- Revisiting a Suisse risk: “Why you need bankruptcies”

- Zooming toward financial censorship

- How the FDIC perceives Main Street know-nothings

- “Triggered by a NEWSLETTER”

- The Fed: Will they or won’t they?… Zach Scheidt on two trends pegged to a weak USD… A wing-and-a-prayer lawsuit… And more!

“This is why you need bankruptcies,” says Sean Ring, Paradigm’s editor at the Rude Awakening, who worked as a Credit Suisse trader and vice president for 11 years, based in both London and Hong Kong.

“This is why you need bankruptcies,” says Sean Ring, Paradigm’s editor at the Rude Awakening, who worked as a Credit Suisse trader and vice president for 11 years, based in both London and Hong Kong.

“How long did the clowns running [Credit Suisse] stay past 2008? When did they leave? Like, yesterday?” he snarks. This after middling Silicon Valley Bank’s malady has spread to a “systemically important financial institution” — so CS was deemed after the 2008 financial crisis.

Regardless, Credit Suisse has been on the ropes for months, if not years. And whatever its label, CS shares have cratered to record lows (down about 20%) after its biggest investor, Saudi National Bank, refused to backstop the infirm bank. “The answer is absolutely not,” Chair Ammar Al Khudairy put it plainly.

According to Sean?

“It was a sh*t bank anyway,” he says. “No more investment bank. Tried to be a private bank for the rich. Except UBS, as usual, got there years — and I mean like five years — before.”

“It was a sh*t bank anyway,” he says. “No more investment bank. Tried to be a private bank for the rich. Except UBS, as usual, got there years — and I mean like five years — before.”

And so, a former colleague of Sean’s — name and location redacted — telegraphs today…

While Sean eulogizes: “To my dear friends and colleagues who daily shook their heads at the idiotic missives sent down from a woeful top-of-the-house, I salute you.

“It’s too bad captains don’t go down with their ships anymore.”

We’ll get to the fallout in the markets shortly. But first, an ill omen: Bank collapses are putting new wind in the sails of censorship-minded politicians and bureaucrats.

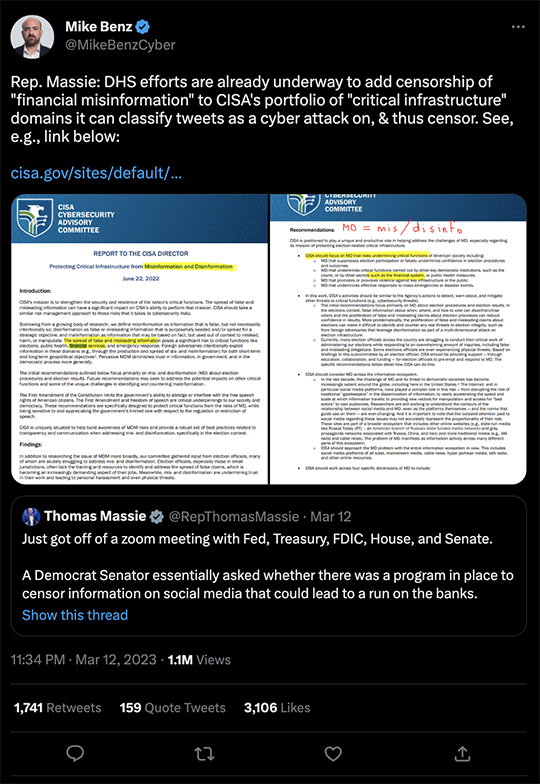

The Department of Homeland Security might have scrapped its dystopian “Disinformation Governance Board” last year… but the mission continues: Censorship. (Can we say that?)

The Department of Homeland Security might have scrapped its dystopian “Disinformation Governance Board” last year… but the mission continues: Censorship. (Can we say that?)

Correction: FINANCIAL censorship.

In June, Homeland Security’s Cybersecurity and Infrastructure Security Agency (CISA) recommended drafting steps to quash the “spread of false and misleading information” — especially anything that undermines “key democratic institutions, such as the courts, or by other sectors such as the financial system, or public health measures.” (Emphasis ours)

Which would leave pretty much all information under the feds’ purview, no? Bringing us to the most recent government power grab in the wake of SVB’s dissolution…

“During a conference call about the Silicon Valley Bank bailout [Sunday]” — which included 200 participants — “Sen. Mark Kelly (D-AZ) asked representatives from the Federal Reserve, Treasury Department and the Federal Deposit and Insurance Corporation (FDIC) if they had a way to censor information on social media to prevent a run on the banks,” says journalist Michael Shellenberger at his Substack, Public.

