- Ray Blanco: Cable companies’ worst nightmare

- A new space race escalates

- Official inflation vs. the real world

- Social Security and a 2021 windfall (kidding)

- A small-business shocker

- Who’s hopping on the negative interest rate bandwagon?

- Singapore Airlines gets mileage out of grounded planes

By the time you read this, Apple will have introduced the iPhone 12 — its first model with speedy 5G wireless technology built in.

By the time you read this, Apple will have introduced the iPhone 12 — its first model with speedy 5G wireless technology built in.

After months and months of 5G hoopla, this morning’s Wall Street Journal could barely stifle a yawn.

“It remains unclear how much interest customers have in faster speeds, especially during a pandemic when millions of people are working from home and are generally using home internet connections…

“Most smartphone makers — including Samsung Electronics Co., which has been selling 5G phones for more than a year — have yet to showcase a killer software application to demonstrate why it is worth the money.”

All true. And very much beside the point. Follow along with us…

“Currently, 5G chips are incredibly expensive. Apple’s cost is estimated to be around $135 per chip,” says our science-and-wealth maven Ray Blanco.

“Currently, 5G chips are incredibly expensive. Apple’s cost is estimated to be around $135 per chip,” says our science-and-wealth maven Ray Blanco.

And yes, that will drive up the price of the latest and greatest iPhone model.

But the chip’s capabilities are staggering — on a level few tech experts could anticipate even four years ago.

They’re made by only one company — ASML of the Netherlands. Using a technology called extreme ultraviolet lithography — and machines that cost $123 million each — the firm can build chips with transistors only 25 atoms wide.

At that scale, precision is key. “What they're doing is akin to hitting a stamp on the surface of Mars with a paper airplane,” tech industry journalist Ian Cutress tells the BBC.

Apple is the first to use the chip. Samsung will be playing catch-up; its first model using ASML’s chips won’t arrive till December.

But what exactly do you get for the extra coin you’re laying out?

But what exactly do you get for the extra coin you’re laying out?

If 5G speeds aren’t essential while you’re relying mostly on your home internet connection… then how valuable are the other capabilities the chips make possible?

If you’re a hard-core gamer, the smoother rendering and lower battery consumption will be mighty attractive. But for the rest of us? How many of us want to edit 4K video or enhance high-res photos on our phones?

Here’s the key: “That higher price tag also primes consumers for the higher cost of even more advanced connectivity that could be making its way into iPhones down the line,” Ray Blanco says.

Here’s the key: “That higher price tag also primes consumers for the higher cost of even more advanced connectivity that could be making its way into iPhones down the line,” Ray Blanco says.

If you’ve been keeping up with us this year, you know Ray’s talking about wireless connectivity via satellite – or, as he’s dubbed it, “Apple-Fi.”

A one-time layout for a more costly phone with super-sophisticated chips becomes all worth it if it means you can tap into unlimited bandwidth anywhere in the world — including at home — for, say, $5 or $7 a month.

[That sound you hear in the distance? Panic in the boardrooms at Comcast and Charter.]

“The global space economy was valued at $366 billion in 2019… and 74% of that is in the satellite industry,” Ray goes on, spelling out the big picture.

“The global space economy was valued at $366 billion in 2019… and 74% of that is in the satellite industry,” Ray goes on, spelling out the big picture.

Click to enlarge

“The profit opportunities in this seem endless, and we’re only just beginning. The biggest names in tech are racing to get their satellites up and running. Bezos, Musk… and Apple’s Tim Cook could be next.

“Plus, the tech is not as far off as some people think. People are already starting to benefit from broadband satellite internet. With Starlink, SpaceX recently kicked off a global internet beta test.

“The performance results have just come in and they’re out of this world! Using only satellites and personal ground devices, users have reported download speeds averaging around 50 Mbps and up to 100 Mbps.

“But SpaceX with its Starlink is just one of several companies racing to beam ultra-fast internet from space.

“Apple’s been rumored to want to bring connectivity to your phone — wherever you might be,” Ray reminds us.

