- The Fed’s balancing act (“terminal rate”)

- Through the years: A marred matinee idol

- Jim Rickards on “when the crash comes”

- Will SBF get “Epsteined”?

- (Meh) Fusion energy breakthrough… Canceling The Nutcracker… And more!

The fate of the markets for the rest of 2022 and into 2023 hinges on an obscure bit of terminology known as “the terminal rate.”

The fate of the markets for the rest of 2022 and into 2023 hinges on an obscure bit of terminology known as “the terminal rate.”

As we’ve done from time to time this year, we’re hitting “send” on this edition of The 5 at exactly 2:00 p.m. Eastern Time, coinciding with a meeting of the Federal Reserve’s Open Market Committee… and with each step the committee takes toward a spectacular market crash.

The Fed is raising the fed funds rate another half percentage point, to 4.5% — the highest in 15 years. As a reminder, the rate still sat near zero a mere nine months ago.

There will undoubtedly be details and nuances that we’ll unpack tomorrow. But the point is that — as Jim Rickards wrote to his Countdown to Crisis readers yesterday — “When the crash comes, it will be epic.”

(Not a member of Countdown to Crisis yet? Follow this link and Jim will let you in on a trade that could 10X your money during a crash… and he’s putting $10,000 of his own money on the line. Watch now, because events are moving quickly and for that reason we’re taking this presentation offline tonight at midnight.)

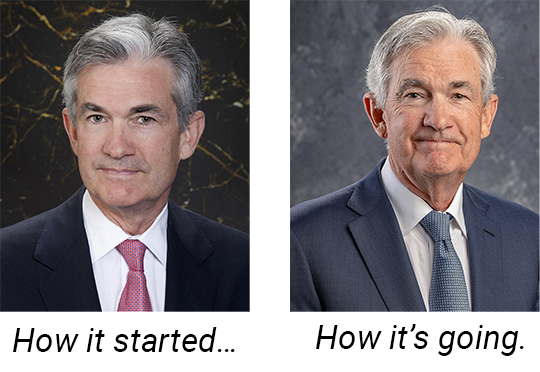

Before we dive into the whys and wherefores of the terminal rate… we pause a moment to examine the toll the job of Fed chair is taking on Jerome Powell.

Before we dive into the whys and wherefores of the terminal rate… we pause a moment to examine the toll the job of Fed chair is taking on Jerome Powell.

We noticed a few weeks ago that Powell has updated his official photo on the Fed website. The previous one dated to 2012, when he first took a seat on the Fed’s Board of Governors. It’s the older photo that prompted us years ago to remark on his “aging movie heartthrob” good looks.

Oh what a difference a decade makes…

Dude’s aged 20 years in the last 10 — most of that in the last five since he was nominated as chair. (He’s 69 now.)

And yet when it came time to re-up for another four-year term earlier this year… he was all on board.

Brings to mind Henry Kissinger’s line about how power is “the ultimate aphrodisiac.” (That’s two days in a row we’ve had occasion to cite Henry the K. Hmmm…)

Back to Fed policy beyond today: “Powell’s Plan is to keep raising rates until he reaches what’s called the terminal rate,” says Jim Rickards.

Back to Fed policy beyond today: “Powell’s Plan is to keep raising rates until he reaches what’s called the terminal rate,” says Jim Rickards.

“What’s the terminal rate? No one knows, but the Fed has adopted the attitude that ‘We’ll know it when we see it.’ The working definition is a rate that’s high enough to bring down inflation on its own without further rate hikes.”

As we mentioned yesterday, inflation is still high, but falling steadily — from 9.1% last June to 7.1% in November.

According to the conventional wisdom on Wall Street, Powell’s work is basically done.

“With inflation coming down and a recession in the cards,” says Jim, “the market’s view is that Powell will get the memo, he’ll stop raising rates after today, he’ll pivot to rate cuts by March or May, the economy will come in for a soft landing, so buy stocks!”

Jim’s assessment: “The market is right that inflation is coming down and a recession is in the cards. But the market is wrong that Powell will blink. He won’t. He’s in search of the terminal rate the way Ahab searched for the White Whale in Moby Dick.

