- It’s a recession (But don’t CALL it a recession!)

- Breaking down the GDP’s fatal flaw

- Jeb Bush on “growing our way out of” national debt

- Bailouts by another name: “Inflation Reduction Act of 2022”

- Is GloboTax back from the dead?

- Long live Choco Taco!

And so it’s a recession… but as we said yesterday, don’t actually come out and call it a recession!

And so it’s a recession… but as we said yesterday, don’t actually come out and call it a recession!

The only major media outlet that didn’t get the memo is the Financial Times…

But it’s not the news that matters — it’s the market reaction to the news.

Jim Rickards — who’s said for weeks a recession is already underway — now says sooner or later, the market reaction will be a “recession shock.” And it will be worse than anything we’ve witnessed so far in 2022.

You need to prepare now. With that in mind, please watch this short message from my colleague Doug Hill right away.

So yes — a 1.6% annualized drop in GDP during the first quarter, followed by a 0.9% drop in the second quarter. It’s a recession.

So yes — a 1.6% annualized drop in GDP during the first quarter, followed by a 0.9% drop in the second quarter. It’s a recession.

As you’re likely aware, the White House has been pushing back on this “two consecutive quarters of declining GDP” definition. From Team Biden’s standpoint, it’s much better to sit back and wait for the National Bureau of Economic Research to declare a recession months after the fact.

Yesterday we told you how the NBER considers a wide variety of data points and is extremely patient making its recession calls. Its primary audience is not you or me or the politicians, but economic historians who will pore over the NBER’s research many decades into the future.

As a result, you end up with anomalies like the NBER saying we had a mild eight-month recession in 2001 — even though we did not have two consecutive quarters of declining GDP.

But here’s the thing, as Bianco Research founder Jim Bianco points out on Twitter: Every time that GDP has declined for two consecutive quarters, sooner or later the NBER says it’s a recession.

So… welcome to the recession. Prepare accordingly.

All that said, there’s a fundamental problem with GDP — one we’ve lamented in these virtual pages for years.

All that said, there’s a fundamental problem with GDP — one we’ve lamented in these virtual pages for years.

Namely, GDP is a meaningless statistical abstraction.

Think about it: Say the number came in this morning at minus 1.5% instead of minus 0.9%. Or say it actually registered a positive reading. What difference would it make to you, really?

GDP has no bearing on your life or your standard of living. “You can’t eat GDP. You can’t wear it. You can’t spend it,” said our old friend Chris Mayer, who’s running a hedge fund these days. “It’s just a number economists can play with.”

And a profoundly flawed number, on many, many levels.

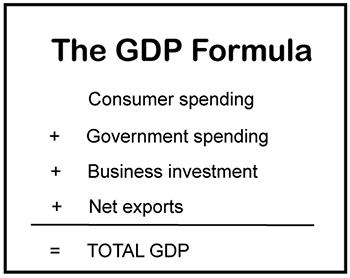

First, a quick review of how GDP is calculated. It’s not that complicated, really…

First, a quick review of how GDP is calculated. It’s not that complicated, really…

But even taking this formula at face value, it’s flawed. For instance, the business investment category is completely understated.

“GDP just measures final output only,” economist Mark Skousen explained last year in an interview with our founding editor Addison Wiggin. “So it measures the hat, the glasses, the shirt that I’m wearing, the cellphones that we use, because those are usable finished products. What it doesn’t include is all the stages of production at the resource stage, the production stage, the wholesale stage — it leaves out all of those steps.”

Leaving out those steps has the effect of giving consumer spending an outsized importance it doesn’t deserve.

Leaving out those steps has the effect of giving consumer spending an outsized importance it doesn’t deserve.

You hear the result of this statistical flaw every time a mainstream economist or journalist bleats about how “Consumer spending is 70% of the U.S. economy!’”

From there, it’s a short leap to the massive economic fallacy that spending is the engine of prosperity in any economy and not savings.

“Properly understood,” writes Ryan McMaken for the Mises Institute, “economic growth increases with saving, because the capital stock is increasing, making it easier for entrepreneurs to deliver new goods and services — and more goods and services — to consumers.”

But even if this massive methodological issue were fixed, GDP would still be a fatally flawed measure.

But even if this massive methodological issue were fixed, GDP would still be a fatally flawed measure.

Bill Bonner, the founder of our parent company, pointed it out years ago: If you mow your lawn, and your neighbor mows his lawn, that has no effect on GDP. But if you pay your neighbor $30 to mow your lawn, and he pays you $30 to mow his, GDP miraculously grows by $60!

Comical, right? But the real-world effects are much more insidious — as PayPal founder Peter Thiel pointed out during a recent seminar at Stanford.

