- Managing expectations: The Fed does a lousy job

- The taper tantrum gathers speed

- Here come the vaccine mandates

- Feds yank Medicaid and Medicare…

- … to punish unvaccinated nursing home staff

- The second-most valuable U.S. silver dollar

- A reader on reviving the gold standard (before China does)

If the Federal Reserve is trying to manage people’s expectations — and it is — it’s doing a lousy job.

If the Federal Reserve is trying to manage people’s expectations — and it is — it’s doing a lousy job.

Let’s rewind to Tuesday, when the Dow and the S&P 500 were in retreat from the previous day’s record closes. The media’s narrative was that the Commerce Department’s retail sales number was a disappointment.

We offered an alternative interpretation — renewed “taper” talk by the Federal Reserve.

The Fed had planted a story in Tuesday’s Wall Street Journal — suggesting the Fed would start dialing back on its $120 billion a month in bond purchases before year-end, and ceasing those purchases altogether by next summer.

It’s those bond purchases — “quantitative easing” in Fed parlance – that have fueled much of the stock market’s epic rise since the corona-crash in March 2020.

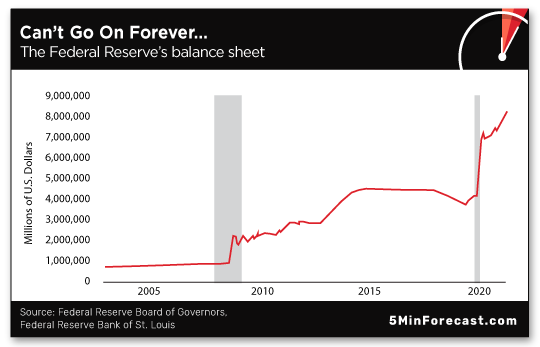

But all the same, the Fed can’t keep mainlining heroin to Wall Street indefinitely; at some point, all that QE swells the Fed’s balance sheet to a point where foreigners start losing confidence in the U.S. dollar.

But all the same, the Fed can’t keep mainlining heroin to Wall Street indefinitely; at some point, all that QE swells the Fed’s balance sheet to a point where foreigners start losing confidence in the U.S. dollar.

As we said Tuesday, the Fed has to start leveling off the steep line on this chart, sooner or later — in a move similar to the one it engineered in late 2014…

The Journal story was an obvious effort to start letting down Wall Street gently. We suggested the effort would continue when the Fed released the minutes from its July meeting yesterday.

We were right. The minutes stuck to the timeline described in the Journal: “Looking ahead, most participants noted that, provided that the economy were to evolve broadly as they anticipated, they judged that it could be appropriate to start reducing the pace of asset purchases this year.”

But the carefully orchestrated attempt to let Wall Street down gently failed; the major U.S. stock indexes landed with a thud by day’s end. And as we write today, the recovery has been halting at best…

But the carefully orchestrated attempt to let Wall Street down gently failed; the major U.S. stock indexes landed with a thud by day’s end. And as we write today, the recovery has been halting at best…

Welcome to Taper Tantrum 2.0.

The original taper tantrum came in May 2013, when Ben Bernanke was still Fed chairman and he told Congress that the time was approaching for the Fed to start “tapering” its purchases of Treasury debt and mortgage-backed securities.

Wall Street went into a snit. Stocks and bonds sold off hard. In the end — look at that chart of the Fed’s balance sheet again — the Fed carried on with its purchases for another year before proceeding with tapering.

Best case, stocks are now in suspended animation until a week from tomorrow. That’s the absolute latest the Fed will drop its next hint about what’s in store.

Best case, stocks are now in suspended animation until a week from tomorrow. That’s the absolute latest the Fed will drop its next hint about what’s in store.

Every year on the fourth Friday of August, the chair of the Federal Reserve delivers a speech to fellow central bankers at a gathering in Jackson Hole, Wyoming.

Ever since the Panic of 2008, this speech has had at least the potential to make big news. Given the events of this week, the 2021 speech will be, as the media are fond of saying, “closely watched.”

Worst case, the tantrum gathers speed — a dirty snowball rolling downhill.

Worst case, the tantrum gathers speed — a dirty snowball rolling downhill.

Heck, even if a “tapering” weren’t in the cards, the market’s overdue for a pullback.

According to figures from the independent research firm CFRA, it’s been 278 calendar days since the S&P 500 registered a drop of 5% or more. That’s the ninth-longest streak on record… and the longest since January 2018.

Ouch. The end of that streak in January 2018 was rough. The market had risen so smoothly for so long that there was a very crowded trade in ETFs keyed to low market volatility. Sooner or later, the “short-vol” trade was destined to blow up… and when it did, the market took a 10% tumble in two weeks.

For some people, it was their first experience with a market drop of that magnitude. For others, it had been so long since their last experience that they forgot what it was like.

They panicked and sold, fearing “the big one” might be underway. Even if they didn’t sell right away in early February, they might have lost patience and sold off later in the spring or early summer. It was almost seven months before the market reclaimed that early-2018 high of 2,872 on the S&P 500.

Of course, the rest is history. Even after the spill of the last couple days, the S&P sits near 4,400.

Time to look in the mirror: Could you resist the impulse to sell if the market takes a 10% tumble in the next two weeks?

Time to look in the mirror: Could you resist the impulse to sell if the market takes a 10% tumble in the next two weeks?

Be honest. Resisting the impulse to sell takes discipline. Either nerves of steel… or the patience of a twentysomething with decades to go before retirement.

But what if you could take a tiny portion of your portfolio — maybe 1% — and lay on a simple “disaster insurance” trade that could hedge those potential losses?

