- An imagined 2018 trade war headline…

- … becomes a 2021 reality

- Tiny violins for giant corporations (oh, wait)

- Jim Rickards: “Big is bad” is back

- The most California story ever (legal weed)

- A reader: Hong Kong, taxes and KISS.

In the fall of 2018, we imagined a headline from the future that would read like this: “Dow Crashes 20% in Hours as Beijing Kicks Apple, GM out of China.”

In the fall of 2018, we imagined a headline from the future that would read like this: “Dow Crashes 20% in Hours as Beijing Kicks Apple, GM out of China.”

At that time, China accounted for 18% of Apple’s iPhone revenues… and General Motors was selling 25% more cars in the Middle Kingdom than in the United States.

We’d spotted a report from the global investment firm KKR that was already spinning worst-case scenarios only a few months into the trade war launched by Donald Trump.

“Without question,” said the KKR white paper, “China has some very powerful tools in its toolkit, including clamping down on U.S. firms selling into China’s burgeoning consumer market as a retaliatory measure, should the U.S. decide to implement further tariffs on Chinese imports.”

Fast-forward to the summer of 2021. Not only is Joe Biden carrying on with the Trump tariffs, the trade war has mushroomed into full-on economic warfare. Our scenario, while still improbable, is becoming more plausible.

Fast-forward to the summer of 2021. Not only is Joe Biden carrying on with the Trump tariffs, the trade war has mushroomed into full-on economic warfare. Our scenario, while still improbable, is becoming more plausible.

We told you about the most recent chapter last week — a new law in China aiming to counter U.S. economic sanctions. Companies and individuals who “enforce or assist” foreign sanctions could be taken to court.

A few days later, Western businesspeople in China are still sussing out the implications. Lester Ross doesn’t like it; he’s a Beijing-based partner at the American law firm WilmerHale. He tells the South China Morning Post how he fears regulators might “reduce [companies’] discretion to determine with whom they wish to do business.”

Ross says that could prove to be a major drag on the banks; by one estimate the top five U.S. banks had $70.8 billion in exposure to China at year-end 2019.

“Businesses that could be at risk,” the newspaper goes on, “include multinational fashion brands that have announced they will not use cotton from Xinjiang – banned by the United States because of concerns about forced labor – or suppliers to the telecoms giant Huawei, which has been hit by U.S. export restrictions.”

And no, that’s not a case of unintended consequences: This is exactly what the architects of the law have in mind.

And no, that’s not a case of unintended consequences: This is exactly what the architects of the law have in mind.

The SCMP article cites Tian Feilong, a law professor at Beihang University who was a consultant to the people who drafted the law.

“To put it simply, foreign companies involved in sanctions against China will lose the Chinese market,” Tian says. “Many companies need to weigh their pros and cons, whether to pick a side between the Chinese market or the U.S. and European market, and between Chinese law and foreign laws.” [Emphasis ours.]

Yeah, we know. Tiny violins. These are giant companies that made their bed in China and now they have to sleep in it.

Still… those giant companies make up a meaningful portion of the assets in people’s 401(k)s… in traditional pension plans… in the giant investment funds of insurance companies.

Which means, as this economic warfare escalates… a lot of people’s retirements will be caught in the crossfire.

Which means, as this economic warfare escalates… a lot of people’s retirements will be caught in the crossfire.

That’s what’s at stake as nation-states impose sanctions and other punitive economic measures on each other.

We can’t cite the figures often enough: The U.S. government is waging economic warfare against one-tenth of the world’s countries — comprising more than a quarter of the world’s population and with economic output nearly equal to America’s.

Washington has the big guns… but as you see now, big vulnerability too.

We’ve been on the economic-warfare beat here in The 5 for more than seven years — ever since U.S. sanctions targeted Russia for annexing the Crimean Peninsula — but our search for a way to “trade around” this big-picture trend for quick profits has come up short.

Until now. As we’ve been telling you for the past week, our macroeconomic maven Jim Rickards has developed a system he calls COBRA — affording you the chance to skim some of the $6.6 trillion that changes hands every day as nations wage economic warfare.

Moments ago, Jim completed the Special Profit Briefing we’ve been talking up for days now. The replay is available for you to watch immediately. Here’s the link.

To the markets — which are in their usual holding pattern as happens eight times a year.

To the markets — which are in their usual holding pattern as happens eight times a year.

Today is one of the eight Wednesdays when the Federal Reserve’s Open Market Committee issues its latest “policy statement” at 2:00 p.m. Eastern Time — and one of the four Wednesdays each year when the Fed pooh-bahs issue their forecasts for the economy.

By the time you read this, they’ll have made their latest pronouncement and Fed chair Jerome Powell will be droning on before the cameras. We’ll follow up with anything meaningful tomorrow.

In the meantime, the Dow and the S&P are microscopically in the red and the Nasdaq is microscopically in the green. Precious metals are also little changed — gold at $1,855 and silver at $27.74. Crude continues to hover near late-2018 levels at $72.31 a barrel. Bitcoin is down about 3.5%, a couple hundred bucks below $39,000.

Copper is stabilizing after a huge whacking yesterday — when China announced it would release some of its huge base-metal stockpile to keep prices in check. A pound of the red metal goes for $4.34 — down big from record highs over $4.80 a few weeks ago.

| ➣ | One economic report of note: Housing starts for May came in slower than expected. And permits — a better indicator of future activity — slipped 3% from the month before. Permits for single-family homes have now fallen three of the last four months.

