- Dispatch from the “Dawn” of the pandemic

- Three years after tyranny descended (we’re still processing)

- Remember COVID’s 9/11 vibe?

- Seventy seconds in March: Read the fine print

- What doomed SVB is a domino of events… A reader’s CBDC question that answers itself… And more!

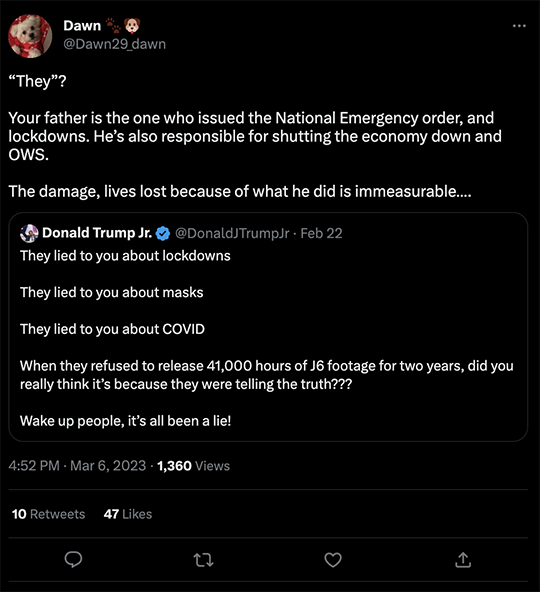

I have no idea who “Dawn” is, but did she ever give Donald Trump Jr. the roasting he deserved a few days ago.

I have no idea who “Dawn” is, but did she ever give Donald Trump Jr. the roasting he deserved a few days ago.

Sorry, Trumpers, the truth hurts. For all his preening and posturing and protestations — “Liberate Michigan,” my ass — it’s your guy who brought tyranny down on our heads starting three years ago this month. I’ll show you how in a few moments.

Fair warning: If you have any sort of conscience, this edition of The 5 will be hard to read. God knows it’s hard to write.

Three years after tyranny descended over the land, most of us still haven’t really processed it — perhaps because of the sheer speed with which everything happened.

Three years after tyranny descended over the land, most of us still haven’t really processed it — perhaps because of the sheer speed with which everything happened.

How fast was it? Here’s New York’s mayor at the time, tweeting Monday March 2.

Two Mondays later, the 16th, he ordered the closing of night clubs, movie theaters and concert venues. All gatherings of more than 50 people were banned. Restaurants were limited to takeout and delivery. Oh, and gyms were to close at 8:00 that evening — just enough time for the mayor to squeeze in one last workout.

The Monday in between, the ninth, things still seemed mostly normal. The CDC was telling universities to consider postponing or canceling student international travel programs. Florida’s health department was advising anyone who’d traveled internationally to “self-isolate” for 14 days upon their return.

Notice the voluntary nature of everything at this stage.

Most of us probably brushed off — I know I did — the Italian prime minister’s decree that same day, locking down the whole damn country as if it were, well, communist China.

Wednesday, March 11 was, for all intents and purposes, COVID 9/11.

Wednesday, March 11 was, for all intents and purposes, COVID 9/11.

I didn’t really think of it in 9/11 terms, but many finance pros did — certainly if they were in New York, where the number of “cases” was mushrooming.

“Then, as now,” wrote Josh Brown of Ritholtz Wealth Management that day, “the life-and-death issues of the moment overrode concerns about market volatility, although the volatility became expected each morning when we opened our eyes and went to work… Then, as now, there were questions about the U.S. government’s response, the Federal Reserve’s role in shoring up the economy, what Congress would pass in terms of fiscal stimulus and, of course, the rumors, fears and theories about subsequent attacks.”

Talking it over with my wife that evening, I mentioned Brown’s observations. “I was thinking now feels a lot like then, too,” she said. My perception was still different.

Then… in the space of an hour before bedtime… Trump banned incoming flights from Europe, the NBA suspended its season and Tom Hanks made it public that he and his wife had tested positive.

“Yeah,” I told her, “now it’s got the 9/11 vibe.”

The tyranny was starting to come into view the next day, Thursday the 12th — as the word “nonessential” was introduced into general usage.

The tyranny was starting to come into view the next day, Thursday the 12th — as the word “nonessential” was introduced into general usage.

California Gov. Gavin Newsom banned “nonessential” gatherings of more than 250 people. Gov. Mike DeWine in Ohio, not yet hip to the nomenclature, banned “mass” gatherings of 100 or more.