Compare American life in the 1950s, he said, with American life now. If “you shift an economy from a single-income household with a homemaker to one with two breadwinners and a third person who’s a child-carer,” he said, “statistically you have three jobs instead of one and therefore you have more GDP, and you will exaggerate the amount of progress that’s happened.”

In other words, it took only one income back in the day to support a middle-class standard of living. Now it takes both parents, scratching and struggling. But if you’re an egghead economist, it’s all good because “the economy” as measured by GDP is bigger.

This ugly disconnect was underscored a few years ago — quite unintentionally — by former Florida Gov. Jeb Bush.

This ugly disconnect was underscored a few years ago — quite unintentionally — by former Florida Gov. Jeb Bush.

When Jeb! was still a semi-viable presidential candidate in the summer of 2015, he gave a fatuous speech in which he got a lot of flak for saying, “People need to work longer hours.”

The quotation in context was much more revealing, though. Let’s pull it apart…

“My aspiration for the country — and I believe we can achieve it — is 4% growth as far as the eye can see.”

Let’s all pull together for a statistical abstraction. Inspiring!

“Which means,” he continued, “we have to be a lot more productive, workforce participation has to rise from its all-time modern lows. It means that people need to work longer hours and, through their productivity, gain more income for their families.”

And then, the coup de grace…

“That’s the only way we’re going to get out of this rut that we’re in.”

The “rut” that Jeb! was referring to was the gargantuan national debt — $18.1 trillion then, $30.5 trillion a mere seven years later.

The “rut” that Jeb! was referring to was the gargantuan national debt — $18.1 trillion then, $30.5 trillion a mere seven years later.

Basically, he was telling you that even being a two-earner household was no longer enough. He was saying one of you needed to take on a second job as well — to generate more tax revenue for Uncle Sam and to keep the Treasury solvent.

Understand, there are only a limited number of ways a government can overcome a crushing debt burden.

- It can slash federal spending and balance the budget (yeah, right)…

- It can default on the debt (not good for the government’s credibility)…

- It can inflate the debt away (a sneaky way to default)…

- Or it can try to enact policies that will generate more “economic growth” and a higher GDP number, thus generating more tax revenue. This has the effect of reducing the ratio of debt-to-GDP — even as the debt itself continues to rise.

Over the years, Republican politicians like Jeb! would give lip service to No. 1… but inevitably they’d gravitate to No. 4. They’d frame it as “growing our way out” of an untenable situation.

Long before pandemic stimmy checks blew up the national debt to stupendous new heights… “growing our way out of it” was not viable.

Long before pandemic stimmy checks blew up the national debt to stupendous new heights… “growing our way out of it” was not viable.

“The fiscal gap is too great to close it with growth alone,” said former U.S. Comptroller General David Walker in 2018. “Over 70% of the budget now is on autopilot — so-called mandatory spending, Social Security, Medicare, Medicaid, etc. We have made no meaningful progress on defusing that ticking time bomb.”

One day, that bomb will go off. And yes, we’ll help you prepare as that day draws closer.

But until it does… you now have some context for why the politicians and the economists are obsessed with GDP… and why a rising GDP does not necessarily translate to your own well-being.

To the markets… where “post-Fed letdown” has not materialized.

To the markets… where “post-Fed letdown” has not materialized.

As expected, the Federal Reserve jacked up short-term interest rates another three-quarters of a percentage point yesterday. More important to the markets, Fed chair Jerome Powell signaled he’s open to smaller rate increases for the balance of 2022. With that, stocks got on the rally tracks.

That rally continues this morning. The Nasdaq is back above 12,000 for the first time in a week.

The Dow is back above 32,000 for the first time since June 9. The S&P 500 is over 4,000, also for the first time since June 9.

➢ The major averages are also shrugging off the news from Facebook parent Meta Platforms: The company reported its first year-over-year decline in revenue ever. Seems all the cool kids have moved on to TikTok and this whole metaverse thing will take years to pay off. Shares are down nearly 7%.

Really, every major asset class is in rally mode — including precious metals. Gold trades at $1,755 and silver is just a nickel away from $20. (Dare we say that support at $1,680 gold and $18.50 silver has held up? Maybe!)

Bonds are rallying too, pushing yields down. The yield on a 10-year Treasury note is under 2.7% for the first time since early April.

Cryptos? Yep, they’re rallying. Bitcoin is barely $100 away from $24,000.

About the only thing moving lower is oil, a barrel of West Texas Intermediate down 42 cents to $96.84.

The lockdowns of 2020 are the gift that keeps on giving: Now you’re on the hook, dear taxpayer, to bail out American makers of semiconductors that are in fact quite profitable.

