- $100-million, publicly traded… pastrami

- Hedge fund manager warns of overvalued stock market

- Hall of shame: Five years of “frothiness”

- Self-discipline when the “top is in”

- James Altucher on Coinbase IPO’s success

- Liberal CA Congressman gets dragged on Twitter

- “Tired of hearing about woke,” a reader carps… Soviet newspapers (and reading between the lines)… And more!

What’s wrong with this picture? A publicly traded company with sales totaling $35,748 over the last two years… and a market cap north of $100 million.

What’s wrong with this picture? A publicly traded company with sales totaling $35,748 over the last two years… and a market cap north of $100 million.

The firm’s core asset is… a delicatessen in Paulsboro, New Jersey.

World headquarters for Hometown International (HWIN), as seen by Google Street View

The company got some press yesterday when the hedge fund manager David Einhorn spotlighted it in a client letter.

“Someone pointed us to Hometown International (HWIN), which owns a single deli in rural New Jersey,” he wrote. “HWIN reached a market cap of $113 million on Feb. 8. The largest shareholder is also the CEO/CFO/treasurer and a director, who also happens to be the wrestling coach of the high school next door to the deli.

“The pastrami must be amazing.”

Bonus points: According to the company’s 10-K filing, the deli was closed for nearly six months last year under New Jersey’s lockdown orders.

As you might imagine, Einhorn is invoking the example of HWIN to make the case that the stock market is, well, a little bit “frothy.”

As you might imagine, Einhorn is invoking the example of HWIN to make the case that the stock market is, well, a little bit “frothy.”

Actually, it’s much worse than that, he ventures: “From a traditional perspective, the market is fractured and possibly in the process of breaking completely.”

For Einhorn, HWIN falls into the same category as the GameStop short squeeze… the craze surrounding bankrupt companies like Hertz… and the enthusiasm for a sketchy-looking cryptocurrency called Tether. (Tether’s creators recently paid a fine and signed one of those “no admission of wrongdoing” agreements to settle a case brought by New York’s attorney general.)

“Small investors who get sucked into these situations are likely to be harmed eventually,” says Einhorn, “yet the regulators – who are supposed to be protecting investors – appear to be neither present nor curious.”

Here’s the problem: Einhorn, or anyone else, could have made a similar case for “frothiness” almost anytime in the last four or five years.

Here’s the problem: Einhorn, or anyone else, could have made a similar case for “frothiness” almost anytime in the last four or five years.

The craze for Uber? Long before it went public in 2019, we spotlighted research saying 61% of every Uber fare was effectively subsidized by gullible venture-capital types who kept pouring money into the company. (It still appears that Uber customers don’t cover the company’s actual costs.)

Remember WeWork, the company that subleases office space? Not the most exciting line of business, but because the founder got the idea to create a mobile app for subleasing office space… WeWork somehow became touted as a world-changing technology innovator.

And then there was Theranos, whose blood-testing machine was a bust. We still don’t know whether founder Elizabeth Holmes was a fraudster or merely someone who convinced herself of her own BS… but the result was the same.

These stories were clear evidence that valuations for both private and public companies were out of whack… that the Federal Reserve’s epic money-printing was “fracturing” markets, to use Einhorn’s term… that even the best and brightest investors had more money than sense.

But… BUT… while all of those things were true in the late 2010s, it did not follow that “the top was in” for the stock market and years of pain were sure to follow.

But… BUT… while all of those things were true in the late 2010s, it did not follow that “the top was in” for the stock market and years of pain were sure to follow.

The market took a nasty spill from all-time highs in early 2018 — thanks to some weird leveraged bets on low market volatility. Then it recovered.

It took a bigger spill, again from all-time highs, in late 2018 — as the Federal Reserve appeared determined to tighten monetary policy. Then the Fed reversed course and the market recovered.

There were two modest dips from all-time highs during 2019 for reasons we don’t even remember off the top of our head. Again, the market recovered.

And of course the bottom fell out of the market from all-time highs last year during the corona-crash — only to roar back and recoup all those losses within six months.

Yesterday, the Dow and the S&P 500 closed at all-time highs again.

Tempting as it might sound… do you really want to sell all your stocks on the assumption that “the top is in”? That now is a moment on par with, say, the years 2000 or 1966? Major market tops that heralded more than a decade of punishing losses, punctuated by false rallies?

