- It’s official: “The most intense banking crisis since 2008”

- Powell’s (insane clown) posse

- Jim Rickards: “Biggest mistake any investor can make”

- The market? “Banks fold, tech holds”

- [Update] Operation Choke Point 2.0… All eyes on tech?… The LME’s latest nickel debacle… And more!

It’s officially “the most intense banking crisis since 2008,” says the Fed’s preferred mouthpiece Nick Timiraos at The Wall Street Journal.

It’s officially “the most intense banking crisis since 2008,” says the Fed’s preferred mouthpiece Nick Timiraos at The Wall Street Journal.

If you’ve been following The 5 for the last 11 days, you know the banking meltdown started with California’s crypto-centric Silvergate Bank, spread to Silicon Valley Bank, extended to New York’s Signature Bank and bounced back to San Francisco regional bank First Republic.

That’s four banks in 11 days… At the same time overseas, chronically ill Credit Suisse was on a knife edge, but ostensibly resuscitated by a “forced marriage” to Swiss banking giant UBS on Sunday.

Which brings us to Fed chair Jerome Powell’s (insane clown) posse…

Which brings us to Fed chair Jerome Powell’s (insane clown) posse…

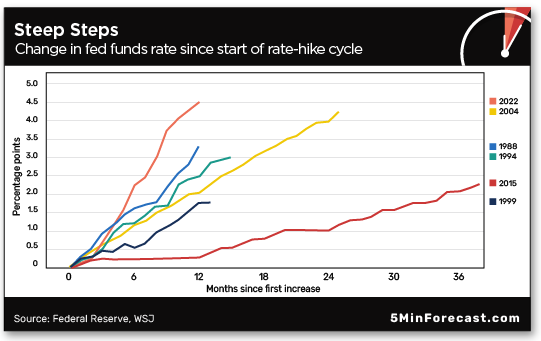

FOMC meetings are underway at the Eccles Building in D.C. today and tomorrow. And Powell’s juggling act includes the decision to raise (or not) fed fund rates to tame inflation… while, at the bare minimum, not aggravating a financial crisis and a recession. (By now, we suppose the chimera of a “soft landing” is totally off the table.)

Note: Even Timiraos’ official Fed channels are uncertain of the Fed’s direction going into tomorrow’s FOMC decision.

To say nothing of another economic stakeholder: Wall Street. “If the banking crisis passes… quickly,” says Timiraos, “a decision to pause rate rises risks worsening the inflation problem by igniting a market rally that counterproductively eases financial conditions.” (Emphasis ours)

But Paradigm’s macro authority Jim Rickards says that’s just wishful thinking…

“The biggest mistake any investor can make right now is to believe that the banking crisis is over,” Jim says.

“The biggest mistake any investor can make right now is to believe that the banking crisis is over,” Jim says.

“Veterans of such crises — and I include myself in that category — know that once the dominoes start falling, they keep falling until some government intervention of a particularly draconian kind is imposed.

“In less than two weeks, we’ve seen sequential bank failures,” Jim notes. “Some were handled by regulatory intervention, others by private bailouts and still others by central bank bridge loans. But in all cases, the target bank had either failed outright or was on the brink of failure.

“We’ve seen some significant regulatory actions from the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), the U.S. Treasury and the Swiss National Bank, but the fixes have been temporary and followed quickly by new failures.

“This will continue…

“What’s important to bear in mind is that crises of this type are not over in days or weeks. A slow-motion rolling panic that takes a year or longer is more typical,” Jim says.

“What’s important to bear in mind is that crises of this type are not over in days or weeks. A slow-motion rolling panic that takes a year or longer is more typical,” Jim says.

“The September 1998 financial crisis, involving Long Term Capital Management, actually began in Thailand with a currency devaluation in June 1997.” (Jim, in fact, was an eyewitness — he was one of the attorneys who helped with LTCM’s liquidation.)

Jim adds: “The September 2008 bankruptcy of Lehman Brothers was the culmination of a panic that started in the summer of 2007 with mortgage losses and a run on a French bank.

“That panic proceeded with the failure of Bear Stearns in March 2008 and the double failures of Fannie Mae and Freddie Mac in June 2008.

“In other words,” says Jim, “panics can run for a year or longer before they are finally squashed by massive regulatory intervention. Using that measure, the current crisis began in March 2023 with the Silvergate collapse and could run until early 2024 before matters are resolved.”

[Jim suggests: “Investors should increase their cash allocations and allocate up to 10% of investable assets to physical gold or silver as a hedge against a banking sector collapse. The time will come for stocks,” he says, but “not yet.”]

“The Fed is in an impossible position,” Jim concludes. “On the one hand, they must tighten monetary policy with further rate hikes to subdue inflation. On the other hand, they must loosen monetary policy through a new kind of QE — underwater asset repurchases — to keep banks afloat.

