- A stock market retrospective: First four months of 2022

- One venture capitalist on old habits die hard (13-year bull market)

- Jim Rickards on Jay Powell’s catch-22

- Homeland Security’s new “Thinkpol”-in-chief

- [Wartime sacrifice] Europe’s dystopian brand of propaganda

- A cliffhanger from The 5’s mailbag (good questions).

The first four months of 2022 are now in the books, and they’re four months for the ages…

The first four months of 2022 are now in the books, and they’re four months for the ages…

In other words, damage comparable to the other two big, bad bear markets so far this century.

Worse, this time it could be just the beginning — based on Jim Rickards’ updated outlook for the rest of the year.

Moments ago, Jim wrapped up an exclusive briefing for a select group of our readers. If you missed the premiere at 2:00 p.m. EDT, you can be among the first to watch the replay and learn how to brace for the incoming impact. We urge you to click and check it out right away — because as you’ll see when you watch, events will start moving very quickly about 48 hours from now.

And that’s just the short term this week. Longer term?

And that’s just the short term this week. Longer term?

“An entire generation of entrepreneurs & tech investors built their entire perspectives on valuation during the second half of a 13-year amazing bull market run,” tweets Bill Gurley — one of the top venture capital guys in Silicon Valley. “The ‘unlearning’ process could be painful, surprising, & unsettling to many. I anticipate denial.”

Gurley’s take is intriguing enough on its own. But look at his fellow 50-something weighing in…

Yes, Jeff Bezos is partly acknowledging the sting from having just disclosed Amazon’s first quarterly loss since 2015… and the fact AMZN’s share price is down 35% from its peak last July.

But we suspect Bezos is also acknowledging the macro factors that helped him become the world’s second-richest man (behind Elon Musk) are no longer operative.

But we suspect Bezos is also acknowledging the macro factors that helped him become the world’s second-richest man (behind Elon Musk) are no longer operative.

Starting in 1981, long-term interest rates were climbing down steadily. Starting in 1987, the Federal Reserve stuck to an unofficial policy of riding to the stock market’s rescue whenever things got rocky.

Both phenomena made it easy for Silicon Valley to access capital… and for the likes of Bezos to make copious quantities of money.

Both phenomena also ground to a halt within the last few months.

After several false signals over the last decade, interest rates finally appear to be headed on a secular upswing. And the Fed appears willing to throw the stock market under the bus if that’s what it takes to get inflation under control; it’s the working class and poor who don’t own stocks who are getting clobbered by inflation the worst.

“Going forward, the Fed has two paths from which to choose,” says our macro maven Jim Rickards.

“Going forward, the Fed has two paths from which to choose,” says our macro maven Jim Rickards.

The Fed’s Open Market Committee holds one of its every-six-weeks meetings tomorrow and Wednesday. Once it’s over, the FOMC will announce a half-percentage-point increase in the fed funds rate. Still more increases are in the offing in mid-June and at the end of July.

But after that? Come mid-September, the Fed will be at a fork in the road.

But after that? Come mid-September, the Fed will be at a fork in the road.

First option: “The Fed can raise rates high enough to kill inflation,” says Jim. “With inflation currently at 8%, it would take interest rates of 10% to produce a real rate of positive 2%.

“That’s practically impossible because the economy will go into a severe recession long before the Fed gets rates to 10%. The market will probably crash before rates get to 5%, let alone 10%. The faster chairman Jerome Powell raises rates, the sooner the crash will come.

“A deep recession will cure inflation, but it will also lead to unemployment, bankruptcies and a possible financial panic.

“The Fed’s other path is to tighten until growth is close to zero and the stock market is dropping in a disorderly way. At that point, the Fed can throw in the towel as they did in 2018 and cut rates once again.

“That may give the stock market a reprieve, but inflation will soar out of control.

“So Jay Powell has to pick his poison — tame inflation at the cost of a severe recession and market crash — or bail out the stock market again at the cost of even higher inflation.”

“So Jay Powell has to pick his poison — tame inflation at the cost of a severe recession and market crash — or bail out the stock market again at the cost of even higher inflation.”

Thing is the Fed’s plans have already made the next downturn in the market a certainty — and you need to be ready. That’s the whole point of Jim’s updated briefing, released a short time ago.

Click here to watch it now — because if there’s just one “wrong” word on Wednesday afternoon in the Fed statement, or Powell’s press conference… the market reaction could be extreme and it would be too late to act.

