- Next phase of the elites’ power grab (early next year)

- Beware the world improvers, empire builders and do-gooders

- Here we go… The Great Reset

- George Gilder on the “most threatening virus of all”

- Jim Rickards: Capitalism in the crosshairs

- Fed’s “Main Street Lending Program” fiasco

- A reader imagines what the media get wrong… Another asks: What about Sturgis?… And readers contend NYC’s fate is relevant

Remember how, as the U.S. lockdowns were taking effect six months ago, certain members of the power elite kept saying, “The world has changed forever” and “We’re never going back?”

Remember how, as the U.S. lockdowns were taking effect six months ago, certain members of the power elite kept saying, “The world has changed forever” and “We’re never going back?”

And how they said those things with a certain sense of, well, glee?

If you don’t, we do. Check out this back issue of The 5 from late March.

But on-again, off-again lockdown measures are just the beginning: The next phase of the elites’ power grab comes early next year.

But on-again, off-again lockdown measures are just the beginning: The next phase of the elites’ power grab comes early next year.

Late January is when the World Economic Forum’s annual shindig typically takes place in Davos, Switzerland.

Now the 2021 version is being delayed until the summer — “The advice from experts is that we cannot [host the event] safely in January,” says a WEF statement — but a series of online “high level” discussions will still take place the week of Jan. 25.

The WEF’s motto alone should be reason enough to give you the willies.

Beware the world improvers, empire builders and do-gooders.

[Photo from U.S. Embassy, Bern, Switzerland]

But for the coming year, they’re upping the ante.

In light of “opportunities” presented by the pandemic, the theme for the 2021 WEF is a “Great Reset.” Makes you all warm-n-fuzzy, huh?

In light of “opportunities” presented by the pandemic, the theme for the 2021 WEF is a “Great Reset.” Makes you all warm-n-fuzzy, huh?

The WEF even made a meme out of it featuring Klaus Schwab, the German who founded the organization in 1971…

More specifically, “The world must act jointly and swiftly to revamp all aspects of our societies and economies, from education to social contracts and working conditions,” Schwab says. “Every country, from the United States to China, must participate, and every industry, from oil and gas to tech, must be transformed. In short, we need a ‘Great Reset’ of capitalism.”

Sounds vaguely threatening… but what exactly does that mean to you and me?

Sounds vaguely threatening… but what exactly does that mean to you and me?

Well, one of the things that made the elites so gleeful last spring was a statistic we cited on May 6: At the peak of the lockdowns, global carbon emissions had reverted to levels of 10 years earlier.

We seldom venture into the topic of “climate change.” But when we do, we usually emphasize the point that for the people who present it as a dire threat, the agenda is not about climate or about carbon. It’s about control.

Or as the former investment banker and government official Catherine Austin Fitts said a few years ago, “Let me tell you what the most dangerous policy action in the world is.

“It is to decide that a phenomenon such as climate change is our No. 1 problem, that we need urgent action on it before understanding who is going to control the policy discussion and implement the solutions. Build a consensus that man-made climate change is our No. 1 problem and I assure you that our mystery governance system will use it to achieve a global taxation system and more centralized control.”

Which brings us back to the present, and a remarkable passage from Herr Schwab’s book, Covid 19: The Great Reset…

Which brings us back to the present, and a remarkable passage from Herr Schwab’s book, Covid 19: The Great Reset…

“By triggering a period of enforced de-growth, the pandemic has spurred renewed interest in this movement that wants to reverse the pace of economic growth, leading more than 1,100 experts from around the world to release a manifesto in May 2020 putting forward a de-growth strategy to tackle the economic and human crisis caused by COVID-19.

“Their open letter calls for the adoption of a democratically ‘planned yet adaptive, sustainable and equitable downscaling of the economy, leading to a future where we can live better with less.’”

Hmmm… “Economic growth” has always struck your editor as an airy-fairy abstraction. You can have “economic growth” and still have large numbers of people experience a declining standard of living. Indeed, that’s been the story of the United States for at least the last 20 years, maybe as long as 50.

But reading between the lines of “live better with less”… we get the sense the world improvers are a lot more serious about the “less” part than they are about the “live better” part. Except, of course, for themselves…

“In short, the social contract they have in mind is designed to save the planet from the greatest, most threatening virus of all — humanity,” ventures our resident futurist George Gilder, tongue firmly in cheek.

“In short, the social contract they have in mind is designed to save the planet from the greatest, most threatening virus of all — humanity,” ventures our resident futurist George Gilder, tongue firmly in cheek.

