- The silver saga continues

- Pro traders crack down on “rookie metal chasers”

- Foretaste of “Zero Hour” for precious metals

- “Beelzebezos” pursues his other interests

- Zach Scheidt on Apple’s mind-blowing Q4 revenue

- Readers on GME’s defective David-and-Goliath narrative… Meddlesome politicos … Ronald McDonald automatons … And more!

The silver story isn’t over. Not by a long shot.

The silver story isn’t over. Not by a long shot.

The WallStreetBets crowd on Reddit were unable to pull off “the world’s biggest short squeeze” in silver. Heck, there wasn’t even unanimity among these financial insurgents that silver was a worthy target of opportunity. Thus, silver sank yesterday as quickly as it rose on Monday.

Turns out one of the factors behind yesterday’s sell-off is that CME Group had raised margin requirements for silver futures. That is, big-time futures traders who fund their activity by borrowing had to put up more cash for collateral.

The commodities exchanges did the same thing to try to tamp down a silver rally a decade ago.

Which only goes to show what Jim Rickards said here yesterday: “When you rely on exchanges and paper contracts for your profits, the rules can always be changed to terminate your bets and rob you of future gains.”

But here’s what the exchanges couldn’t stop yesterday — record inflows of metal to the silver ETFs.

But here’s what the exchanges couldn’t stop yesterday — record inflows of metal to the silver ETFs.

Mainstream financial media perked up on Friday when the amount of money pouring into SLV and the other silver ETFs set a one-day record of $920 million. That’s when the Redditors (some of them, anyway) were already making their big silver move.

But amid the sell-off yesterday, the media were quiet as a church mouse when those inflows smashed Friday’s record — totaling $1.58 billion.

The fast-buck crowd was selling… while the proverbial “strong hands” were swooping in.

Point being, “We’re early in the process,” says colleague Byron King, a veteran observer of the metals and mining biz. “The first round included a run-up in the silver spot price, which was quickly quashed by the paper dealers, as well as exchanges hiking margin requirements,” he wrote yesterday in our sister e-letter Whiskey & Gunpowder.

“Professional traders are confident, if not smug. They will smite those rookie metal chasers.”

For the moment, the paper price of silver has stabilized. At last check, the bid is $26.55 an ounce.

For the moment, the paper price of silver has stabilized. At last check, the bid is $26.55 an ounce.

But to emphasize, that’s the paper price. Real physical metal remains costly and hard to come by.

But to emphasize, that’s the paper price. Real physical metal remains costly and hard to come by.

The big-name online retailers are still scrambling for supply that can meet the insatiable demand. On the home pages of their websites, they warn of up to five-day delays in processing times. Generic silver rounds go for nearly $32 an ounce. If you want something issued by a government mint, you’ll pay even more.

Adding to the supply squeeze: The U.S. Mint announced yesterday it will continue rationing sales of U.S. Silver Eagles “for the foreseeable future.”

Adding to the supply squeeze: The U.S. Mint announced yesterday it will continue rationing sales of U.S. Silver Eagles “for the foreseeable future.”

From a Bloomberg dispatch: “The Mint’s silver coin sales jumped 24% to 4.775 million ounces last month, marking the highest for a January since 2017…

“Throughout the past year, and in part due to the effects of the coronavirus pandemic, the Mint was unable to meet demand due to precious metal blank availability and plant capacity issues.”

Not helping matters: The Mint has “limited distribution of its silver coins to suppliers as it is currently changing the designs for its American Eagle gold and silver bullion coins,” says Reuters. The new designs are set to debut this summer.

At the risk of repeating ourselves, everything that’s happening now is a foretaste of the “Zero Hour” for precious metals that we’ve been writing about now and then since 2013.

At the risk of repeating ourselves, everything that’s happening now is a foretaste of the “Zero Hour” for precious metals that we’ve been writing about now and then since 2013.

At present, for every one ounce of silver in existence, there are as many as 250 “paper ounces” — futures, forwards, options, swaps, ETFs.

One day, confidence in those paper products is sure to evaporate. The disconnect between the paper and physical price will become permanent. And if you want real metal in your hands, you won’t be able to get it. That’s Zero Hour.

We’re not there yet. We expect the gap between paper and physical silver will normalize over the next few days — as it did when there was a run on physical metal during the early wave of the pandemic last spring.

But one day — we can’t predict when — there will be no more second chances.

But one day — we can’t predict when — there will be no more second chances.

