- Sweeping conclusions are dangerous, but…

- Spotify gets its censorship comeuppance

- The U.K.’s economy is on the ropes

- An alarming BoA branch mixup

- Readers on Bitcoin’s “store of value”… Banks’ cash-circulation shortage… “Lefties vs. righties?”… And more!

It’s always dangerous to draw sweeping conclusions from one morning’s market action… but it’s a big deal that cryptocurrencies are holding their own while tech stocks are tanking.

It’s always dangerous to draw sweeping conclusions from one morning’s market action… but it’s a big deal that cryptocurrencies are holding their own while tech stocks are tanking.

Begin at the beginning: After the closing bell yesterday, Facebook parent Meta Platforms reported its quarterly numbers. “Horrendous” doesn’t do them justice.

The number of daily active users fell for the first time since the company’s founding in 2004. Profits declined more than expected. The outlook for the rest of the year was glum.

Upon the market open this morning, FB shares collapsed 25%.

We tried to locate a picture of Mark Zuckerberg in shock, until we remembered he doesn’t experience normal human emotions…

On the assumption FB is a harbinger for the rest of the tech sector, the Nasdaq took a spill in sympathy — opening down 2.5%.

Meanwhile, cryptos are hanging tough — Bitcoin at $36,846 and Ethereum at $2,632. They’re in the red, but not by much.

Meanwhile, cryptos are hanging tough — Bitcoin at $36,846 and Ethereum at $2,632. They’re in the red, but not by much.

That runs counter to the mainstream narrative that’s taken hold since late last year. It goes like this: Cryptos are correlated to tech stocks… and tech stocks are vulnerable to the Federal Reserve’s plans to tighten monetary policy.

We’ve been skeptical of this correlation thesis. Cryptos crater 50% or thereabouts most every year — regardless of what the Fed does.

Again, one morning’s action doesn’t tell the whole story… but the thesis is looking shakier and shakier.

One morning’s action also doesn’t eliminate the jitters that have shaken the crypto space since November. But as our crypto evangelist James Altucher keeps saying, the noise from the sell-off is obscuring a deeper crypto story — one that could prove enormously lucrative to those who act quickly.

James and his team bring you this deeper story right here. We suggest you watch right away; given the time-sensitive nature of this briefing, we’re pulling it offline tonight at midnight.

As the day wears on, FB continues to be a drag on the market as a whole. The Nasdaq is still down about 2% at 14,116.

As the day wears on, FB continues to be a drag on the market as a whole. The Nasdaq is still down about 2% at 14,116.

The S&P 500 is down 1.25% — but it’s still about 30 points above 4,500, the level our Alan Knuckman is watching closely.

The Dow is holding up best, down about two-thirds of a percent at 35,388.

Gold clings to $1,800; silver has sunk to $22.33. Crude is back above $88.

In addition to FB, a headline-making earnings release comes from the streaming service Spotify — down nearly 15% today after CEO Daniel Ek said it’s “too early to know” the impact of the boycott by Neil Young and other musicians who’ve pulled their catalogs because they’re offended by Joe Rogan’s podcast.

In addition to FB, a headline-making earnings release comes from the streaming service Spotify — down nearly 15% today after CEO Daniel Ek said it’s “too early to know” the impact of the boycott by Neil Young and other musicians who’ve pulled their catalogs because they’re offended by Joe Rogan’s podcast.

“We don’t change our policies based on one creator,” Ek said. “nor do we change based on any media cycle or calls from anyone else.”

We sympathize with Ek’s plight, but we’re not buying what he’s selling — not when the White House says slapping a disclaimer on Rogan isn’t good enough.

“Ultimately our view is that it’s a good step, it’s a positive step,” says White House press secretary Jen Psaki, “but there’s more that can be done.”

No, no governmental censorship pressure there, no siree.

Ek simply didn’t see this fecal storm coming — even though Psaki said last summer the White House has been “flagging problematic posts for Facebook that spread disinformation.”

