- Housing hiccups: 19-year-old rents in senior complex…

- … While many sellers can’t sell into a seller’s market

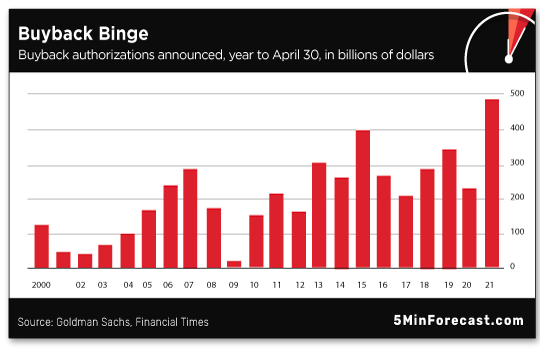

- The $484 billion catalyst for stocks’ next leg up…

- … Not that it’s good news for the economy

- Ray Blanco on the vaccine waiver “disaster”

- Retail sales flat-line… why gold matters even if a CBDC never comes to pass… how image is everything for the green grifters… and more!

We know the property market in 2021 — whether you’re in the market to buy or rent — is a little nutso…

We know the property market in 2021 — whether you’re in the market to buy or rent — is a little nutso…

And we know many prospective buyers and renters are snapping up their new dwellings sight unseen…

But the story of nursing assistant Madison Kohout is on a whole other level.

At age 19, Ms. Kohout recently moved from Norman, Oklahoma, to a small town in Arkansas. She was pleased that even before she arrived, she secured a two-bedroom apartment for just $350 a month.

Once there, she couldn’t help noticing something was just a little out of place — namely, that all her neighbors were 65 and over.

And then, the revelation — as she described on TikTok…

Not that she’s particularly upset, understand: “Most of my neighbors are asleep by the time I get home. But one major perk is that I can play music whenever I want to, because some of them can’t hear.”

If you’re wondering how it is that the manager didn’t screen for age, Kohout tells Newsweek, “They are equal-opportunity housing, meaning they do not discriminate based on age…

“I plan on staying for quite a while!” she adds. “I absolutely love my neighbors.”

Meanwhile, here’s a counterintuitive explanation for the tight housing market: In some places, a lot of people who’d like to sell can’t afford to do so.

Meanwhile, here’s a counterintuitive explanation for the tight housing market: In some places, a lot of people who’d like to sell can’t afford to do so.

At least that’s what Crain’s Chicago Business is reporting from its backyard: The weekly business newspaper just picked apart a boatload of data from the property information company Attom.

The figures show 8.6% of Chicago-area homeowners with a mortgage are “seriously underwater” — that is, they owe at least 25% more on their mortgage than the home is worth.

That’s the highest percentage by far among the 20 largest metro areas in Attom’s study — all told, 159,400 households. That’s more than the totals in New York, Los Angeles and Dallas combined.

Meanwhile, 18.4% of Chicago-area homeowners are “equity rich” — meaning their equity is at least half current market value.

“Chicago therefore,” says Crain’s, “has the smallest share of homeowners who can easily afford to sell and the largest share of people who can’t afford it.”

Thus, the vanishingly small inventory. And while Chicago is a standout among major metro areas, the phenomenon is surely found elsewhere.

On to today’s market action — which is making the media freakout earlier this week look even sillier than it was yesterday.

On to today’s market action — which is making the media freakout earlier this week look even sillier than it was yesterday.

As we check our screens, it’s the Nasdaq’s turn to take the lead — up 1.7% to 13,346. The S&P 500 is up 1% to 4,153 — a mere 1.9% below last Friday’s record close. The Dow is the laggard, but still up 0.6% to 34,217 — only 1.6% below last Friday’s record close. Volatility as measured by the VIX is back below 20, where it was last Friday.

The media’s FED TIGHTENING SELL EVERYTHING narrative? That was so two days ago.

Heck, gold is back where it was before it got smacked down on Wednesday — $1,836. And silver’s up a quarter to $27.33. Bitcoin is hanging in there above $50,000. Copper continues to take a breather at $4.66, but crude is rallying again, just 15 cents away from $65 a barrel.

The stock market might still be in for a few more days or weeks of sideways chop… but a new catalyst for sustained record highs is gathering steam.

