- Team Biden opens new page of its scapegoating playbook

- After the debt ceiling “deal”: This is a relief rally?

- In case of U.S. default, consider this portfolio insurance

- Stupid lawsuit tricks: ChatGPT makes stuff up (again)

- Farewell to The 5, Hello 5 Bullets

![]() White House Seeks Market Scapegoats

White House Seeks Market Scapegoats

Go figure: The stock market is at nine-month highs, but the Biden administration is amping up its jihad against short sellers — people who bet on falling stock prices.

Go figure: The stock market is at nine-month highs, but the Biden administration is amping up its jihad against short sellers — people who bet on falling stock prices.

We told you about the first foray earlier this month — when White House press secretary Karine Jean-Pierre said the president’s team was watching the market closely, “including the short-selling pressures on healthy banks.”

Well, it’s true the banks’ share prices aren’t faring nearly as well as the broad market: While the S&P 500 has rebounded from the regional bank scare in March, the KBW Nasdaq Regional Banking Index (KRX) remains mired near levels last seen in late 2020.

But “So what?” goes the conventional thinking. “Most analysts believe this mini-banking crisis is over and the Fed and FDIC have done enough to reassure depositors and to prevent further runs on the bank,” says Paradigm’s macroeconomics authority Jim Rickards.

In reality, “this crisis is far from over. It’s just taking a breather,” says Jim. “The hit list of midsized regional banks that are vulnerable to bank runs and sitting in the crosshairs is well-vetted on Wall Street. When the banking crisis reignites, stocks will go down again.

In reality, “this crisis is far from over. It’s just taking a breather,” says Jim. “The hit list of midsized regional banks that are vulnerable to bank runs and sitting in the crosshairs is well-vetted on Wall Street. When the banking crisis reignites, stocks will go down again.

“The selling pressure will increase for reasons in addition to the banking panic, including an emerging recession and a global liquidity crisis. When that happens, Washington will have to pull out their stock market panic playbook last used in 2008.

“This will include a ban on short selling.”

Then again… why resort to an outright ban when you can plant a story in the media about selective prosecutions? You know, just put the fear of God in everyone?

Then again… why resort to an outright ban when you can plant a story in the media about selective prosecutions? You know, just put the fear of God in everyone?

That’s what an apparatchik at the Justice Department did last week. Avi Perry is his name and he runs the “market integrity team” of the DOJ’s fraud section.

“You’ll see some more activity from us involving short sellers sometime in the next few months,” Perry said at a conference in New York.

Jim Rickards’ take, posted yesterday for readers of Rickards’ Strategic Intelligence: “To be clear, insider trading and market manipulation can be crimes and criminal activity should be thoroughly investigated. Still, it’s no coincidence that a wave of short-selling cases is coming at exactly the same time that markets are expecting a crash and the Securities and Exchange Commission may have to re-institute new short-selling bans in a panic situation.

“Short sellers have always been the designated bad guys in market-crash situations going back to the 1929 crash and even further.

“The truth is that short sellers do the market a service by helping the process of price discovery and providing market information about the direction of markets.”

Even the regulators understand this reality: “Based on my experience, I believe any new regulatory intervention banning short selling would be a huge mistake,” writes Jim Overdahl in the Financial Times.

Even the regulators understand this reality: “Based on my experience, I believe any new regulatory intervention banning short selling would be a huge mistake,” writes Jim Overdahl in the Financial Times.

And Overdahl’s experience is, ummm, highly relevant: He was chief economist at the SEC during the 2008 short-selling ban. “Its effects were extensively studied by SEC economists and by a number of academic researchers,” he writes. “The results of these studies paint a uniform picture of a policy that clearly failed any reasonable cost/benefit test…

“Furthermore, the studies found the ban was counterproductive, as it led to a severe degradation in market quality by increasing intraday stock price volatility, reducing market liquidity, increasing bid-ask spreads and price impacts, reducing pricing efficiency and increasing trading costs.”

But — and Overdahl is too circumspect to say this in his Op-Ed — the ban gives the impression the authorities are doing something in the face of a crisis. And sometimes in their eyes, that’s all that counts — even if they know the approach will backfire.

Rest assured we’ll keep a wary eye on the SEC and the Justice Department as spring turns to summer. They could easily set off the panic they say they want to avoid.

➢ Speaking of Jim Rickards: Did you see Jim’s provocative email yesterday about a different scheme afoot at the White House? This one is about — Jim’s words here — “President Biden’s sinister plan to ‘steal’ the 2024 election.” At 11:59 EDT tomorrow night, Jim says Biden will “close the bidding to wire certain companies more than $200 billion in payments — all in a blatant attempt to ‘buy’ his reelection to the White House in 2024.” To prepare and to profit, give Jim’s exposé a look right away.

![]() This Is a Relief Rally?

