- Power trippers, UFOs and FUD

- DIY state of emergency in South Africa

- “Load-shedding” American style

- Jet fuel and travel stocks: Ready for takeoff

- The cost of doing business (Super Bowl ads)… Condi says the quiet part out loud… Gold’s glass-half-full interpretation… And more!

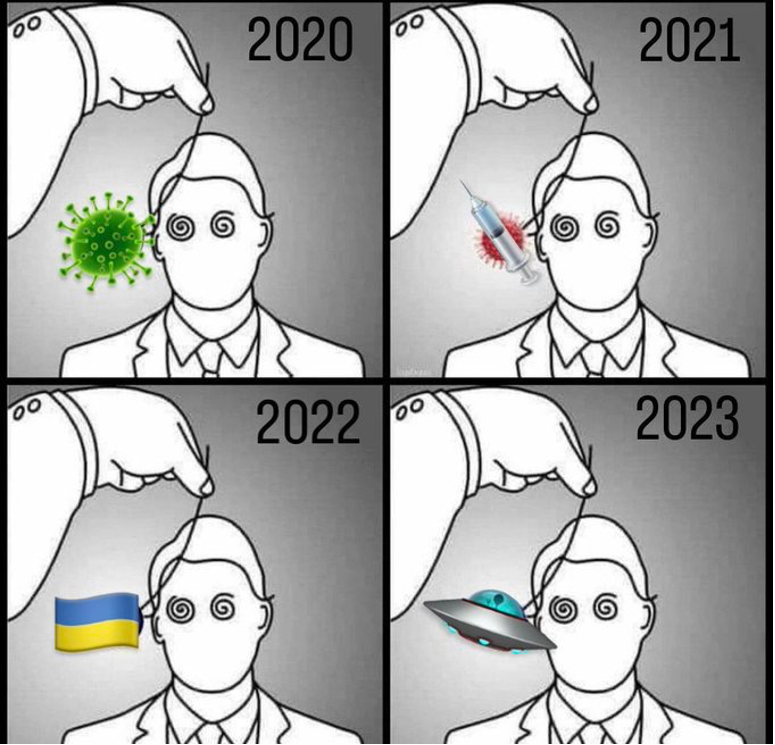

Really? Six weeks into Anno Domini 2023, this is the shape of things to come?

Really? Six weeks into Anno Domini 2023, this is the shape of things to come?

Look, we don’t know any more than you do about the three “objects” shot down by U.S. military jets on three consecutive days. All we know is that the control freaks and power trippers among us will never miss an opportunity to exploit FUD. (If the term is unfamiliar, that’s “fear, uncertainty and doubt.”)

So we’ll leave it there for today… and return to a different catalyst for a crisis, one that’s easier for us to wrap our arms around…

The South African government has declared a state of emergency in response to a crisis of the South African government’s own making.

The South African government has declared a state of emergency in response to a crisis of the South African government’s own making.

As we mentioned last month, 15 years of mismanagement at the state-owned electric utility Eskom have resulted in extreme levels of “load shedding” — rolling blackouts totaling as much as 15 hours a day.

“We have had customers who assume that we are closed because of load-shedding,” says Thando Makhubu, owner of an ice cream shop in Soweto. “So I am really worried that if load-shedding worsens, people won’t come,” he tells the BBC.

President Cyril Ramaphosa issued the emergency declaration during his state of the nation address last Thursday.

But the details remain sketchy, and the opposition party fears corruption at best and a power grab at worst. “[It] gives unfettered powers to the executive, the parliament has no oversight over the executive under some of those sections of the act,” warns Siview Gwarube, chief whip of the Democratic Alliance.

Gwarube is right to be concerned… because “the disaster declaration is a direct copy of the one which put South Africa into a state of disaster due to COVID-19,” reports the South African edition of Business Insider.

Gwarube is right to be concerned… because “the disaster declaration is a direct copy of the one which put South Africa into a state of disaster due to COVID-19,” reports the South African edition of Business Insider.

President Ramaphosa designated an electricity czar of sorts — Nkosazana Dlamini-Zuma, a longtime rival within the ruling African National Congress. Note well: As the country’s “minister of Cooperative Governance and Traditional Affairs,” she was previously the country’s COVID czar.

Thus, Business Insider says the new declaration “gives the exact same five reasons why Dlamini-Zuma could issue ‘directions,’ or rule by decree: to protect the public, to offer relief, to protect property, to combat disruption and ‘dealing with the destructive nature and other effects of the disaster.’

