- The next out-of-nowhere scare: Deutsche Bank

- Janet Yellen’s mixed signals (bank deposits)

- [Banking crisis] It only took a snowflake

- A conflated copper narrative

- TikTok: “Dude, can I get a word in edgewise?”… Trump’s trade war turns five years old… The SEC’s “bizarre” Coinbase crackdown… And more!

Aaand the next out-of-nowhere scare comes from… Deutsche Bank.

Aaand the next out-of-nowhere scare comes from… Deutsche Bank.

“Shares in the lender, one of Europe’s largest and most important, tumbled to their lowest level since last fall,” says The Wall Street Journal. “The cost to insure against default in Deutsche Bank’s debt jumped and there’s been a frenzy of bearish put options trading tied to the stock.”

A shock, perhaps, but no surprise. Like Credit Suisse, Deutsche Bank has been a basket case for years.

“Germany’s giant dead bank walking,” we labeled it in 2016. By some accounts, trouble at DB was the reason the “repo” market froze up in 2019 — a situation that might have become a full-blown financial crisis in 2020, but then COVID came along and gave the authorities cover for trillions in bailouts.

Thus, the question I posed on our internal Paradigm Press chat this morning: “Is this The End for DB, or just another act in a never-ending drama?”

Thus, the question I posed on our internal Paradigm Press chat this morning: “Is this The End for DB, or just another act in a never-ending drama?”

The short answer from Sean Ring, Rude Awakening editor and recovering investment banker: “Ze Germans can’t let DB go under. That would be like the U.S. government letting Citi go bankrupt.”

A longer answer from Dan Amoss, who heads up our Jim Rickards research unit: “I doubt that Deutsche Bank will follow Credit Suisse into a death spiral… The German government and [central bank] will do ‘whatever it takes’ to avoid a cutoff of credit to DB… DB is not great, but I think it’s much better managed than Credit Suisse was.”

Back in these United States, it’s become impossible to figure out Treasury Secretary Janet Yellen’s stance on protecting bank deposits.

Back in these United States, it’s become impossible to figure out Treasury Secretary Janet Yellen’s stance on protecting bank deposits.

On Tuesday, she told the American Bankers Association that the feds were ready, if necessary, to repeat what they did with Silicon Valley Bank — cover everyone’s deposits, including those over the FDIC’s $250,000 insurance limit.

Wednesday, she testified to the Senate — and that same promise was conspicuous by its absence in her prepared statement. All she said was, “The federal government’s recent actions have demonstrated our resolute commitment to take the necessary steps to ensure that depositors’ savings remain safe.”

Yesterday, she testified to a House subcommittee — and her prepared statement was tweaked to include the promise. “The strong actions we have taken ensure that Americans’ deposits are safe. Certainly, we would be prepared to take additional actions if warranted.”

Amazing how little it took to trigger all this trouble with the banks…

Meanwhile, the rescue of the banks has blown up the Federal Reserve’s balance sheet for a second week running.

Rather than show a one-year chart or a 20-year chart as we have in recent days… let’s look at it from the perspective of 18 months.

Let’s see, that’s nearly $300 billion during the first week of the crisis… and another $94 billion in the week ended on Wednesday.

Reminder: Jim Rickards says before the crisis is all over, the Fed’s balance sheet could swell by $3 trillion… bringing the total to about $11.3 trillion.

Jim addressed all of the foregoing topics this morning in a live briefing available to all Paradigm readers. You can catch the replay right now at this link.

For all the drama of this week… the U.S. stock market is on track to end the day where it started on Monday.

For all the drama of this week… the U.S. stock market is on track to end the day where it started on Monday.

At last check, the S&P 500 is down a little more than a half percent at 3,925. The index closed last Friday at 3,916.

The Dow is also down just over a half percent, back below 32,000. The Nasdaq is taking it worst, down nearly 1% at 11,688.

Economic numbers today include the “flash PMI” — which is showing a rebound in both manufacturing and services. The manufacturing index moved up from 47.2 to 49.3 — but that’s still below the 50 level, suggesting the factory sector is still contracting. Services bounced off the 50 level nicely — from 50.6 to 53.8.

Meanwhile, durable goods orders shrank 1% in February, in contrast with expectations for a 1.5% jump. But as always, the number is skewed by volatility in aircraft and military hardware. Strip those out and you get a modest 0.2% increase.

Commodities and cryptos: Gold keeps trying to punch through $2,000, but the powers that be keep punching back; as we write the bid is $1,990. Silver’s at $23.26. Bitcoin is hanging tough just under $28,000.

Crude is back below $70… while copper is back above the $4-a-pound level.

If the reopening of China isn’t giving a lift to oil prices… copper is a whole other story.

If the reopening of China isn’t giving a lift to oil prices… copper is a whole other story.

Trafigura, the world’s biggest private metals trader, projects copper will soar to record highs this year — exceeding the $5 levels of a year ago.