Jim’s assessment: “The market is right that inflation is coming down and a recession is in the cards. But the market is wrong that Powell will blink. He won’t. He’s in search of the terminal rate the way Ahab searched for the White Whale in Moby Dick.

“Here’s the reality. We are heading for a recession. It will be especially acute because Powell will raise rates too high. The terminal rate is already in the rearview mirror. The market cheerleaders are bidding up stock prices in the false hope that Powell will see reason.”

Instead, Powell sees only models given him by the Fed’s egghead economists — models that time and again have led the Fed to “crash the airplane” instead of achieving the elusive “soft landing.”

“We may be in the worst of all worlds,” Jim concludes — “where markets bid up stocks based on false hopes of Powell’s intentions and Powell continues raising rates based on false models.”

Result? As we’ve said all week, it’s either a nasty market reaction now… or a nasty market reaction later.

Jim has you covered with both outcomes. That’s the whole idea behind his one-of-a-kind “10X crash trade.” It can make you 10 times your money whenever the crash comes. Jim’s conviction level is so high, he’s put $10,000 of his own money into this play.

But with the Fed pulling the trigger again at the very moment this missive hits your inbox… the window of opportunity is slamming shut. Take a look at Jim’s warning and action plan right now before it’s too late.

In the meantime, the markets are drifting slightly higher as the Fed announcement approaches.

In the meantime, the markets are drifting slightly higher as the Fed announcement approaches.

The Dow is up another third of a percent to 34,237… the S&P 500 is up a half percent to 4,039… and the Nasdaq is up a half percent at 11,314. Bond yields are mixed, the 10-year Treasury a hair below 3.49%. Precious metals are little moved — gold at $1,810, silver at $23.76.

Crude is up another $1.25 ahead of the Energy Department’s weekly inventory numbers, to $76.64 a barrel.

Repairs of the Keystone pipeline leak in Kansas are proceeding apace. Keystone operator TC Energy is promising a full restart by next Tuesday, pending federal approval of a restart plan — which as we write the company hasn’t submitted to the feds yet.

Crypto prices are hanging tough despite a new rupture in the space.

Crypto prices are hanging tough despite a new rupture in the space.

Yesterday, Binance — the world’s biggest crypto exchange — halted withdrawals of the stablecoin USDC for about eight hours amid as much as $3 billion in outflows.

But Binance’s own coin, known as BNB, still appears to be all right. Thus at last check, Bitcoin is just over $18,000 and Ethereum is at $1,340.

Meanwhile, a judge in the Bahamas has denied bail to FTX co-founder Sam Bankman-Fried. He’ll remain in a Bahamian lockup until at least Feb. 8. Whenever he’s extradited to the United States, there’s a good chance he’ll be held at the Metropolitan Correctional Center in New York — the same place where Jeffrey Epstein was taken in 2019.

Alternatively, it wouldn’t surprise us if the feds ginned up excuses to keep SBF lingering in Bahamian custody for a looong time.

Actually bringing a case to trial? That could prove profoundly embarrassing for legions of people in America’s power elite who either 1) fell for SBF’s song and dance or 2) actively colluded in his shenanigans.

If you suspect there’s less than meets the eye to the much-ballyhooed “fusion energy breakthrough” announced by the government yesterday, you’re right.

If you suspect there’s less than meets the eye to the much-ballyhooed “fusion energy breakthrough” announced by the government yesterday, you’re right.

“Scientists studying fusion energy at Lawrence Livermore National Laboratory in California announced on Tuesday that they had crossed a long-awaited milestone in reproducing the power of the sun in a laboratory,” was The New York Times’ take.

“That sparked public excitement as scientists have for decades talked about how fusion, the nuclear reaction that makes stars shine, could provide a future source of bountiful energy.”

“Meh,” say our experts at Paradigm Press — even our energy expert Byron King, who visited the National Ignition Facility in Livermore, California, in 2013. “NIF is a technological marvel,” he says, pulling off achievements like “getting lasers to converge from 192 different directions all at the same time, down to the billionth of a second.”