This Is a Relief Rally?

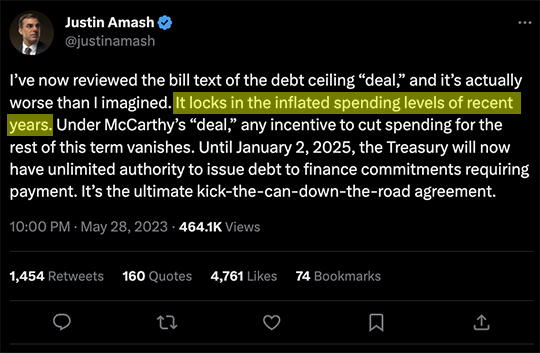

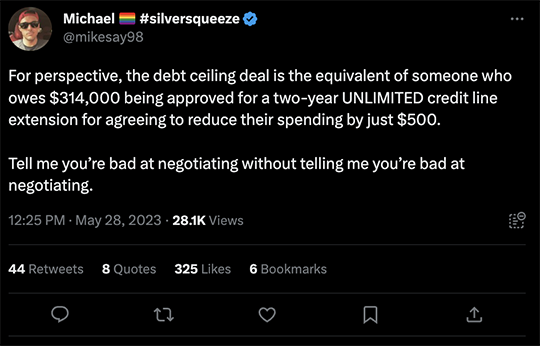

If a “debt ceiling deal” is supposed to propel the stock market higher… well, the rally is kinda underwhelming today.

If a “debt ceiling deal” is supposed to propel the stock market higher… well, the rally is kinda underwhelming today.

Heck, the Dow is in the red — down about a third of a percent and back below 33,000. But the S&P 500 is up seven points to 4,212 (let’s see if this over-4,200 vibe can be sustained for more than a day or two) and the Nasdaq is over 13,000 for the first time since last August.

Helping the Nasdaq no doubt is Nvidia — up another 6% today, propelling it into the rarefied society of trillion-dollar market caps along with Apple, Microsoft, Alphabet and Amazon.

But in the scheme of things, it’s not much of a relief rally. Then again, if the rally is underwhelming, so is the “deal.”

But in the scheme of things, it’s not much of a relief rally. Then again, if the rally is underwhelming, so is the “deal.”

Assuming it passes, the Trump-Biden pandemic spend-a-palooza of 2020–2022 becomes the new baseline for all federal spending going forward.

Supposedly the House votes on this obscenity tomorrow. Treasury Secretary Janet Yellen says Uncle Sam can still avert a default if a deal is signed into law by next Monday.

In any event, the Treasury market is rallying too — prices up, yields down. The yield on a 10-year T-note is back below 3.7%.

And gold is staging a mild rally, up $18 to $1,960 — but silver is flat at $23.17. Crude is falling hard, down more than three bucks and back below $70 again.

There are no knock-your-socks off economic numbers today — and won’t be until at least Thursday (ISM manufacturing index) or Friday (May job numbers).

![]() In Case of Default, Break Glass

In Case of Default, Break Glass

If you don’t have confidence the debt ceiling will be raised in time to avert a default… might we suggest a way to play it?

If you don’t have confidence the debt ceiling will be raised in time to avert a default… might we suggest a way to play it?

“According to my research,” says Paradigm retirement specialist Zach Scheidt, “the market could be vulnerable to a 20% pullback if politicians are unable to raise the debt limit. Tech stocks in particular are the most vulnerable to a pullback, because many tech stocks have lofty valuations and are trading at unreasonably high prices.”

Thus, Zach suggests you consider put options on the Invesco QQQ Trust, which is keyed to the Nasdaq-100 index.

➢ As long as we brought up short selling earlier: Compared with short selling, put options are a much safer way for retail investors to “go short” a specific stock, or the market as a whole: You can never lose more than your initial stake, while with short selling your losses are hypothetically infinite.

Yesterday in his free Rich Retirement Letter, Zach suggested buying the QQQ June 16, $330 put contract. At $1.50 a share today, one contract would cost you $150. “If the market drops by 20% and QQQ falls to $272, these contracts will be worth at least $58 per share. That’s a gain of $56.50 per share (or $5,650 per contract, minus fees and commissions).”

Zach suggests buying four contracts for every $100,000 you have invested in the overall market. “That way if a 20% decline causes your investments to fall by $20,000, you’ll more than make up for this decline with profits from your put contract.”

And if the worst doesn’t happen, you’re out only about 1.3% of the total value of your account. So don’t think of this trade as a speculation — it’s more like an insurance policy in case of the worst.

