- January job numbers: Less than meets the eye…

- … and MORE than meets the eye

- Over-55 workforce and bad news for Social Security

- (ZOMG!) Will the Fed keep tightening?

- A Big Tech triple threat (earnings)… Objections to Alaska’s Pebble Mine are “99% political”… No “b-word” for The 5… And more!

There’s less than meets the eye with the January job numbers.

There’s less than meets the eye with the January job numbers.

First, the numbers themselves…

- The wonks at the Bureau of Labor Statistics conjured 517,000 new jobs in January — way more than the “expert consensus” expecting 185,000

- The official unemployment rate dipped to 3.4% — lower than the 2019 lows and indeed the lowest since May 1969, before the first moon landing

- Hours worked grew. So did overtime. So did hourly wages (though, of course, not enough to keep up with inflation).

We’ll get to the market reaction soon enough — surprisingly sanguine by recent standards.

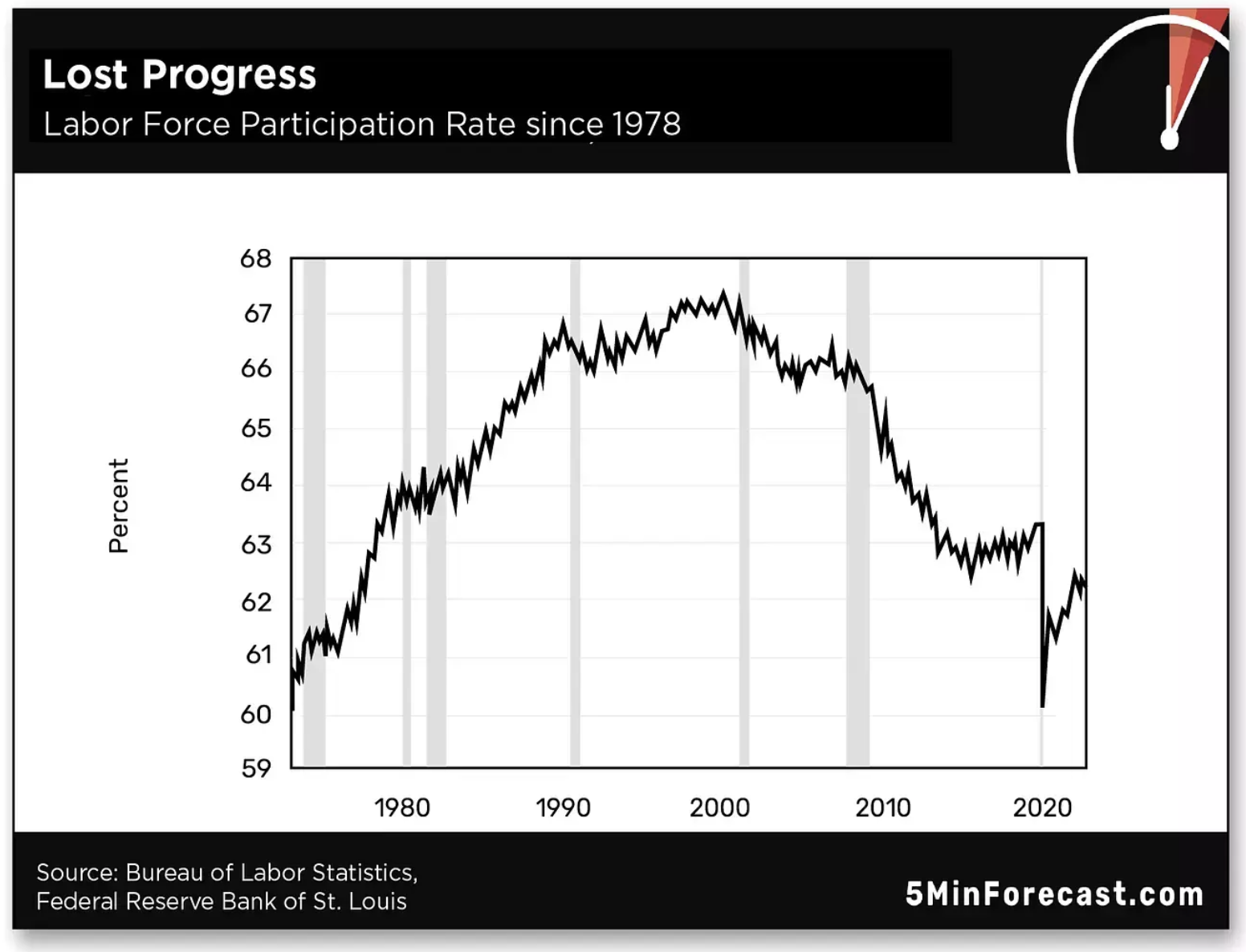

In the first place, the labor force participation rate — the percentage of Americans either working or looking for work — remains well below pre-pandemic levels.