The stock market might still be in for a few more days or weeks of sideways chop… but a new catalyst for sustained record highs is gathering steam.

“Companies are preparing to launch a record wave of share buybacks,” says the Financial Times, “as executives get comfortable with spending excess cash following a blockbuster earnings season and greater clarity on the trajectory of the world economy.”

Per figures from Goldman Sachs, U.S. firms announced $484 billion in buybacks during the first four months of 2021.

Not only is that a 35% jump from 2020’s muted levels, it’s the highest in at least two decades…

Big Tech has been leading the way — $90 billion, or nearly one-fifth of that 2021 total, is just Apple, which no doubt pleases our retirement specialist Zach Scheidt — but the exhilaration is dispersed across most industries and sectors, including health care and financials.

We look upon this news with profoundly mixed feelings: Yes, it’s great for shareholders. It’s not great for the economy.

We look upon this news with profoundly mixed feelings: Yes, it’s great for shareholders. It’s not great for the economy.

As a reminder, companies sitting on a boatload of cash can do basically one of three things with it…

- Return the cash to shareholders in the form of buybacks or dividends

- Merge with or acquire another company

- Invest in the company’s future growth — either research and development or capital expenditures like new factories and equipment.

Only the last of those three activities is a vote of confidence in the economy, in new ideas, in a brighter future. And it’s the activity that’s been least in evidence during the entire economic expansion that began once the Panic of 2008 was over.

In March 2014, Blackrock CEO Larry Fink wrote an open letter to the other 499 CEOs of the S&P 500 companies.

“It concerns us,” he wrote, “that in the wake of the financial crisis, many companies have shied away from investing in the future growth of their companies. Too many companies have cut capital expenditure and even increased debt to boost dividends and increase share buybacks.”

Here at The 5, we furnished a real-world translation: “After five years, you turkeys have cost-cut as much as you possibly can. If you expect to keep growing your earnings, you jolly well better start investing in the future of your businesses to attract more customers. You do think such investments will pay off, right? Don’t you? Anyone? Bueller?”

No, they don’t. Not in 2014 and not now. But there’s so much EZ money sloshing around the system, thanks to incessant Federal Reserve money printing, that earnings keep growing anyway. (The corporate tax cut of 2017 didn’t hurt, either.)

No, they don’t. Not in 2014 and not now. But there’s so much EZ money sloshing around the system, thanks to incessant Federal Reserve money printing, that earnings keep growing anyway. (The corporate tax cut of 2017 didn’t hurt, either.)

That’s the essence of the disconnect between the stock market and the economy — as well as the ever-growing prosperity of the top 0.1%, while the bottom 90% keeps losing ground.

If you’re fortunate enough to have the means to invest in the stock market — presumably that’s the case if you read this e-letter — enjoy the ride. But don’t confuse it with real prosperity of the sort that was the American experience of the 20th century.

Oh, and call it a bubble if you wish. But as we said on Monday citing the investment legend Jeremy Grantham… bubbles can last a lot longer than even pros like him expect.

OK, so did everyone already blow their stimmy checks? That’s all we can conclude from the April retail-sales figures.

OK, so did everyone already blow their stimmy checks? That’s all we can conclude from the April retail-sales figures.

We knew this was going to be a comedown from March’s insane 10.7% increase… but the April number is ruler-flat, compared with an “expert consensus” looking for a modest 1% increase.

If you factor out high demand for cars as well as rising gasoline prices, the figure is even more disappointing — a 0.8% drop, compared with expectations for a 0.7% rise.

The other big economic number of the day also falls short of expectations: Industrial production rose 0.7% in April; the consensus guess among dozens of economists polled by Econoday was a 1.2% jump. Some of the blame can be pinned on the semiconductor shortage that’s squeezing the auto industry.

All told, 74.9% of the nation’s industrial capacity — factories, oil fields, mines and utilities — was in use during April…

… which doesn’t even register as a pandemic-era high. That big dip in early 2021? That’s the Texas deep freeze. Going by the chart, U.S. industry still hasn’t fully recovered from that blow.

“In short, this is a disaster,” says our science-and-wealth maven Ray Blanco of the so-called vaccine waiver.

