- Ray Blanco on Tesla’s undercover story

- “This disruptive energy storage boom…

- … “is just getting started”

- Should Robinhood worry?

- What TSA data reveals about air travel

- Readers on our Assange issue: One of The 5’s “best ever”… “Do not free Assange,” a reader writes… And more!

Do you remember Feb. 1, 2021? Truth is, unless you’re a Texas resident, probably not…

Do you remember Feb. 1, 2021? Truth is, unless you’re a Texas resident, probably not…

“That’s the day a freak cold storm gripped the state,” says our science and technology maven Ray Blanco, “plunging the Lone Star state into below-20 weather.”

And quite literally freezing Texas’ electric power grid. In fact, according to The Wall Street Journal, by mid-February the grid was within five minutes of a complete and total collapse. “I’m talking about a blackout of historic proportions that would’ve sent Texas back to the stone age,” says Ray.

“Thankfully, the Texas power crisis eventually passed,” he continues, “but not without revealing a painfully obvious weakness in Texas’ energy infrastructure.”

Which might have everything to do with a California-based billionaire’s relocation to Texas in December 2020…

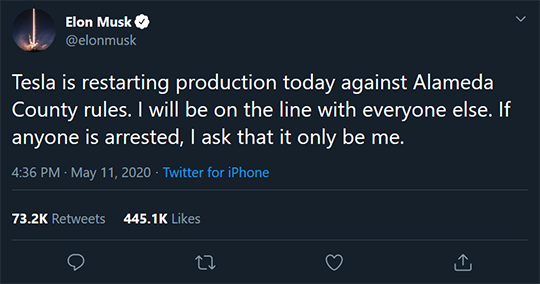

Ostensibly, Elon Musk had an ax to grind with California’s draconian pandemic lockdowns. (To say nothing of taxes.)

Ostensibly, Elon Musk had an ax to grind with California’s draconian pandemic lockdowns. (To say nothing of taxes.)

If you recall, Tesla’s car factory in Fremont, California, defied government orders…

It was a gutsy stance, for sure. But Ray says: “Most people assume [Musk] wanted to get away from high taxes and anti-business regulations… 99% of folks don’t know the full story.

“My research reveals Musk’s move to Texas gives him a strategic foothold for his next major disruption: the energy industry,” says Ray.

“My research reveals Musk’s move to Texas gives him a strategic foothold for his next major disruption: the energy industry,” says Ray.

“You see, experts call Texas the ‘the epicenter of the U.S. energy economy.’ It produces more power than any other state.

“That’s why not long after the Texas blackout, Musk stepped in with Tesla Inc. and registered a secret project under the name ‘Gambit Energy Storage LLC.’

“It’s worth mentioning Tesla never publicly announced this project,” Ray says. “And when prying reporters asked about it, Tesla executives would not respond for comment.

“But an obscure SEC filing revealed a critical connection,” he says, “confirming Gambit Energy LLC is filed as a subsidiary under Tesla.

Gambit Energy LLC

“So 40 miles outside of Houston, Texas, in a small town called Angleton…

“Tesla is quietly installing colossal batteries into the Texas power grid,” Ray says. “Make no mistake, these are not your everyday lithium-ion batteries. These batteries are big. REALLY big.

“Tesla is quietly installing colossal batteries into the Texas power grid,” Ray says. “Make no mistake, these are not your everyday lithium-ion batteries. These batteries are big. REALLY big.

“These Tesla batteries are mammoth-sized devices,” says Ray. “They’re what experts call ‘utility scale’ or ‘grid scale’ energy-storage batteries.

Rendering courtesy of plusenergystorage.com

“They’re big enough to take up two parking spaces. And they connect together like Lego blocks to form even bigger ‘mega-batteries.’

“Until recently, energy storage batteries were too costly for widespread commercial adoption,” Ray says.

“Until recently, energy storage batteries were too costly for widespread commercial adoption,” Ray says.

“But because of recent technological improvements made to the lithium-ion battery during the electric vehicle manufacturing rush, the cost to produce the lithium-ion battery pack has dropped like a rock.

“Over the past 10 years, lithium-ion battery prices have cratered 85%,” he notes. “This past year alone they plunged 30%. And experts forecast they will drop another 65% by 2030.

“Lithium-ion batteries have become so cheap, they’re now affordable for applications outside the EV industry — like energy storage.

“These giant batteries enable us to store energy from cheap, renewable sources of power, like solar and wind,” says Ray.

“These giant batteries enable us to store energy from cheap, renewable sources of power, like solar and wind,” says Ray.

“These big storage batteries turn solar and wind power from an inconsistent source of electricity into a 24-hour power plant.”

