- (Survey, schmurvey) Signal within the noise

- Bizarro Evergrande in one hilarious flowchart

- Global food prices on par with mid-1970s

- Credit Suisse on what it takes to honor Paris Accord

- Do not, under any circumstances…

- … make this precious metals mistake

- A reader suspects Bitcoin manipulation (well said!).

These “surveys” about people’s interest in cryptocurrency are becoming a joke.

These “surveys” about people’s interest in cryptocurrency are becoming a joke.

The newest entrant is from Grayscale Investments, which touts itself as “the world’s largest digital currency asset manager.”

Its third annual report finds that 26% of surveyed investors own Bitcoin.

Wow! The number has doubled in the space of only a few months!

(Sorry, perhaps the written word doesn’t fully convey our tongue’s firm presence in cheek.)

As our crypto maven James Altucher mentioned last month, a University of Chicago survey found 13% of Americans invested in crypto of any kind between July 2020 and July 2021.

Really, the variance from one survey to another is such that it’s impossible to get a handle on crypto’s “market penetration.”

Still, there’s signal to be found within the noise…

The Grayscale study finds 87% of Bitcoin owners own at least one other digital currency.

The Grayscale study finds 87% of Bitcoin owners own at least one other digital currency.

So now we’re drilling down into current Bitcoin owners. Even if the number isn’t precisely 87%, even if it’s more like 67%, we can see a supermajority of Bitcoin owners find value in diversification.

In other words, they’re not “Bitcoin maximalists” — the hardcore BTC enthusiasts for whom all other cryptos are at best pale imitations.

But those are individual investors. To the extent corporate America is into crypto at all, you could be forgiven for thinking it’s all Bitcoin all the time.

But those are individual investors. To the extent corporate America is into crypto at all, you could be forgiven for thinking it’s all Bitcoin all the time.

True, BTC isn’t the most “efficient” crypto. But regardless, “It is the token corporations are buying for their treasury,” says our James Altucher.

“Just days ago, data analytics firm MicroStrategy (MSTR) announced it purchased another 7,002 Bitcoin for approximately $414 million. This brings the company’s holding to 121,044 bitcoins with an average cost around $29,500 per coin. That’s a solid double!

“Tesla (TSLA), a ‘small’ car company run by a ‘little known’ guy named Elon Musk, holds 42,000 Bitcoin. Then there is Square (SQ), a company that not only holds Bitcoin but has been finding ways to integrate cryptocurrency into its payment platform” — thus its planned name change to Block. “Coinbase (COIN) is another obvious name.”

Oh, and let’s not forget the aforementioned Grayscale. As manager of the Grayscale Bitcoin Trust (GBTC), it dwarfs most other players with 654,885 tokens in its possession, James says.

You, fortunately, don’t have to be locked in to Bitcoin maximalism.

You, fortunately, don’t have to be locked in to Bitcoin maximalism.

After all, it’s safe to say the biggest Bitcoin gains have already been made; James Altucher was pounding the table for Bitcoin on CNBC when it was trading for $118. (Checking our screens this morning, it’s at $50,510.)

More recently, he landed a 125X crypto gain in four years.

And this year, he unearthed a powerful catalyst in the crypto space that poised to send nine tiny cryptos soaring for explosive profit potential.

He recently pulled his findings together into an exclusive briefing for our readers — complete with his No. 1 coin recommendation that he’s giving away free.

Is there a hitch? Yes — these recommendations could skyrocket at any moment, independent of the rest of the crypto market.

Consider it your “second chance” at huge crypto profits. Don’t waste any time checking it out — we’re pulling it offline tomorrow night at midnight.

The U.S. stock market is taking a pause after a two-day monster rally.

The U.S. stock market is taking a pause after a two-day monster rally.

At last check, the Dow is off a quarter percent to 35,625… the S&P 500 is down microscopically to 4,682… and the Nasdaq is up a quarter percent to 15,721.

Crude is likewise stabilizing after a huge ramp up, a barrel of West Texas Intermediate fetching $72.51.

Precious metals remain in a winter’s slumber, gold at $1,781 and silver at $22.38.

Among the cross-currents traders are chewing on is a still-unconfirmed report that China Evergrande missed a payment yesterday on some dollar-denominated debt.

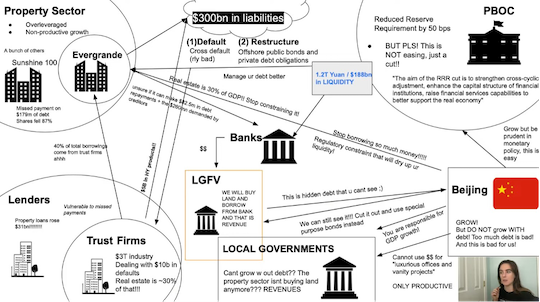

Evergrande, you’ll recall, is the bizarro Chinese property developer our Jim Rickards likens to “Tesla owned by Fannie Mae.” If that explanation seems unsatisfying, the investor/writer Kyla Scanlon tried her hand at visualizing Evergrande’s business model. Hilarity ensued…

Click to enlarge

Elsewhere, we see the latest debt-ceiling tussle in Washington is close to a resolution — one week before Uncle Sam potentially defaults on a portion of the national debt. Meanwhile, the president’s education-health care-climate spendapalooza — replete with changes to the tax code — is likely being pushed off to early next year.<a id=”150″></a>

The Biden-Putin summit? What a snooze. Putin promises not to stage an invasion he never intended to stage anyway, and Biden gets to claim he “thwarted” said invasion. Meanwhile, the crucial question of whether Washington will deploy “defensive” missiles on Russia’s doorstep in Ukraine — an existential issue for Moscow — remains unresolved.