“And in the process, of course, secure their absolute control. Indeed, while the oligarchic members of the WEF elite decry the myriad gross inequalities in the world, you can be sure that they will be the most equal of all. (We’ve already seen the kinds of double standards that would make even Nancy Pelosi’s hair stand on end.)

“Of the industries they plan to weave into ‘The Great Reset’ agenda, they have identified more than 50 areas, including: blockchain, digital identity, internet governance, future of health care, fintech, drones, 5G, aviation, international trade and investment, future of food, air pollution, 3D printing, batteries, future of mobility, future of media, entertainment and culture, digital economy and new value creation, workforce and employment, advanced manufacturing and production, environment and natural resource security, plastics and the environment, inclusive design, future of computing, artificial intelligence and robotics… OK, pretty much everything.”

Nor does it end there: “A new form of world money controlled by the International Monetary Fund will not be far behind,” says our macro maven Jim Rickards.

Nor does it end there: “A new form of world money controlled by the International Monetary Fund will not be far behind,” says our macro maven Jim Rickards.

“This reset will be the end of capitalism and personal freedom and the beginning of an elite top-down system that taxes your wealth and limits your opportunities.

“The elites are using the COVID-19 pandemic as a cover for pushing an extreme agenda. They are pushing fear. When people are fearful, they are more open to radical change without fully understanding what those changes mean. As the globalist Rahm Emanuel once said, never let a good crisis go to waste.”

For the moment, consider this merely a heads-up: We’ll continue to clue you in during the months ahead as the Davos crowd becomes more specific about their agenda. And of course, we’ll explore what you can do about it to stay out of harm’s way and preserve whatever wealth you’ve accumulated…

For once, it’s the Dow taking the lead and the Nasdaq pulling up the rear among the major U.S. stock indexes.

For once, it’s the Dow taking the lead and the Nasdaq pulling up the rear among the major U.S. stock indexes.

At last check, the Dow is up more than half a percent, over 28,100. The S&P 500 is up a third of a percent, continuing its latest run past 3,400. But the Nasdaq is down fractionally at 11,183.

Gold continues its drift upward, the bid $1,965 as we write. Silver’s at $27.30.

But in general, markets are in suspended animation, awaiting the Federal Reserve’s every-six-weeks policy statement and Chairman Jerome Powell’s press conference this afternoon.

We’re not sure why; what are they going to say, other than interest rates will remain near zero until there’s a vaccine for the corona-crud, and probably well beyond that time?

Speaking of the Fed, its “Main Street Lending Program” looks like an utter fiasco.

Speaking of the Fed, its “Main Street Lending Program” looks like an utter fiasco.

The media are soft-pedaling it, of course. Bloomberg says the program “isn’t living up to expectations, as few banks are willing to provide the loans.”

Of the $600 billion the Fed made available for the program, the total amount of loans issued to date is… $1.4 billion. That’s a 0.2% uptake rate. Seems some of the biggest lenders “have demanded such crushing terms that discussions have stalled from the get-go, while other banks have decided not to participate at all.”

Bloomberg cites the case of IDM, a data-analytics firm just outside Washington, D.C., a company with $30 million in annual revenue that was hoping a loan could help meet payroll, refinance debt, maybe even make a few new hires. "We can't even get out of the box and submit an application," says chief operating officer John Chung. "This whole thing is kind of a joke."

Gee, why can’t we shake the thought that the big players in Mr. Chung’s line of business — say, Salesforce or Alteryx — are circling his company like vultures?

It’s the post-pandemic big-get-bigger world, with Fed bungling accelerating the process…

The big economic number of the day affirms the theme of “slowing recovery.”

The big economic number of the day affirms the theme of “slowing recovery.”

Retail sales grew 0.6% in August — less than expected. Even if you throw out volatile auto sales and weak gasoline sales, the number still disappoints — up 0.7%.

So the consuming economy looks much like the producing economy, as borne out in the industrial production numbers cited here yesterday — moving in the right direction, but at a steadily slower pace for three months now.

“It is so sad that some of your readers are so binary in their thinking,” a reader reacts to our mailbag section in Monday’s 5, “that they can’t imagine there is one possible instance where the popular media are wrong, where their belief or faith is wrong or where the president might have actually done something right. They’ve lost all sense of balance or perspective.

“It is so sad that some of your readers are so binary in their thinking,” a reader reacts to our mailbag section in Monday’s 5, “that they can’t imagine there is one possible instance where the popular media are wrong, where their belief or faith is wrong or where the president might have actually done something right. They’ve lost all sense of balance or perspective.

