- Zach Scheidt explodes the myth of “transitory” inflation

- This high-speed elevator is going up!

- Three inflation remedies for your retirement savings

- Palantir’s infectious Olympic spirit

- Homeland Security punts Real ID (again and again)

“If I hear the word ‘transitory’ one more time,” says our retirement specialist Zach Scheidt, “I might start pulling out my hair!

“If I hear the word ‘transitory’ one more time,” says our retirement specialist Zach Scheidt, “I might start pulling out my hair!

“Fed Chairman Jerome Powell seems to be fond of using this word to describe inflation, implying that inflation is only something we’ll have to worry about for a short time.

“But that’s not how inflation works…

“Even if (and that’s a big ‘if’) inflation is only high for a limited time,” Zach says, “its effects still last forever when it comes to your savings.

“Even if (and that’s a big ‘if’) inflation is only high for a limited time,” Zach says, “its effects still last forever when it comes to your savings.

“I like to use the analogy of a high-rise retail building where prices increase every time you move to a higher floor,” he says. “In a typical year, consumers might move one story higher. And this means you have to pay just a bit more for all the things you want to buy.

“Today’s ‘transitory’ inflation period is like jumping in the elevator and skipping higher by 20 floors.

“Suddenly the prices you have to pay are much higher than they were just a short time ago. Sticker shock is what happens when ‘transitory’ inflation causes prices to quickly jump higher.

“Now, suppose I told you, ‘Don’t worry, that elevator ride was just a one-time thing. You won’t see that kind of jump in prices again,’” he continues. “Does that make it better?

“You still have to pay higher prices. And now, the money you’ve saved won’t go as far as it used to. Meanwhile… [returning] to a ‘normal’ rate of inflation means soon you’ll need to pay more — on top of today’s higher prices — for the things you need.”

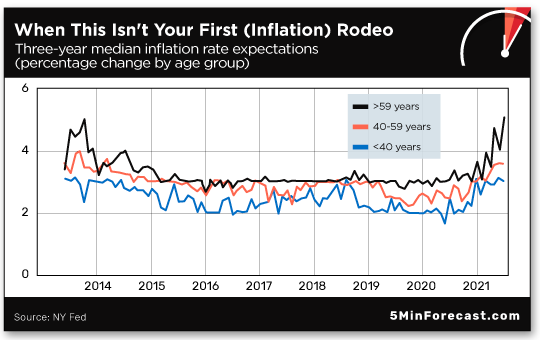

And this is something seasoned Americans already have a gut feeling about, according to a chart that crossed Zach’s desk this week….

“Older (and wiser) consumers expect more inflation,” says Zach. Just take a look at this chart from the Federal Reserve Bank of New York, showing the inflation expectations among three age demographics. “Here’s a longer-term view of the inflation people are expecting for the next three years…

“Older (and wiser) consumers expect more inflation,” says Zach. Just take a look at this chart from the Federal Reserve Bank of New York, showing the inflation expectations among three age demographics. “Here’s a longer-term view of the inflation people are expecting for the next three years…

“Who do you think has a better handle on inflation?” Zach asks… rhetorically. “The older generation certainly has experience on their side.

“We’ve just experienced a 20-year-plus bull market for bonds — which tells us that interest rates have been steadily heading lower for decades — so inflation has been modest that entire time.

“How could younger Americans worry about something they haven’t dealt with their entire professional careers?”

But here’s what their elders know: “Inflation causes the value of your savings to drop. It drives prices higher as it reduces the purchasing power of your savings.

“Fortunately, there’s still time to protect the value of your savings,” Zach says. “And there are some very good ways to beat inflation so that you wind up in a better position

“Fortunately, there’s still time to protect the value of your savings,” Zach says. “And there are some very good ways to beat inflation so that you wind up in a better position

“There are a few key categories that should be particularly effective in protecting your wealth and growing your spending power over the next few months…

Precious metals: “Gold and silver tend to hold their value and even accelerate higher when inflation fears kick in.

“Over the last few months, gold and silver haven’t performed the way they typically do when inflation picks up,” Zach notes. “But for a longer-term inflation investment, I still think gold, silver and mining stocks that produce these precious metals will be great ways to use inflation to build your wealth.”

Real estate: “Here in the U.S., there’s just too much demand for homes and builders aren’t creating enough supply,” he says. “Investing in real estate is a great way to turn inflation on its head and make it work for you.

“You can also invest in homebuilder stocks, and in real estate investment trusts (or REITs) that own and rent out single-family homes or apartment buildings.”

Blue chip stocks: “You can protect your savings from inflation just by purchasing shares of stocks that generate profits and pay dividends,” says Zach.

“Owning stocks that pay regular dividends can allow you to keep less cash on hand because you know that you’re getting payments from these stocks month after month. Since cash sitting in your bank account will lose value thanks to inflation, you want to hold as little of it as possible.

“With a little planning,” he says, “you can have your dividend checks come in right at the times when you need cash to do your grocery shopping, pay your utilities or pay for other expenses.

“Meanwhile, most of the rest of the money you’ve saved is still working hard for you invested in companies that are growing with our overall economy,” says Zach. “Bonus points if you buy shares of a company that enjoys bigger profits when inflation heats up.

“Remember, inflation is here and it is affecting your wealth. Don’t panic,” he urges, “but don’t let your cash lose value during this period.”

