have a good weekend,

Dave Gonigam

The 5 Min. Forecast

P.S. “Once I reveal this research to you,” says Ray Blanco, “I’m pretty sure you’ll be convinced that this $2 company is the key to Tesla’s million-mile battery.

“I believe that knowing this information ahead of Elon Musk’s big announcement next Tuesday could allow you to potentially double your money in a matter of minutes — and 10X your money in the coming three months.”

Why is Ray so sure?

Keep an eye on your inbox this afternoon. Ray will tell you about three “smoking guns” that he believes make a partnership between Tesla and this $2 company a lead-pipe cinch.

The subject line of the email will be, “Does a $2 Company Have the Most Important Patent of 2020?” We’ll be sending it at 4:00 p.m. EDT.