High prices for building materials? Local land-use regulations that are too strict? Whatever the reasons, supply of new construction is tight and prices are soaring. Something’s gotta give… |

For the record…

For the record…

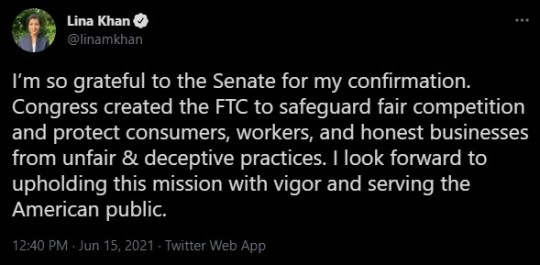

There’s a new sheriff in town for Big Tech. Yesterday, the Senate voted 69-28 — with 21 Republicans voting in favor — to confirm Lina Khan for a seat on the Federal Trade Commission. The president immediately named her as chair.

Khan has been in the forefront of a movement to interpret antitrust law in a way that might eventually lead to the breakup of Google, Facebook and Amazon.

| ➣ | We’ve already encountered cheesy jokes online about “the wrath of Khan” — which made us realize that particular Star Trek movie was made several years before Lina Khan was born. She’s 32. Feeling old yet? |

Our Jim Rickards anticipated a development like this more than a year ago: He described for us how antitrust law has evolved from…

- “Big is bad” in the early 20th century (i.e., the breakup of Standard Oil)…

- To the 1980s idea that “big is OK as long as it benefits the consumer”…

- To the present zeitgeist of “big is bad if the consumer is abused in unseen ways” (i.e., Google and Facebook’s “free” services in which, as the saying goes, “you’re the product”).

No, it’s not necessarily time to bail from shares of the Big Tech firms if you hold them. In fact, Jim says if they’re broken up… it might be a boon for shareholders who, for instance, would end up owning shares of both Facebook and an independent Instagram.

In what might be the most California story ever… state officials are looking to subsidize the legal cannabis industry to better compete with the illegal cannabis industry.

In what might be the most California story ever… state officials are looking to subsidize the legal cannabis industry to better compete with the illegal cannabis industry.

From the Los Angeles Times: “The California Legislature on Monday approved a $100 million plan to bolster California’s legal marijuana industry, which continues to struggle to compete with the large illicit pot market nearly five years after voters approved sales for recreational use.”

Seriously, you can’t make this stuff up. But we’re not surprised.

Even before recreational weed became legal on Jan. 1, 2018, we raised an eyebrow at the 15% excise tax as well as a flat $9.25 per ounce tax on flowers and $2.75 per ounce on leaves — no matter the market price! Little wonder that by mid-2019, the black market for pot in California was still three times the size of the legit one.

And oh, those regulations. More from the LA Times piece: “Many cannabis growers, retailers and manufacturers have struggled to make the transition from a provisional, temporary license to a permanent one renewed on an annual basis — a process that requires a costly, complicated and time-consuming review of the negative environmental effects involved in a business and a plan for reducing those harms.”

And oh, those regulations. More from the LA Times piece: “Many cannabis growers, retailers and manufacturers have struggled to make the transition from a provisional, temporary license to a permanent one renewed on an annual basis — a process that requires a costly, complicated and time-consuming review of the negative environmental effects involved in a business and a plan for reducing those harms.”

Thus, fully 82% of licensees are still classified “provisional.”

What will the $100 million be used for? It “would help cities hire experts and staff to assist businesses in completing the environmental studies” and transitioning to permanent licenses.

Hey, we’ve got an idea. What if the “costly, complicated and time-consuming reviews” were simplified? Or eliminated altogether? Yeah, we know, dream on…

On the topic of complicated tax codes, we hear from a reader who suggests many of us Americans might have it easy…

On the topic of complicated tax codes, we hear from a reader who suggests many of us Americans might have it easy…

“I recall when I was a taxpayer in Hong Kong,” he writes.

“Being paid a salary (by my own company) the tax form arrives pre-filled out reflecting my income. I can add rentals and parent/grandparent support and Bob’s your uncle… done and in the mail. No tax on dividends, capital gains. No carry-forwards or -backwards… just straight cash salary income.

“KISS worked for me.

“Now back home in Canada I have to pay $2,000 every year to get my taxes done.”

The 5: Yikes.

Many countries have it arranged now so you can go online and much of the essential info is pre-filled, like your old paper Hong Kong forms. But not in Canada, it sounds like, and certainly not in the United States.

Yes, the IRS has a “Free File” program, but as we mentioned last year, it was developed in conjunction with Intuit and H&R Block… and it’s so hellaciously complex you could be forgiven for thinking it’s designed to steer you to Intuit’s TurboTax software or H&R Block’s prep services.

Naw, they wouldn’t do that, now, would they?

Best regards,

Dave Gonigam

The 5 Min. Forecast

P.S. Once more, Jim Rickards’ Special Profit Briefing went live just moments ago. He revealed how to parlay global economic warfare into lucrative short-term trades — with profit potential of an average 160% every 45 days.

The replay of this event is available to watch right now. Click here for instant access.

P.P.S. Thanks to Emily for going above and beyond yesterday, battling power and internet issues to bring you a polished episode of The 5 while I was out of pocket.