- Tales from a late-stage degenerate empire

- Proof that venture capitalists are “more equal” than Farmer Bob

- Banksters expand their “window” of tolerance

- Jim Rickards: Exactly as he scripted

- Precious metals and crypto (Inflation ahead!)… St. Patrick’s Day: Feast or fast?… “Dutch Build Back Better”… And more!

Looking back upon the events of the last 24 hours, it’s hard to escape the conclusion we’re living in a late-stage degenerate empire.

Looking back upon the events of the last 24 hours, it’s hard to escape the conclusion we’re living in a late-stage degenerate empire.

“Europe’s financial regulators are furious at the handling of the Silicon Valley Bank collapse,” says the Financial Times, “privately accusing U.S. authorities of tearing up a rule book for failed banks that they had helped to write.

“One senior eurozone official described their shock at the ‘total and utter incompetence’ of U.S. authorities, particularly after a decade and a half of ‘long and boring meetings’ with Americans advocating an end to bailouts.”

The understanding coming out of those “long and boring meetings” was that in the post-2008 world, customer deposits over the standard insurance limits would not be protected.

The understanding coming out of those “long and boring meetings” was that in the post-2008 world, customer deposits over the standard insurance limits would not be protected.

In the United States, the FDIC insurance limit is $250,000. In most European Union countries it’s a more conservative €100,000 — about $106,000 at today’s exchange rate.

But then along comes the SVB blowup, and the American authorities decide on the fly to cover those over-$250K deposits anyway — invoking a “systemic risk exception” for SVB. In other words, they gave SVB the same too-big-to-fail treatment they’d give to the likes of Citi or Bank of America.

So much for the “rules-based international order” with America in the position of “the indispensable nation,” huh?

“At the end of the day,” an anonymous European regulator tells the FT, “this is a bailout paid for by the ordinary people and it’s a bailout of the rich venture capitalists, which is really wrong.”

And at the end of the day, it’s also clear the rich venture capitalists connected to SVB are “more equal” than small-business customers at community banks.

And at the end of the day, it’s also clear the rich venture capitalists connected to SVB are “more equal” than small-business customers at community banks.

There was a remarkable exchange on Capitol Hill yesterday between Treasury Secretary Janet Yellen and Sen. James Lankford (R-Oklahoma).

The quotations in this tweet aren’t exact — and they don’t capture Yellen’s long awkward pauses — but they convey the gist…

Only yesterday, I wrote: “Really, they can’t very well bail out tech companies like Roku (which held $487 million in cash at SVB) while leaving Farmer Bob high and dry in a future crisis, right? Or maybe they would.”

Now we know. Hell yes, they would.

Meanwhile, “Emergency loans to banks spiked to a new record in the week through Wednesday, surpassing previous highs reached during the 2008 financial crisis,” says the Axios website.

Meanwhile, “Emergency loans to banks spiked to a new record in the week through Wednesday, surpassing previous highs reached during the 2008 financial crisis,” says the Axios website.

“As of Wednesday, banks had $153 billion in loans at the ‘discount window,’ a long-standing tool through which the Fed provides cash to banks in need of liquidity by lending against solid collateral.” The 2008 record was $111 billion.

In a separate article, Bloomberg reminds us the discount window “is often seen to carry a stigma and has historically involved banks taking a haircut on the amount borrowed relative to collateral.”

But when “everyone else is doing it,” there’s no stigma, right?

Between the discount window and the new Bank Term Funding Program, analysts at JPMorgan Chase figure the Fed will “inject” as much as $2 trillion of new money into the financial system.

And so we circle back to the dilemma we’ve mentioned more than once this week: The Fed is now in the worst of all worlds — wrestling with a new financial crisis before inflation is back under control.

Stated a different way, the dilemma is this: Does the Fed let the banksters suffer the consequences of their own stupidity… or does the Fed throw up its hands and let inflation rip?

Stated a different way, the dilemma is this: Does the Fed let the banksters suffer the consequences of their own stupidity… or does the Fed throw up its hands and let inflation rip?

Of course, the question answers itself. The Fed always has the banksters’ back.

