- Silicon Valley Bank: No honor for a Fed trustee

- Jim Rickards’ “Biden Bucks” bulletin

- An eerie Signature Bank, CBDC tie-in

- A couple politicians stand against CBDCs

- Big banks are a buy… Taibbi gets a visit from the goon squad… THAT’s a nugget… And more!

The Federal Reserve’s “vice chair for supervision” goes to Capitol Hill for hearings today. If he had any honor, he’d announce his immediate resignation.

The Federal Reserve’s “vice chair for supervision” goes to Capitol Hill for hearings today. If he had any honor, he’d announce his immediate resignation.

From The Wall Street Journal: “The failure of Silicon Valley Bank demonstrates a ‘textbook case of mismanagement,’ the Federal Reserve’s top banking regulator is expected to tell Senate lawmakers on Tuesday, while acknowledging there may have been shortcomings in the central bank’s oversight.”

May have been?

“Why was Michael Barr not removed from office immediately after this historic failure?” asks Paradigm’s macro maven Jim Rickards. “Instead, the Fed has ginned up its PR machine by pretending it was on the case all along.”

“Why was Michael Barr not removed from office immediately after this historic failure?” asks Paradigm’s macro maven Jim Rickards. “Instead, the Fed has ginned up its PR machine by pretending it was on the case all along.”

Indeed, the Fed planted a butt-covering story in The New York Times back on March 19: “Silicon Valley Bank’s risky practices were on the Federal Reserve’s radar for more than a year,” it said, before the bank got into terminal trouble three weeks ago.

“So what happened next?” Jim asks rhetorically. “The answer is nothing. The Fed sent a few warning letters and that was it. Why was the bank not taken over when these cash and control defects were spotted? At a minimum, why was management not replaced and immediate remedial steps implemented?

“It’s time to replace Michael Barr. And let’s replace Jay Powell while we’re at it.”

Tell us how you really feel, Jim!

We mention the latest developments with SVB to tee up a reader inquiry about “Biden Bucks”…

“With the calamity of the SVB situation and the Fed allegedly riding the white horse to the rescue, how likely will the government use this event to further push central bank digital currencies on the public?” asks a subscriber to Rickards’ Strategic Intelligence.

“With the calamity of the SVB situation and the Fed allegedly riding the white horse to the rescue, how likely will the government use this event to further push central bank digital currencies on the public?” asks a subscriber to Rickards’ Strategic Intelligence.

It’s an important question. Jim addressed it to his readers last Friday, and it’s worth breaking the Strategic Intelligence paywall on this occasion to share the answer.

Jim’s short answer: “This is highly likely.”

The longer answer: “The push toward central bank digital currencies (CBDC) is well underway in all advanced economies and some developing economies including China, the Bahamas and El Salvador.

The longer answer: “The push toward central bank digital currencies (CBDC) is well underway in all advanced economies and some developing economies including China, the Bahamas and El Salvador.

“However, there are two major obstacles standing in the way of the CBDC rollout. The first is cash, and the second is cryptocurrencies. These are both alternatives to CBDCs. The government must eliminate cash (or make cash impractical for all but small transactions). And the government must eliminate cryptos entirely.

“This cannot be done all at once. It will be done in small steps so that most people don’t notice,” Jim continues.

“This cannot be done all at once. It will be done in small steps so that most people don’t notice,” Jim continues.

As for cash, “it’s already the case that many retailers have ‘No Cash Accepted’ signs in their store windows. Self-checkout in big-box stores and supermarkets also does not permit the use of cash.”

➢ Historical aside: I’m reminded here of what Jim wrote years ago about FDR’s gold confiscation orders in 1933. Contrary to popular myth, there was no need for G-men to go house-to-house… and for the most part, law-abiding folks didn’t even need to show up at the bank to exchange their gold coins for paper money. They’d already been conditioned over the previous couple of decades to use convenient “gold certificates” instead of gold coins.

As for crypto, “The U.S. government took a big step toward eliminating cryptos when it rescued Signature Bank,” Jim says.

“Signature operated a payment facility called Signet, which acted as a portal between the mainstream banking system and the world of cryptocurrencies. As part of the rescue, the FDIC left the fate of the Signet portal up in the air. It may or may not be acquired by another bank when the FDIC sells the assets.