“I see many things that I dislike, some I abhor and others that embarrass me, but I can also acknowledge some positives or real beneficial actions. Given some comparisons to other countries that did less or more, I’m now more inclined to think that President Trump let things get too overblown, rather than that he performed some great malfeasance in downplaying the coronavirus threat.

“I think all would be well advised to remember that the ‘scientific community’ still doesn’t have consensus on the best way to handle things, and they certainly didn’t back in March or April. I feel most press picks a scientist or report that fits into the story they want to tell and takes it from there.

“And I will not vilify someone for expressing an opinion I don’t agree with, although over time I might decrease my trust in them if the majority of the time I disagree with them, when I have occasion to form an informed opinion.”

“Dave, maybe I misunderstood the reader's comment about media reporting on mass protests and the health implications vis-à-vis the virus,” writes a reader offering the benefit of the doubt.

“Dave, maybe I misunderstood the reader's comment about media reporting on mass protests and the health implications vis-à-vis the virus,” writes a reader offering the benefit of the doubt.

“If he's contending that the media did, in fact, sound the alarm like they did with 150 people attending church, people going to concerts, eating out, quaffing a few, going to work at the office, going to a political gathering and a host of other activities, he is either practicing at the extreme end of intellectual dishonesty or is living in an alternate universe. What does he think about Sturgis this year… I wonder?

“You are a cornerstone of patience.”

“I agree that your coverage of the suicide of many cities is relevant to all Americans and investors alike,” writes a reader, pivoting to a different sore spot in our mailbag yesterday. “Keep up the good work!”

“I agree that your coverage of the suicide of many cities is relevant to all Americans and investors alike,” writes a reader, pivoting to a different sore spot in our mailbag yesterday. “Keep up the good work!”

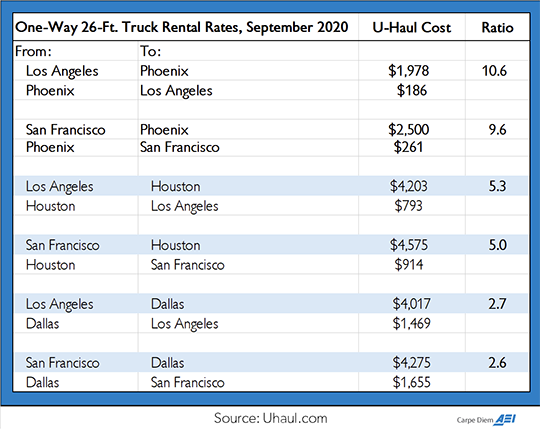

The 5: More evidence of the topic’s relevance comes from economist Mark Perry of the American Enterprise Institute, who shared this table last weekend…

“Emily’s response to the cranky reader’s comment was very cordial and absolutely correct,” adds another. “What’s happening in major U.S. cities has enormous implications for the rest of the country — especially us real people.

“Emily’s response to the cranky reader’s comment was very cordial and absolutely correct,” adds another. “What’s happening in major U.S. cities has enormous implications for the rest of the country — especially us real people.

“As a resident of New York state, I can attest to how the goings-on in NYC (which is almost 400 miles from me) affect everyone. That’s true even during ‘normal’ times.

“But lately things haven’t been so normal. Since my last note to The 5, which you were kind enough to publish on July 27, it has become even more evident to me that the bad guys are targeting specific populations and industries in major metro areas. They are hurting everyone.

“I don’t think I’m the only one who has noticed that. It’s also clear that these things keep happening in cities (and states) where the political leaders have ultra-liberal ideologies.

I don’t see any way the riots, fires and economic destruction are due to incompetence. It all reeks of malevolence, but I repeat myself.

“Anyway, maybe it’s time for our experiment with ‘democratic socialism’ to end. That’s nothing more than the starter-kit version of tyranny. I don’t like it very much, but the oxymoronic euphemism is pretty comical.

“Apologies for ranting again.”

The 5: We always have time for rants grounded in reality and well-articulated.

Best regards,

Dave Gonigam

The 5 Min. Forecast

P.S. Just for fun — a screenshot from our Aug. 21 edition, during a discourse on the pandemic and the economics of higher education…

Perhaps you’ve heard by now, but news came in this morning that the conference will in fact take up fall football starting the weekend of Oct. 24.

Already, enterprising types on the internet are making hay…

Credit where it’s due. And hey, we’ll take our cheer wherever we can find it these days. (Go Badgers!)