- The least certain Fed announcement in years…

- …but no matter what happens, “the last drop” is coming

- The bumpy path to $3,000 gold (the Fed will help)

- Crypto busts out, leaves tech stocks behind

- EVs, AM radio and SHTF scenarios

We’re coming to you much earlier than usual today… because you need to be ready for whatever shoe drops from the Federal Reserve at 2:00 p.m. EDT.

We’re coming to you much earlier than usual today… because you need to be ready for whatever shoe drops from the Federal Reserve at 2:00 p.m. EDT.

As noted here yesterday, there’s an immense amount of uncertainty about what the Fed will do. This is highly unusual by recent standards. Usually, the Fed telegraphs its intentions well in advance — often through its favorite conduit for authorized leaks, Nick Timiraos of The Wall Street Journal.

But even Timiraos is noncommittal. Raise the fed funds rate another quarter percentage point (to tamp down inflation)? Or leave the rate where it is (to help the shaky banks)? We don’t know.

No matter what happens, however, Paradigm macro maven Jim Rickards says the stage is set for the final washout phase of the 2022–23 bear market — “the last drop,” as he puts it.

“The case for a 0.25% rate hike rests on the fact that inflation is still too high,” Jim wrote yesterday to his Countdown to Crisis readers… and that’s what Jim figures the Fed will do.

“The case for a 0.25% rate hike rests on the fact that inflation is still too high,” Jim wrote yesterday to his Countdown to Crisis readers… and that’s what Jim figures the Fed will do.

“Economic indicators that the Fed watches have been running hot since early February. Inflation rose slightly in January and February after declining steadily from July to December 2022. Job creation was huge in January and strong again in February. The unemployment rate is the lowest since the 1960s. Retail sales have remained strong.

“All of these factors lean heavily in the direction of more inflation and a rate hike.”

In addition, Powell is mindful of the experience of Fed chair Paul Volcker in 1980: Volcker’s steep interest-rate increases were working and inflation was starting to ease… but then the economy slipped into recession, Volcker backed off and inflation started roaring again. Volcker had to resort to shock therapy, resulting in the deep recession of 1981–82.

“Volcker could have achieved his inflation goals with far less economic damage,” says Jim, “if he had stuck to his rate hike plan in 1980.” And Powell knows this history up and down.

At the same time, with banks under stress, “the case for a pause is also strong and cannot be discounted,” Jim says.

At the same time, with banks under stress, “the case for a pause is also strong and cannot be discounted,” Jim says.

Between the banks hitting the discount window and availing themselves of the Fed’s new Bank Term Funding Program… the Fed has resumed massive money-printing.

“Depending on how many banks take up this offer from the Fed,” says Jim, “it may be necessary to print $3 trillion of new money to cover the losses and stabilize the system.”

Under that circumstance, “many experts believe it would be reckless for Powell to raise rates. The financial crisis itself is a form of monetary tightening because banks are reducing their balance sheets and restricting new credit. Also, as the crisis grows worse, the economy will slow on its own, bringing down inflation.”

Conclusion: “In truth, the Fed has no good options,” Jim says.

Conclusion: “In truth, the Fed has no good options,” Jim says.

“If the Fed raises rates it will work against inflation, but it could make the banking crisis worse. If the Fed pauses, the banking crisis may abate but inflation will come back with a vengeance.

“The implications for investors could not be greater. A Fed rate hike could sink stocks (especially bank stocks) beginning [this] afternoon. A Fed rate pause would trigger a stock rally also beginning [this] afternoon in anticipation of rate cuts in the near future.”

But as Jim sees it, that rally won’t last. A recession is already baked into the cake… so no matter how quickly the Fed cuts rates and prints money, “a sharp recession is disastrous for stocks.”

That’s why he calls what’s coming “the last drop”… and why he’s urging readers to take a specific set of steps no matter what the Fed decides this afternoon.