“The Fed is in an impossible position,” Jim concludes. “On the one hand, they must tighten monetary policy with further rate hikes to subdue inflation. On the other hand, they must loosen monetary policy through a new kind of QE — underwater asset repurchases — to keep banks afloat.

“The result is confusion both at the retail and institutional levels,” Jim says. “The economy is sliding into both a recession and a global financial crisis… with no salvation from a Fed pivot,” he admits. “And no way out for those who don’t act before 2 p.m. on Wednesday, March 22.

“According to my research,” says Jim, “America is about to get hit with a seismic-sized economic event. A crash so massive that the Dow could eventually plummet even 60%… and not recover for decades. I’m calling it the ‘Last Drop’ because once this crisis hits, there will be NO economic recovery.”

In case you missed Jim’s “Last Drop Summit” yesterday afternoon, you owe it to yourself to review Jim’s warning about this massive event set to hit the markets just 30 hours from now.

Who knows the mind of the market? Ahead of the Fed’s rate decision — more on that tomorrow — the tech-heavy Nasdaq is partying, up 1.15% to 11,810. In second place among the three major U.S. indexes, the S&P 500 is up 0.85% to 3,985 while the stodgy Dow is up 0.60% to 32,435.

Who knows the mind of the market? Ahead of the Fed’s rate decision — more on that tomorrow — the tech-heavy Nasdaq is partying, up 1.15% to 11,810. In second place among the three major U.S. indexes, the S&P 500 is up 0.85% to 3,985 while the stodgy Dow is up 0.60% to 32,435.

“Banks folds, tech holds” is market analyst Greg Guenthner’s pithy take today. “While many tech subsectors — and the Nasdaq Composite, for that matter — endured sharper pullbacks last month, semis are staying constructive and attempting to lead us out of this mess.

“The VanEck Vectors Semiconductor ETF (SMH) jumped more than 20% to kick off 2023 in style,” Greg says. “We highlighted NVDA’s strong post-earnings performance as one of the key reasons SMH held steady during recent market weakness.” (Keep reading for more Nvidia news.)

“Strength is spreading through the semis,” says Greg. “A clean breakout here could lead to the next leg of this powerful rally.”

Now turning to the commodities complex, oil’s bouncing back, up 2.3%… but still under $70 for a barrel of WTI. Looking at precious metals, gold’s pulled back 2.10% to $1,940.10 per ounce and silver’s down over 1%, above $22.

As for the crypto market, Bitcoin is up another 1.25% to $28,200 while Ethereum’s gathered 2.5% to $1,800.

“A little more about Operation Choke Point 2.0,” says Paradigm editor and crypto expert Chris Campbell.

“A little more about Operation Choke Point 2.0,” says Paradigm editor and crypto expert Chris Campbell.

Last month, Chis reminded us: “In 2013, there was a coordinated Obama-era effort by the DOJ, FDIC and OCC to marginalize industries they deemed unsavory.” (For further background on the feds’ “diabolical” scheme, this link takes you back nine years into The 5’s archive.)

“Since January,” says Chris, “there’s been a creeping suspicion in the crypto industry that we’re seeing an ‘Operation Choke Point 2.0’ targeting crypto.”

During the first go-round in 2013, for instance, “the OCC and FDIC began intimidating banks into shunning lawful but politically unfavored industries.

“The guy ultimately responsible [for the 2013 episode] was FDIC chair Marty Gruenberg, who served from 2012–2018. Now Gruenberg’s back… just sworn into the position again in January. (He and SEC chair Gary Gensler also worked for Sen. Paul Sarbanes [D-MD] at the same time, back in 2002, for what it’s worth.)

“By the way, it’s not just crypto sounding the alarm.

“Last year, the Independent Community Bankers of America (ICBA) accused the FDIC of trying to resurrect Operation Choke Point, targeting ‘climate-disfavored businesses and industries from the financial system,’” Chris notes. Mainly? Energy-intense crypto…

“Last year, the Independent Community Bankers of America (ICBA) accused the FDIC of trying to resurrect Operation Choke Point, targeting ‘climate-disfavored businesses and industries from the financial system,’” Chris notes. Mainly? Energy-intense crypto…

Over the weekend, for example, “a week after Signature Bank failed, the Federal Deposit Insurance Corporation said it has sold most of its deposits to Flagstar Bank, a subsidiary of New York Community Bank,” CNN says.

“Not included in the transaction is about… $4 billion in deposits from Signature’s digital bank business,” CNN says, “which will remain in the FDIC’s receivership.” (Emphasis ours)

“The FDIC claims they were acting as a neutral party and they didn’t influence Flagstar’s decision not to acquire the crypto deposits,” Chris adds.