So here’s what we suggest if you haven’t done so already: Take advantage of the next few days to set up an account with Hard Assets Alliance. By the time you get your account funded, the supply situation will have stabilized and the gap between the paper and physical price will have narrowed. You can add to your metal stash (or start building it) with confidence.

Hands down, Hard Assets Alliance is the easiest way to buy, sell, store and take delivery of real physical metal — gold, silver, platinum or palladium. It has an unrivaled network of wholesalers who can scrounge up supply when other retailers can’t. And the premiums it charges are among the lowest in the business.

Again, here’s the signup link. As always, the disclaimer: Our firm owns a piece of Hard Assets Alliance, so you can expect us to take a small cut once you fund your account. But we wouldn’t have taken that stake unless we were fully confident Hard Assets Alliance would do right by our customers.

The stock market is taking a midweek pause.

The stock market is taking a midweek pause.

As we write, the major averages are little moved after a strong two-day run-up. Still, the Nasdaq is slightly in the green and if that gain holds by day’s end, it’ll be a record close.

Gold? Also little moved at $1,835. But crude is sprinting higher after the Energy Department’s weekly inventory numbers; a barrel of West Texas Intermediate is now pennies away from $56, another one-year high.

Bitcoin is quietly pushing higher at $36,726.

With the GameStoppers retreating from the headlines, earnings season is once again coming into view. But even there, Amazon’s record revenue figures are eclipsed by the announcement that Jeff Bezos is stepping aside as CEO in favor of longtime lieutenant Andy Jassy.

With the GameStoppers retreating from the headlines, earnings season is once again coming into view. But even there, Amazon’s record revenue figures are eclipsed by the announcement that Jeff Bezos is stepping aside as CEO in favor of longtime lieutenant Andy Jassy.

“As exec chair,” Bezos says of his new position, “I will stay engaged in important Amazon initiatives but also have the time and energy I need to focus on the Day 1 Fund, the Bezos Earth Fund, Blue Origin, The Washington Post and my other passions.”

Oh, God, Bezos is going the Bill Gates route.

Oh, God, Bezos is going the Bill Gates route.

Gates stepped down as Microsoft CEO in early 2000 — at the peak of the dot-com bubble, hmmm — and launched his foundation. Fast-forward 21 years and he’s got a book coming out in a few days called How to Avoid a Climate Disaster. So he’s become a renowned authority on climate change and epidemiology and public education. He’s da Vinci for the global age!

We cringe at the thought of what “Beelzebezos” must have in mind for humanity over the next 21 years.

You can actually buy T-shirts and hoodies with this design from an outfit called Redbubble…

Anyway, AMZN shares are down about a third of a percent on the day.

Also reporting earnings among the Big 5 tech stocks is Google parent Alphabet, also booking record revenue. GOOG is up over 7% as we write.

Speaking of the Big 5…

“Judging from what we heard from Apple last week, there should be plenty of additional profits to come,” says our income specialist Zach Scheidt.

“Judging from what we heard from Apple last week, there should be plenty of additional profits to come,” says our income specialist Zach Scheidt.

Hardly anyone noticed amid the Reddit hoopla, but AAPL reported its numbers last week — including record quarterly revenue.

“I’ve been watching this company’s business for years,” says Zach, “and it’s still hard to wrap my head around revenues of $111 billion.”

But that’s the top line. What about the bottom line? “More importantly, the company’s earnings came in above expectations at $1.68 per share. As fundamental investors, earnings are ultimately the most important metric for us because those profits are what pay for the dividends we receive.”

AAPL is up 360% since Zach sang its praises in a rare “Three Free Stock Picks” edition of The 5 in late 2015. And while the share price has been treading water since last fall, it’s been picking up again of late… and Zach believes that’s good for the long run.

“After a few weeks (or even a few months) of pullbacks, investors left holding shares of AAPL will be more committed to their positions. So when the stock continues to move higher, there will be fewer shares available for sale.”

From there, supply and demand will do their thing. “Consider adding some AAPL shares to your retirement account.”

To the mailbag, and back to the GameStoppers: “Someone pointed out that JPMorgan was long millions of shares of GME according to a document filed with the SEC in October last year, balanced with a put for about 1,900 shares.

To the mailbag, and back to the GameStoppers: “Someone pointed out that JPMorgan was long millions of shares of GME according to a document filed with the SEC in October last year, balanced with a put for about 1,900 shares.