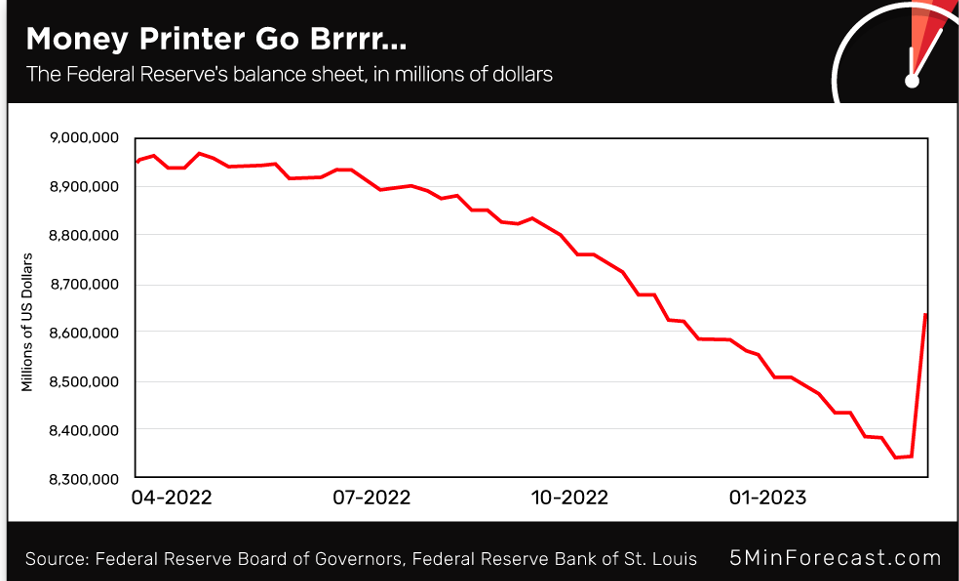

But for confirmation, look no further than a chart of the Fed’s balance sheet.

In addition to raising short-term interest rates, reducing the balance sheet — selling Treasuries and mortgage-backed securities — has been key to the Fed’s inflation-fighting efforts over the last year. The technical term is “QT” or quantitative tightening.

Whelp, we’re back to “QE” or quantitative easing now — just like 2008 and 2020.

Here’s an updated version of the Fed balance-sheet chart we ran on Tuesday: In just the last week, the Fed’s emergency measures have wiped out nearly half of the Fed’s QT efforts of the previous 51 weeks.

The one-week spike even shows up on this chart going back 20 years!

How high will the Fed balloon its balance sheet this time?

We don’t know — no one does — but we can start to tease out the repercussions.

In fact, Jim Rickards’ 2023 forecast — published here on Jan. 6 — is starting to play out exactly as he scripted it. “The Fed will probably have to cut rates by June,” he said.

In fact, Jim Rickards’ 2023 forecast — published here on Jan. 6 — is starting to play out exactly as he scripted it. “The Fed will probably have to cut rates by June,” he said.

Jerome Powell and co. probably won’t cut next Wednesday and they might even do one more teensy quarter-point increase to make it look as if they still care about containing inflation. Then they’ll pause at their next meeting in May and start cutting in June.

“The reason for the pause and early cuts,” Jim continued, “will be that the Fed has thrown the economy into a severe recession.”

Yes. Not only is the Fed contending with a financial crisis, it’s also contending with an economy that’s slowing dramatically.

Here, we revisit one of the economic numbers we mentioned yesterday — the Philadelphia Fed Manufacturing Index, which is now deep in contraction territory below zero. Renowned economist David Rosenberg shares a chart with some history…

OK, “Rosie” has a reputation as a perma-bear. But the numbers going back more than 50 years don’t lie.

And the most important thing from Jim’s Jan. 6 forecast: The stock market will not celebrate a return to Fed money-printing. That’s because “a sharp recession is disastrous for stocks.

And the most important thing from Jim’s Jan. 6 forecast: The stock market will not celebrate a return to Fed money-printing. That’s because “a sharp recession is disastrous for stocks.

“Stock markets could fall 30% or more from current levels,” he said. Again, this was on Jan. 6. The market is a bit higher now than it was then. So we’re looking at a drop potentially steeper than 30%.

Jim calls it “the last drop” — on top of all the drops going back to the start of 2022. To help you prepare, he’s convening his next live online briefing called The Last Drop Summit.