“Apple’s been rumored to want to bring connectivity to your phone — wherever you might be,” Ray reminds us.

“Apple’s slow adoption of 5G coupled with its recent hiring spree of satellite communications engineering talent set the stage pretty well.”

Whether or not Apple announces a satellite venture today, Ray says one thing’s for sure: Apple is clearly “getting consumers comfortable with the higher price tags Apple will need to charge to put chips able to transmit satellite internet in new devices, either in this generation of phones or the next.”

But… Which companies stand to skyrocket on the heels of an Apple move into satellites?

That’s the subject of a research project Ray’s been working on since last year. You can see the fruits of his labors right here. But don’t wait too long; Ray says the next “Apple-Fi” catalyst could come only eight days from now.

Well, the market had to take a breather sooner or later.

Well, the market had to take a breather sooner or later.

At last check, both the Dow and the S&P are down about a third of a percent. But even with that, the S&P remains above the rarefied 3,500 level. And the Nasdaq is actually pushing higher, up about a quarter percent and back above 11,900.

Earnings season is underway and JPMorgan Chase is the first of the Dow 30 stocks to report. Profits are up and JPM set aside less money to cover soured loans. Wall Street likes the first part of that previous sentence, but the second part has sent JPM shares down nearly 1.5% as we write.

But one morning’s market action doesn’t tell the whole story: “The market is right back to being red-hot again following that quick 10% correction,” says Greg Guenthner of our trading desk.

But one morning’s market action doesn’t tell the whole story: “The market is right back to being red-hot again following that quick 10% correction,” says Greg Guenthner of our trading desk.

“It feels like summer all over again with the big tech stocks dragging the market higher. So much for the doom and gloom we heard about last month. The correction played out just as we expected and the market is back on track.

“That does not mean we won’t see some volatility in the weeks ahead. I have no idea what’s going to happen. But for now, it looks like higher prices are on the horizon.”

➢ We see the Financial Times is piling onto the mainstream narrative we unpacked yesterday. “Investors are starting to prepare for the Democrats to win not just the White House in next month’s election but both houses of Congress as well.” Thus the salmon-colored rag tells us small caps and value plays are starting to outperform.

Gold’s big rally last Friday didn’t have any staying power; the bid is down nearly $30 to $1,892. Silver has shed nearly a buck to $24.18.

The big economic number of the day is the consumer price index — up 0.2% in September, as expected, driven in large part by the rising cost of used cars and trucks. The official year-over-year inflation rate works out to 1.4%.

The big economic number of the day is the consumer price index — up 0.2% in September, as expected, driven in large part by the rising cost of used cars and trucks. The official year-over-year inflation rate works out to 1.4%.

Of course, as we always point out, any resemblance to your own cost of living is purely coincidental. Having said that, even the official number has been moving up steadily since the pandemic lows of May.

The real-world inflation rate from Shadow Government Statistics is also on the move — pushing past 9% for the first time since March.

Meanwhile, if you’re on Social Security, don’t spend all your 2021 windfall in one place. Yes, we’re being facetious — just as we were a year ago at this time.

Meanwhile, if you’re on Social Security, don’t spend all your 2021 windfall in one place. Yes, we’re being facetious — just as we were a year ago at this time.

It being October, the current inflation report is the one the Social Security Administration uses to set its annual cost of living adjustment. For 2021, it will be 1.3%.

➢ Why is it lower than the official inflation rate? Because Social Security relies on a different inflation gauge with the express aim of keeping a lid on the annual COLA.

Thus the 2021 increase is less than the 2020 COLA of 1.6%. But it’s in line with the average over the last decade of 1.4%.

For the average Social Security recipient, that works out to an increase of $21 a month next year.

How much of that increase will be eaten up by rising Medicare premiums is up in the air. The pandemic has thrown the government’s usual calculations into a cocked hat. But the final word should come sometime next month.