In the meantime, the major U.S. stock averages are trying to pick themselves up off the floor after getting beaten to a pulp on Friday.

In the meantime, the major U.S. stock averages are trying to pick themselves up off the floor after getting beaten to a pulp on Friday.

After notching its worst monthly performance since October 2008, the Nasdaq is up a quarter-percent as we write to 12,368. But the S&P 500 is slipping a bit further into the red at 4,126 — the lowest in nearly a year. The Dow is also down a bit to 32,937 — which for the moment is still above its March lows.

Bonds are selling off, pushing yields higher: The yield on a 10-year Treasury is *this* close to breaking above 3% for the first time since November 2018.

Precious metals are getting no mercy. Gold is down to its lowest since February at $1,859. And silver (or to be more accurate paper silver contracts) appears set for its 10th-straight day of losses, now $22.44. Crude, meanwhile, is down $2.43 to $102.16.

The biggest cryptos are treading water, Bitcoin at $38,751 and Ethereum at $2,823.

The big economic number of the day is a nasty downside surprise.

The big economic number of the day is a nasty downside surprise.

The ISM Manufacturing Index for April rings in this morning at 55.4 — way lower than anyone expected among dozens of economists polled by Econoday. (The “expert consensus” likewise whiffed last week on the GDP numbers.)

Yes, 55.4 is comfortably above the 50 dividing line between growth and contraction. But the number hasn’t been this weak in 18 months.

Survey respondents blame the slowdown on — what else? — labor shortages and supply-chain snags.

While not strictly related to the markets and the economy — not yet, anyway — we’re compelled to note Washington’s creation of a “Disinformation Governance Board.”

While not strictly related to the markets and the economy — not yet, anyway — we’re compelled to note Washington’s creation of a “Disinformation Governance Board.”

Housed within the Department of Homeland Security, the agency will — at least at the outset — focus on “countering misinformation related to homeland security, focused specifically on irregular migration and Russia.”

Hmmm… “Will the new board condemn any articles that blame Biden (instead of Putin) for soaring inflation and ravaging average Americans?” muses James Bovard in the New York Post. Seems like a slippery slope, there…

Heading up the agency will be one Nina Jankowicz — whose primary qualification for the job appears to be unfailing loyalty to power-elite talking points. She was right there to denounce the absolutely authentic Hunter Biden laptop as “Russian disinformation” three weeks before Election Day 2020.

On the Sunday talk shows, the spin was that there’s nothing nefarious about a “Disinformation Governance Board.”

On the Sunday talk shows, the spin was that there’s nothing nefarious about a “Disinformation Governance Board.”

But Jankowicz herself let slip the agenda last month during an interview with NPR — more government strong-arming of social media, as the White House openly copped to last year.

“We need the platforms to do more, and we frankly need law enforcement and our legislatures to do more as well. And in other countries that are looking at this, you know, the U.K. has an online safety bill that’s being considered right now where they’re trying to make illegal this currently, quote, ‘awful but lawful content’ that exists online where people are being harassed.”

Back to Bovard in the New York Post: “‘Disinformation’ is often simply the lag time between the pronouncement and the debunking of government falsehoods.

“In early 2003, anyone who denied that Saddam Hussein had weapons of mass destruction was guilty of disinformation — until after George W. Bush’s Iraq invasion found no WMDs. For much of last year, anyone who disputed Biden’s assertion that people who get vaccines won’t get COVID was guilty of disinformation — until the administration was forced to admit the president was wrong.

“Is the new definition of disinformation ‘anything which undermines trust in President Biden’?”

Hard to see it any other way right now…

As long as we’ve got dystopia on the brain, we return briefly to the theme of wartime sacrifice.

As long as we’ve got dystopia on the brain, we return briefly to the theme of wartime sacrifice.

With Europe generally being more strapped for energy supplies than the United States, we’re observing a creepy new brand of propaganda targeted at everyday Europeans…

