- An out-of-control global financial system (WROL)

- The London Metals Exchange saves “Big Shot’s” bacon

- “Russia has not stood still” in the face of sanctions

- Two media moguls, the SEC… and lucky timing?

- Canceling a 19th-century Russian composer (That’ll show Putin!)

- A reader on the odds of nuclear annihilation (Cuban Missile Crisis vs. 2022)… “Glad I watched Ukraine on Fire with Oliver Stone… before YouTube took it down”… And more!

We’re rapidly approaching a state of affairs in which the global financial system is operating “WROL” — according to this commodities-trading veteran who now manages money for wealthier folks…

We’re rapidly approaching a state of affairs in which the global financial system is operating “WROL” — according to this commodities-trading veteran who now manages money for wealthier folks…

“WROL” is short for “without rule of law.” In patriot/prepper lingo, it’s the twin of SHTF — which, uhhh, we assume you’re familiar with by now.

We discussed at length the freezing of Canadian truckers’ bank accounts last month.

And our own Jim Rickards has laid out in stark relief how freezing roughly 60% of Russia’s foreign exchange reserves is unprecedented. (More from Jim about how Russia can fight back a bit later in our 5 Mins.…)

But this nickel debacle at the London Metals Exchange we mentioned yesterday? It might strike you as obscure… but any more of this and the global financial system could completely seize up.

But this nickel debacle at the London Metals Exchange we mentioned yesterday? It might strike you as obscure… but any more of this and the global financial system could completely seize up.

Again, the backdrop: Nickel demand is zooming higher thanks to electric vehicles and other “green” initiatives. Russia produces about 10% of the world’s nickel supply. Amid the sanctions targeting Russia, nickel prices skyrocketed 250% in two days on the London Metals Exchange. The LME suspended nickel trading Tuesday; it won’t resume until next week.

Further backdrop: Many companies that produce raw materials hedge their considerable exposure to raw materials prices by short selling futures on an exchange like the LME. Most of the time, those hedges either pay off or register small losses. That’s what hedges are for, right?

But with such an extreme move in nickel this week, a small loss became a very big one for China’s nickel giant Tsingshan Holding Group, owned by the tycoon Xiang Guangda — or as he’s known in Chinese commodity circles, “Big Shot.”

Tsingshan quickly racked up $8 billion in trading losses — a sum far larger than the cash it had on hand to meet a margin call.

Rather than declare Tsingshan in default, the LME literally canceled some of the trades after they’d been executed — saving Big Shot’s bacon but totally hosing the brokers on the other side of those trades.

Rather than declare Tsingshan in default, the LME literally canceled some of the trades after they’d been executed — saving Big Shot’s bacon but totally hosing the brokers on the other side of those trades.

LME chief Matthew Chamberlain justified it like so: “We faced a choice between ensuring the overall and longer-term financial stability of the market, and the shorter-term trading profits of those participants who had traded on Tuesday morning.”

In other words, the sanctity of contracts had to be thrown under the bus to keep the whole system from blowing up. And that’s supposed to inspire confidence in the “overall and longer-term financial stability of the market”?

Back to where we began: Time and again we’re now witnessing events in which a government or a government-regulated exchange can tell you, “You know, that money you thought you had in your account there? Yeah, it’s a zero now. Why? Because we say so.”

And it’s amid this backdrop that our Jim Rickards says we’re on the cusp of a full-on financial crisis.

And it’s amid this backdrop that our Jim Rickards says we’re on the cusp of a full-on financial crisis.

Jim has detected a chart pattern with an uncanny history for accuracy. It showed up before the big stock market crash in 1987… before the dot-com bubble burst in 2000… and before the financial crisis we affectionately call the Panic of 2008.

And he’s convinced this chart pattern will begin to recur only days from now.

That’s why he’ll host an urgent briefing from just outside the White House this coming Monday. You’ll learn why it’s a near-certainty this chart pattern will start recurring next week. And he’ll lay out a trade that can protect your portfolio with the potential to 10X your money — absolutely FREE.

If you’ve never attended one of Jim’s briefings before, you can’t afford to miss this one. It’s set for this coming Monday at 2:00 p.m. EDT. Click here to reserve your spot.

Whether it’s the inflation numbers, the breakdown of Ukraine ceasefire talks or something else… the U.S. stock market is in retreat again.

Whether it’s the inflation numbers, the breakdown of Ukraine ceasefire talks or something else… the U.S. stock market is in retreat again.

