- Most Important Federal Reserve Meeting In a Year™

- A sign of a “healthy” job market

- The Fed spins out of control

- Jim Rickards: The NYT published CIA propaganda

- Gary Gensler’s bizarro approach to crypto regulation… Stupid marketing tricks: “Experience Regina”… And more!

In a way… nothing fundamentally changed yesterday after the Most Important Federal Reserve Meeting In a Year™.

In a way… nothing fundamentally changed yesterday after the Most Important Federal Reserve Meeting In a Year™.

At the start of 2023, Paradigm’s Jim Rickards channeled Fed chair Jerome Powell: “Inflation’s job one. We’re going to crush it. We’re going to keep raising interest rates until we’re confident we’re there. There is going to be a recession. There is going to be higher unemployment. Too bad.”

Yesterday, the Fed’s Open Market Committee jacked up the fed funds rate by a quarter percentage point to 5% — the highest since 2007.

That’s despite the trouble with the banks. And by all indications, the Fed still isn’t done raising rates.

“As of now, we expect at least one more rate hike of 0.25% on May 3, 2023,” Jim projects now.

“As of now, we expect at least one more rate hike of 0.25% on May 3, 2023,” Jim projects now.

As evidence, Jim cites Powell’s post-announcement press conference yesterday.

“Powell made a number of comments to confirm that another rate hike is on the table. He said, ‘Without price stability, the economy does not work for anyone.’ He also said, ‘The labor market remains extremely tight,’ and that ‘inflation pressures continue to run high.’ To emphasize these points, Powell said that getting inflation under control will be ‘bumpy.’ Those are not the comments of a man who believes the fight against inflation is over.”

About that tight labor market: The number of people filing for first-time unemployment claims is still near historic lows.

About that tight labor market: The number of people filing for first-time unemployment claims is still near historic lows.

The Labor Department says a mere 191,000 people filed during the week gone by. The number has remained under 200,000 for the last couple of months.

Even 300,000 is typically considered a sign of a “healthy” job market… and the number’s been lower than that since late 2021.

Jim Rickards’ senior analyst Dan Amoss elaborates: “As long as Jay Powell is talking about a tight labor market, it indicates that he still sees wage inflation as a threat to getting inflation back down to the 2% target.

“So before we see rate cuts, I think he will want to see several months in a row of slower wage gains in addition to [a slower consumer price index].”

Of course, Powell still had to give lip service to the banking crisis.

Of course, Powell still had to give lip service to the banking crisis.

Jim Rickards again: “Powell said the Fed was well aware of the stress in the banking system. He reassured the public by saying, ‘All depositor savings are safe.’ With regard to recent bank failures, he said the Fed staff were going to ‘work to prevent events like this from happening again.’

“In effect, Powell tried to have it both ways. He raised rates to fight inflation. At the same time, he offered assurances that bank failures were on the Fed’s radar screen and that the Fed had the tools (liquidity facilities, bond purchases, deposit guarantees, supervision, foreign currency swaps, etc.) to put out any fires on the banking side.”