“That language was created to deal with the kind of disasters routinely declared in South Africa, mostly drought and floods. But when COVID-19 hit, Dlamini-Zuma used those powers to, or gave other ministers the delegated power to, close borders, decree what clothing shops may sell and impose a curfew.”

Reassuring, huh?

As we also said last month, “load shedding” is a term Americans might become familiar with in 2023.

As we also said last month, “load shedding” is a term Americans might become familiar with in 2023.

The brownouts in California made national headlines last year. Even as the state is pushing people into electric vehicles, it’s asking EV owners to refrain from charging at certain hours of the day.

On the other side of the country, New York is bound and determined to get 70% of its electricity from renewables by 2030. “California’s brownouts last year are a glimpse of the green-energy nightmare awaiting New York,” says the New York Post’s editorial board.

And in flyover country, a total of 42 million people served by the Midcontinent Independent System Operator — including your editor — are on notice that “temporary, controlled outages” are a possibility in the event of extremely hot weather both this summer and next. There’s just not enough capacity to replace the coal and nuclear plants that have been shut down in recent years.

Paradigm’s macroeconomics maven Jim Rickards expects a 10-year energy crisis. Which will be hard to endure, yes. “But,” he adds, “because of certain opportunities brought on by the crisis, you can potentially grow your own personal wealth even while most of America suffers.”

In short, “the Energy Armageddon could create a one-time opportunity to secure new, substantial wealth.”

Subscribers to Rickards’ Strategic Intelligence are already clued in to the details: If you’re not among them, best heed Jim’s warning at this link right away.

As a new week begins, the early 2023 rally is trying to regain a head of steam.

As a new week begins, the early 2023 rally is trying to regain a head of steam.

After last week’s sell-off, all the major indexes are solidly in the green as we write — the Dow up a little less than 1%, comfortably back above 34,000… the S&P 500 up 1% and easily back over 4,100… and the Nasdaq up 1.5%, almost within 100 points of 12,000 again.

Crude has inched back above $80. Alas, precious metals are getting no love — gold down $13 to $1,852 and silver below $22.

But industrial metals are taking off again, and the most likely catalyst is the end of zero-COVID in China. Demand is surging — propelling copper prices to their best January in 20 years, while aluminum is up 10% on the year and tin up 11%. The Wall Street Journal is finally catching on to what we’ve been telling you for months: Supply will likely lag demand “because mining companies aren’t substantially increasing production.”

While gasoline prices are still well off their record levels of mid-2022, “Jet Fuel Prices Hit 12-Year Highs,” says a headline at the energy website Rigzone.

While gasoline prices are still well off their record levels of mid-2022, “Jet Fuel Prices Hit 12-Year Highs,” says a headline at the energy website Rigzone.

Here too, the reopening of China gets the credit. Demand for jet fuel is up 20% year-over-year: “As the Chinese took to the skies to celebrate their freedom and the Lunar New Year,” says a report from the research firm Kayrros, “national jet fuel demand doubled within a week.”

That’s not the whole story, though. It’s also a matter of chemistry, says Paradigm’s resident oil field geologist Byron King. “In a 42-gallon barrel of oil, maybe three gallons (it depends on the crude base) process out as jet fuel.

“If you want lots more jet fuel, you must refine many more barrels. But crude oil supply has plateaued, and Russia is cutting 500,000 barrels per day come March.”

Worse, the easy-pouring low-sulfur crude that comes out of most U.S. oil fields? It yields even less jet fuel than the “heavy, sour” stuff produced in other parts of the world.

The rising cost of jet fuel notwithstanding, travel and leisure stocks are poised for takeoff according to Paradigm’s income-and-retirement specialist Zach Scheidt.

The rising cost of jet fuel notwithstanding, travel and leisure stocks are poised for takeoff according to Paradigm’s income-and-retirement specialist Zach Scheidt.

“Following the pandemic, businesses are putting sales teams back on the road. Families are traveling again. China is reopening and allowing tourists in and out of the country…

“All of this is putting strain on the travel industry. Meanwhile, it’s creating huge profits for airlines, hotels, cruise lines, high-end restaurants and similar businesses.

“I don’t expect this trend to back off anytime soon, which means there’s still an opportunity for you to invest in these stocks.”

And then Zach goes a step further: “Forget overpriced artificial intelligence and machine learning stocks. Today’s hot area is the travel and leisure industry, which means it’s a great time to add more of these stocks to your retirement portfolio.”