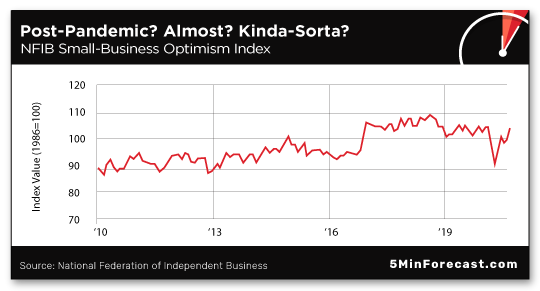

For small-business America, it’s almost as if the pandemic didn’t happen.

For small-business America, it’s almost as if the pandemic didn’t happen.

Or so you’d believe from the National Federation of Independent Business’ monthly Optimism Index, anyway.

At 104.0, the September survey clocks in at its highest by far since the pandemic hit stateside… and, for that matter, higher than it was anytime during the Obama years. (At the risk of generalizing, NFIB membership leans conservative.)

NFIB chief economist Bill Dunkelberg is doing his best to tamp down the near-giddy sentiment. “As parts of the country continue to open, small businesses are seeing some improvements in foot traffic and sales,” he counsels.

“However, some small businesses are still struggling financially to operate at full capacity while navigating state and local regulations and are uncertain about what will happen in the future.”

➢ Example: On the afternoon of Friday, Oct. 2, Michigan Gov. Gretchen Whitmer announced our little section of the Great Lakes State would revert to “Phase 4” of her lockdown scheme. Under Phase 4, restaurants are limited to take-out and delivery. After some initial panic among the local restaurateurs, it turned out to be a modified Phase 4 and dine-in is still allowed.

Indeed, the “uncertainty” portion of the survey remains elevated.

For a third-straight month, “quality of labor” tops the portion of the survey where business owners are asked to identify their single-most important problem. Fully 21% say finding good help is their biggest obstacle right now. Nothing else comes close… with taxes at 16%, regulation at 13% and poor sales at 12%.

Heads up: One of the globe’s major central banks is about to join the negative-interest-rate bandwagon.

Heads up: One of the globe’s major central banks is about to join the negative-interest-rate bandwagon.

The Bank of England put out an inquiry yesterday to its member banks: How ready are they for zero or negative rates, should it come to that? “We are requesting specific information about your firm’s current readiness… and the steps that you would need to take to prepare for the implementation.” Replies are expected by Nov. 12.

Europe and Japan have both resorted to negative rates in recent years, hoping they would spur consumers to spend and businesses to invest.

It never works — negative rates have the perverse effect of scaring people into saving more to make up for the lack of yield — but central bankers have no better ideas. (Letting the free market set interest rates and letting the chips fall where they may? Sacrilege!)

➢ As a reminder, the Federal Reserve is very much open to the idea of negative rates — as our Jim Rickards learned last year during a confab of central bankers and other global elites at Bretton Woods, New Hampshire. “It was not regarded as controversial by the panelists,” Jim told us, “even though it was completely unprecedented in the history of U.S. monetary policy.”

Looks as if this “high-end airplane food at ground level” thing is catching on. At least in Asia…

Looks as if this “high-end airplane food at ground level” thing is catching on. At least in Asia…

Last month we mentioned how with most of its fleet grounded, Thai Airways transformed the cafeteria of its headquarters into an “airline-themed” restaurant — serving up 2,000 meals a day.

But Singapore Airlines just one-upped the Thais — serving meals aboard a couple of parked Airbus A380s. The first two lunchtime seatings, with proper social distancing of course, sold out within a half hour, at prices of up to $496 (!).

Now the airline has added six more seatings, both lunch and dinner. Go figure, there’s a waiting list.

But here’s what we want to know: Do you still have to go through security theater to get on board the jet? No, thanks.

Best regards,

Dave Gonigam

The 5 Min. Forecast

P.S. Congratulations to readers of Alan Knuckman’s Rapid Riches Report. They bagged a clean 100% gain yesterday playing options on SPY, the big S&P 500 ETF.

If you’ve been looking for a low-risk way to dip your toe into the options market… with plenty of hand-holding and without spending a hefty sum on one of our premium research services… then Alan would like to introduce you to what he calls “the simplest retirement strategy of all time.”