Which is why Forbes says: “Energy storage is referred to as the ‘holy grail’ of renewable energy as it gives solar and wind the ability to generate electricity 24/7.”

Ray continues: “Point being, when you combine the infinite power of the sun with Tesla’s battery, you can produce a virtually unlimited supply of dirt-cheap energy.

“In other words, big batteries are producing some of the cheapest energy in the world,” says Ray. “And that’s great news for you…

“This disruptive energy storage boom is just getting started,” Ray says. “Big batteries are about to blast off into a state of ‘hypergrowth,’” he says.

“This disruptive energy storage boom is just getting started,” Ray says. “Big batteries are about to blast off into a state of ‘hypergrowth,’” he says.

“At first, new technologies are slow to catch on, only taken up by a handful of die-hard ‘techies’ until eventually, the general public and business world adopt these technologies on a widespread basis, triggering a phase of exponential growth.

“In fact, Swiss Bank UBS says $140 trillion in new investment capital will pour into clean technology over the coming years… That’s about four times the size of the U.S. stock market.”

And per Ray’s research: “There’s one little-known tech company that’s perfectly positioned to ride this once-in-a-life-time megatrend…

“Which explains why Wall Street insiders like Vanguard, BlackRock and T. Rowe Price have already parked billions of dollars in this underreported stock.”

Get the complete details on this fast-moving disruption story right here. You’ll even get Ray’s No. 1 ticker symbol for playing this new 12,100% tech boom…. It’s free, no sign-up required. The best part? It’s a company that’s only 1/600th the size of Tesla…

“PYPL is reportedly going to launch stock trading features,” says our market analyst Greg Guenthner. “Should Robinhood worry?

“PYPL is reportedly going to launch stock trading features,” says our market analyst Greg Guenthner. “Should Robinhood worry?

“The market seems to think so — at least for now. PYPL shares jumped 3.6% yesterday, while poor HOOD dropped almost 7%.” Today? Both stocks are paring their gains and losses with PYPL down 1% and HOOD up 1%.

“Next story that might matter: Affirm (AFRM) is partnering with Amazon. That means installment payments are coming to Amazon. High-tech layaway? You bet!

“Honestly, I’m not sure what this means for AMZN,” says Greg. “Is this a way to get into selling more higher-ticket items? Maybe. But AFRM certainly enjoyed the bump. The stock ripped almost 50% on the news yesterday. Anyone who bought the IPO in January is back in the green… so that’s something.”

As for Zoom’s earnings: “On the surface, ZM posted good numbers — beats on both top and bottom lines,” Greg says. “But it feels like the Zoom magic from the pandemic has worn off. Investors are concerned about slowing growth, and they’re punishing the stock right now.” Indeed, ZM is down over 16% at the time of writing — below $300.

As for Zoom’s earnings: “On the surface, ZM posted good numbers — beats on both top and bottom lines,” Greg says. “But it feels like the Zoom magic from the pandemic has worn off. Investors are concerned about slowing growth, and they’re punishing the stock right now.” Indeed, ZM is down over 16% at the time of writing — below $300.

“That puts ZM close to its May lows,” Greg notes. “The stock has been in a downtrend since late October 2020. No reason to try to buy this thing right now, especially with sentiment shifting away from work-from-home darlings.

“I think the herd is turning back to the reopen plays instead,” Greg concludes. An idea our next editor is on board with…

“Based on the frightening headlines you see in the mainstream media,” says our retirement specialist Zach Scheidt, “you might think that the world is going back into lockdown.

“Based on the frightening headlines you see in the mainstream media,” says our retirement specialist Zach Scheidt, “you might think that the world is going back into lockdown.

“But that’s not actually what’s happening,” he continues. “According to TSA data I reviewed over the weekend, passengers are still flying.

“Even if some travelers are putting off plans until the Delta variant is more contained, the number of travelers… is still very high.

“Meanwhile, the reaction on Wall Street sets up a great opportunity for us,” Zach says.

“You see, shares of major airline stocks peaked early in the summer and have pulled back to key support levels. Investors are showing more concern while the actual statistics on the ground show much less risk,” says Zach.

“So as airlines sell tickets, fill planes and report strong profits, investors will soon realize their error. In fact, most airlines are already starting to bounce after a late-summer pullback.

“Bottom line: This pullback for airline stocks should be temporary as Americans (and travelers around the world) are anxious to get back into the skies,” says Zach.

Hmm… About that: American Airlines (AAL), Delta (DAL) and Southwest (LUV) are all in the green today.

Hmm… About that: American Airlines (AAL), Delta (DAL) and Southwest (LUV) are all in the green today.

