- One-year anniversary of the corona-crash

- The Federal Reserve pulls out all the stops

- Bull markets and the law of averages

- Alan Knuckman follows his own advice ($10,000)

- CalPERS proves good help is hard to find

- Homebuilding and hardware-supply shortages… The “easiest way… to a global financial reset”… And more!

“The Bull Market In Stocks Is Heading Into Its Second Year, and History Suggests a 17% Gain Could Be in Store,” says a headline at Business Insider.

“The Bull Market In Stocks Is Heading Into Its Second Year, and History Suggests a 17% Gain Could Be in Store,” says a headline at Business Insider.

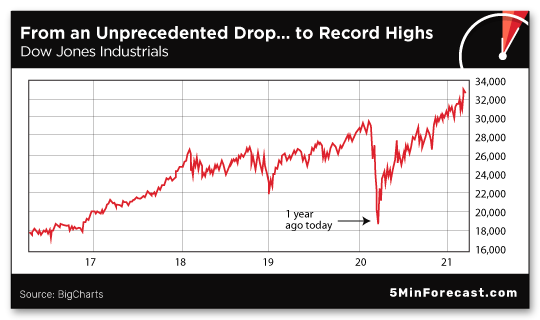

To our surprise, we’re not finding a lot of mainstream articles today noting the first anniversary of the market hitting bottom after the corona-crash.

Maybe it’s just the nature of the 24/7 media cycle these days. Look forward, not back. Who cares about the anniversary of anything anymore? Aren’t there more urgent things happening right now? Don’t you know March Madness is back on this year? Or that Ellen DeGeneres’ ratings have tanked?! And who was performing which sex acts in the chambers of Australia’s parliament?

Well… even though “Forecast” is in our name, we’d be remiss this morning to overlook a watershed event in the history of financial markets…

It was a year ago today the Federal Reserve adopted what we dubbed “the 2008 playbook, on a cocktail of steroids, Adderall and meth.”

It was a year ago today the Federal Reserve adopted what we dubbed “the 2008 playbook, on a cocktail of steroids, Adderall and meth.”

In addition to near-zero interest rates and purchases of Treasuries and mortgage-backed securities, the Fed also committed to buying corporate bonds, municipal bonds and commercial paper — the short-term loans companies take out to pay routine bills.

The initial market reaction was negative, as in: “OMG, things must really be bad if they’re resorting to such crazy-extreme measures. Sell!” The Dow tumbled 600 points on that Monday, adding to a drop that was unparalleled in its speed and ferocity. All of the market’s gains since Election Day 2016? Gone in just over a month.

But after sleeping on it, traders changed their tune the next day: “Wow, the Fed will do anything to prop up confidence in stocks. Buy!” The Dow rallied 2,100 points on that Tuesday… and, for the most part, hasn’t looked back since.

The Dow is up 76% from those panic lows a year ago today. Ditto for the S&P 500. The Nasdaq, powered by all those stay-at-home tech stocks, did even better.

So now what?

So now what?

Back to that Business Insider headline: Researchers at the broker-dealer LPL Financial studied every bull market since World War II that began after a steep bear-market decline of at least 30%.

On average, the second year of that bull run resulted in a 17% gain in the S&P 500.

So it’s all good, right?

Hold on: Amid that average 17% gain, there was also an average 10% sell-off.

Hold on: Amid that average 17% gain, there was also an average 10% sell-off.

That’s how it worked with the bull market that began in 2009: The S&P 500 jumped 69% in the first year. The second year added to those gains — up another 16%.

But along the way that second year, there was a 17% sell-off in the space of two months — a stretch that included the still-mysterious “flash crash” when the Dow instantly plunged 9.2% the afternoon of May 6, 2010. (The feds fingered a patsy in 2015, a guy literally living in his parents’ basement. No one with a modicum of critical-thinking skills buys the official story.)

Now think back to that time barely a decade ago, and the likely experience of many retail investors…

Now think back to that time barely a decade ago, and the likely experience of many retail investors…

Scarred from the Panic of 2008, they were just starting to tiptoe back into the market. They’d already missed a big chunk of the bull market’s 69% gain that first year. And no sooner did they get back into the market than it began sliding anew.

