- Budget, what budget? Janet Yellen’s China warning

- Uncle Sam’s $250 billion “compete with China” boondoggle

- Another front of an economic war — and how to profit

- Expectation violation: “Post-Fed letdown” afflicts markets

- The simplest explanation for the Fed’s hawkish turn

- What a stoned autoworker might say… The 5 inspires a reader’s 1975 concert memory… the “sixth domain” of war… and more!

“China is our most serious competitor and it poses challenges to our security and our democratic values,” said Treasury Secretary Janet Yellen yesterday, testifying to the Senate Finance Committee.

“China is our most serious competitor and it poses challenges to our security and our democratic values,” said Treasury Secretary Janet Yellen yesterday, testifying to the Senate Finance Committee.

Ostensibly, Yellen was there to make the case for the president’s gargantuan $6 trillion 2022 budget proposal. But given the bipartisan animosity toward the Middle Kingdom that’s now all the rage inside the Beltway, there was much China chatter.

“We are looking at the full range of tools that we have to push back and to redress practices that harm us (and our) national security and our broader economic interests,” she said — citing, as an example, Washington’s curbs on Chinese investments in the United States.

That said, “I would worry somewhat about complete technological decoupling,” Yellen added. “Many of our allies would be very reluctant to all but do business in China. This is a difficult issue.”

That said, “I would worry somewhat about complete technological decoupling,” Yellen added. “Many of our allies would be very reluctant to all but do business in China. This is a difficult issue.”

She should worry. As we noted on Tuesday, the other G7 democracies have little interest in helping Joe Biden come up with a plan to counter China’s massive “Belt and Road” initiative, linking dozens of countries across Eurasia with ports and pipelines and high-speed rail and fiber-optic cables.

We’ve spilled a lot of digital ink in the past week about “economic warfare” — focused mostly on the looming U.S.-China conflict and especially on the use of economic sanctions.

But as you can see from Yellen’s testimony, sanctions are just one front of the war. In the years ahead, we have a feeling government busybodies will resort frequently to the buzzword “decoupling.”

Which brings us to the $250 billion boondoggle known as the United States Innovation and Competition Act.

Which brings us to the $250 billion boondoggle known as the United States Innovation and Competition Act.

Passed by the Senate last week with a 68-32 supermajority, its 2,400 pages are “powered by rising fears among members of both parties that the United States is losing its edge against China and other authoritarian governments that have invested heavily in developing cutting-edge technologies,” says The New York Times.

Literally, this is the thinking in Washington nowadays: If China’s government is going to bigfoot the private sector and make top-down decisions about how to invest in research and development… then we need to do it too! And harder!

We’re sure this adventure in central planning will work out just swell.

“The bill spends well over $100 billion on special interests and managing the U.S. economy in areas where the private sector has already proven itself effective,” says Walter Lohman of the Heritage Foundation.

“The bill spends well over $100 billion on special interests and managing the U.S. economy in areas where the private sector has already proven itself effective,” says Walter Lohman of the Heritage Foundation.

That includes $52 billion in subsidies for Intel and other U.S. semiconductor firms, allegedly to spur domestic chip production.

Seriously? We’re talking about an industry whose global revenues jumped 10% last year amid a global government-imposed depression — how needy are they, really?

Meanwhile, Intel is already hard at work building a $20 billion fab facility in Arizona.

And American competitiveness? U.S.-based firms control nearly half of the global chip industry.

Yes, a lot of those American chips are made elsewhere. As if Congress could do anything about that.

Yes, a lot of those American chips are made elsewhere. As if Congress could do anything about that.

“It is true that America has slipped to a 12% market share in semiconductor manufacturing, but it doesn’t follow that firms need government help not to slip further,” writes Cypress Semiconductor CEO T.J. Rodgers in The Wall Street Journal.

“Around 60 years after the commercialization of the integrated circuit, most chips have become commodities with little strategic value, and their manufacturing has been pushed offshore by relentless demand for lower cost.”

Supply-chain issues and shortages? Hello, there was a pandemic and lockdowns last year. American know-how is working its way through the mess.

It takes up to 26 weeks to make semiconductors. That’s just reality — members of Congress can’t snap their fingers to speed it up.