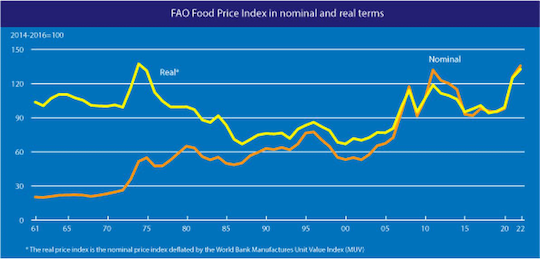

Global food prices now exceed their peaks of a decade ago, according to the U.N.’s Food and Agriculture Organization.

Global food prices now exceed their peaks of a decade ago, according to the U.N.’s Food and Agriculture Organization.

The FAO Food Price Index for January clocks in at 135.7 — driven up by vegetable oils and dairy. Whether or not you adjust the figure for inflation, it’s higher now than it was in 2011.

As we always remind you when we mention this number, high food prices in 2011 brought on the “Arab Spring” revolts that toppled several governments in the Middle East.

No sign of anything similar yet… although it was rising fuel prices that made people take to the streets in Kazakhstan a few weeks ago. That uprising was put down quickly.

Maybe we were a little too quick to sound the alarm on cannabis and its continued viability as a sector worth investing in.

Maybe we were a little too quick to sound the alarm on cannabis and its continued viability as a sector worth investing in.

On Tuesday, we noted how the feds are working hand in hand with California sheriff’s deputies to seize cash from armored trucks serving licensed marijuana dispensaries. Using the maneuver of civil asset forfeiture, the authorities keep the cash while sidestepping legal niceties like filing charges and going to trial. A rather significant business risk, no?

But Congress might be coming to the rescue. Yesterday, for the sixth time, the House passed the SAFE Banking Act — which would finally give explicit legal protection to banks that take canna-businesses as customers. No longer would pot have to be a cash-only enterprise.

This sixth attempt might actually fly in the Senate because it’s been tucked in as an amendment to other legislation.

Nor is that the only weed-friendly legislation in play.

Nor is that the only weed-friendly legislation in play.

Rep. Nancy Mace (R-South Carolina) is lining up support for what she calls the States Reform Act. “The SRA regulates cannabis like alcohol and respects state medical programs,” she writes in The Wall Street Journal. “This will be a boon to small businesses and agricultural producers.”

Mace is a freshman rep, but our Ray Blanco says she already commands respect from colleagues: “Mace, the first woman to graduate from military college The Citadel, has personal reasons. Mace believes cannabis helped her cope with depression after childhood rape.” Ray tells us Amazon — with no small amount of lobbying heft — is backing Mace’s bill.

Assuming either bill makes it to the president’s desk, it’s hard to imagine him vetoing it — not when his approval rating is pitifully low and his party is at risk of getting clobbered in the midterms.

As weak as the U.S. economy looks at the moment, Great Britain’s looks worse — and Jim Rickards says that bodes ill for the British pound.

As weak as the U.S. economy looks at the moment, Great Britain’s looks worse — and Jim Rickards says that bodes ill for the British pound.

Start with the fact Prime Minister Boris Johnson is on the ropes politically because he was caught partying during lockdown. He might step down as leader of the Conservative Party or call for new elections. “Either course,” Jim tells us, “would weaken his grip (at least in the short run) and add to the economic turmoil in the U.K. (because of uncertain outcomes).

“The U.K. also has a lot of unfinished business with both the EU and the U.S. with regard to Brexit. The actual Brexit has been completed, but new trade deals with the EU and U.S. are still not finalized. (U.K./EU deals announced so far are merely transitional to facilitate Brexit; long-term trade relations are still up in the air.)

“Given this uncertainty, the U.K. economy will certainly struggle more than its peers in terms of recovery from the pandemic, which every nation is still suffering.”

This week, Jim told his Tactical Currency Profits readers how to profit from weakness in the pound — while avoiding all the hassles that come with currency trading. Learn more about Jim’s system at this link.

If you dismiss cryptocurrencies as the “Wild West,” here’s a reminder that conventional transactions come with their own risks.

If you dismiss cryptocurrencies as the “Wild West,” here’s a reminder that conventional transactions come with their own risks.

Brian Leonard is in the midst of a home remodel. To pay the contractor he needed to transfer $33,000 from Wells Fargo to Bank of America. He took a cashier’s check to a teller at a Bank of America in Oakland, California.