Zach’s takeaway? “A proactive approach to inflation can pay off handsomely, letting you focus on the things that matter instead of worrying about your savings.”

“A few earnings reports are trickling in so far this morning,” says our market analyst Greg Guenthner. “But the averages aren’t budging so far today.”

“A few earnings reports are trickling in so far this morning,” says our market analyst Greg Guenthner. “But the averages aren’t budging so far today.”

| ➢ | Most notably, retailers Target (TGT) and Lowe’s (LOW) reported better-than-expected earnings, and both companies raised third-quarter guidance. That said, Target and Lowe’s shares are diverging at the time of writing, with TGT down almost 4% and LOW up almost 10%. Hmm… |

“By the way, small caps have been absolutely crushed over the past four sessions,” Greg says. “They looked to be shaping up to break out of their recent range, or at least make an honest effort, but the iShares Russell 2000 ETF (IWM) dropped almost 4.5% over the past four trading days… right back down toward its seven-month lows.

“Thankfully, buyers stepped in and caught the falling knife Tuesday afternoon,” Greg says. “We’ll see if it can rally out of the danger zone today.” (Shares of IWM are nominally in the green.)

Today? The market seems to be holding its breath ahead of the Fed minutes release later this afternoon. The S&P 500 and Nasdaq are flat at 4,440 and 14,655 respectively, and the Big Board is down 30 points to 34,310.

Oil’s stuck in neutral at $66.60 for a barrel of WTI, and precious metals are in the red: Gold’s lost $5.10 to $1,782.60 per ounce and silver is down 0.25% to $23.40.

A recent check on Bitcoin finds the flagship crypto down 0.25% to $45,385.

Data software company Palantir Technologies (PLTR) is going for gold… While other cutting-edge tech companies — think Tesla — have hedged with crypto, Palantir’s keen on a more traditional safe haven.

Data software company Palantir Technologies (PLTR) is going for gold… While other cutting-edge tech companies — think Tesla — have hedged with crypto, Palantir’s keen on a more traditional safe haven.

Palantir’s Aug. 12 earnings report notes: “During August 2021, the company purchased $50.7 million in 100-ounce gold bars. Such purchase will initially be kept in a secure third-party facility located in the northeastern United States and the company is able to take physical possession of the gold bars stored at the facility at any time with reasonable notice.”

CNBC says: “The move reflects a growing company stashing cash in an unconventional asset in response to economic uncertainty spurred by the coronavirus pandemic and governments’ response to it.”

[See above: Zach on the precious metals remedy for “transitory” inflation… Just sayin’.

Of course, we’ve been banging the drum for Hard Assets Alliance where you can buy and store gold, silver and other precious metals in a secure location or take possession of your bullion. Your choice.

And we’re so pleased with how HAA helps everyday investors, we even took a stake in the company. So you can assume we’ll receive a small fee… but those fees are among some of the lowest in the business.]

If you can believe it, the last time The 5 addressed the Real ID saga was in the early days of the pandemic.

If you can believe it, the last time The 5 addressed the Real ID saga was in the early days of the pandemic.

In late March 2020, we pointed out Homeland Security’s postponement requiring an “enhanced identification” to board domestic flights. Now the Real ID deadline is getting kicked even further down the road.

So we re-reprise (heh) a TSA warning that was posted at airports…

We took the liberty of — once again — updating the poster.

It’s been more than 15 years since Congress passed the Real ID Act of 2005, requiring “American citizens and legal residents have a specific type of identification, incorporating proof of not just their identity but their citizenship, to enter federal buildings or board domestic flights,” says an article at Reason.

“Implementation of Real ID has been a real mess,” the article continues. It’s almost farcical, in fact, with Homeland Security extending the deadline multiple times…

- First deadline: May 2008

- Second? December 2009

- Next, May 2011

- Then January 2013

- Aaand October 2020

- October 2021.

Now? You must mosey on over to your local MVA before the May 2023 deadline. (We guess Homeland Security threw up their hands, skipping right over 2022.)

“Assuming that deadline is not extended yet again,” Reason concludes.

“The popularity of so-called shoffices — shed offices — has risen,” the BBC says. But these WFH escapes have become liabilities.

“The popularity of so-called shoffices — shed offices — has risen,” the BBC says. But these WFH escapes have become liabilities.

Heh…

“Insurer Zurich has warned that outbuilding fires — in sheds, garages and conservatories — rose by 16% last year compared with 2019,” BBC says. Zurich “said the popularity of conversions to home offices, gyms and… bars increased the fire risk.”

To say nothing of outdoor pizza ovens. (Also a thing, apparently.)

“Aside from storing gardening tools, our sheds and garages have become a haven to escape the stresses of family life and for others, a place to work,” says Zurich’s Phil Ost.

“Aside from storing gardening tools, our sheds and garages have become a haven to escape the stresses of family life and for others, a place to work,” says Zurich’s Phil Ost.

In the U.K., in fact, the word “garage” has become the most popular search term for homebuyers surfing the web for their next home.

“But as they take refuge in their garden sheds and garages,” Mr. Ost says, “it appears to have sparked a rise in accidental blazes.” And buyer beware: Unless you’ve updated your homeowners’ insurance to cover updated outbuildings, your insurer might not cover losses.

At my suburban home on the outskirts of Baltimore, no shed conversion is on the horizon. The original 1950s shed is just creepy…

Take care, and we’ll be back tomorrow.

Best regards,

Emily Clancy

The 5 Min. Forecast