What did they do? They probably thought, “Oh God, here we go again.” They likely panicked and sold. And they missed out on the market’s subsequent gains for maybe another year or two.

That’s not their fault. It’s just human nature. Resisting the impulse to sell under those circumstances? Takes discipline. Either nerves of steel… or the patience of a twentysomething with decades to go before retirement.

Time to look in the mirror: Could you resist the impulse to sell if the market takes, say, a 17% tumble this spring — as it did in 2010?

Time to look in the mirror: Could you resist the impulse to sell if the market takes, say, a 17% tumble this spring — as it did in 2010?

No?

OK, what if you took a tiny portion of your portfolio — maybe 1% — and laid on a simple “disaster insurance” trade that could hedge those potential losses? We’re talking about a trade that could pay off so big, it would offset the losses elsewhere in your portfolio. It could even boost your overall account balance. In an extreme case, it could make your retirement.

You could sleep at night even if the mainstream was bombarding you with end-of-the-world headlines, right?

This is the trade my colleague Alan Knuckman will describe during a special briefing set for tomorrow at 1:00 p.m. EDT.

As you might know, Alan has over a quarter century of floor-trading experience under his belt. As you might also know, he’s something of a perma-bull. So if he suggests laying on a trade he calls “disaster insurance,” you know he’s not doing it from a doom-and-gloom perspective. It’s just common sense and smart money management.

And to demonstrate his commitment level, Alan’s doing something we’ve never allowed an editor to do before (and likely never will again): He’s putting $10,000 of his own money into this “disaster insurance” trade.

And to demonstrate his commitment level, Alan’s doing something we’ve never allowed an editor to do before (and likely never will again): He’s putting $10,000 of his own money into this “disaster insurance” trade.

As we’ve explained in the past, we aim to keep church and state as separate as possible: To avoid a conflict of interest, our editors cannot own a position in the securities they recommend to you. We’ve had popular editors quit on us because of that policy.

But because Alan’s conviction on this disaster-insurance trade is so high, we’re breaking the rule this one time as a good-faith demonstration to you, the reader. He’s eating his own cooking. If he’s doing this for himself and his family, it’s validation of the strategy for you and your family.

And you don’t have to put up $10,000 to make it happen, either. You can invest as little as $500 and the potential payoff from this disaster insurance will give you peace of mind if a sell-off materializes the way it did in 2010.

Again, Alan’s debriefing is set for tomorrow at 1:00 p.m. EDT. We’ll send you an email reminder with a link to the event a few minutes beforehand.

Do whatever you can to be there — that is, if you value the ability to rest easy while everyone else is losing their minds.

The major U.S. stock indexes are treading water today: At last check, the Dow is down a hair, the S&P 500 and Nasdaq up a hair. Treasury yields continue climbing down, the 10-year now approaching 1.65%.

The major U.S. stock indexes are treading water today: At last check, the Dow is down a hair, the S&P 500 and Nasdaq up a hair. Treasury yields continue climbing down, the 10-year now approaching 1.65%.

Precious metals can’t catch a break. Gold is down nearly three-quarters of a percent at $1,727. Silver is down more than 2% to $25.17. The platinum group metals are slumping too — except rhodium, now at another record high of $27,000.

Crude is down nearly 3%, well below $59 a barrel — a move the mainstream attributes to the renewed lockdowns in Europe putting a damper on demand. Whatever the case, oil is down more than $6 in just a week.

Bitcoin has pulled back to just over $55,000.

Like yesterday, the big economic number today is a major surprise to the downside in housing. Sales of new single-family homes fell 18.2% from January to February. Again, blame it on rising mortgage rates — although the deep-freeze in Texas last month couldn’t have helped.

Wanted: Chief investment officer for the nation’s biggest government pension fund. Compensation negotiable.

Wanted: Chief investment officer for the nation’s biggest government pension fund. Compensation negotiable.

CalPERS — the California Public Employees’ Retirement System — is still looking for a CIO seven months after cashiering Ben Meng because his financial disclosure forms omitted a thing or two about his personal investments in private equity firms and Chinese companies.