Despite the fact all the major indexes are nominally in the red… with the S&P 500 pulling back the most by 0.16% to 4,520. Meanwhile, the Big Board and Nasdaq are taking a breather at 35,360 and 15,250 respectively.

It’s a slow day all around: Oil’s lost about 0.77% to $68.66 for a barrel of West Texas crude, but gold’s catching a bid, up $5.00 to $1,817.10 per ounce. Silver, however, has dropped below $24.

Crypto? The market that never sleeps? Flagship Bitcoin is down 2.6% to $47,255.

And we received a lot of feedback on our “Free Julian Assange” reboot yesterday…

“Your latest newsletter concerning Julian Assange and free speech was one of the best ever,” a reader says.

“Your latest newsletter concerning Julian Assange and free speech was one of the best ever,” a reader says.

“The 5’s insights corroborate what freethinkers sense and observe daily. Thank you!”

“Do not free Assange,” says another, “try him in a fair court of law.”

“Do not free Assange,” says another, “try him in a fair court of law.”

The 5: We wonder if the “fair” part is just too much to expect…

She continues; “I totally disagree with your defense of Julian Assange and his co-conspirators. He knowingly paid government employees to steal information in violation of the oaths they signed. He knew and did not care if they were prosecuted as long as he got his stories.

“They put other Americans in jeopardy for a buck. There was no higher purpose. If there was, the employees could have brought their concerns through the proper channels and not endangered people helping our government.”

The 5: Chelsea Manning is a prime example of one of Assange’s “co-conspirators.” She contacted Assange after coming across sensitive, some classified and all disillusioning documents while stationed in Baghdad as a young Army private.

But before dumping her cache of documents at WikiLeaks, Manning did, in fact, attempt to go through the “proper channels,” contacting prestige media — The New York Times and The Washington Post — but to no avail. That’s standard procedure for a whistleblower, right?

Wait, you wouldn’t expect Manning to take her concerns to some military-industrial complex spook, would you? Seems like a sure-fire way to get “disappeared.” At any rate, we found nothing to indicate Assange paid his WikiLeaks informants…

“As for freedom of the press, I did believe in it once. Not so sure now after seeing how it’s been so warped and abused,” our reader muses. “The current crop of journalists appear to be hacks, not truth tellers. It is a shame.

“As for freedom of the press, I did believe in it once. Not so sure now after seeing how it’s been so warped and abused,” our reader muses. “The current crop of journalists appear to be hacks, not truth tellers. It is a shame.

“I consider The 5 to be more journalistic than any of our news media even though I sometimes disagree with you. You don’t resort to name calling and other nefarious verbiage in lieu of making a factual case.”

The 5: Thanks for your commendation; it means a lot. Giving a fair hearing — even when it cuts against the grain — is at the heart of civil discourse. Cheers…

“I have a question to your following statement,” writes a reader from Germany. “Last week, Jonas Elmerraji said: ‘You can also transfer your bitcoins to your own digital wallet or even to a cold storage wallet like the Ledger Nano.’

“I have a question to your following statement,” writes a reader from Germany. “Last week, Jonas Elmerraji said: ‘You can also transfer your bitcoins to your own digital wallet or even to a cold storage wallet like the Ledger Nano.’

“I have read many negative comments about Ledger’s Nano S and X. What do you think?”

For guidance, we reached out to our colleague…

“So I’m not a hardware wallet expert by any means,” Jonas says, “but the Ledger wallets are the most popular (i.e., most trusted) hardware wallets on the market right now.

“So I’m not a hardware wallet expert by any means,” Jonas says, “but the Ledger wallets are the most popular (i.e., most trusted) hardware wallets on the market right now.

“They use secure elements, which make them much harder to hack, and they’re reasonably easy to use and inexpensive. But I wouldn’t talk someone out of the other big hardware wallet brands like Trezor.

“My advice for hardware wallets is to make sure you buy a wallet made by an established major brand and buy it directly from the manufacturer’s website, even if it costs a little more. (I wouldn’t even buy one from Amazon). It’s the easiest way to make sure your wallet is genuine and untampered with.”

Many thanks to Jonas for his solid advice… We’ll be back tomorrow. Take care!

Best regards,

Emily Clancy

The 5 Min. Forecast

P.S. While Wall Street is focused on Tesla’s…

- “Million-Mile Battery”

- Autonomous-driving technology

- Bitcoin holdings…

They’re missing the BIGGER story… Tesla is quietly working on a disruptive, game-changing technology project that’s part of a new ground-floor opportunity which (Bloomberg says) will grow an exponential 12,100% over the coming years.

What exactly is Tesla working on now? Go here now to get the full details on this fast-moving disruption story… Plus, Ray Blanco’s No. 1 “disruptor stock” pick. No sign-up required!