“Rather than countering a perceived threat from China,” writes Eric Boehm at Reason, “lawmakers risk bogging down one of the most innovative and successful parts of the American economy with an industrial policy that will force chipmakers to care more about what makes Washington happy than what is best for their own businesses.”

We come back to the question that often confronts us in these virtual pages: Heavy-handed governments act by their own twisted logic, so how do you invest around that?

We come back to the question that often confronts us in these virtual pages: Heavy-handed governments act by their own twisted logic, so how do you invest around that?

In the present case, we’re neutral on the semiconductor stocks. Sure, they’d benefit from a short-term infusion of federal cash. But if it makes them fat and lazy and captive to Washington in the long term? Obviously, that’s not so good.

A far better way to play the theme of global economic warfare is with a unique new strategy developed by our macroeconomic maven Jim Rickards.

It’s called COBRA — and it gives you the chance to grab a share of the $6.6 trillion that changes hands every day as nations wage economic warfare. COBRA trades have the potential to deliver average gains of 160% every 45 days.

Jim took the wraps off this strategy just yesterday. You can get up to speed with his brand-new presentation right here. It’s available for viewing now through Sunday night.

To the markets — which are contending with “post-Fed letdown.” The precious metals have contracted an especially severe case.

To the markets — which are contending with “post-Fed letdown.” The precious metals have contracted an especially severe case.

After we went to virtual press yesterday, the Federal Reserve issued its latest policy statement. No surprise there — the Fed is keeping its boot on the fed funds rate at near-zero, and it will continue buying bonds at a pace of $120 billion a month.

The surprise came from the circular exercise in which four times a year, the Fed pooh-bahs look into their crystal ball and guess at what their own decision-making will be next year and the year beyond that.

Three months ago, the consensus among the pooh-bahs was that they’d keep their boot on the fed funds rate near zero all the way through 2023.

Now? Fully 13 of the 18 officials expect they’ll bump up the rate twice before year-end 2023.

That outlook violated Wall Street’s expectations — to say nothing of the Fed’s own stated goals.

That outlook violated Wall Street’s expectations — to say nothing of the Fed’s own stated goals.

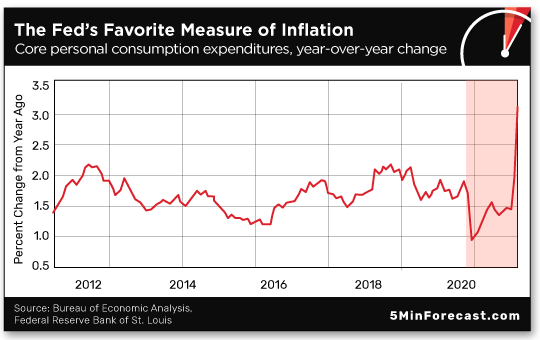

Yes, the inflation numbers have been zooming higher, but the Fed has hitched its wagon to the notion those higher numbers are “transitory.” In addition, the Fed is adamant that it won’t raise the fed funds rate until its preferred measure of inflation holds above 2% for a long time — long enough to make up for all the years it was stuck below 2%.

So what gives? Why is the Fed implicitly changing its tune? Why the hawkish turn?

Financial “news” websites are squandering terabytes of bandwidth with speculation today, but we gravitate toward the answer that’s the simplest: As Jim Rickards put it to me during one of our first conversations in 2014, “Don’t ever think for a minute that the central bankers know what they’re doing.” Heh…

Our friend Chuck Butler at the venerable Daily Pfennig e-letter has a slightly more charitable explanation: “I know what the Fed is thinking here — that inflation is rising faster than they expected, and their hands are tied for now to combat it, so they’ll try to jawbone inflation down with talk of rate hikes 1½ years from now.”

Anyway, the Fed’s abrupt shift in tone has tanked pretty well every asset class for the moment…

Anyway, the Fed’s abrupt shift in tone has tanked pretty well every asset class for the moment…

- The Dow ended yesterday down 0.8% and it’s down another 0.6% as we write, back below 34,000. The Nasdaq is holding up much better — down a quarter-percent yesterday, up 0.8% today, easily holding the line on 14,000

- Precious metals — ugh. It was a rout yesterday, and it’s continuing today. Gold has plunged $85 in less than 24 hours, the bid $1,775 as we write. All the gains of the last six weeks? Gone. Silver got whacked too; it’s back below $26 after touching $28 only days ago

- Even bonds sold off, pushing yields higher. The yield on a 10-year Treasury note jumped above 1.5% for the first time in over a week; at last check it’s 1.55%.