![]() Miscellaneous Money Stuff

Miscellaneous Money Stuff

In what we’ll chalk up as progress, “More High-School Grads Forgo College in Hot Labor Market,” says this morning’s Wall Street Journal

In what we’ll chalk up as progress, “More High-School Grads Forgo College in Hot Labor Market,” says this morning’s Wall Street Journal

Last year, only 62% of recent high school graduates were enrolled in higher ed — down from 66% in the pre-pandemic year of 2019. Some of it is service-sector jobs — restaurants, theme parks and whatnot — but a sizeable chunk is in construction, manufacturing and warehousing. The unemployment rate for workers age 16–19 is now 9.2%, the lowest since the early 1950s.

Prediction: Whenever the labor market finally cools off, it won’t translate to rising college enrollment. The WSJ points out that according to its own polling data, “most Americans don’t think a college degree is worth the cost.”

Great moments in AI: Lawyers relying a little too much on ChatGPT just got their butts handed to them in a New York courtroom.

Great moments in AI: Lawyers relying a little too much on ChatGPT just got their butts handed to them in a New York courtroom.

It was an otherwise run-of-the-mill personal injury case — a guy suing the Colombian airline Avianca because a metal serving cart smacked his knee during a flight to Kennedy Airport.

But when Avianca asked a federal judge to dismiss the case, the man’s lawyers submitted a 10-page brief citing several relevant cases — all involving airlines.

“There was just one hitch,” says a New York Times account: “No one — not the airline’s lawyers, not even the judge himself — could find the decisions or the quotations cited and summarized in the brief. That was because ChatGPT had invented everything.”

Sheesh. As we said a few weeks ago during one of our occasional forays into the topic of AI, this is exactly what ChatGPT was built to do — mimic the patterns of language, and use “large language models” to come up not with an answer to your question but something that sounds like an answer to your question. Bogus citations are part and parcel of its MO.

The judge will decide on what penalties to impose at a hearing next week.

Coincidence?

Coincidence?

After our discussion last week about the downside of plastic recycling — the release of “microplastics” into the water and the air — suddenly microplastics are the stuff of memes…

![]() Something Old, Something New

Something Old, Something New

“If it ain’t broke, don’t fix it” was the reaction more than one reader had to my announcement Friday that The 5 Min. Forecast is being retired, with this new e-letter taking its place.

“If it ain’t broke, don’t fix it” was the reaction more than one reader had to my announcement Friday that The 5 Min. Forecast is being retired, with this new e-letter taking its place.

“What a shock!” says a member of Paradigm’s Omega Wealth Circle. “As someone who has been here since the first issue of The 5, it is a mystery to me why you feel any need to change it. And no, your ‘explanation’ in today’s final issue didn’t really explain anything.

“I realize that changes are occasionally necessary, but I hope you are not shooting yourselves in the foot with this one. I will keep reading regardless, but your new 5 Bullets is going to have to be really good if it’s not going to disappoint us faithful readers of The 5. It’s not just the content, it’s the style, the flair, the connection that we all feel.

“At least I have a long weekend through which to grieve!”

“Color me skeptical of change,” adds another reader.

“Color me skeptical of change,” adds another reader.

“Been reading it since it began. If you are just changing the name, then OK. Total rebuild does not sound good to me. How many times have you had a perfectly operating software program ‘improved’ by issuing a new version? It is always more difficult to use.”

“At first blush,” says a third, “going from the 5 Min. format to the 5 Bullets format seems to imply a loss of information.

“If it becomes just a ‘a concise summation of our editors’ uncommon wisdom’ without Dave’s sometimes off-the-wall comments, it probably won’t be worth my time. I don’t always agree with Dave, but I always read and think about his comments. This is especially true when he writes about something not directly tied to any of your services, but rather, something tied to social or financial issues that I had not thought about.

“I’ve been a 5 Min. recipient from the beginning. I read it every day. I hope this change in format will work and I will give it a chance, but as of now, my expectations are low.”

One more: “Dave, a huge thank you to you, Emily and your team for putting together The 5. I, for one, have always looked forward to receiving it. I know change is inevitable; however, will miss it.”

Dave responds: OK, this isn’t so bad now, is it?

Look, Paradigm Press has a lot of new readers who’ve come in the door over the last year. For whatever reason, The 5 in its old form wasn’t clicking with them — and much as we value our legacy readership, we need to keep the new folks in the tent, too.

So a facelift after 16 years isn’t the worst thing in the world. Perhaps this new way of organizing the subject matter will make it clearer to a newbie that we tackle several topics on any given day.

And no matter how long you’ve been with us, starting tomorrow we’ll have several bonus features coming your way — beginning with Jim Rickards’ 6 Survival Tips to Prepare for Financial Disaster.

New name, new look, same discernment, same attitude — however long you’ve been around, we hope you like it!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom’s 5 Bullets

P.S. At the risk of being redundant… if you like what you see, could you please whitelist our new sending address?

paradigm5@email.paradigmpressgroup.com

Follow these instructions and the internet gods should smile down on us and ensure these daily messages land reliably in your inbox.