The day after that was Friday the 13th… and Donald Trump declared a national emergency. It didn’t seem like a big deal. Such declarations typically open the spigot of federal aid to the states. If anything, it seemed as if freedom would be expanded a bit as the declaration made it easier for doctors to engage in telehealth visits with out-of-state patients.

Even as late as Sunday the 15th, Washington, D.C., still emphasized the voluntary aspect: Guidance from the CDC recommended canceling or postponing in-person events of 50 or more people nationwide for the next eight weeks.

Monday March 16 was the day Trump unleashed the control freaks and power trippers — not that he was paying attention.

Monday March 16 was the day Trump unleashed the control freaks and power trippers — not that he was paying attention.

“Seventy seconds that shook the world,” is how our former colleague Jeffrey Tucker described it last fall in an article for the Brownstone Institute.

Trump was joined at a White House press event by Anthony Fauci and Deborah Birx. Reporters were handed a two-page flier from the CDC that, as Mr. Tucker wrote, “mostly consisted of conventional health advice.”

But at the very bottom of the second page, in that small print, it said, “In states with evidence of community transmission, bars, restaurants, food courts, gyms and other indoor and outdoor venues where groups of people congregate should be closed.”

Freedom of association, freedom of movement, freedom of commerce, freedom of worship — all of it obliterated in one fell swoop by edict of the “public health” clerisy.

Freedom of association, freedom of movement, freedom of commerce, freedom of worship — all of it obliterated in one fell swoop by edict of the “public health” clerisy.

And the subject didn’t even come up in the opening remarks by Trump and Fauci and Birx — only in the Q&A later: Are people supposed to “avoid restaurants and bars,” a reporter asked, or is the government saying “bars and restaurants should shut down over the next 15 days”?

Trump deferred to Fauci who deferred to Birx, who dodged the question. Fauci ends up reading the fine print aloud.

Jeffrey Tucker picks up the story from here: “As he reads, Birx herself is smiling from ear to ear, as if the words were poetry to her. It was not an unfamiliar text. She had been working on these words the entire weekend. Finally all her work had come to fruition.”

“What was Donald Trump doing during this time? He got distracted by someone in the audience who got his attention. He smiles and points a finger. One wonders who and why.”

“Was someone assigned to do the job of distracting him? One cannot rule it out. This was the most significant moment of all. The big reveal had come. And Trump’s attention was clearly elsewhere. To whom was he pointing and smiling?”

Once Trump returned to the lectern, he was oblivious to what just went down…

Reporter: So Mr. President, are you telling governors in those states then to close all their restaurants and their bars?

Trump: Well, we haven’t said that yet.

Reporter: Why not?

Trump: We’re recommending but…

Reporter: But if you think this would work.

Trump: … we’re recommending things. No, we haven’t gone to that step yet. That could happen, but we haven’t gone there yet.

Oh yes they did. Or, circling back where we started today, “they.”

“Everything followed from that brief moment,” Mr. Tucker concludes: “lockdown chaos, the closed schools and churches, the end of basic rights, the wrecking of business, and then began the spending, inflating, mad welfare checks and the demoralization of the population that continues to this day.”

“Everything followed from that brief moment,” Mr. Tucker concludes: “lockdown chaos, the closed schools and churches, the end of basic rights, the wrecking of business, and then began the spending, inflating, mad welfare checks and the demoralization of the population that continues to this day.”

Oh, and the censorship — as we’re learning from the Twitter Files, discussed here most recently just yesterday. Yes, the censorship had been underway in earnest since 2017, but the virus was a convenient pretext to amp it up to staggering new levels.

The stock market is on track to end the week surrendering all the gains it notched going back to Jan. 20.

The stock market is on track to end the week surrendering all the gains it notched going back to Jan. 20.

After we went to virtual press yesterday, the bottom fell out. Some of it was the usual jitters over Fed policy; much of it was a meltdown in bank stocks after SVB Financial Group (SIVB) disclosed it had to unload some of its assets at fire-sale prices — and needed to raise $2.25 billion by selling new shares.

Maybe you’ve never heard of SVB, but it’s the parent firm of Silicon Valley Bank — a top 20 U.S. bank measured by assets and a critical source of additional financing for companies launched by venture capital. Last year alone, SVB had a hand in nearly half of all VC-backed tech and biotech firms listed on the stock market.

SVB shares ended yesterday down 60% and the spillover effect on other banks was palpable: The KBW Bank Index took a 7.7% spill. JPMorgan Chase tumbled 5.4%. The S&P 500 ended the day down 1.8%.