“In short, this is a disaster,” says our science-and-wealth maven Ray Blanco of the so-called vaccine waiver.

As you might have heard last week, the Biden administration came out in favor of waiving “intellectual property” protections for COVID-19 vaccines. The idea is that a waiver would allow developing nations — like hard-hit India — to spin up their own vaccines for their populations faster than is the case now.

“An action like this would cause an unprecedented upheaval in the biotech world,” says Ray.

“This is not the solution to getting more reliable vaccines into the hands of people who need them. And furthermore, this will only hinder the development of good drugs with high efficacy rates down the line.

“There’s still going to be a need for booster shots and treatments with new variants of COVID-19 popping up in different countries,” Ray goes on. “A second wave of a new variant can be more easily combatted by the companies that already know what they’re doing. And if you take away the profits they get from this initial wave, we make them less equipped to fight it.”

In addition, Ray says the waiver is no guarantee that vaccine production can be quickly ramped up: “They are a complicated new form of vaccine that requires materials and assembly unlike we’ve ever seen.

“The Biden administration already gave the go-ahead to give away a stockpile of AstraZeneca to other nations. This is the way to end the pandemic… taking away the IPs from these companies just pulls the rug out from under them.”

That said, the waiver is far from a done deal.

That said, the waiver is far from a done deal.

It’s not something the U.S. government can impose on its own. It all goes through the World Trade Organization. There will be weeks, maybe months, of back-and-forth. It’s right there in Team Biden’s press release: “Those negotiations will take time given the consensus-based nature of the institution and the complexity of the issues involved.”

And the press release was very careful not to spell out any details of how the White House would like the waiver to be implemented. The details could turn out to be very pharma-friendly. (Politicians trying to have it both ways? Perish the thought!)

So it’s still early days — way too early to engage in a knee-jerk reaction of selling pharma or biotech stocks, to be sure. We’ll keep an eye out for any potential impact.

“Read your second try at the gold/silver question,” a reader writes us.

“Read your second try at the gold/silver question,” a reader writes us.

To quickly summarize, the question is how can gold and silver be used as an escape valve from a future central bank digital currency — with its capacity for total surveillance and mandatory negative interest rates.

“After reading I wonder what is the point of even having precious metals? Is it just to try to convert them to CBDC when gold gets to $10,000-plus? Is it to hold onto through the crisis and convert when the U.S. regains its sanity? Thank you.”

The 5: Those are both valid possibilities. But even if a CBDC never comes into being, you want gold as a core element of your portfolio.

Apart from its disaster-protection function, it’s also the go-to asset in times of steep inflation like the 1970s. Under that circumstance, it will more than compensate for any losses in your stocks and bonds.

“You wondered,” writes our final correspondent, “how a CBDC dependent on electricity would square with a green agenda.

“You wondered,” writes our final correspondent, “how a CBDC dependent on electricity would square with a green agenda.

[Indeed we did.]

“Those are easy to reconcile. As long as the Fed states they are very concerned with climate change, all is good. Actual green practices mean nothing. Appearing to be green means everything. Image über alles.”

The 5: You have a point.

It’s how Elon Musk has successfully cultivated his image as a savior of the planet even though his electric vehicles require mass quantities of base metals that have to be extracted from the Earth’s crust, to say nothing of electricity that just can’t be generated exclusively with renewables. Not if we’re to carry on with our “happy motoring” culture, to borrow James Howard Kunstler’s expression.

Which renders Musk’s alleged come-to-Jesus moment with Bitcoin even more preposterous than it was at first blush…

Have a good weekend,

Dave Gonigam

The 5 Min. Forecast

P.S. Along those lines, take a look sometime at Planet of the Humans, the documentary directed by Jeff Gibbs, with Michael Moore as executive producer.

You don’t have to buy into their population-control agenda — God knows we don’t — to revel in how they show up so many of the green grifters like Al Gore and Bill McKibben for their rank hypocrisy.

So offended was the power elite by this film that for a while they got it removed from YouTube on the basis of a bogus copyright claim involving a four-second clip.

These days, Planet of the Humans is available on several of the familiar streaming platforms, maybe even one you’re paying for already.