Yes, another 2000 or 1966 moment will come eventually. But you can’t live your life or arrange your portfolio on the assumption that it’s just around the corner.

Yes, another 2000 or 1966 moment will come eventually. But you can’t live your life or arrange your portfolio on the assumption that it’s just around the corner.

The problem is that even if you know this is true on an intellectual level… it’s hard to keep emotions in check whenever the market sells off hard.

There’s always that temptation to mash the sell button — usually after the sell-off is well underway and you’re booking steep losses. Later comes the regret as the market stages a comeback well past its previous highs and it dawns on you all the potential profit you’ve left on the table.

That’s why we devoted much of our digital ink a few weeks ago to “disaster insurance” — one simple trade that can cushion your losses elsewhere whenever the next big sell-off rolls around. It helps you sleep at night while your friends and neighbors are selling in a panic.

We got a lot of positive feedback when we unveiled this “disaster insurance” strategy last month. We’re in the midst of making a few refinements to reflect changing market circumstances since then. (Folks who acted on our guidance last month can sit tight; it’s new prospective readers who might need to do something just a little different.)

Watch this space for updates in the weeks ahead…

For a second day running, the Dow and the S&P 500 are sailing into record territory while the Nasdaq is struggling to keep pace.

For a second day running, the Dow and the S&P 500 are sailing into record territory while the Nasdaq is struggling to keep pace.

At last check, the Dow was up nearly a half-percent at 34,193… the S&P up a quarter percent at 4,181… and the Nasdaq flat at 14,036.

There’s a bit of earnings-season excitement from Morgan Stanley, which disclosed it wasn’t as nimble as first thought in reacting to the blowup of Archegos Capital; the firm actually lost $911 million. The surprise has sent MS shares down more than 3% as we write.

Gold’s big rally yesterday just might have legs; the bid is up another 14 bucks to $1,777. And silver is a penny away from $26. Crude and copper are consolidating the week’s big gains, a barrel of West Texas Intermediate now $63.05 and a pound of the red metal $4.18.

Bitcoin continues to slip, down another 3% or so to $61,432.

“Coinbase’s IPO was an astounding success by traditional measures,” declares our crypto enthusiast James Altucher, roughly 48 hours after the company went public.

“Coinbase’s IPO was an astounding success by traditional measures,” declares our crypto enthusiast James Altucher, roughly 48 hours after the company went public.

“The company chose to pursue what is known as a direct listing of its shares on the market. Typical IPOs usually sell shares in advance of trading, with a large number of those buyers selling stock into the opening hype.

“This process is important, as it controls the number of shares that employees and investors can sell during the IPO. By artificially limiting the number of shares available during the IPO, the company, and their bankers, can create hype to force the stock price up when it starts trading.

“In Coinbase’s IPO, the direct listing did away with this pre-sell and allowed the company’s shareholders and employees to sell their shares directly into the market.”

In other words, no “lock-up” period where the pre-IPO shareholders are forbidden to sell. “So while the price of Coinbase did temporarily reach record highs, these highs were not sustainable, as investors dumped their shares into the market.”

COIN began trading Wednesday afternoon at $409.62… and instantly slid to $329.66 within 90 minutes. At last check this morning, it’s up to $339.17.

“Coinbase’s success as a stock will largely depend on the ability of Bitcoin to reach and surpass its all-time highs,” James concludes.

“Coinbase’s success as a stock will largely depend on the ability of Bitcoin to reach and surpass its all-time highs,” James concludes.

In other words, it’s a proxy for Bitcoin — and as such, James prefers the actual cryptocurrency. “There is no substitute for the real thing.”

But if you do want to take a flyer on COIN, our Zach Scheidt suggests dollar-cost averaging your purchases — maybe five buys spread across the next three months while the volatility that accompanies any IPO shakes out.

Hey, with commission-free trading these days, why not?

Meanwhile, an intriguing and incisive take on Coinbase from — of all people — a member of Congress.

Meanwhile, an intriguing and incisive take on Coinbase from — of all people — a member of Congress.

Rep. Ro Khanna (D-California) is surely one of the more liberal members of Congress — notching 95% on Americans for Democratic Action’s most recent scorecard. But he’s also one of the few members of Congress we kinda-sorta like because he’s not totally in thrall to the military-industrial complex.