(By the way, Sen. Kelly says his remarks were misconstrued.)

Please note, this isn’t a Democrats-only phenomenon. Shellenberger points to “a statement by House Banking Chairman Patrick McHenry (R-NC)… that mentions social media.”

“This was the first Twitter-fueled bank run,” Sen. McHenry said Sunday about SVB’s collapse.

“This was the first Twitter-fueled bank run,” Sen. McHenry said Sunday about SVB’s collapse.

“At this time, it is important to remain levelheaded and look at the facts — not speculation — when assessing the right path forward.”

Without reading too much into McHenry’s statement, he implies the 99% shouldn’t worry their pretty little heads about things like bank runs. The coup de grace is that McHenry’s ilk might even blame the downfall of SVB on Twitter-wielding know-nothings.

If only we would leave things to the professionals!

Sen. McHenry says so himself: “I have confidence in our financial regulators and the protections already in place to ensure the safety and soundness of our financial system.”

But here’s how “our financial regulators” perceive Main Street…

But here’s how “our financial regulators” perceive Main Street…

A closed FDIC meeting in November of 2022

A few highlights from this 2022 FDIC meeting about the role of “bail-ins” (an alternative to bailouts whereby a bank on the brink could cancel debts owed to creditors and depositors):

- “You’d scare the public if you put this out there”

- “I don’t think you’d have much hope of reaching a public that doesn’t have a professional need to know”

- [Snicker] “There’s a select crowd, on the institutional side, and if they want to understand this, they’ll find a way to understand this.”

You get the idea…

In this context, the proposed clampdown on social media makes even more sense — in addition to, say, the FTC’s demand that Elon Musk “identify all journalists” involved with exposing the Twitter Files, as well as rounding up indy journalists Matt Taibbi and Michael Shellenberger to testify before Congress.

But there’s attempted media suppression that hits even closer to home…

“Was Silicon Valley Bank’s collapse triggered by a NEWSLETTER?” says a headline at the U.K.’s Daily Mail. (The sneer is unmistakable.)

“Was Silicon Valley Bank’s collapse triggered by a NEWSLETTER?” says a headline at the U.K.’s Daily Mail. (The sneer is unmistakable.)

“Bryne Hobart writes a popular daily newsletter, The Diff, exploring the latest developments in finance and tech. It was suggested that his post on Feb. 23 could have spooked Silicon Valley Bank investors…

“In Hobart’s February post he pointed out that Silicon Valley Bank had a debt-to-equity ratio of 185 and that it was ‘technically insolvent’ in the last quarter of last year,” the article says.

[Aside: Hobart also pointed out that $1.16 billion of SVB’s $74 billion loan portfolio was “premium-wine” backed — “an amount almost equal to last quarter’s marked-to-market equity.” As in, the Napa Valley wine industry, including this guy…

Ironically enough, The Diff newsletter, with around 50,000 paid subscribers, caters to the techie Silicon Valley set. So who knows whether The Diff tipped over the first domino in SVB’s collapse?

But it’s not the first time The 5’s had its own existential crisis — for instance, when Alex Jones was de-platformed in 2018. And whether you love Jones or hate him, we’ve felt the nexus between government and digital control becoming further enmeshed in the intervening five years. And now that you add financial censorship to the mix…

Well, we’ll still be around, in one form or another, even if the establishment gets its way.

[Banks are closing: First it was Silvergate… Then Silicon Valley Bank and Signature Bank… Will Credit Suisse be next? Or will your bank close its doors forever?

Don’t be a victim, and don’t wait… because, as Jim Rickards has been warning for a year, central bank digital currency trials are underway.

Scary, isn’t it? But you can learn the No. 1 way Jim knows to protect wealth… It’s the information you’re not supposed to know. And for that reason, we’ll be removing the link at MIDNIGHT.]

So yes, there’s definitely fallout from Credit Suisse hitting the markets today — just when the powers that be thought they’d tidied everything up with SVB, right?

So yes, there’s definitely fallout from Credit Suisse hitting the markets today — just when the powers that be thought they’d tidied everything up with SVB, right?

CS’ Swiss-traded shares ended the trading day down 24%. That’s on top of the 68% they’ve cratered in the previous year. The European stock market ended its trading day down about 3%.