But the dollar soared relative to other major currencies. The dollar index leaped from 90.5 at the time of the Fed announcement to over 91.8 as we check our screens.

Scanning the day’s economic numbers, there’s one surprise — first-time unemployment claims jumping back above 400,000 during the week gone by. That’s the first rise in six weeks.

Our 5 Mins. are running short and thus we must resort to an abbreviated item of “quirk” from the business world.

Our 5 Mins. are running short and thus we must resort to an abbreviated item of “quirk” from the business world.

Actually, the story isn’t especially funny: General Motors might join the ranks of companies that will cease testing prospective hires for cannabis use.

It’s the take at the business page of Fark.com that’s amusing: “Or maybe they could put the doors on the INSIDE of the vehicle instead of the outside, so you could come and go from wherever you are in the universe, man.”

“Damn, Dave, The 5’s headlines suckered me in last night,” writes a reader with a stream-of-consciousness summary of yesterday’s edition.

“Damn, Dave, The 5’s headlines suckered me in last night,” writes a reader with a stream-of-consciousness summary of yesterday’s edition.

“While reading about trade war rumblings, Jim Rickards scaring the hell out of me and my retirement, I’ve got to look into this COBRA link. Cali being Cali, subsidizing their pot retailers with what, their already exorbitant fees/taxes they charge for pot sales… Excuse me? Oh, a Cali rebate scheme of some sort. Like you said Dave, ‘only in Cali’… and of course, how can you forget Capt. Kirk yelling, ‘KHAN’!

“Ah, here it comes finally. A small glimpse ahead and there, I see it, ‘KISS’! Can it be that the Kiss Army has made it to The 5’s pages? Am I going to read about another Kiss fan’s story??? NOPE, a reader living in Canada pays $2K a year for tax preparation and ‘yikes’ is an understatement, Dave. So the ‘KISS’ referred to is the ‘Keep it simple, stupid’ acronym, bummer!

“Dave, it must be the special blend Suntory Hibiki whisky my son brought me back from Japan talking, and I’m going to relay a true KISS story.

“May 24, 1975, Paramount Theater, Seattle. Me and a friend scored free tickets to the Kiss show at our local record shop and there’s a band called Rush doing the first act. Hum… so we sit down, center stage, front row of the balcony. Not bad for freebies but wait a drum set, couple of Marshalls, a black Fender Jazz Bass and a Gibson guitar. Well, the guitar is promising.

“Three guys walk out and Alex Lifeson breaks into this great riff from ‘Finding My Way.’ The long-haired, big-nosed bass player, Geddy Lee, starts wailing like Robert Plant and new drummer Neil Peart is mashing away. The rest, as they say, is history. New Rush fans have been created!

“Oh, yeah, Kiss. Well, a wall of Marshalls, fire pots, Gene Simmons flicking his tongue and spewing fire, Peter Criss’ drums rising to eye level with us in the balcony and of course more pyrotechnics! You can feel the heat from the fire pots! The Kiss Army satisfied after Rock and Rolling all Nite! A mind-numbing, hearing-destroying show.

“But (I had to, Dave) I digress!

“Always enjoy The 5!”

The 5: Thanks for the reminiscence. It inspires your editor to do a quick web search — seeing as I was, umm, a bit young to have experienced that moment.

Among all the bands that ever opened for Kiss, Paul Stanley recalled in 2018 that “I think for us, Rush was most exciting. When we first had them playing with us in Canada and John Rutsey was still the drummer. The first album was so… It was Humble Pie, it was Zeppelin. They obviously found their footing in something they wanted to do later on. They were always great.”

Seriously, thanks for sharing. Been a while since we had some rock ’n’ roll reader mail — maybe 2016? — that started with a couple of random references I made to Metallica and Dream Theater. Before it was all over, I included a Yes lyric in the title of a chart about durable-goods orders, go figure.

By the way, it’s Emily who composes those headlines most days — good to know they’re fulfilling their purpose! (Not today — she’s hit the road with her family for a few days, so I’m minding the store solo.)

Best regards,

Dave Gonigam

The 5 Min. Forecast