And we like him even more after this tweet yesterday — for which he immediately got torched by the Twittersphere.

He was accused of enabling tax evasion and human trafficking, because of course those are the only things crypto are good for, right? Oh, and of course, accelerating climate change because of all the electricity Bitcoin mining requires. “Hey dude, this sucks” was a typical reply. That and “Rethink this.”

| ➢ | Khanna is absolutely right, by the way, about how hard it is for retail investors to take advantage of startups. The JOBS Act of 2012 was supposed to address that problem… but as we’ve chronicled over the years, the SEC dragged its feet on implementing the law and its final regulations brought new meaning to the word “onerous.” |

We bring up the ****storm generated by Khanna’s tweet as a cautionary note: If you have crypto investments and if this is the kind of hostility crypto is generating from the center-left types who’ve come to dominate the Establishment… well, let’s just say it never hurts to look around the theater for the nearest exit. We’ll stay on top of the zeitgeist.

Speaking of Establishment zeitgeist…

“Tired of hearing about woke,” reads the subject line of a reader’s email reacting to our Wednesday edition.

“Tired of hearing about woke,” reads the subject line of a reader’s email reacting to our Wednesday edition.

“I do not care what The New York Times or The Washington Post or any of the other paid-off liberal news outlets think or say. Please quote from other news sources.

“There are just as many conservatives (if not more) who do not support or agree with these idiotic companies that are going ‘woke.’ I put my spending money elsewhere as much as I can and hope others do too.

“All of these ‘woke’ humanistic ideals are completely irrational and will fail in the long run. I fear how much the nation may suffer before the average American figures it out.

“I am glad Coinbase has some sense. I wish more would do the same and that people would get some courage to say so and also spend so. Appreciate The 5.”

The 5: Seriously?

We cite things in the Times and the Post in part because they are the key mouthpieces of the power elite. You ignore them at your peril. Might as well ask us to ignore what the Federal Reserve does, too. (By the way, the Fed is increasingly giving a nod in its papers and statements to “DEI” — diversity, equity and inclusion…)

What other sources would you prefer we cite? Apart from a handful of reporters — The Daily Caller’s Chuck Ross is the only one who comes to mind right away — most conservative media outlets are more interested in “owning the libs” and virtue-signaling their target audience than in actually breaking stories that would hold powerful people to account.

And so you have to read the mainstream between the lines, or look for salient facts buried several paragraphs in, to figure out what’s really going on.

Not unlike what folks did in the Soviet Union, per a Wikipedia article: “The Russian populace regarded the major publications with a great deal of cynicism. The papers were, however, information transmission belts, so people would try to decipher what was going on by reading them.

“Soviet papers were written in such a way that the beginnings of articles would have a list of what was going well, and then would transition with a ‘however’ to the real news. So many people would read from the ‘however’ in the hopes to get at the real story.”

And so it goes…

Try to have a good weekend,

Dave Gonigam

The 5 Min. Forecast

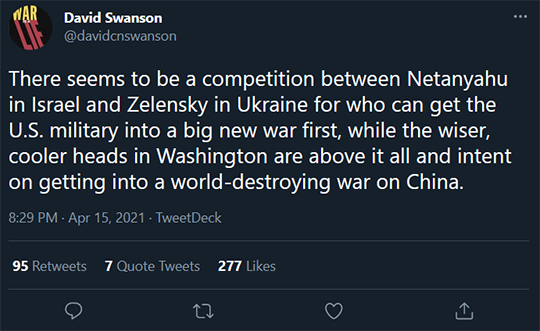

P.S. We concede we’ve dropped the ball a bit this week in alerting you to the sort of geopolitical tensions that have the potential to disrupt markets with no warning. But here’s a good tongue-in-cheek summary of the state of play…

We’ll follow up as needed next week.

P.P.S. Yesterday the CEO of Pfizer announced patients who’ve received his firm’s corona-vaccine will likely need a third shot within 12 months… and maybe annual booster shots after that.

Not coincidentally, readers of The Profit Wire booked a 50% gain this morning playing call options on Pfizer.

That’s because Profit Wire trades piggyback on the activity of connected market insiders who often know market-moving news before it breaks.

Membership in The Profit Wire is currently capped… but we’ll be able to lift that cap in the weeks ahead. Stay tuned.