“What’s the price of something the whole world needs but we don’t have any of?” says Kostas Bintas, Trafigura’s co-head of metals and minerals.

His reasoning? “Global inventories of the metal used in everything from power cables and electric cars to buildings have dropped rapidly in recent weeks to their lowest seasonal level since 2008,” says the Financial Times, “leaving little buffer if demand in China continues to pace ahead.”

Goldman Sachs says Chinese copper demand last month was 13% higher than a year earlier. “Like oil in the 2000s, you’ve got to absolutely love copper in the 2020s,” says Goldman’s respected commodities research chief Jeff Currie.

Reminder: Crude soared that decade in the 2000s from $20 all the way to a peak of $147 in the summer of 2008.

The Beltway class took out all of its China frustrations yesterday — lost jobs, the lab leak, Taiwan, the alleged “spy balloon” — on the CEO of TikTok, Shou Zi Chew.

The Beltway class took out all of its China frustrations yesterday — lost jobs, the lab leak, Taiwan, the alleged “spy balloon” — on the CEO of TikTok, Shou Zi Chew.

Chew testified to the powerful House Energy and Commerce Committee about his firm’s immensely popular video-sharing app — and his company’s Chinese ownership.

The bipartisan frothing at the mouth was disturbing to watch.

Reason writer Elizabeth Nolan Brown: “Imagine someone repeatedly asking you if you plan to stop killing puppies. You would probably want to assert that you did not, in fact, kill puppies in the first place. Now imagine that every time you tried to say this, your interrogator yelled that whether you would stop murdering puppies was a simple yes or no question — so yes or no?

“That’s basically what happened with Chew at this hearing, over and over again.”

Sample exchange: “Rep. Bill Johnson (R–Ohio) claimed that TikTok’s code was ‘riddled’ with avenues of CCP ‘censorship’ and asked Chew whether he had directed TikTok employees to ‘change that source code.’ Chew started to object, saying he didn’t understand the question, and was told by Johnson that he should just answer yes or no.”

“Dude, can I get a word in edgewise here?”

The theater surrounding Chew’s appearance makes it easy to forget there’s actual legislation in the works empowering the president to ban TikTok outright, at his discretion.

The theater surrounding Chew’s appearance makes it easy to forget there’s actual legislation in the works empowering the president to ban TikTok outright, at his discretion.

Already one out of every five senators is sponsoring the bill — ranging from Mitt Romney on the right to Tammy Baldwin on the left.

As independent reporter Michael Tracey observes, “It would vest the president with unilateral power to make an incredibly vague determination that some entity poses a ‘national security’ risk, and then just let him take whatever punitive action he wants.

“Of course it’s not only China that would be designated a ‘foreign adversary’ whose ‘holdings’ are subject to censorship. And it’s not only TikTok that could be banned under this authority. It’s a sweeping new array of ill-defined ‘national security’ powers handed to the Executive.”

But as we said earlier this week — and as we’ve learned from both the Twitter Files and the court case Missouri v. Biden — TikTok is the only major social-media platform that doesn’t snap to it when one or another three-letter agency demands that someone’s account get the ban hammer.

The bipartisan anti-China animus that started five years ago this month with Donald Trump’s trade war ended up focused on Chew yesterday.

The bipartisan anti-China animus that started five years ago this month with Donald Trump’s trade war ended up focused on Chew yesterday.

We said in 2019 that the trade war was morphing into a new Cold War. Already that year federal employees were being warned by the FBI that their fellow soccer dads might be Chinese spies.

During the early weeks of COVID in 2020, Trump and Joe Biden were +ping each other with accusations of selling out to China.

When Nancy Pelosi visited Tawan last year, we observed that the Beltway class felt betrayed by Chinese leaders. A generation ago, the U.S. government started pursuing engagement with China on the assumption Beijing would become a pliant second-tier power under Washington’s thumb, like Boris Yeltsin’s Russia in the 1990s.

Now, with Beijing refusing to follow the script, U.S. military leaders talk openly about going to war with China over Taiwan in 2025.

And it was all so avoidable. We can’t help wondering how much of this history was running through Chew’s head yesterday as he was being berated nonstop for five hours.

The feds’ impending crackdown on Coinbase “isn’t groundbreaking or shocking. But the way the SEC has gone about this is bizarre,” asserts Paradigm crypto analyst Chris Campbell.

The feds’ impending crackdown on Coinbase “isn’t groundbreaking or shocking. But the way the SEC has gone about this is bizarre,” asserts Paradigm crypto analyst Chris Campbell.

As we mentioned yesterday, the Securities and Exchange Commission has notified Coinbase that it will probably sue within the next six months for a handful of ill-defined offenses.

Here’s what’s bizarre: “For starters,” says Chris, “it was two years ago that the SEC reviewed Coinbase and approved it to go public. And nothing has changed to its business model since.”