If you haven’t seen Jim’s Last Drop Summit since it went “live” on Monday afternoon… time’s a-wasting. Give it a look right here, right now, before the Fed makes its move in less than five hours.

Gold’s latest beat-down yesterday is just one more buying opportunity on the way to $3,000, says Paradigm retirement specialist Zach Scheidt.

Gold’s latest beat-down yesterday is just one more buying opportunity on the way to $3,000, says Paradigm retirement specialist Zach Scheidt.

After flirting with $2,000 early Monday morning, the Midas metal closed yesterday at $1,940.

“Regardless of what the Fed does this week,” says Zach, “investors expect the Fed will be forced to cut rates — possibly several times — by the end of the year.

“Low interest rates tend to pressure the value of the U.S. dollar. Basically, when international investors get less of a return on dollars, they’re more likely to pull their money and invest it elsewhere.

“Capital moving out of the dollar will naturally act as a tailwind for gold.

“Meanwhile, if inflation comes back like when the Fed stopped hiking rates in the 1970s, investors would scramble to protect the value of their wealth. And gold is the best way to do this!

“Bottom line: I expect gold to resume its sharp rise this year.”

But yes, there will be volatility along the way — as we’ve seen this week. How do you cope?

But yes, there will be volatility along the way — as we’ve seen this week. How do you cope?

“You’ll want to add to your gold position on any pullback. And you might also consider taking some profits off the table when we get a surge like the one we had last week.

“For my family’s money, I’ve been buying in-the-money call option contracts on the SPDR Gold Trust (GLD). I like this approach because call option contracts let me book larger profits while committing less capital.

“And when GLD trades higher, I can sell the call contracts I have for a profit and use a portion of that profit to buy new contracts with a higher strike price. This is a great way to lock in profits while still keeping my position in play.”

Zach is promising his readers much more detail about this aggressive strategy in the weeks ahead. “I’m working on a project behind the scenes with my team. Once we’re done putting on the finishing touches, I’ll have some exciting news to share with you.”

Something fascinating is happening in the crypto space: At roughly $28,000, Bitcoin is no longer trading in tandem with tech stocks.

Something fascinating is happening in the crypto space: At roughly $28,000, Bitcoin is no longer trading in tandem with tech stocks.

“I’ve long argued that Bitcoin is a tech trade,” old friend Greg Guenthner writes in Paradigm’s recently launched Morning Reckoning e-letter.

“If it walks like a tech stock and talks like a tech stock, it’s a tech stock! Crypto behaved exactly like the tech growth stocks during last year’s meltdown — and it rallied with them in January.”

But no longer: “Bitcoin is hitting nine-month highs, while tech growth names are still stuck in neutral following their sharp January rallies.

“The Bitcoin faithful believe crypto is rallying because it’s a safe haven during the current bank turmoil. I’m not so sure. After all, this base breakout has been brewing since before we got the first whiff of Silicon Valley Bank going down in flames. Perhaps the recent turmoil is a good excuse for some buying here — but I don’t believe it’s the full story.

“Even so, we should continue to watch this relationship develop to see if we truly get a decoupling. So far, Bitcoin has built a formidable lead, with the tech-growth stocks in Cathie Wood’s Ark Innovation ETF (ARKK) falling woefully behind over the past couple weeks.

“Will Bitcoin drag its former bull market cousins back onto their feet? We’ll know soon enough.”

Tying up loose ends from yesterday: The typical price of an existing home just registered its first year-over-year drop for the first time since 2012.

Tying up loose ends from yesterday: The typical price of an existing home just registered its first year-over-year drop for the first time since 2012.

Yes, the drop is a paltry 0.2%… but it’s a start. The National Association of Realtors says the median price of an already-existing home is now $363,000. (Still five times median household income — gaah!)

Lower-priced homes are getting multiple offers, while higher-priced homes stay on the market longer. Inventory is tight at 2.6 months’ worth… but that’s better than 1.7 months a year earlier.