“This caused a panic in the crypto stablecoin called USDC (although the USDC price recovered last week after dropping to $0.85. The USDC sponsors promise that the price will not fall below $1.00).

“More to the point, extensive investigations and massive new regulations are on the way and they will not favor crypto. As Rahm Emanuel said in 2008, ‘You never want a serious crisis to go to waste.’”

But on the plus side of the ledger, we do see prominent politicians taking a stand against CBDCs.

But on the plus side of the ledger, we do see prominent politicians taking a stand against CBDCs.

In Washington, Sen. Ted Cruz (R-Texas) has introduced a bill forbidding the Federal Reserve from pursuing a consumer-level CBDC. It has at least two Republican co-sponsors.

Meanwhile, a rumored contender for the GOP presidential nomination is taking a stand in the state where he’s governor…

Can Gov. DeSantis be trusted to keep his word? After his craven climb-down about Ukraine a few days ago, you can be forgiven for harboring doubts.

But it’s at least interesting to see which way the wind is blowing in one branch of the uniparty that presumes to rule over us. And I daresay it’s Jim Rickards who deserves the lion’s share of the credit for bringing the issue to widespread attention, starting last summer with his “Biden Bucks” warning.

Still… never count on the politicians to save you. It’s always best to take matters into your own hands… and you are not helpless if a CBDC comes into being.

That’s why Jim is eager to tell you about a new kind of alternative currency. It’s light as a feather, but also made of real gold — so it can’t be inflated away by central banks. Already in use in three states, Jim says “because it’s a physical, hold-in-your-hand gold currency, the government can’t control how you transact or who you transact with.”

If you’re a current subscriber to Rickards’ Strategic Intelligence, we urge you to check out this presentation from Jim: If you respond by tomorrow, he’ll give you a special offer to claim this unique gold currency for FREE.

The bank mess might be the focus in Washington today, but not on Wall Street: It’s shaping up to be a ho-hum sideways day for U.S. stocks.

The bank mess might be the focus in Washington today, but not on Wall Street: It’s shaping up to be a ho-hum sideways day for U.S. stocks.

The Dow is slightly in the green at 32,490… the S&P 500 is slightly in the red at 3,970… and the Nasdaq is down 0.6% at 11,699. Bond yields are rising, the 10-year Treasury at 3.56%.

Gold is fighting back after its early-Monday beatdown, up 11 bucks as we write to $1,968. Silver’s up to $23.18. Crude is back above $73; the dip below $66 a few days ago sure didn’t last.

Big banks are a buy, says Paradigm’s value-and-dividend hound Zach Scheidt.

Big banks are a buy, says Paradigm’s value-and-dividend hound Zach Scheidt.

“It’s no secret that banks are struggling right now, especially smaller regional banks across the country. Regional banks play a vital role in small-town America, helping individuals and small businesses with checking accounts, loans and various services.

“But most of these banks aren’t considered vital to the overall banking system. So investors can’t expect the government to fully rescue any of them if they run into trouble.

“Large blue chip banks, on the other hand, are very different. The Federal Reserve and other political institutions see these banks as extremely important to our country’s financial well-being.

And we can expect that in a crisis, the government will give these large banks assistance so they don’t fail. We saw this assistance during the global financial crisis of 2008.”

An outrage? Yes. But you can’t let outrage get in the way of your investing decisions. And right now, the big banks’ share prices have been beaten down along with the smaller fry.

“While I can’t tell you for sure that the large-cap banks are finished trading lower,” Zach says, “I can tell you that I expect a very sharp rally once investors figure out large banks are going to be just fine.”

As a practical matter, we’re talking about the Big Four commercial banks — JPMorgan Chase (JPM), Bank of America (BAC), Citi (C) and Wells Fargo (WFC). For maximum safety, Zach suggests dollar-cost averaging — buying a small piece every few weeks.

A disturbing 5 follow-up: On the day independent journalist Matt Taibbi testified to Congress about online censorship… the IRS paid a call on his home.

A disturbing 5 follow-up: On the day independent journalist Matt Taibbi testified to Congress about online censorship… the IRS paid a call on his home.

Taibbi and colleagues have reported extensively since December on the federal government’s heavy-handed intervention to censor people expressing unapproved narratives on Twitter under Twitter’s pre-Elon Musk ownership.