In the first place, the labor force participation rate — the percentage of Americans either working or looking for work — remains well below pre-pandemic levels.

In fact… at 62.4%, this number is lower than it was in 1978, when women were still entering the labor force en masse.

When you drill down into the raw numbers among certain age brackets, a more interesting picture emerges.

When you drill down into the raw numbers among certain age brackets, a more interesting picture emerges.

Here’s the total number of Americans age 25–54 either working or looking for work.

A lot of volatility there. But notice a couple of things: It took over a decade for this number to recover from the 2007–09 financial crisis. And once it finally did recover in late 2019, it instantly got whomped by lockdowns. Still, it recovered to set record levels by last spring… and sits at yet another record this morning.

Now… you get a very different picture when you look at the over-55 set.

Now… you get a very different picture when you look at the over-55 set.

At the dawn of the 21st century, fewer than 20 million Americans over age 55 were either working or looking for work. The number rose relentlessly — more than doubling — until early 2020.

Notice how it didn’t even miss a beat after the calamity of 2008.

Some of that was your proverbial gray-haired fast-food worker desperately trying to make ends meet. But some of it was also better-educated higher earners who chose to keep earning and burning.

That’s all over now. It will be years before the size of the over-55 workforce returns to its pre-2020 trajectory — if it ever does. Which is bad news for Social Security.

That’s all over now. It will be years before the size of the over-55 workforce returns to its pre-2020 trajectory — if it ever does. Which is bad news for Social Security.

Back in 2005, about 54% of women and 50% of men opted to take Social Security at age 62 — even though that meant a lower monthly benefit than if they waited until full retirement age.

Those percentages fell steadily for more than a decade — down to only 31% of women and 27% of men by 2018. That’s a lot more people working longer and still contributing to the system.

Now those percentages are rising again. The most recent figures we see are from 2020 — which just starts to capture the swell of later-wave boomers opting for early retirement. The percentage of women taking Social Security at 62 is back up to 34%, and men 31%. It’s a safe bet they’ll continue rising.

You know those projections that the Social Security trust fund will be depleted by 2034, and then benefits would have to be cut at least 20%? In its latest projection issued last year, the Social Security trustees say, “At this time, there is no consensus among experts on the lasting effects of the COVID-19 pandemic. We currently assume that the pandemic will have no net effect on our long-range projections.”

Really? All those folks opting for early retirement aren’t going to put at least a short-term strain on the system? OK, boomer!

One more less-than-meets-the-eye take on the job numbers, and then we’ll move on to the markets.

One more less-than-meets-the-eye take on the job numbers, and then we’ll move on to the markets.

We still pay heed to the real-world unemployment rate issued by economist John Williams at Shadow Government Statistics. He runs the numbers the way the government did during the Carter administration — including part-timers who want to work full-time, and people who’ve dropped out of the labor force.

This alternate unemployment rate ticked up last month to 24.5%. By this measure, the job market is no better off now than it was a year ago. For perspective, the pre-pandemic high was 23.5% — notched in May 2014.

OK, so now the market reaction to the job figures.

OK, so now the market reaction to the job figures.

Yes, there was a knee-jerk sell-off on the open. That’s how it’s been for the last year — Mr. Market interpreting numbers like these not as WOW THE ECONOMY’S DOING GREAT — BUY! but rather as ZOMG THE FED WILL KEEP TIGHTENING — SELL!

But as we write, the major U.S. stock indexes are getting their bearings. The Dow is slightly in the green at 34,105. The S&P 500 is slightly in the red at 4,172 — still well above the 4,100 level that signaled a breakout earlier this week. And the Nasdaq is also barely in the red at 12,175.

Three of the Big Four tech stocks reported their numbers after the closing bell yesterday…

- Apple recorded its biggest drop in revenue since 2019. Cash-strapped shoppers have better things to do with their limited resources than buy the latest and greatest iPhone. Nonetheless, traders are scooping up AAPL shares, up 3.6% on the day

- Traders aren’t nearly as forgiving with Amazon — which warned its go-go growth days are over for now and even its cloud-computing business is no longer the cash cow it once was. AMZN is down nearly 5% at last check

- Google parent Alphabet reported its first drop in ad revenue since the onset of lockdown — and only the second drop since the company went public in 2004. GOOG is down about 1.75%.

These numbers have led to crepe-hanging headlines like “Lackluster Earnings Reports Show Big Tech’s Golden Age Is Fading” (Washington Post). But really, trees don’t grow to the sky. Apple successfully made the transition years ago from a go-go growth company to a mature dividend-paying stalwart.