The inflation numbers came in more or less as expected — up 7.9% year over year. That’s the highest since January 1982, when Burt Reynolds was the big box office draw with Sharky’s Machine and Olivia Newton-John topped the charts with “Physical.”

Some of the “internals” of this report are astonishing. We’re looking at month-over-month increases of 1.0% in food… 1.2% in personal care items… 1.2% in auto insurance… 1.9% in health insurance… and 5.2% in airfares.

Reminder: For the most part, these figures do not take into account the ramp-up in energy prices and the follow-through effects on everything else since Russia invaded Ukraine on the 24th of last month. That’ll show up in the numbers released next month.

The real-world inflation rate from Shadow Government Statistics — which runs the numbers the way the government did in Jimmy Carter’s day — is up to a record 16.1%.

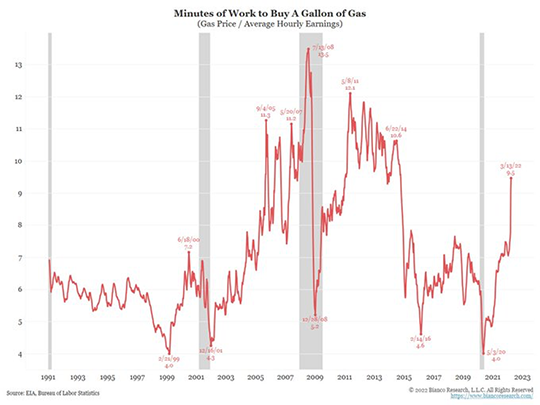

We mentioned on Monday that gasoline prices would have to reach $5.18 a gallon to equal the 2008 record if you adjust for inflation. Another way of looking at it is how many minutes of work it takes for a typical American to buy a gallon of gas — per a helpful chart from Bianco Research.

Americans were working longer for a gallon of gas during most of 2011, 2012 and 2013 — and by and large, they didn’t complain about it. Read into that what you will…

Anyway, at last check the Dow is down 1%, back below 33,000 — and the Nasdaq down 2%, back below 13,000. The S&P 500 splits the difference, down 1.3% at 4,221.

Anyway, at last check the Dow is down 1%, back below 33,000 — and the Nasdaq down 2%, back below 13,000. The S&P 500 splits the difference, down 1.3% at 4,221.

Alas, it’s not as if any other asset class is benefiting. Bonds are selling off, pushing yields higher — the 10-year Treasury note a hair below 2% again. Gold is stagnant at $1,995.

Cryptos are selling off in sympathy with tech stocks — Bitcoin well below $40,000 again and Ethereum approaching $2,600.

After yesterday’s monster sell-off, crude popped a bit today with the failure of the Ukraine ceasefire talks. As we write, a barrel of West Texas Intermediate fetches $109.59.

“Russia has not stood still” in response to unprecedented Western sanctions, says Jim Rickards.

“Russia has not stood still” in response to unprecedented Western sanctions, says Jim Rickards.

For starters, “the Central Bank of Russia imposed capital controls so that Russian companies cannot pay interest or principal on international debts. That means those loans and bonds may soon go into default. Many such securities may be stuffed into 401(k) plans of Americans under the umbrella of ‘emerging markets’ funds or ETFs.

“Even more important is the possibility that interbank eurodollar lending may start to dry up as Russian banks are frozen and Western banks reduce leverage and contract balance sheets in order to reduce risk.

“That type of activity can lead to a global liquidity crisis that can only be contained by Federal Reserve currency swap lines. Even that technique may not work since there are no swap arrangements in place between the Fed and the Central Bank of Russia.

“The financial war has just started and will continue after the shooting stops. For that matter, a global financial panic may emerge even before the shooting stops.”

[Ed. note: And totally separate from that panic is the likelihood of a severe market dislocation based on a chart pattern that preceded the stock-market bloodbaths of 1987, 2000 and 2008.

Again, Jim Rickards is all but certain this pattern will begin to recur next week. So he’s hosting an emergency summit from outside the White House this coming Monday at 2:00 p.m. EDT. Once more, you can register to attend online right here.]

Media mogul Barry Diller says he did nothing wrong betting on the video-game outfit Activision Blizzard… and we’re inclined to believe him.

Media mogul Barry Diller says he did nothing wrong betting on the video-game outfit Activision Blizzard… and we’re inclined to believe him.

The Justice Department and the SEC are looking into whether Diller and fellow media mogul David Geffen engaged in insider trading.