While Taibbi was testifying on March 9, an IRS agent left a note at his home asking him to call four days later. “Taibbi was told in a call with the agent that both his 2018 and 2021 tax returns had been rejected owing to concerns over identity theft,” according to The Wall Street Journal’s editorial board.

That seems like a routine inquiry, not worthy of an unannounced in-person visit, no?

Taibbi has informed House Judiciary Committee chair Jim Jordan (R-Ohio) of the peculiar circumstances. Jordan has sent the proverbial strongly worded letter to IRS chief Danny Werfel and Treasury Secretary Janet Yellen. We’ll let you know if anything comes of it…

OK, time for some golden eye candy…

OK, time for some golden eye candy…

That rock there weighs just over 10 pounds… and it contains 83 ounces of gold worth about $160,000.

An Australian man with an ordinary metal detector found it in Geelong, about an hour southwest of Melbourne — the heart of Australia’s 19th-century gold rush.

The fellow who discovered it wants to keep his anonymity… but the guy he sold it to tells the BBC it’s the biggest specimen he’s seen in a 43-year career. “I was just gobsmacked,” says Darren Kamp. “It’s a once-in-a-lifetime find.”

“I can see and appreciate your delight is less work regarding your joy in the lower word count in the fed heads’ statements,” a reader writes after yesterday’s edition…

“I can see and appreciate your delight is less work regarding your joy in the lower word count in the fed heads’ statements,” a reader writes after yesterday’s edition…

“BUT (you knew that was coming ) I’m worried that the use of fewer words is going to equal more obfuscation from an already obfuscatory ‘organization.’”

The 5: Hmmm… In general, it seems to me that verbosity opens the way to flimflam, while an economy of words stimulates plain speaking.

Or maybe it’s the complexity of the words and sentences that’s the issue?

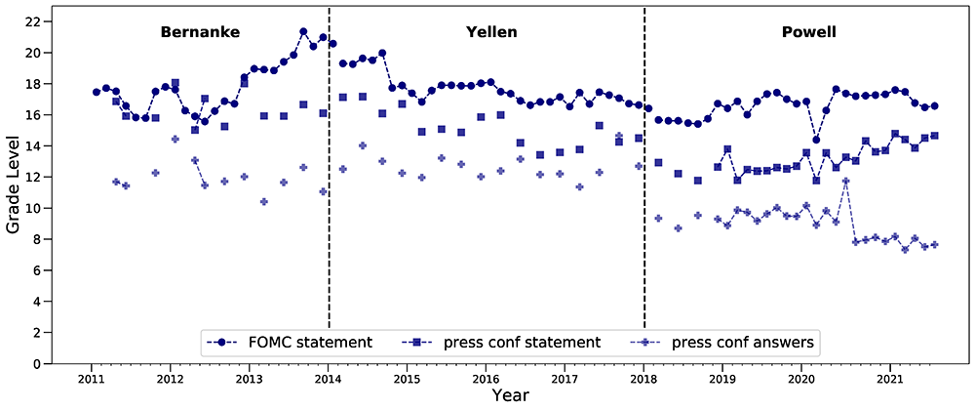

In 2014, The Economist ran two decades’ worth of Fed statements through a word processing program — this time to calculate a Flesch-Kincaid score. F-K scores are a widely used tool measuring the simplicity or complexity of text, expressed as a grade level.

As you can see from the chart the editors generated, the complexity ramped up after the 2008 financial crisis — from an undergrad-level understanding to a postgraduate level.

And it nearly went off the charts during the late Bernanke and early Yellen years.

Then again, that peak coincides with the peak in word count we described yesterday!

According to the Fed’s own analysis published in late 2021, the F-K scores have climbed back down since. (The darkest dots depict the Fed statements; the others depict the post-statement press conferences started by Ben Bernanke in 2011.)

Not sure this brings us closer to any conclusions, but thanks for the diversion!

Best regards,

Dave Gonigam

The 5 Min. Forecast

P.S. Shout-out to Technology Profits Confidential editor Ray Blanco: We mentioned yesterday that he’s on the hunt for the developer of the next great cancer treatment. As it happens, his most recent recommendation issued less than three weeks ago is up nearly 65% as we write today — not on its cancer therapeutic, but rather on a weight loss drug it has in the pipeline.

Either way, we’re sure Ray’s readers are pleased. Technology Profits Confidential is currently closed to new subscribers, but watch this space for announcements soon.