Besides, too much of the growth in these companies’ share prices can be traced back to all the Federal Reserve funny money created since 2008. It’s healthy that they’re seeing something of a comeuppance now. (And for all the buzz about layoffs at Alphabet, Amazon and Microsoft, they still employ way more people now than they did pre-2020.)

The job numbers were a convenient excuse for the powers that be to absolutely crush the precious metals going into the weekend.

The job numbers were a convenient excuse for the powers that be to absolutely crush the precious metals going into the weekend.

After breaching $1,950 earlier this week, gold is down another $47 today — all the way back to $1,865. Silver is off more than a buck on the day to $22.36. That’ll leave a mark.

And crude is off nearly two bucks more, back below $74 for the first time in nearly four weeks.

Bonds are also selling off, pushing yields higher. After touching multimonth lows yesterday, the yield on a 10-year Treasury note is back above 3.5%.

Much as we’d rather not, we should probably suss out what the job numbers mean as far as Fed policy.

Much as we’d rather not, we should probably suss out what the job numbers mean as far as Fed policy.

Even before today, it was a lead-pipe cinch that the Fed will jack up the fed funds rate another quarter percentage-point at its next meeting on March 22 — to 5%. The only question is whether the Fed is done with its rate-raising cycle at that point… or if it does one more quarter-point jump on May 3.

The strong job numbers today make it more likely the Fed won’t be done until May. The trade in fed funds futures this morning suggests a 56% probability of that outcome.

The problem, as Jim Rickards wrote to his Countdown to Crisis readers yesterday, is that the Fed has probably jacked up interest rates more than enough already to throw the economy into a deep recession. Jobs are a lagging indicator, indeed one of the last things to roll over going into a recession.

A deep recession would not be good for the stock market — no matter how quickly the Fed “pivots” to looser monetary policy.

To the mailbag, and a reader’s reaction to the EPA blocking the big Pebble Mine copper-gold project in Alaska…

To the mailbag, and a reader’s reaction to the EPA blocking the big Pebble Mine copper-gold project in Alaska…

“Since the fishing and mining industries of Alaska coexisted for more than a century before the EPA existed, I think objections to the Pebble project are 99% political to appease the socialist Democrats’ radical environmental constituency.

“As an investor in gold miners large and small, I followed Pebble for a couple of years, but it seemed to be going nowhere. That was further guaranteed when the Obama administration shut it down without even allowing a full environmental review. This project is the mining equivalent of the Keystone Pipeline — It has a big liberal target on its back.”

The 5: It’s worth noting the Pebble decision comes on the heels of the Interior Department effectively nixing the Twin Metals copper-nickel project in Minnesota.

The Reuters newswire described the dilemma delicately: “The decision further escalates the U.S. tension over where and how to procure the minerals crucial for the green energy transition. Copper and nickel are used to build electric vehicles, solar panels, wind turbines and other renewable energy devices.”

Where indeed?

“The big problem,” as Paradigm metals-and-mining guru Byron King wrote last month, “is that many of the oldest copper mines in the world are aging out and moving to scale back or close.

“These range from deposits in the U.S., like Bingham Canyon, Utah (in operation since 1906), to a string of red metal plays up and down the spine of Chile. These great old deposits have served mankind well for many decades, but the geological facts are that the ore bodies are fading fast.”

“Great stuff,” a reader writes after yesterday’s edition, “and thanks for the link to your Jan. 20 missive. I missed that one, as it was right before car auction week here in Arizona.

“Great stuff,” a reader writes after yesterday’s edition, “and thanks for the link to your Jan. 20 missive. I missed that one, as it was right before car auction week here in Arizona.

“Interesting stuff on potential Google killers; here’s one that a good bud/work associate pointed out. I just punched in ‘auction week’ to Google, and it said 221 million results came up in 0.45 seconds. Now let’s see how far we can go with that inquiry…

“When I scroll down to the bottom of the page until it gets to ‘load more,’ one would think with 220 million-plus results you would be loading well into the following day. Lo and behold, the loading on this particular result stopped at Page 18. Try it with anything, and you will see the actual amount that you can see is a small fraction of what Google says is out there.

“Keep up the great work.

“P.S. I had to proof this before sending to make sure there would be no ‘b-word’ found.”

The 5: Yeah, one more example of how awful Google is anymore — except that everything else is worse.

At least Google is functional if — as I frequently do — you use it in a web browser with cookies disabled. ChatGPT, on the other hand, insists that you sign up for an account.

Which is surely generating gobs of trackable and saleable data. Makes their new subscription plan even more outrageous, no?

Have a good weekend,

Best regards,

Dave Gonigam

The 5 Min. Forecast