This one is set for Monday at 2:00 p.m. EDT. There, Jim will lay out everything you need to know, and every action you need to take, in advance of the Fed’s next big move — which is set for 48 hours later.

As always, the event is free. Enter your email at this link, and you’ll be registered immediately. You’ll also get access to Jim’s up-to-the-minute research via a special drop box website. One more time, here’s where to register.

For all the drama of the last five days… the U.S. stock market is still set to end the week in the green.

For all the drama of the last five days… the U.S. stock market is still set to end the week in the green.

To be sure, the major indexes are all in the red on the day. The Nasdaq is holding up best, down about three-quarters of a percent at 11,633. The S&P 500 is off about 1% to 3,922. And the Dow is down just over 1% at 31,898.

Some of that might be a function of the ongoing drama with San Francisco-based First Republic Bank (FRC). Yesterday the Treasury and the Fed knocked heads with the leaders of 11 banks to engineer a $30 billion rescue of FRC. But then First Republic management killed the buzz this morning when they announced they’re suspending the dividend — which would seem to suggest FRC still isn’t out of the woods, no?

Treasury yields are inching down, the 10-year T-note now 3.43%.

The big economic number of the day is industrial production — which came in flat for February in contrast with expectations for a 0.4% jump. All told 78.0% of America’s industrial capacity was in use last month — down from a peak of 80.2% last April.

Precious metals and crypto are both screaming “inflation ahead” as the week winds down.

Precious metals and crypto are both screaming “inflation ahead” as the week winds down.

At last check, gold has roared up nearly $44 to $1,963. And silver’s up 56 cents to $22.23.

Looking at the chart action, Paradigm trading authority Alan Knuckman says the level to watch now is gold at $1,975. If it can punch through there, a breakout move to record highs of $2,150 is in view.

Alan also points out it’s especially promising that gold has made its big move recently without a meaningful drop in the U.S. dollar index. He also reminds us that gold’s 1980 high, adjusted for inflation, is $3,600. Hold on tight…

Meanwhile, Bitcoin has soared to $26,615, the highest level since last June. (FTX collapse? What FTX collapse?)

In addition to inflation expectations, Bitcoin has another tailwind: This week, Fidelity quietly added Bitcoin and Ether trading to all its platforms for retail investors…

Ethereum’s rally this week hasn’t been as strong, but it’s back over $1,700.

We don’t envy folks in the restaurant business today: How much fish do they keep on hand versus how much corned beef?

We don’t envy folks in the restaurant business today: How much fish do they keep on hand versus how much corned beef?

St. Patrick’s Day always falls during Lent. But this year is the first year since 2017 — and only the third time since 2000 — that it’s fallen on a Friday.

What’s an observant Roman Catholic to do? “You cannot feast and fast at the same time,” points out C.J. Doyle of the Catholic Action League of Massachusetts.