This week, The Wall Street Journal reports CalPERS has suspended its search. Says CEO Marcie Frost, “It became clear during the process that we need to provide greater clarity regarding the position’s compensation.”

Oh hell, we’re only bringing up the topic today so we can dump on Meng one more time.

Oh hell, we’re only bringing up the topic today so we can dump on Meng one more time.

In the year ended June 30, 2020, CalPERS earned 4.7% on its investments — a wee bit shy of its 7% target. Meng’s crowning achievement came in 2019, when he dumped a position in three hedge funds designed to generate big payoffs when the stock market falls hard — as it did a year ago. That is, he walked away from what would have been a 3,612% gain — heh.

For this stellar performance, Meng pulled down $1.76 million in 2019 — a base salary topping $633,900, “other compensation” totaling $910,000 and retirement and health benefits of about $215,900. Per the watchdog group Transparent California, this made him the state’s highest-paid employee.

| ➢ | By a separate tally, Chip Kelly earned a much-higher $3.5 million in 2019 for leading UCLA’s football team to a 4-8 record. However you measure it, failure comes at a steep price for California taxpayers. |

Anyway, CalPERS plans to adjust the compensation package to encourage whoever winds up being hired to stick around for five years. No one since 2006 has held the job that long, and Meng lasted all of 18 months.

Meng, meanwhile, was most recently seen penning an article for a think tank titled “Saving America’s Public Pensions.” We swear we don’t make this stuff up…

“Have you been to one of the big-box stores lately?” a reader writes after our riff on rising lumber prices.

“Have you been to one of the big-box stores lately?” a reader writes after our riff on rising lumber prices.

“Not only is the price of wood going up, the plastic electrical boxes used in construction for switches, outlets, etc., are nowhere to be found. Talked to a Lowe’s employee who said it was a nationwide shortage because there’s only one supplier in Texas and they shut down due to the cold weather. She said contractors have had to delay or cancel projects and the supply will take awhile to become stable again — think toilet paper.

“Love The 5. Keep on digging through the manure.”

The 5: And the semiconductor shortage won’t be getting better anytime soon. There’s been a fire at another Japanese factory, on top of the one last fall. The automakers are already looking at having to dial back production even further.

On the subject of a “global financial reset,” a reader writes: “One way to reduce debt burden would be global devaluation of all currencies.

On the subject of a “global financial reset,” a reader writes: “One way to reduce debt burden would be global devaluation of all currencies.

“Easiest way would be a return to a global gold standard. All central banks have gold to some degree/not Bitcoin and if the price reset were high enough, debt (denominated in ‘old currency’) would be greatly diminished and income would be paid in the ‘new’ currency. So income and debt servicing would be easily managed. Asset prices would also be in new currency, so markets would adjust easily.

“Just a thought.”

The 5: What you describe is more or less the scenario our Jim Rickards has described for years. It’s also the rationale for his long-term forecast of gold at $14,000 an ounce.

Not that he envisions a new gold standard necessarily — but definitely a devaluation of fiat currencies relative to gold.

It would be the quickest way to achieve the inflation central bankers so desperately want… but really, it can be done only after confidence in the current system is broken beyond repair. Making such a drastic move now would, by itself, shatter confidence.

And so we wait…

Best regards,

Dave Gonigam

The 5 Min. Forecast

P.S. We don’t expect such a “confidence-shattering” event on the immediate horizon.

But a garden-variety pullback in the markets of 10–15%? As we said above, totally plausible — if not likely.

How certain are you that you could hold on tight and avoid the impulse to mash the “sell” button — and then miss out on the gains that would follow once the market recovers and moves on to new heights?

It takes discipline, for sure. But that discipline comes a lot easier if you’ve laid on a “disaster insurance” trade with a small portion of your portfolio. It’s the kind of trade that helps you sleep at night while everyone around you panics in reaction to every scary new headline.

Our Alan Knuckman will lay out this strategy just for you during a special debriefing tomorrow at 1:00 p.m. EDT. No need to sign up in advance; we’ll send you a reminder email a few minutes before. But mark it in your calendar now; your portfolio will thank you later.