But when he checked his account the next day, the money wasn’t there. And when he went to the bank… the bank wasn’t there. The branch had closed.

“I’m starting to think I may not see the money ever,” he recalls.

Management at another branch was no help, even though Leonard came armed with a deposit receipt. “‘You’re telling me that Bank of America lost $33,000 of my money, and you’re telling me right here to my face, there’s nothing you can do?’ ‘That’s right, sir.’

“Nobody said, ‘We’ll find out where the money is, we’ll make good on it, we’ll take care of it…'”

Only with the intervention of the consumer reporter at the Bay Area’s ABC station did the matter finally get resolved. BofA’s excuse was that the cashier’s check was made out to Bank of America and not Leonard.

Sheesh…

“I’m curious as to how you calculate that Bitcoin or any other ‘crypto’ has achieved, as you say, a ‘store of value’ role,” a reader inquires after we mentioned it in passing yesterday.

“I’m curious as to how you calculate that Bitcoin or any other ‘crypto’ has achieved, as you say, a ‘store of value’ role,” a reader inquires after we mentioned it in passing yesterday.

“All cryptos are nothing but strings of numbers on a distributed ledger. There will never be any kind of intrinsically stored value there like you have with gold or any base metal.

“Nobody will ever be able to turn a bitcoin into any other kind of usable product. A gold coin can be turned into anything that is made of gold. Its elemental properties will remain for all time.

“Let’s see anyone do that with a BTC. Heck, turn the power or 5G connection off and you can’t even access your wallet or exchange.”

The 5: Hate to break it to you — and I’d characterize myself as a gold bug — but gold has no “intrinsic” value.

Gold’s value lies only in people’s perceptions of its value; the Austrian School economists were all over this with their “subjective theory of value.”

With nearly any physical object, perceptions of value change from time to time and place to place; gold happens to be a remarkable outlier, which is how one ounce of gold has bought a quality men’s suit consistently across centuries.

And one reason those perceptions of gold have been so stable is that while it’s relatively rare, gold does not have many uses beyond jewelry. Silver is a comparatively poor monetary metal because of its industrial uses, which are changeable; i.e., demand falling with the demise of analog photography and rebounding with wider adoption of solar panels.

Argue all you want about how Bitcoin differs from gold… but neither has any “intrinsic” value. And if the perception is that “Bitcoin is the new gold” — I’m not saying it is, that’s not how I’m investing personally, I’m saying if — then it is what it is.

Here’s a new wrinkle after we heard from several readers who’ve noticed the ATM spits out $50s instead of $20s nowadays: “Before Christmas I stopped by my bank and asked for some new $10s and $20s to stuff in tip jars for the holidays,” a reader writes.

Here’s a new wrinkle after we heard from several readers who’ve noticed the ATM spits out $50s instead of $20s nowadays: “Before Christmas I stopped by my bank and asked for some new $10s and $20s to stuff in tip jars for the holidays,” a reader writes.

“The teller informed me that they had no uncirculated bills, hadn’t received any for some time and had no idea when they might have some.

“Or maybe with that transient, imaginary inflation they were having problems keeping the ATMs full and so upped the denominations.”

“Do you have a percentage split as to how many people who complain about ‘political bias’ are lefties versus righties?” a reader inquires — this, after we fielded one of our occasional stick-to-the-markets complaints yesterday.

“Do you have a percentage split as to how many people who complain about ‘political bias’ are lefties versus righties?” a reader inquires — this, after we fielded one of our occasional stick-to-the-markets complaints yesterday.

“I am guessing 75% at least are lefties. They just cannot bear to have anyone think different from them without getting triggered and cue the ‘I did not subscribe to this kind of political BS’…

“Love The 5!”

The 5: Thanks. It goes back and forth. Time was we’d say something critical of Donald Trump and we’d get an earful from people who insisted Trump was the most awesomest president ever and why were we giving aid and comfort to the commie pinkos who hate everything that’s good and true?

But if we said something in passing about how Russiagate was a joke and maybe it’s not a good idea to demonize the only other nuclear superpower just to take down a political opponent… then we’d hear it from the other side.

Such is the life of an equal-opportunity offender…

Best regards,

Dave Gonigam

The 5 Min. Forecast