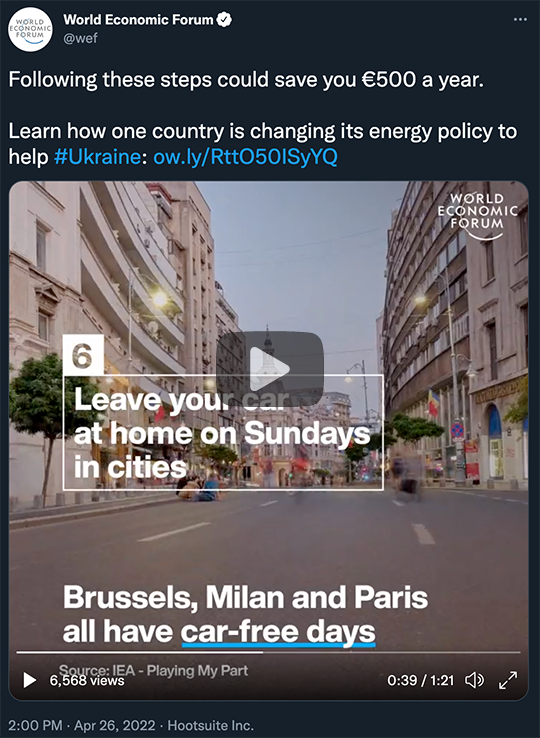

That was a few days ago. Since then, the World Economic Forum has weighed in with its own chilling harangue to European plebes…

Follow all nine tips, the video promises, and it’ll save 500 euros a year — about $526 at today’s exchange rate. Yeah, that’ll salve the pain of “Putin’s price hike”!

Straw in the wind: “Chinese regulators have held an emergency meeting with domestic and foreign banks,” says the Financial Times, “to discuss how they could protect the country’s overseas assets from U.S.-led sanctions.”

Straw in the wind: “Chinese regulators have held an emergency meeting with domestic and foreign banks,” says the Financial Times, “to discuss how they could protect the country’s overseas assets from U.S.-led sanctions.”

The salmon-colored rag says Beijing is worried that what happened to Russia could happen to China “in the event of a regional military conflict or other crisis.

“The meeting began with remarks from a senior finance ministry official who said [President Xi Jinping’s] administration had been put on alert by the ability of the U.S. and its allies to freeze the Russian central bank’s dollar assets.”

Yep. That freeze was a Rubicon, as we’ve said over and over since it took place on Feb. 26. No one wants to be caught holding dollars if they can be rendered zeros by order of the U.S. president. This story’s just getting started…

“New normal” snapshot: Attendance is way down at one of the first industry conferences to be held in three years.

“New normal” snapshot: Attendance is way down at one of the first industry conferences to be held in three years.

The National Association of Broadcasters gathered in Las Vegas last month… and the organization released its final attendance figures a few days ago. The total was 52,468.

Not mentioned in the press release is that pre-COVID attendance was on the order of 92,000.

Again, that’s just a snapshot — not necessarily indicative of other industries or future years. But your editor still keeps up now and then with the broadcast biz 15 years after walking away from the TV news racket…

To the mailbag: “In last Thursday’s edition, you mention Bitcoin and gold manipulations, which happen to fit perfectly into some pondering of my own, to wit:

To the mailbag: “In last Thursday’s edition, you mention Bitcoin and gold manipulations, which happen to fit perfectly into some pondering of my own, to wit:

“Jim Rickards has regularly discussed the currency wars of recent years, long before they were a subject for wider discussion. They still are not a subject to be found in mainstream news. His prediction that they would ultimately break into actual warfare seemed to be a stretch, but he was right on the money.

“I routinely monitor currency fluctuations because they often reveal what is really going on in the markets, especially commodities. For example, if oil prices go up, I can tell if it’s due to a real change, or just a response to a decline in the value of the dollar. Similarly with gold, silver, nickel, etc., depending on whether or not it is a vital import or in the case of gold, a genuine asset.

“So my question for Mr. Rickards is to explain the recent abrupt and substantial decline in fiat currencies all around the globe in relation to the dollar. In my normal analysis of greatly expanding U.S. debt, I would expect the dollar to be in gradual decline, but the recent changes are a sudden acceleration of an already steady increase over the past year. The mystifying part of this is that the ruble has returned to its pre-war levels.

“But the shape of the chart you show in the gold price mirrors those I see in currencies like the euro, yen, yuan and even the CHF (which is usually my reference to actual dollar values). This claim of gold manipulation is greatly supported by the illustrated changes in currency relative to the dollar. How is that happening when the dollar is not gold based?

“On a note related to the Bitcoin commentary, a friend of mine who recently left Russia (married to a Russian woman) tells me that most people there are moving to crypto because of the sanctions. Is gold losing to crypto?”

The 5: Good questions, deserving good answers. Unfortunately, our 5 Mins. are running short, so we must resort to a cliffhanger: We promise we’ll get to it tomorrow!

Best regards,

Dave Gonigam

The 5 Min. Forecast