Problems you hadn’t started to think about yet: Makers of electric vehicles are increasingly ditching an automotive accessory that’s come standard for decades — an AM radio.

Problems you hadn’t started to think about yet: Makers of electric vehicles are increasingly ditching an automotive accessory that’s come standard for decades — an AM radio.

“Car companies say the motors on such vehicles generate electromagnetic frequencies on the same wavelength as AM radio signals,” explains The Wall Street Journal, “creating buzzing and signal fading from the interference.”

And it’s not just EVs: Ford is dropping the AM radio from next year’s edition of the gasoline-powered Mustang.

So what? you might say. We’ve got smartphones to stream all our audio entertainment now, and map apps to show us traffic jams. Even FM radio feels more and more like a relic.

The problem is that “AM radio is one of the critical ways that federal, state and local officials communicate with the public during natural disasters and other emergencies,” reports the Axios website. “If drivers don’t have access, they might miss important safety alerts.”

No fewer than seven former administrators of the Federal Emergency Management Agency are sounding the alarm. As the WSJ explains, “More than 75 radio stations, most of which operate on the AM band and cover at least 90% of the U.S. population, are equipped with backup communications equipment and generators that allow them to continue broadcasting information to the public during and after an emergency, FEMA said.”

Every article we’ve seen on this subject leaves out critical information. Here is — as the AM radio legend Paul Harvey said — the rest of the story.

Every article we’ve seen on this subject leaves out critical information. Here is — as the AM radio legend Paul Harvey said — the rest of the story.

For one thing, many of these 75-plus radio stations — they’re called PEP or “primary entry point” stations — are outfitted for a true SHTF scenario, not just a natural disaster.

In 2018, the trade publication Inside Radio reported on WLW Cincinnati’s hardened setup in the suburb of Mason: ”The fenced-in, shed-like 8-by-20-foot structures include all the things needed to broadcast remotely, including a studio, backup transmitter and generator, as well as facilities for a two-person staff such as a 60-day supply of food and water, bunks and an air filtration system.” [Emphasis ours]

Pretty hard-core, huh? And FEMA foots most of the bill.

Ready for (nearly) anything: The SHTF studio at the transmitter site of WLW Cincinnati [FEMA photo]

Also missing from these articles is an answer to the basic question: Which radio stations are PEP stations? You know, just in case the power grid, the cell towers and the internet all go down?

For all the effort FEMA has put into this arrangement, there’s no list on the FEMA website. (Are you surprised?) Someone on Wikipedia took a stab at it… but good luck trying to navigate it.