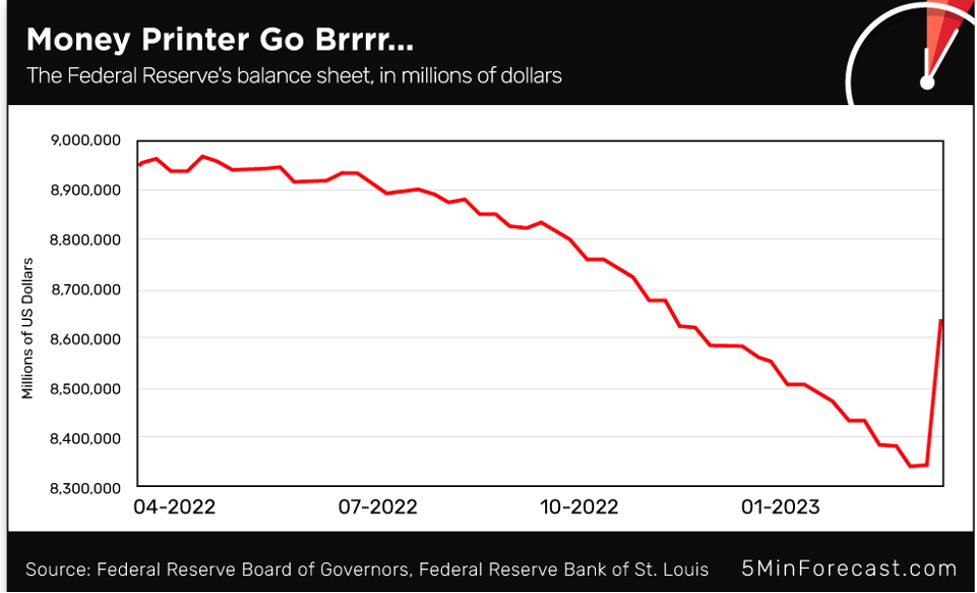

The problem, as we’ve said for the last week, is that to help rescue the banks, the Fed has resumed money-printing — expanding its balance sheet — even as it continues to raise short-term interest rates.

It’s as if the Fed is mashing the accelerator and stomping the brake at the same time.

It’s as if the Fed is mashing the accelerator and stomping the brake at the same time.

“Under the Fed’s new Bank Term Funding Program (BTFP) created as part of the response to the Silicon Valley Bank collapse,” Jim explains, “the Fed will take unlimited amounts of U.S. government securities from banks and provide cash loans at par value even if the bonds are worth far less, as many are.

“The BTFP is designed to provide liquidity to banks without the banks having to sell bonds in the open market and realize losses that destroy capital. Where does the cash come from to make these loans? The Fed prints it!”

We can’t show you this chart often enough: Nearly half of the balance-sheet reduction the Fed achieved since March of last year was wiped out in the week ended Wednesday, March 15.

The Fed updates these numbers weekly. The new update is set for release later this afternoon. It promises to be epic — check back with us tomorrow.

So that’s the Fed’s playbook going into the spring. “What we don’t know,” says Jim, “is whether any of this will work.

So that’s the Fed’s playbook going into the spring. “What we don’t know,” says Jim, “is whether any of this will work.

“The banking crisis will continue with or without rate cuts. The recession will get worse with or without rate hikes. The fundamental forces behind economic growth and global liquidity are bigger than the Fed.”

Those fundamental forces — and their implications for markets — will be the focus of an exclusive Zoom call for Paradigm readers like you, set for tomorrow at 10:00 a.m. EDT. It’s titled FED WATCH: Rate Hikes and the Coming Collapse.

As you might know, Zoom has a limit of 10,000 participants per event. So if you want to look in, you’ll want to reserve your spot right now. Click here to register.

In the meantime, the U.S. stock market has recovered all of the losses it notched yesterday in the knee-jerk reaction to Powell’s press conference.

In the meantime, the U.S. stock market has recovered all of the losses it notched yesterday in the knee-jerk reaction to Powell’s press conference.

At last check, the Dow is up 1.25% or 400 points to 32,436. The S&P 500 is up 1.5% and only two points away from the 4,000 mark. The Nasdaq is up 2.2% and less than 75 points away from 12,000.

Even the beaten-up KBW Bank Index is up 1% on the day… although it’s still down 27% from its levels before banks started blowing up earlier this month. The drama du jour is that the rescue of San Francisco-based First Republic Bank might need some government backing after all — and not just from the 11 banks that have already pledged $30 billion.

Gold powered higher yesterday at just the suggestion the Fed was nearing the end of the current rate-raising cycle… and it’s adding to those gains today. From $1,940 before the Fed meeting, the bid is now back to $1,986. And silver’s up to $23.10.

Crude is also powering higher — back above $71.

One other economic number of note: Thanks to falling mortgage rates, February new home sales registered a 1.1% jump from January — the third-straight monthly increase. The median price of new single-family construction is $438,200 — up 2.5% from a year earlier.

For the record: The legendary investigative reporter Seymour Hersh has confirmed what Jim Rickards asserted here a week ago today: The CIA planted a plainly bogus story about the Nord Stream pipeline explosions in The New York Times.