Zach is back tomorrow to run down five “technology” names that have run up too far too fast this year…

It’s too bad there isn’t a way to invest in futures tied to the cost of a Super Bowl commercial. Because it would be a sure winner.

It’s too bad there isn’t a way to invest in futures tied to the cost of a Super Bowl commercial. Because it would be a sure winner.

A typical 30-second spot during the Eagles-Chiefs matchup last night netted Fox $7 million. That’s 175 times what it cost to advertise during the original Packers-Chiefs matchup in 1967. And even if you adjust for inflation, the appreciation is 15x.

A bubble destined to burst? Maybe, maybe not.

Compared with decades gone by, the Super Bowl is the only opportunity for advertisers to put their wares in front of vast numbers of people all at once. On a list of the most-watched TV broadcasts of all time — that is, the sheer number of eyeballs watching — almost every entry in the top 10 is a Super Bowl.

Meanwhile, on a list of the 10 TV programs with the highest Nielsen ratings of all time — that is, the percentage of homes with TVs that were tuned in to that show — only one aired in the 21st century.

Super Bowl XLIX — the Patriots-Seahawks matchup in 2015 — ranks No. 9 on the list with a 47.5 rating.

Meanwhile, every show in the top five aired between 1977–1983 — the last episode of M*A*S*H, the “Who shot J.R.?” episode of Dallas, the final installment of Roots, and Super Bowls XVI and XVII in 1982 and ’83.

The year 1983 was the zenith of broadcast television and the Big Three networks; from that year forward, cable began making more and more inroads. If it’s a mass audience you want nowadays, the Super Bowl’s all ya got.

“Wow, nice find with the Condoleezza Rice clip,” a reader writes after Friday’s edition. “Right at the end I said ‘holy ****’ out loud.”

“Wow, nice find with the Condoleezza Rice clip,” a reader writes after Friday’s edition. “Right at the end I said ‘holy ****’ out loud.”

The 5: Yeah. Good find Emily had there.

In theory, economic sanctions are supposed to be aimed at changing the behavior of the government in the targeted country so that in time the sanctions can be lifted.

But after the last 12 months, it’s blindingly obvious the point of the sanctions against Russia is not to force Russian troops out of Ukraine.

If Moscow withdrew and sanctions were lifted, well, then Russian energy could start flowing again to Germany and the rest of central and western Europe. Who in Washington would want that when there’s a huge new bounty flowing to, say, Cheniere Energy and the other American companies producing liquefied natural gas for the foreign market?

No, the point of the sanctions against Russia is to permanently alter global flows of energy. That was also the point of Washington blowing up the Nord Stream pipelines.

Meanwhile, the mainstream pushback against Seymour Hersh’s Nord Stream expose has been nothing short of breathtaking. To wit…

Also, check out this headline after the White House issued a pro forma denial…

As the acid-tongued Australian media critic Caitlin Johnstone quipped on Twitter, “Love how Reuters calls it a ‘blog post’ to imply that Sy ****ing Hersh is just some rando with a Tumblr account.”

“So central banksters are accumulating gold at a record pace — and no prior year comes close to 2022,” writes a reader reacting to an item we’ve mentioned more than once recently.

“So central banksters are accumulating gold at a record pace — and no prior year comes close to 2022,” writes a reader reacting to an item we’ve mentioned more than once recently.

“Yet,” he says, “the dollar price of gold slogs sideways as if it’s being suppressed in perpetuity. And I toggle back and forth between cynicism and cognitive dissonance.

“Anyway I had a moment of clarity when I saw this post:

“I don’t know the author or what his business model is, but IMHO that sums it up well.

“P.S. The ‘All Previous Records Smashed’ graphic in Thursday’s edition of The 5 is compelling.”

The 5: We’ll opt for the glass-half-full interpretation today: The dollar price of gold would be substantially lower in the absence of all that central bank gold buying.

Jim Rickards says Russian and Chinese acquisition alone “will put a de facto floor under the gold price.”

Yes, the big smash earlier this month after the U.S. job numbers was discouraging. But even at sub-$1,850 levels today, that’s a heckuva lot better than $1,622 last September. And even though gold posted only a minuscule gain for 2022, it held its own in a rare year when both stocks and bonds took a beating.

And if that’s still not enough comfort for you, check out this edition of The 5 from just over a year ago. The longer the stock market goes without reclaiming its record highs, the better it looks for the Midas metal during the rest of the Flaming Twenties…

Best regards,

Dave Gonigam

The 5 Min. Forecast