In addition, Coinbase agreed to SEC overtures to discuss registering some portion of its business with the agency. From there, “the SEC asked them to provide their views on what a registration path should look like,” says Chris.

“Coinbase spent millions of dollars on legal support to create these proposals for the SEC, repeatedly asking for their feedback. But in a span of nine months, Coinbase met with the SEC over 30 times, never receiving feedback on their proposals.”

By now it’s apparent what the SEC’s “feedback” is turning out to be. Bloomberg columnist Matt Levine summed it up thus yesterday…

By now it’s apparent what the SEC’s “feedback” is turning out to be. Bloomberg columnist Matt Levine summed it up thus yesterday…

- “There absolutely are existing, reasonably clear rules about how you register securities.

- “Yes, you’re right, it’s impossible for crypto tokens to follow those rules.

- “Oh well! Guess that means crypto exchanges are illegal.”

Coinbase Chief Legal Officer Paul Grewal threw up his hands in a blogpost: “Tell us the rules and we will follow them. Give us an actual path to register, and we will register the parts of our business that need registering.

“In the meantime, the U.S. cannot afford for regulators to continue to threaten the good actors in the crypto industry for doing the same legal and compliant things they’ve always done. This unfair approach will only drive innovation, jobs and the entire industry overseas.”

Yup. We give Chris Campbell the last word on the subject: “The world is changing rapidly. Hong Kong is softening its stance on crypto… the U.K. released a proposal for sensible regulation…

“As the U.S. tries to export and enforce its rules on the world, it increasingly feels like the world has stopped listening.”

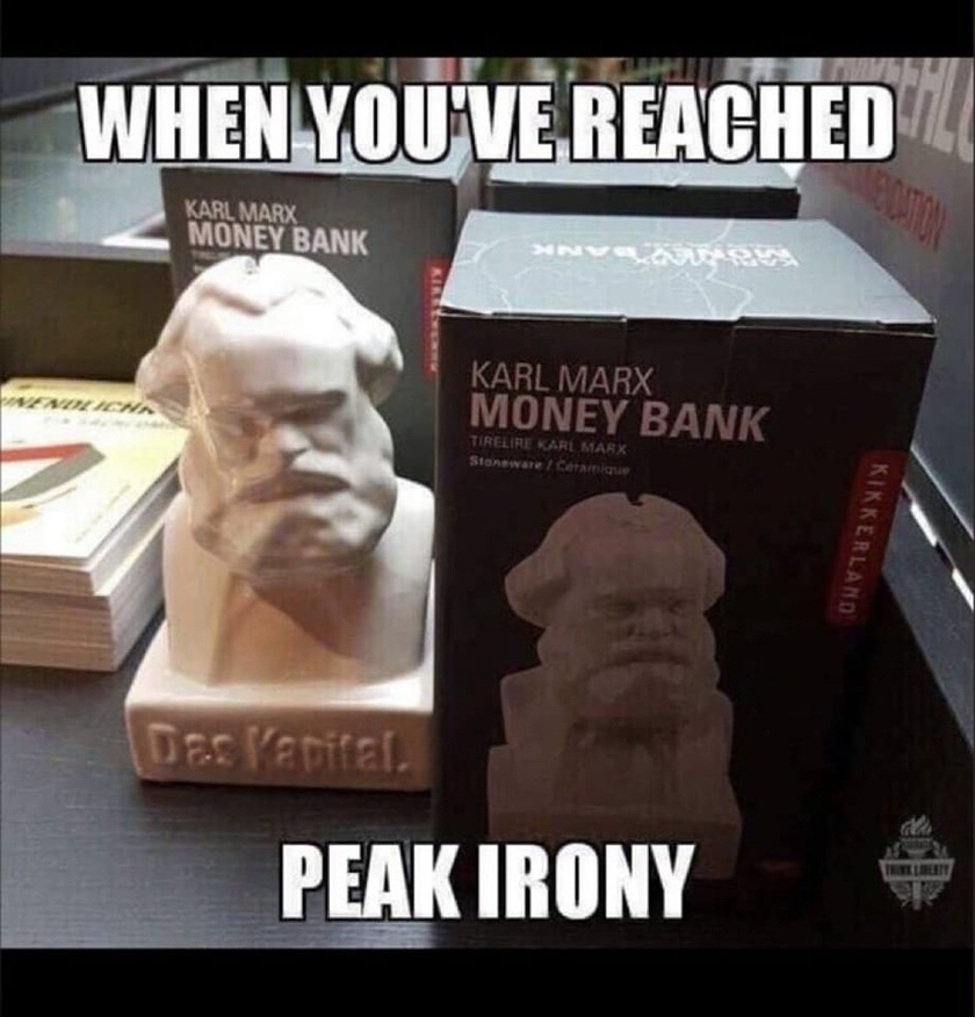

Time’s almost up — just enough for a meme…

Time’s almost up — just enough for a meme…

Have a good weekend,

Dave Gonigam

The 5 Min. Forecast