For the record: The legendary investigative reporter Seymour Hersh has confirmed what Jim Rickards asserted here a week ago today: The CIA planted a plainly bogus story about the Nord Stream pipeline explosions in The New York Times.

In January, Jim said flat-out that Joe Biden ordered the gas pipelines between Russia and Germany be blown up. In February, Hersh published a thoroughly detailed account explaining just how it happened. This month, the Times published a painfully thin article saying no, the perps were Ukrainian special forces, but not connected to the Ukrainian government.

Last Thursday, Jim said the CIA put the Times up to it: “Spreading lies is all in a day’s work for the CIA. I know; I worked there for 10 years.”

Hersh has now published a follow-up piece saying the CIA was indeed ordered to come up with a cover story after German Chancellor Olaf Scholz visited the White House on March 3. Unlike most visits by a foreign leader, there was no joint press conference afterward — lest any foreign reporters ask Scholz what he thought about Hersh’s original article.

Said Hersh’s source within the U.S. intelligence community: “It was a total fabrication by American intelligence that was passed along to the Germans, and aimed at discrediting your story.”

So did Scholz know about the plot in advance? As Hersh writes, “At this point, it must be noted that Chancellor Scholz, whether or not he was alerted of the destruction of the pipeline in advance — still an open question — has clearly been complicit since last fall in support of the Biden administration’s cover-up of its operation in the Baltic Sea.”

Crypto is hanging tough — Bitcoin over $28,000 and Ethereum over $1,800 — despite a new offensive in SEC chair Gary Gensler’s anti-crypto jihad.

Crypto is hanging tough — Bitcoin over $28,000 and Ethereum over $1,800 — despite a new offensive in SEC chair Gary Gensler’s anti-crypto jihad.

The Securities and Exchange Commission has served Coinbase with a Wells notice — basically, a heads-up that the SEC plans to sue within the next six months.

Coinbase is the respectable, responsible crypto exchange — the one that holds customer assets 1:1 and has publicly filed financial statements. No FTX-like shenanigans.

But now it’s in the SEC’s crosshairs. Per The Wall Street Journal, “The notice concerned several aspects of Coinbase’s business, including assets listed on its crypto exchange, its staking service Coinbase Earn and its wallet service, the company said.”

We’re disappointed, but not surprised. Gensler’s approach to crypto regulation has been downright bizarre, as Bloomberg columnist Matt Levine explained last year: “Gensler wants the SEC to have jurisdiction over basically all of crypto, because basically every crypto token is a security, but that he does not seem to have any interest in writing new rules to accommodate the crypto market.

“Gensler’s approach would put the SEC in charge of crypto, and then more or less ban crypto, and I am not sure that is a winning position for him to take.”

The news has knocked the stuffing out of COIN’s share price — down 13.4% at last check.

Great moments in marketing: The tourism bureau of Saskatchewan’s capital city has abandoned a brand-new campaign that might as well have been dreamed up by a 13-year-old boy.

Great moments in marketing: The tourism bureau of Saskatchewan’s capital city has abandoned a brand-new campaign that might as well have been dreamed up by a 13-year-old boy.

Tourism Regina recently rebranded as Experience Regina. Key point if you’re not aware: The city’s name is pronounced with a long “I.”

Accompanying the new name was a campaign with slogans like “Let’s make Regina sexy”… “The city that rhymes with fun”… and…

Yeah, they really went there.

The backlash was instant: “It was clear that we fell short of what is expected from our amazing community with some of the slogans that we used,” said an apology from Experience Regina CEO Tim Reid.

As Global News reports, “In the initial response to the sexual innuendos that Experience Regina was using as its slogans, Reid had said that conversation has been going on around Regina for decades. ‘Let’s be unapologetically Regina. Let’s embrace the fact that our city is called Regina,’ Reid added.”

Supposedly the tourism bureau spent about $30,000 on the campaign, working with a local PR firm.

What we’d really like to know is this: Were any women consulted before these slogans got the green light?

Or as a rando on Twitter observed, “Exactly what kind of tourists, businesses and residents are they hoping to attract?”

Best regards,

Dave Gonigam

The 5 Min. Forecast