“Could they be telling the truth? Sure. Crazier things have happened. But the crypto conspiracy theorists are feeling pretty vindicated this week,” he says.

“If, as some suspect, the U.S. is trying to push the crypto industry out — in a sly, indirect way that would only foment more distrust in the system — it would make me far more bearish on the U.S. than sour me on crypto,” Chris says.

“While eyes have been on the banking system, there’s been a lot going on in tech,” says Paradigm’s science-and-technology hand Ray Blanco.

“While eyes have been on the banking system, there’s been a lot going on in tech,” says Paradigm’s science-and-technology hand Ray Blanco.

“Early last week, the OpenAI Foundation released ChatGPT-4, the newest version of its artificial intelligence-enabled chatbot,” he says. “It’s a more powerful and refined version of the technology,” he explains. “The new version is trained [to] ‘understand’ and respond to human questions more intelligently.

“ChatGPT-4 is also what’s called a multimodal artificial intelligence, meaning it can do more than one thing. It doesn’t just chat and respond in natural language to text-based questions; it can also create images and audio based on user queries.”

Ray says: “Microsoft (NASDAQ: MSFT) has been a major investor in OpenAI and owns the license to use the technology. The company is already using ChatGPT-4 in a limited way on its Bing search engine,” he says, “but right now you might have to join a waitlist.” MSFT’s AI aspirations, in fact, might be the reason “shares broke out to a six-month high,” says Ray.

“New highs are also coming fast for AI hardware play Nvidia (NASDAQ: NVDA), which is now trading at levels near its one-year high. This week Morgan Stanley upgraded Nvidia to $304 based on the AI megatrend, representing an upside of about 18% to the current share price.

“Microsoft is considered an AI leader,” Ray says. “And all that AI capability demands more powerful chips” — Ray believes Nvidia is poised to deliver.

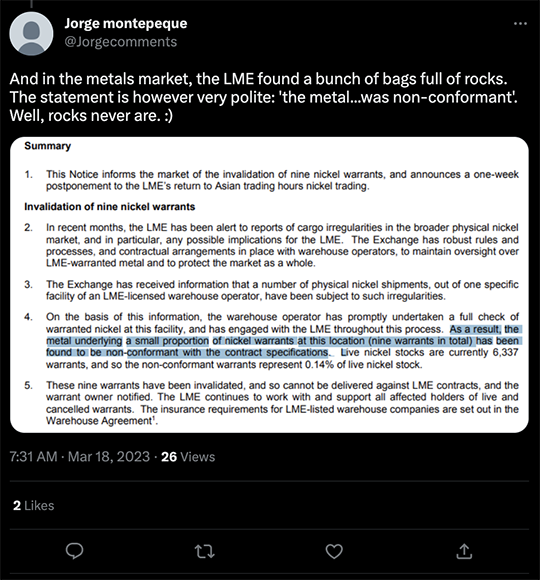

The London Metal Exchange (LME) has been rocked by another nickel scandal…

The London Metal Exchange (LME) has been rocked by another nickel scandal…

In February, we mentioned base metals trader Trafigura Group thought it had bought $577 million worth of nickel; instead, containers contained low-cost materials like carbon steel.

Now a Bloomberg article reports hinky dealings at an LME-approved warehouse in Rotterdam.

Namely, instead of stores of nickel, “Access World, which is one of the more prominent companies that operates facilities registered on the LME network, investigated and subsequently found that the bags of ‘nickel’ underlying nine contracts — representing 54 tons of metal — did not contain the nickel that they should have.

“The LME discovered the problem after it received reports that some nickel delivered out of a warehouse in Rotterdam contained bags of stones instead of nickel briquettes,” says Bloomberg.

“The LME discovered the problem after it received reports that some nickel delivered out of a warehouse in Rotterdam contained bags of stones instead of nickel briquettes,” says Bloomberg.

“For the [LME], the issue is a major headache, coming as it is still dealing with the fallout of its last nickel crisis — the cancellation of billions of dollars in trades after prices spiked last year.”

Just a little over a year ago, the LME violated the sanctity of trading contracts… to save a Chinese nickel tycoon from an $8 billion loss. “The nickel market has struggled to return to normal since the crisis,” Bloomberg says, “and is still operating on shortened hours.”

And how’s this for irony: “The LME had planned to allow the beleaguered nickel contract to resume trading during Asian hours [starting] Monday, but has delayed the move by a week.”

“We need the LME to function properly,” says BoA metals researcher Michael Widmer. “It’s just not at the moment, that’s the problem.”

And the same could be said for the rest of the fouled-up financial system, no?

Try to take it easy… We’ll be back with another episode of The 5 tomorrow.

Best regards,

Emily Clancy

The 5 Min. Forecast