“So it is one Goliath AND David versus another Goliath.

“I’m sure JPM was not bashful about selling a lot of those shares to Melvin and company as the price rode up, and that they are very experienced at doing it without disturbing the ride up, at least not disturbing it much.

“And there would have been no uproar from Wall Street if JPM had done the squeeze without help from the Redditors.”

The 5: You’re a little off with the numbers, but you’ve got the gist. As Emily noted in Saturday’s 5, JPM’s long position towered its short hedge.

Yes, reality is usually more complicated than a simple white hat/black hat narrative.

Not that that’s stopping the politicos from barreling ahead with plans to “do something.”

“What’s frustrating to me is that too many people are getting caught up in stick-it-to-the-man narrative, which admittedly is an attractive narrative,” Rep. Jim Himes (D-Connecticut) tells the Financial Times.

“It’s being used in the service of exposing some retail investors to huge risk, and I think they’ve probably already been very badly hurt.”

Himes has a plum post on the House Financial Services Committee. His district includes Fairfield County, where many Wall Streeters have either first or second homes. We’re sure he’ll come up with a plan that looks out for his plum donors “retail investors who’ve been badly hurt.”

On the subject of McDonald’s abandoning its opposition to higher minimum wages a couple years ago: “McDonald’s also started installing order kiosks and reducing the number of staff at about the same time,” a reader writes.

On the subject of McDonald’s abandoning its opposition to higher minimum wages a couple years ago: “McDonald’s also started installing order kiosks and reducing the number of staff at about the same time,” a reader writes.

“Since I believe in the Tooth Fairy, the timing was just a coincidence that just happened to price out the mom and pop burger places by increasing mom’s salary costs.”

The 5: “To curtail rising labor costs, businesses are investing in automation that can replace ‘low-skilled’ workers, high school educated or less,” said a 2018 report from the payroll firm ADP, with an eye toward minimum-wage increases.

“Automation has already taken hold in grocery stores with self-checkout lines and fast-food restaurants with touchscreen order-entry kiosks. We see it with smart ATMs and the robots installed in manufacturing plants.”

We’re sure the politicos have a solution for that, too. “Universal basic income,” anyone?

Best regards,

Dave Gonigam

The 5 Min. Forecast

On the subject of silver — and how powerful pullers of strings can change the rules with no notice — former 5 Min. associate editor Chris Campbell offers some illuminating history from a time when Kramer vs. Kramer was the big box office draw and Rupert Holmes topped the charts with “Escape (The Piña Colada Song).”

The following was first published yesterday in Laissez Faire Today, where Chris holds forth six days a week…

Groundhog Day: The Hunt Brothers Squeezed Silver, Too

H.L. Hunt amassed his fortune as an oil tycoon, which he left to his family when he passed in the early ‘70s.

The Hunt Brothers — Nelson Bunker Hunt, William Herbert Hunt, and Lamar Hunt — took over the empire and grew it even further.

The 1970s economy, however, was chaotic.

The oil crisis had led to stagflation — high inflation, low growth, and high unemployment.

The Hunt Brothers believed this stagflation would keep spiraling, eventually destroying their fortune. As a hedge, the brothers looked to silver. And the more they looked, the more they liked it.

In 1973, the Hunts began loading up on silver at $3 an ounce. By the late-1970s, they began backing up the truck, adding silver futures to their massive collection.

Though futures usually settled in cash, the Hunts demanded physical. At one point, they were having planeloads of silver shipped to vaults in Switzerland.

Gradually, and then suddenly, the price of silver began to climb. The short squeeze was on. There was no end in sight to how high it could go.

The price of silver went from $6/oz in 1979 to over $49/oz in 1980. The Hunts’ silver stash at its peak was worth $5 billion, making up, aaccording to some estimates, a hefty two-thirds of the entire silver market.

But then the tables turned.

The Hunts Become the Hunted

First, public outrage ensued.

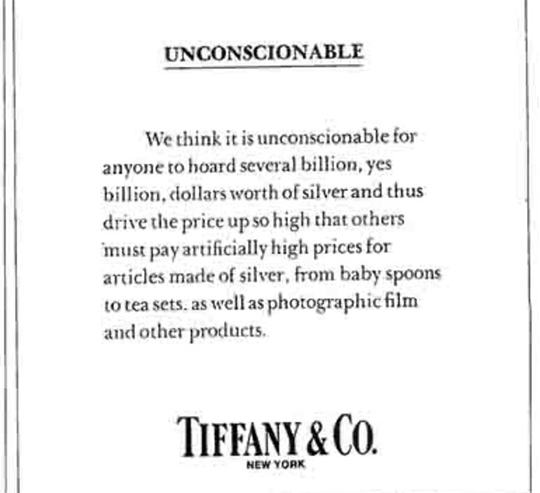

Tiffany’s bought a full-page ad in the New York Times chastising the Hunts for artificially inflating the price of silver.