This morning, trading was halted in SVB after the firm announced it would scrap those plans to issue new shares and would instead look for a buyer. As midday approached, California regulators stepped in to shut the joint down; the FDIC promises to protect insured deposits.

What doomed SVB is a domino of events…

What doomed SVB is a domino of events…

- The Federal Reserve, as you know, has been raising interest rates

- Rising rates hurt the value of the bonds held by banks (remember rising interest rates translate to falling bond prices)

- As long as banks don’t have to sell those bonds, it’s all good: It’s just paper losses and if the bank holds those bonds to maturity, it gets back the full value of the bonds

- But if the bank does have to sell to raise cash for some reason, it’s then forced to unload those bonds at potentially fire-sale prices

- “Some reason” can be a sudden rush of deposits out the door. That’s happening at a lot of banks now: Why hold your money in a bank for a pittance of interest when Treasury bills pay you 5% or more?

Unfortunately, the bulk of SVB’s liabilities are deposits — 89% as of year-end 2022. That’s much higher than at other banks — i.e., 69% at Bank of America.

And deposits were indeed rushing out the door for most of the last 12 months “in part because of [SVB’s] concentration in investor-funded technology company deposits and the slowdown in public and private investments over the past year.” That’s according to credit analysts at S&P — who downgraded SVB’s debt rating to BBB-, one notch above junk.

Turns out their assessment was too cautious, no?

And so the major U.S. indexes are adding to yesterday’s losses.

And so the major U.S. indexes are adding to yesterday’s losses.

At last check, the S&P 500 is down a quarter-percent at 3,908. The KBW Bank Index is down another 1.75%. JPM, however, is rebounding big-time — up over 2.5%.

- Not helping matters are the February job numbers: The wonks at the Bureau of Labor Statistics conjured 311,000 new jobs for February — considerably more than expected. The official unemployment rate ticked up from 3.4% to 3.6% as many folks who’d been out of the labor force for a while started looking for work again.But the numbers don’t materially change Wall Street’s calculus for Federal Reserve policy: Since Wednesday, the consensus has been that the Fed will raise short-term rates a half percentage point on the 22nd of this month.

Hot money is seeking safety in Treasuries, pushing rates lower: The yield on a 10-year T-note is down to 3.75%, the lowest in nearly a month. Precious metals are also rallying, gold up $27 to $1,858 and silver at $20.50. Crude is up 77 cents to $76.49.

Alas, Bitcoin has broken below that danger zone we’ve been describing for the last week, now under $20,000. Ethereum has also sold off hard to $1,420.

A knock-on effect of SVB? Maybe. “I still hold that Bitcoin, at least for now, is a tech play,” colleague Sean Ring writes in our sister e-letter, The Rude Awakening. “It’s too correlated to the general market to be considered a store of value.”

“One question I have that nobody seems to be addressing about the new Biden Bucks,” a reader writes, “is if they are programmable why in the world would any foreign country want to use them to settle international transactions knowing they could be made worthless with the push of a button?

“One question I have that nobody seems to be addressing about the new Biden Bucks,” a reader writes, “is if they are programmable why in the world would any foreign country want to use them to settle international transactions knowing they could be made worthless with the push of a button?

“Since the U.S. government seems hell-bent on weaponizing everything at their disposal the next logical thing would be the CBDC once it’s online. Perhaps one of your experts can explain why this wouldn’t lead to the death of the dollar?”

The 5: Your question answers itself. Foreigners are already fleeing the dollar — or at least they’re no longer nearly as interested in buying U.S. Treasury debt. Not after Washington froze Russia’s central bank reserves and sanctioned Russian oligarchs.

“If you’re Chinese, if you’re Saudi, if you’re from Brunei, Bahrain or Qatar, you might not feel as secure owning U.S. Treasuries as you did before,” says the renowned Louis-Vincent Gave of Gavekal Research.

Mr. Gave explains it like this to our old acquaintance Erik Townsend, host of the MacroVoices podcast: “Where all the excess savings in the world are accumulating right now is basically China and oil producers. Those are the guys that are running huge current-account surpluses, and more often than not fiscal surpluses as well.

“So those are the guys that technically would have the ability to buy more U.S. Treasuries. And you know, aside from Norway we’ve told all these guys, ‘Your money’s no good here.’ We’ve told these guys, ‘Your money might be good here this week but next week we might change our mind.’ Or next month, or next year, we might decide, ‘You’re Chinese, your leader’s a jerk, so we’re just gonna take your stuff.’ And that’s not a very attractive proposition.”

In that context, launching a CBDC would just be bowing to the inevitable…