All that technology — just to generate heat to boil water and spin a turbine to create electricity.

Did the Livermore breakthrough really generate more energy than it created? “The claim to have exceeded breakeven is extremely misleading,” says Paradigm tech specialist Ray Blanco — “since it doesn’t account for the extreme inefficiency of the lasers, or the losses that would be involved if the energy given off by the reaction were to be harvested and used.

“Plus, it was a tiny bit of energy. Not sure how they could ever scale this method to generate a practical amount of electricity.”

Bottom line: “NIF is a true national asset,” says Byron King. “And we might see more advancements over the next 50 years — those of us who live so long.

“Don’t buy into the hype. Just wish everyone well, and keep the funds flowing to NIF for more of that basic science.”

Wait… If you spend your money during the holidays on a performance of The Nutcracker, you’re enabling Russian aggression?

Wait… If you spend your money during the holidays on a performance of The Nutcracker, you’re enabling Russian aggression?

In an Op-Ed for The Guardian, Ukraine’s culture minister Oleksandr Tkachenko writes that Vladimir Putin uses Russian culture as “a tool and even a weapon” against the West.

Thus, he’s urging a temporary boycott of Russian artists and composers. “We’re not talking about canceling Tchaikovsky, but rather about pausing performances of his works until Russia ceases its bloody invasion.”

Oy. We took note way back in March when an orchestra in Wales canceled an all-Tchaikovsky concert — even though Tchaikovsky died in 1893 and as one sensible person pointed out on social media, “He was gay, liberal and ultimately rejected Russian nationalism.”

So far, major ballet companies aren’t budging from their plans to stage The Nutcracker over the holidays. Not when, for instance, it accounts for nearly half of the New York City Ballet’s annual ticket revenue.

“The Nutcracker‘s secure place as a seasonal tradition has made it into the crown jewel of every self-respecting troupe’s repertoire,” reports NPR — “as well as its main moneymaker.”

To the mailbag, and a reader’s inquiry after yesterday’s inflation numbers…

To the mailbag, and a reader’s inquiry after yesterday’s inflation numbers…

“I was wondering if inflation today is 7.1%… and if it’s around 15% using the method the government used 40 years ago… and if today’s core PCE rate is 5%… then wouldn’t the equivalent core rate be around 10% using the 40-year-old method?

“If that’s the case and inflation is really running 15% then isn’t it likely that when the Fed gets interest rates to 5%, inflation will still run rampant? Won’t they need to get to around 10% to really get inflation to go down?”

The 5: Great question. The all-time peak in core PCE was 10.2% in February 1975 — when Paul Newman and a cast of thousands were the big box office draw in The Towering Inferno and Linda Ronstadt topped the charts with “You’re No Good.”

Another peak of 9.8% came in November 1980, when inflation frustrations helped sweep Ronald Reagan into the White House. So yeah, you’re onto something with your 10% thinking.

Remember, though, inflation is not — as the late Milton Friedman said — “always and everywhere, a monetary phenomenon.”

It is just as much a psychological phenomenon. If for whatever reason people are too frightened to go out and spend money, then no amount of money-printing by a central bank is going to generate broad increases in consumer prices. This has been the lesson of Japan for the last three decades.

The willingness to spend is what economists call velocity. Jim Rickards has been paying heed to velocity signals for many years.

As painful as inflation has been throughout 2022, velocity has remained in check: That is, it’s not as if folks are going out and snapping up everyday goods at the store before the prices go up again (even if we think that’s a great idea). By and large, they’re grinning and bearing it — or even waiting for prices to come back down.

The Fed pays heed to inflation expectations as much as it does inflation itself. And most folks, unlike you and me, pay attention only to the official managed-and-massaged inflation numbers. If the mainstream tells them inflation is back under control, and if the pace of price increases is slowing… well, it becomes something of a self-fulfilling prophecy.

That said, the “inflation is back under control” moment will come only after the Fed crashes the economy and the markets — which brings us back full circle to Jim Rickards’ warning at the start of today’s 5. (You have watched it by now, right?)

Best regards,

Dave Gonigam

The 5 Min. Forecast