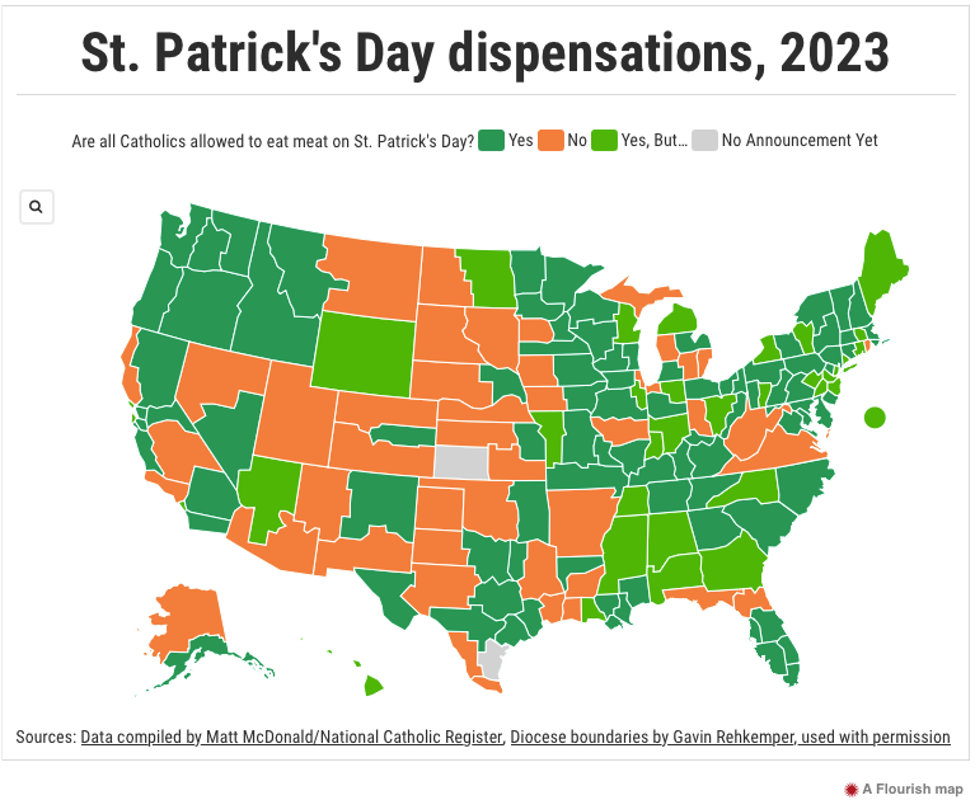

In the United States, it’s up to the bishops in each of the 176 Latin-rite territorial dioceses whether to grant a dispensation allowing meat-eating on St. Patrick’s Day.

The National Catholic Register sent inquiries to all of them. As of yesterday, all but two furnished a response. We reproduce the NCR’s resulting map verbatim…

Out of the 176 diocesan bishops, the NCR reports 93 are offering dispensation with no strings attached… while 34 more are “requiring a substitute through what canon law calls a ‘commutation’ of the requirement, such as attending Mass on St. Patrick’s Day, saying the Breastplate of St. Patrick, praying the rosary, abstaining from meat another day or helping the poor.”

Even some of the 46 “nos” come with a “backdoor,” says the NCR. In a handful of dioceses, individual pastors are authorized to grant dispensation… and in at least two, “people who belong to parishes named St. Patrick are allowed to eat meat because for them it is a solemnity.”

Restaurateurs, take note.

“Too bad that you don’t check your sources. The true farmer’s organization(s) did not win in the Dutch election,” writes a reader from Germany.

“Too bad that you don’t check your sources. The true farmer’s organization(s) did not win in the Dutch election,” writes a reader from Germany.

“The MSM in Netherlands made sure the WEF-backed BBB [BoerBurgerBeweging or Farmer-Citizen Movement] got the votes/seats. Result, now the WEF Netherlands government can steal the land from several thousand Dutch farmers for their Mega Tristate City and begin to starve the people or at least ensure prices will start going through the roof.

“The BBB, or as I refer to them the Dutch Build Back Better, is 100% WEF infiltrated. I highly recommend watching this link to be better informed of what is going on in the Netherlands.”

The 5: So there was a stalking-horse party, sounds like.

We’re usually able to sift the noise from the real news stateside, but not always elsewhere in the world. Thank you for the emendation.

“Please, please stop using fraught if you can’t use it correctly,” a reader scolds. “By itself, it’s meaningless.

“Please, please stop using fraught if you can’t use it correctly,” a reader scolds. “By itself, it’s meaningless.

“I know dictionaries call it an adjective, but it works more like a preposition, e.g., fraught with danger, fraught with suspense, fraught with emotion. Don’t follow what major media types do because most of what they do in journalism today is wrong.”

The 5: Duly noted. Indeed, the newer usage does not appear in my 1985 American Heritage Dictionary.

But I reserve the right to make the same “mistake” again. Language is, for better or worse, a forever-evolving thing. As the late James J. Kilpatrick wrote in his 1984 book The Writer’s Art, “In 1973 Harper & Row produced the first Barnhart Dictionary of New English. It contained 5,000 new words (or new usages of old words) that were not then contained in standard dictionaries.

“The editors had planned to wait 10 years before a second edition. The language couldn’t wait. In 1980, three years ahead of schedule, out came the second Barnhart — and it contained another 5,000 words or usages that had arrived in the meanwhile.”

And that was in pre-internet times!

Try to have a good weekend,

Dave Gonigam

The 5 Min. Forecast