Global food prices have notched another highest-in-a-decade number.

Global food prices have notched another highest-in-a-decade number.

The FAO Food Price Index from the United Nations Food and Agriculture Organization clocks in at 134.4 for November — up 27.3% over the last 12 months.

The index hasn’t been this high since June 2011. And adjusted for inflation — the yellow line on this chart — food is nearly as costly as it was in the mid-1970s…

The big drivers of last month’s increase were grains and dairy, followed by sugar. Meat and vegetable oils were down slightly. Again, this is a global index — your mileage may vary.

The global supply chain snafus are making life miserable for hardcore gamers — which ought to please the climate-change crowd.

The global supply chain snafus are making life miserable for hardcore gamers — which ought to please the climate-change crowd.

The Sony PlayStation 5 is particularly hard to find. “You definitely need intel to get a console,” Philadelphia-area resident Nicole DeSantis tells CNN. “You can’t just get it without.”

Microsoft’s Series X version of the Xbox is likewise scarce. And as we’ve noted previously, the Nintendo Switch OLED is even harder to locate. CNN again: “The gaming industry has been hit notably hard” by the chip shortage as it competes with the auto industry and the makers of consumer electronics.

| ➣ | Speaking of which, an intriguing cocktail-party factoid courtesy of our tech guru Ray Blanco: Chips account for 40% of the cost of a new car nowadays — up from 18% two decades ago. |

Sony and Microsoft are offering previous customers early access to restocks based on, in the case of Sony, “previous interests and PlayStation activities.” Retailers like Walmart, Best Buy and Costco are also offering members-only access to restocks.

But hey, it’s all good for the climate. According to recent research from Credit Suisse, a “responsible” inhabitant of the Earth should give up playing video games altogether…

In addition to forswearing video games, the report says a carbon-neutral individual should give up red meat, beer and coffee.

Alrighty then…

And now a public service announcement: Do not, under any circumstances, attempt to keep physical gold in your personal possession and claim it’s part of an IRA.

And now a public service announcement: Do not, under any circumstances, attempt to keep physical gold in your personal possession and claim it’s part of an IRA.

The Wall Street Journal’s tax columnist Laura Saunders tells the sorry story of a couple from Rhode Island who kept their “IRA precious metals” in a home safe. After a recent Tax Court decision, Andrew and Donna McNulty are out about $320,000 in back taxes and penalties — a hefty chunk, considering the IRA assets in dispute total $730,000.

We won’t thrash through the details, not least because some of the relevant details aren’t public. The key point is that a judge ruled that Donna McNulty’s storage of $411,000 in gold and silver American Eagle coins inside a home safe is absolutely, positively, not kosher for IRA purposes — no matter what the clowns who “advised” them said about setting up an LLC to hold the metal.

Bottom line: Don’t fall for any schemes that promise you can keep metal at home and claim it’s part of an IRA. You have to use a third-party custodian.

Our friends at Hard Assets Alliance know the rules backward and forward, and for nearly a decade they’ve been helping folks like you put real metal in an IRA, safely and legally. It’s “allocated” metal, held in your name within secure vaults located in New York and Salt Lake City.

Details here. As always, know that our firm owns a stake in Hard Assets Alliance and we’ll collect a modest cut once you fund your account. Together, we prosper.

“It seems like no one wants to come out and say it, but the Bitcoin crash on Friday night looks like classic manipulation trying to blast the price lower,” writes a Financial Reserve member.

“It seems like no one wants to come out and say it, but the Bitcoin crash on Friday night looks like classic manipulation trying to blast the price lower,” writes a Financial Reserve member.

“On a five-minute chart it was trading at one–20 coins every five minutes, when suddenly at 11:50 p.m. EST, it went to hundreds of BTC every five minutes, for a total of over 7,000 in 40 minutes, at which point the price was several thousand dollars lower, and volume dropped back to close to what it had been before.”

Responding to a fellow reader’s speculation yesterday, he goes on: “If Evergrande, or anyone, anyone, had needed to raise money by selling Bitcoin, they could have spread their selling out over several hours or the whole weekend and gotten a much better price.

“Dumping huge quantities on the market at a very thinly traded hour is very hard to explain except as an effort to crash the price. And we have seen this show before, multiple times, in the gold and silver futures markets, where monster sell orders have been dropped on the thinly traded overnight market on Sunday night in order to crash the price.

“And no, this is not a call for anyone, government or otherwise, to regulate or prevent such actions. This is truly a world market, and anyone playing in it had better be aware that things like this can happen.

“The real justice will be when Bitcoin moves back above previous highs and the Friday night seller finds he is poorer by several thousand Bitcoin with nothing to show for it. But in the meanwhile, someone got a heck of a deal!”

The 5: Well said.

The advent of Bitcoin futures — which, as we recall, came into being right around this time in 2017 — makes these sorts of shenanigans inevitable.

As you point out, it’s just part of the landscape for precious metals. Ditto for oil, which has been jerked around routinely ever since modern-day oil futures started trading in 1983.

We can complain about it… or as you suggest take advantage of opportunities to buy the dip.

Best regards,

Dave Gonigam

The 5 Min. Forecast