The lockdowns of 2020 are the gift that keeps on giving: Now you’re on the hook, dear taxpayer, to bail out American makers of semiconductors that are in fact quite profitable.

Yeah, that’s our cheeky take on the big news from Washington — Senate passage of the “CHIPS and Science Act of 2022” by a 64-33 vote. [Just in: It’s passed the House, too.]

In theory, the legislation aims to build up domestic chipmaking capacity and compete better with government-subsidized chipmakers in China. In practice, it’s a $280 billion boondoggle — complete with $52.7 billion in direct handouts to U.S. manufacturers.

“This chapter began with the disruption caused by lockdowns to global supply chains,” writes economist Veronique de Rugy in her syndicated column. “Unsurprisingly, that led to a series of semiconductor shortages aggravated by a surge in demand for automobiles. Automakers wrongly assumed that the original drop in demand would persist, canceled orders for semiconductors and then could not keep up with the buying public.”

It was a temporary problem that American know-how was already solving, says Ms. de Rugy — with the industry planning $800 billion of new investment, including $80 billion for new U.S.-based factories.

It was a temporary problem that American know-how was already solving, says Ms. de Rugy — with the industry planning $800 billion of new investment, including $80 billion for new U.S.-based factories.

Meanwhile, as we mentioned last year, the COVID-driven chip shortage actually gave a 10% boost to the U.S. chip industry’s revenues. This isn’t the automakers in 2009, for crying out loud. (Not that bailing them out was a good idea, either.)

Oh, well — in investing, “follow the money.” The news did goose the share prices of many semiconductor firms — something our Ray Blanco anticipated here in The 5 earlier this month.

Longer term, Ray says the companies best positioned to book ongoing profits from the CHIPS Act are Intel (INTC), Micron (MU) and Applied Materials (AMAT).

Uh-oh: Is GloboTax back from the dead?

Uh-oh: Is GloboTax back from the dead?

Another item of news from Washington is that Sen. Joe Manchin (D-West Virginia) has changed his mind and signed on to a scaled-back version of Joe Biden’s “Build Back Better” bill.

The details are hazy, but what was originally a $1.9 trillion spend-a-palooza has been trimmed to about $370 billion of health care and climate schemes.

Most of that cost — about $300 billion — would be covered by 1) stepped-up enforcement at the IRS and 2) a minimum 15% corporate income tax.

As you might recall, a 15% minimum corporate tax is the linchpin of a global scheme agreed to by representatives of 136 governments and jurisdictions last fall.

For much of this summer, it looked as if GloboTax was in trouble. Manchin’s support is key to passage in a 50-50 Senate, so his flip-flop — there’s no other word for it — is a huge development.

➢ Exactly why Manchin came around to the White House’s position, he’s not saying. Reminds us of Rep. Dennis Kucinich (D-Ohio) changing his mind on Obamacare in 2010. Kucinich favored a Canadian-style “Medicare for all” health care system, so he opposed Obamacare from the left — until he took a mysterious flight with Obama aboard Air Force One. Despite his change of heart and his yes vote, years later Kucinich still insisted, “Frankly, he was not that persuasive.”

Meanwhile, the legislation has been rebranded as the “Inflation Reduction Act of 2022.” Yeah, pull the other one…

The Choco Taco is dead. Long live the Choco Taco?

The Choco Taco is dead. Long live the Choco Taco?

Maybe you saw the news this week…

The multinational consumer-goods giant Unilever decided to kill off a legendary product in its Klondike ice cream line — the Choco Taco.

“Over the past two years, we have experienced an unprecedented spike in demand across our portfolio,” a Klondike flack tells The Associated Press, “and have had to make very tough decisions to ensure availability of our full portfolio nationwide.”

(So we can blame this on the pandemic-lockdowns-supply chains, too? Seems to be the implication…)

Reddit co-founder Alexis Ohanian has approached Unilever about buying the rights to the brand and formula. So far, no response.

But it appears there’s no shortage of smaller purveyors ready to step into the breach and fulfill demand for ice cream in a taco-shaped waffle cone, dipped in chocolate and peanuts. The Salt & Straw chain in the Pacific Northwest is among those gearing up. Other variants on the Choco Taco appear to exist already in San Francisco and Chicago.

Granted, it might take a while to figure out how to spin up mass production. “Hand-piping ice cream into every single mold and making sure it doesn’t slide out or melt out — we could make like 10 a day,” says Salt & Straw’s founder Tyler Malek. “To this day, I have no idea how [Klondike was] able to make so many of them,” he tells the San Francisco Chronicle.

Malek better get it figured out right quick: He’d like to roll out his version in time for National Taco Day in October!

Best regards,

Dave Gonigam

The 5 Min. Forecast