Checking our screens stateside, the KBW Bank Index has slid 4.5%… and all the major U.S. stock indexes are well into the red. The Dow is down nearly 2% at 31,568… the S&P 500 down 1.7% to 3,853… and the Nasdaq down about 1% to 11,309.

Oil is trading as though the globe is about to tumble into a depression, a barrel of West Texas Intermediate down nearly 6% to a six-month low of $67.16.

Hot money is fleeing for the perceived safety of U.S. Treasuries, sending yields sharply lower: The 2-year Treasury note is now under 3.9%, a six-month low. And the yield curve remains inverted, with the 10-year at 3.47%.

Precious metals are also rallying, gold up to $1,924 and silver at $21.83.

Amid all the turmoil, futures traders are now betting the Federal Reserve will stand pat at its meeting a week from today — with no increase in the fed funds rate.

Amid all the turmoil, futures traders are now betting the Federal Reserve will stand pat at its meeting a week from today — with no increase in the fed funds rate.

In the meantime, Fed economists have no shortage of numbers to chew on. For the most part, today’s figures seem to reinforce the case for holding off on any more rate increases…

- Wholesale inflation: The producer price index slipped 0.1% in February, in contrast with expectations for a 0.3% jump. The year-over-year increase decelerated sharply from 5.7% to 4.6%, the lowest level in nearly two years

- Retail sales: Down 0.4% in February. If you factor out vehicle and gasoline sales, the number was flat — which is actually better than expected

- New York state manufacturing: The Fed’s Empire State survey has been negative for four straight months and the March reading is deeply negative at minus 24.6

- Homebuilder sentiment: Still negative but improving a bit, rising from 42 to 44, says the National Association of Home Builders. But that’s still below the 50 level, so home construction is still in contraction.

“After rebounding for much of February, the U.S. dollar turned sharply lower on Friday,” says Paradigm’s retirement-and-income authority Zach Scheidt. “That’s because investors don’t expect the Fed to be as aggressive this week,” he says, “thanks to the bank uncertainty and the rising unemployment rate.

“After rebounding for much of February, the U.S. dollar turned sharply lower on Friday,” says Paradigm’s retirement-and-income authority Zach Scheidt. “That’s because investors don’t expect the Fed to be as aggressive this week,” he says, “thanks to the bank uncertainty and the rising unemployment rate.

“If the U.S. dollar is about to resume its downtrend (and I believe it is), two areas of the market will benefit.

“First, precious metals should surge,” says Zach. “On Friday, the price of gold jumped sharply higher” — and the rally continues today. “This makes sense because it takes more dollars to buy an ounce of gold.

“Look for this trend to continue. And consider buying shares of gold mining stocks in addition to holding physical gold as an inflation hedge.

“Second, blue chip international stocks have an advantage,” Zach adds. “When the U.S. dollar is weak, it makes American products and services more competitive in overseas markets.

“That’s because customers with euros, yen or other relatively stronger currencies have more buying power. International dividend payers like Procter & Gamble (PG), Coca-Cola (KO) and Yum! Brands (YUM) tend to do well in this type of environment.

“I’ll be keeping a close eye on the next Fed decision, scheduled for March 22,” concludes Zach. “But for now, the picture looks bearish for the dollar, bullish for gold and bullish for large international dividend stocks.”

An Illinois man is suing Buffalo Wild Wings for “false and deceptive marketing and advertising” related to the eatery’s “boneless wings.”

An Illinois man is suing Buffalo Wild Wings for “false and deceptive marketing and advertising” related to the eatery’s “boneless wings.”

Plaintiff Aimen Halim says he ordered “boneless wings,” expecting the restaurant chain to serve deboned chicken wings. Instead, according to his lawsuit, “the Products are not wings at all, but instead, slices of chicken breast meat deep-fried like wings.”

The filing continues: “Consumers have suffered injury in fact, as a result of Defendants’ deceptive practices.” Oy…

“The defendants named in the suit include Buffalo Wild Wings Inc. and parent company Inspire Brands Inc.,” says an article at the Today show’s website. “When reached for comment, a representative for both companies directed us to the following…

That’s some fine Twitter work, right there… an exceptional nugget of information.

You all take care, and we’ll be back tomorrow with another episode of The 5.

Best regards,

Emily Clancy

The 5 Min. Forecast