“Diller, Geffen and Diller’s stepson, Alex von Furstenberg, together made large bets on Activision stock in January,” says CNBC, “just days before that video game maker said it had agreed to be bought by Microsoft in a $68.7 billion deal.”

Specifically, the trio bought options to buy Activision stock at $40 on Jan. 14, when it traded about $63. Four days later, the deal was announced — which translated to an unrealized gain of about $60 million. “A lucky bet,” Diller tells The Wall Street Journal.

If you look at the figures in the last paragraph carefully, you’ll notice Diller and his compatriots bought in-the-money call options — where the stock price is higher than the call option’s strike price.

In-the-money calls are how the pros can leverage stock gains without taking undue risk. They’re not lottery tickets, like the crazy out-of-the-money calls that millennials buy on the Robinhood platform. If Diller really had inside info, he could have made way more playing out-of-the-money calls. Just sayin’…

In-the-money calls are key to the successful strategy we pursue in The Profit Wire — the options-trading service where I team up with Alan Knuckman, our resident veteran of the Chicago options pits. We’ll reopen membership in The Profit Wire later this spring. Stay tuned…

Stupid virtue signaling trick of the day — and we acknowledge upfront there’s no financial angle to this one, but still…

Stupid virtue signaling trick of the day — and we acknowledge upfront there’s no financial angle to this one, but still…

The Cardiff Philharmonic Orchestra in Wales has nixed plans for an all-Tchaikovsky concert, saying it would be “inappropriate at this time.”

Never mind Tchaikovsky lived during the time of the czars, dying in 1893. Or that, as one sensible person points out on social media, “He was gay, liberal and ultimately rejected Russian nationalism.”

But we figured this was coming sooner or later: After American entry into World War I, the Metropolitan Opera in New York banned all German and German-language composers. No Wagner, no Fidelio, no Mozart. That’ll show the Kaiser!

Still more reader reflections about the Cuban Missile Crisis and how the vibe of October 1962 compares with today…

Still more reader reflections about the Cuban Missile Crisis and how the vibe of October 1962 compares with today…

“Probably the biggest difference I see are the players,” a reader writes.

“During the CMC, we had relatively sane people (on both sides) pulling the strings. Now we have largely incoherent, much less predictable buffoons as the puppet masters.

“If Vegas is taking odds on whether this could spin out of control into a nuclear tornado, I would be tempted to put my money on the yeas rather than the nays. Scary and sad.”

The 5: Returning to our recurring theme of “wartime sacrifice”… and how it seems Western elites are more keen for sacrificial measures than the hoi polloi… we submit the following without comment.

“Boy, am I glad I watched Ukraine on Fire with Oliver Stone before YouTube took it down,” writes one of our semi-regulars. “Another victim of the Ministry of Truth.

“Boy, am I glad I watched Ukraine on Fire with Oliver Stone before YouTube took it down,” writes one of our semi-regulars. “Another victim of the Ministry of Truth.

“My husband was watching some CNN blowhard just this morning talking about the history of Ukraine. All I could do was shake my head in disgust as the guy oversimplified, contorted the facts and, of course, blamed the whole sh*tstorm on Trump. This could all have been avoided and Russia would have been perfectly OK with the prospect of Ukraine joining NATO if only someone other than Trump had been elected in 2016 (eye roll). Oy.

“Anyway, I know YouTube is currently the go-to platform for video posting, but people should really start thinking about using blockchain-based platforms — such as Hive — where your postings can’t be ‘taken down,’ you can’t be deplatformed and there’s no one for the government to threaten with regulation or other disincentives for ‘non-compliance.’”

“True, the learning curve is probably a lot higher than with YouTube and it will take a little time to steer viewers away from The Tube. All the more reason to get started NOW. Isn’t it worth the effort to thwart Big Brother?

“Love The 5!”

The 5: An intermediate step might be Rumble, the Canadian-based video hosting service that appears to have a rock-solid commitment to freedom of expression. Basically, Rumble is to video what Substack is to text.

Best regards,

Dave Gonigam

The 5 Min. Forecast

P.S. It has nothing to do with Russia-Ukraine… but it has the potential to destroy $42.4 trillion in wealth.

That’s Jim Rickards’ estimate of the damage that could be done by events that start next week.

Time and again, going back a century now, events just like these have tanked the stock market. Badly. Including just before the crash of 1987, the 2000 dot-com crash and the 2008 global financial crisis.

It’s urgent that you take protective measures… which is why Jim is hosting a live online event from outside the White House this coming Monday at 2:00 p.m. EDT. Secure your spot at this link.