We’re talking about a trade that could pay off so big, it would offset the losses elsewhere in your portfolio. It could even boost your overall account balance. In an extreme case, it could make your retirement.

You could sleep at night even if the mainstream were bombarding you with end-of-the-world headlines, right?

Here’s the thing: You don’t want to waste any time laying on a trade like this. Not with Taper Tantrum 2.0 underway. Not when the Fed could further muck up its “messaging” and send the market on an even steeper slide. It’s entirely within the realm of possibility that this coming Monday could be the next “Black Monday” of market legend.

As the day wears on, the major U.S. stock indexes have clawed their way into the green — but that doesn’t begin to make up for yesterday’s losses. Still, the S&P 500 has held the line on the 4,400 level.

As the day wears on, the major U.S. stock indexes have clawed their way into the green — but that doesn’t begin to make up for yesterday’s losses. Still, the S&P 500 has held the line on the 4,400 level.

The gloom is spilling over into the commodity sector. Crude is down more than $2.50 a barrel — below $63 for the first time in nearly three months. Copper is threatening to break below $4 a pound for the first time since April.

Among precious metals, gold is holding up somewhat better — down five bucks to $1,782. But silver’s down nearly 1% to $23.24.

As for the day’s economic numbers, first-time unemployment claims during the week gone by numbered 348,000 — better than expected and a new low for the pandemic era. Meanwhile, mid-Atlantic manufacturing as measured by the Philadelphia Fed is still growing solidly, but not at the torrid pace of earlier this year.

Here come the vaccine mandates — and, perhaps, the resistance.

Here come the vaccine mandates — and, perhaps, the resistance.

Tuesday night was the first night bars and restaurants in New York City were required under the orders of Mayor Bill de Blasio to verify all customers have had a COVID vaccine. Ditto for movie theaters, gyms, even strip joints.

Businesses found in violation face fines of $1,000 for a first violation, quickly escalating to $5,000 for the third violation and every one beyond that.

Enforcement doesn’t start till Sept. 13, but a handful of business owners aren’t waiting to sue the city. “The city does not have the right to tell us who we can serve for any reason – that decision is up to us as private business owners,” says Long Island gym owner Charlie Cassara.

Fully 25% of New Yorkers remain unvaccinated, mostly in poor and minority-dominated areas. “It remains to be seen,” writes Reason’s Liz Wolfe, “whether de Blasio’s enforcement squad will be slapping minority business owners with fines in the coming weeks for the apparent crime of serving their communities without verifying their vaccination status.”

Meanwhile, Team Biden intends to yank Medicare and Medicaid funding from any nursing home with unvaccinated staff.

Meanwhile, Team Biden intends to yank Medicare and Medicaid funding from any nursing home with unvaccinated staff.

Could be interesting: Federal data suggest only about 60% of nursing home staff are vaccinated right now.

“The industry is dominated by low-income workers who are disproportionately women of color,” points out Roll Call, “and many worker advocates previously urged education rather than mandates, pointing to mistrust that stems from years of marginalization and underpayment….

“The division among nursing home staff regarding vaccinations is threatening the industry, which long suffered from staffing shortages. Lori Porter, CEO of the National Association of Health Care Assistants, which represents certified nursing assistants, fears the industry will lose 20–30% of its workforce.

“‘My hope is that those great CNAs will remain in the field,’ she told CQ Roll Call. ‘They’re needed. The residents value them. The residents’ families value them, and I hope in the end that will reign supreme and they won’t leave the industry.’”

Oy. And restaurants think they’ve got it tough with staff shortages…

Behold, the second-most valuable silver dollar in existence…

Behold, the second-most valuable silver dollar in existence…

Kind of a stern-looking Lady Liberty there… [Stack’s Bowers Galleries photo]

It’s perhaps the best-preserved sample of the 1804 U.S. silver dollar — graded Proof 68 by Professional Coin Grading Service, if you geek out on this stuff — and it sold at auction on Tuesday for $7.68 million.

While dated 1804, this particular coin was struck in 1834 on the request of President Andrew Jackson, and presented the following year to the sultan of Muscat and Oman.

The seller is the estate of the late coin collector D. Brent Pogue — who bought it at auction in 1999 for $4.14 million.

Again, the second-most valuable silver dollar in existence. The most valuable is a 1794 Flowing Hair silver dollar sold for $10 million in 2013. Or is it? We mentioned how that coin went up for auction again last year… and there were no takers.

“Gold,” says the subject line of a reader’s email — prompted, we presume, by our Monday edition.

“Gold,” says the subject line of a reader’s email — prompted, we presume, by our Monday edition.

“Make America great again by backing the dollar with gold before China or some other country does. Let us know what you think of this idea.”

The 5: By all means. Revive the U.S. Gold Commission, only this time don’t stack it with banksters who have a vested interest in the current system.

Somehow we doubt China or any other nation-state is liable to beat America to the punch. But even if it does, that’s just one more argument for having gold in your portfolio mix.

Best regards,

Dave Gonigam

The 5 Min. Forecast

P.S. If we really are into Taper Tantrum 2.0 and the start of a 10% correction… well, as we say, it’s just the start, coming off record closes on Monday.

How certain are you that you’ll hold on tight and avoid the impulse to mash the “sell” button — and then miss out on the gains that would follow once the market recovers and moves on to new heights?

It takes discipline, for sure. But that discipline comes a lot easier if you’ve laid on a “disaster insurance” trade with a small portion of your portfolio. It’s the kind of trade that helps you sleep at night while everyone around you panics in reaction to every scary new headline.

With the help of our floor-trading veteran Alan Knuckman — who’s putting his own money on the line with this trade — I’ll show you how it works when you follow this link.