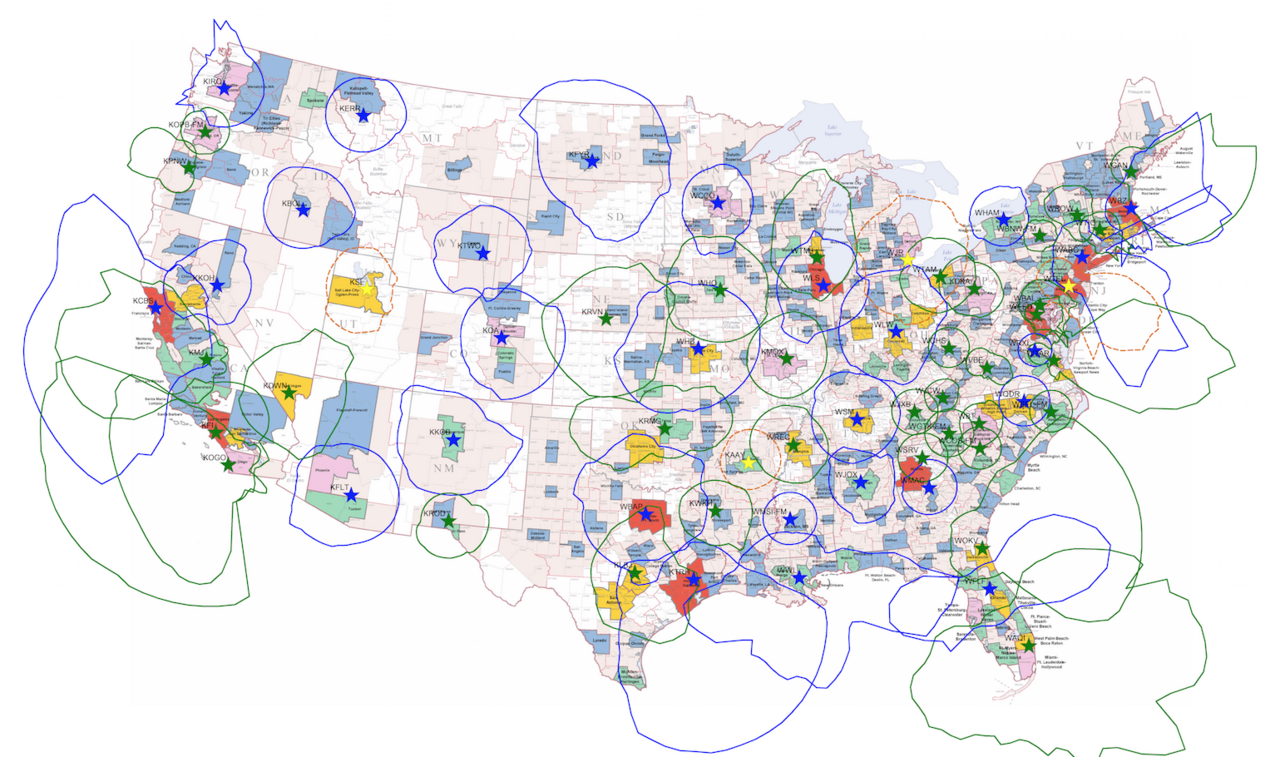

Your best bet is this map: Click on it to blow it up, locate where you are, look for the nearest call letters, then do a web search for the frequency.

Find your nearest PEP radio station: Click to enlarge

And don’t rely just on your car radio, even if it still has AM. Have something at home too.

If you live in an urban area within the coverage range of a PEP station, you’ll probably be fine with whatever portable radio you’ve got stashed in a drawer somewhere. (For goodness’ sake, make sure the batteries haven’t leaked after years of disuse.)

If you live in the sticks like me, consider an investment in a proper AM radio. An excellent choice for under $75 is the Sangean PR-D4W. If you want to go all out for performance, the CCRadio 2E from the American firm C. Crane will set you back $180. As a bonus, both models come with the NOAA Weather Radio band and can trip an alarm in the event of something like a tornado warning.

Look, your tax dollars are paying for all of this infrastructure: You might as well take advantage in case of the worst.

To the mailbag, and more on the topic of the generous pay packages for regional Fed presidents…

To the mailbag, and more on the topic of the generous pay packages for regional Fed presidents…

“If I’m not mistaken the Federal Reserve banks are not ‘owned’ by the U.S. government — they’re owned by the collective U.S. banking industry — no?? And the various bank presidents are paid by the banks….

“I think Powell is only big dog on the federal payroll… but you folks would/should know better than I.”

The 5: You are correct, sir. The 12 regional Fed banks are owned by their respective member banks.

The pay of the chair and other members of the Fed Board of Governors is set by Congress. The Board of Governors sets salary ranges of the regional bank presidents, and those levels vary based on cost of living — thus the low level paid to the head of the St. Louis Fed relative to the head of the San Francisco Fed. It’s up to the regional Reserve bank’s board of directors to set actual pay increases, though.

In other words, setting the pay of regional Fed presidents is a process nearly as convoluted as monetary policy itself!

Best regards,

Dave Gonigam

The 5 Min. Forecast