And then, of course, the government got involved… and pulled the rug out from under the Hunts.

With “Silver Rule 7,” regulators increased the margin requirements on silver futures contracts. Meaning, the Hunts would have to put up additional collateral to satisfy their loans at a time when they were leveraged to the hilt.

The government forced their hands. They had to sell, which caused a downward spiral in the price. Silver sank from $48 to $11.

After filing for bankruptcy, the family fortune barely survived the onslaught.

Rule #1: Don’t Get Wrecked

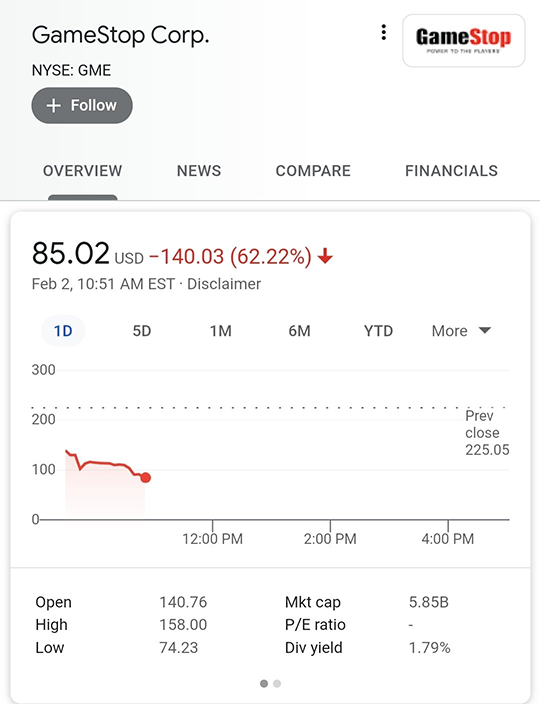

As we also saw last week with Gamestop, the rules can change virtually overnight.

Even today, brokerages are still limiting and restricting retail traders from buying Gamestop, but not restricting selling. The inevitable result is that the stock keeps plunging, forcing retail investors to take it on the chin.

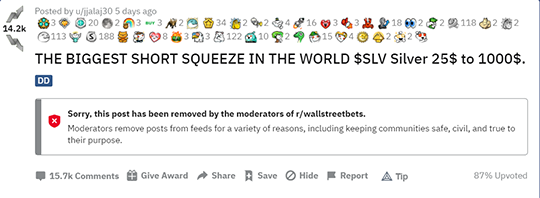

In the “Great Silver Squeeze,” Redditors on r/wallstreetbets may be in danger of overlooking this important lesson.

While many are loading up on physical silver (not a bad idea, IMO), others are being seduced with promises of fast, easy gains in $SLV.

(The original post calling for traders to squeeze $SLV from $25 to $1,000 has been removed from Reddit.)

They could be right. But this might also be akin to bringing a wooden spoon to a gunfight.

$SLV isn’t Gamestop.

The top holders of $SLV include Citadel and many other big-league Wall Street firms, who can — especially with the help of the government, the Fed, and brokers — pinky spank retail investors into submission.

Fundamentally, of course, silver looks great. Increased industrial demand and rising interest as an inflation hedge make the moon metal a likely long-term boon.

But when messing with paper silver in hopes of fast gains, inexperienced traders increase their chances of ending up just like the Hunts…

And getting absolutely wrecked.

Paper is the Money of Peasants

As the old saying goes…

Gold is the money of kings. Silver is the money of gentlemen. Paper is the money of peasants. And debt is the money of slaves.

With that in mind, if you haven’t already…

Check out the latest offer from our friends at Hard Assets Alliance (HAA).

Hands down, HAA offers the best way to buy, store, and get delivery on precious metals… especially if you’re itching to incorporate metals into your IRA.

(Full disclosure: As part of the “Alliance,” we benefit from their services if you do.)

Click here for a quick rundown of everything you need to know to get started.

Regards,

Chris Campbell

For The 5 Min. Forecast