- Nightmarish “Biden Bucks” get worse

- White paper outlines sea change at the Treasury Department

- Real-world inflation (according to Carter-era tables)

- Zach Scheidt: Amazon “Prime Day” or “Dump Day”?

- BMW tries out maddening subscription service

- A reader on organic warfare in Sri Lanka.

You heard it here first: “Biden Bucks” will be even more nightmarish than Jim Rickards originally let on.

You heard it here first: “Biden Bucks” will be even more nightmarish than Jim Rickards originally let on.

By now, we hope you’re familiar with all the downsides of a CBDC, or central bank digital currency — in which physical cash is rendered worthless at the stroke of a pen, replaced by a trackable “spyware” digital currency that destroys any last shred of your financial privacy.

But last Friday, we suggested another wrinkle — one that would make “Biden Bucks” entirely worse than CBDCs in other countries.

Given the sway that the big banks have in the U.S. power structure, we suggested an American CBDC might resemble our health care system.

That is, it would have all the top-down government control you see in other countries — but with added layers of bureaucracy and appallingly higher costs, all to benefit a parasitic cartel.

Lo and behold, the Treasury Department just issued a “framework” document saying an American CBDC “could involve both public and private participants.”

Lo and behold, the Treasury Department just issued a “framework” document saying an American CBDC “could involve both public and private participants.”

That’s a sea change from a couple years ago, when Federal Reserve chair Jerome Powell told Congress the private sector should be shut out: “I do think this is something the central banks have to design.”

The Treasury delivered its white paper to Joe Biden only days ago, as required by Executive Order 14067 — the CBDC directive Biden issued on March 9 of this year.

The contents of the white paper are still under wraps. But in a press release, the Treasury says the supporting infrastructure of a CBDC could involve both government and the private sector.

The contents of the white paper are still under wraps. But in a press release, the Treasury says the supporting infrastructure of a CBDC could involve both government and the private sector.

“This presents opportunities for U.S. companies to lead in the development of these technical systems and for the U.S. government, working with G7 partners, to encourage technological development that would support a CBDC.”

Beyond that, it’s all very much a black box. “As the exact framework was not made public,” writes Forbes contributor Jason Brett, “the description provided seems to indicate that the U.S. needs to lean into ways to lead the global CBDC digital infrastructure that is developed by leveraging private-sector companies, respond to the challenges of foreign adversaries developing their own protocols and lead on competitiveness and standards for digital asset technology globally.”

Yeah, that’s a lot of mumbo jumbo. Point is, as we said Monday, the “Biden Bucks” train is leaving the station… and before it mows you down, you need to start thinking about how to get out of harm’s way.

Fortunately, Jim Rickards has been researching CBDCs and their impact for years. He’s developed a comprehensive action plan, which you can start to review as soon as you click here.

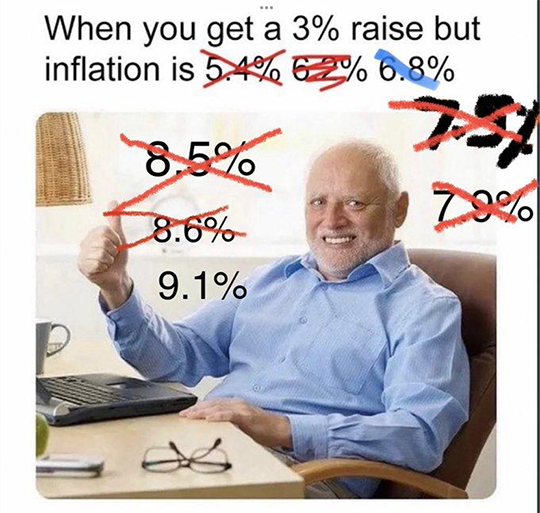

To the markets… where the buzz is all about a red-hot inflation number. Right, Mr. Older Thumbs-Up Stock Photo Guy?

To the markets… where the buzz is all about a red-hot inflation number. Right, Mr. Older Thumbs-Up Stock Photo Guy?

The Bureau of Labor Statistics regaled us this morning with the June consumer price index. The official inflation rate is now running 9.1% year over year.

That’s rather higher than the “expert consensus” of economists expecting 8.8%. It’s also the highest number since November 1981 — when Olivia Newton-John topped the charts with “Physical” (No. 1 for 10 straight weeks!) and Sean Connery was the big box-office draw in Terry Gilliam’s fantasy Time Bandits.

Energy accounts for nearly half of the increase — up 7.5% in just one month. Food rose 1.0%… shelter 0.6%… health care 0.4%… used vehicles 1.6%. About the only thing that didn’t go up is airfares, because who the hell wants to fly with air travel such a mess at the moment?

As always, any resemblance to your own cost of living is purely coincidental. The real-world inflation figure from Shadow Government Statistics — using the same methodology the feds used in Jimmy Carter’s day — set another record of 17.3%. (The Carter-era peak was 14.8%.)

With the release of these figures, any chance the Federal Reserve would raise short-term interest rates a mere half-percentage point is out the window.

With the release of these figures, any chance the Federal Reserve would raise short-term interest rates a mere half-percentage point is out the window.

In fact, looking at the trade in fed funds futures this morning, there’s now a 44% likelihood the Fed will raise a full percentage point and not just three-quarters. (Reminder: The rate is currently a little over 1.5% after sitting near zero only four months ago.)

And yet even as the junkies on Wall Street are set to be further deprived of the Fed’s EZ-money fixes… the withdrawal pangs aren’t too terrible today.

And yet even as the junkies on Wall Street are set to be further deprived of the Fed’s EZ-money fixes… the withdrawal pangs aren’t too terrible today.

As we write, the Dow is down only a half percent at 30,840. And it’s faring the worst among the major U.S. stock indexes. The S&P 500 is off a quarter percent and still above 3,800. The Nasdaq is nearly flat from yesterday’s close at 11,258.

Interest rates continue to suggest Fed tightening will tip the economy into recession — the 10-year Treasury note at 2.94% but the 2-year note delivering a higher yield at 3.1%. That’s the biggest inverted spread since 2000.

Precious metals are perking up, if only a bit — gold at $1,739 and silver at $19.25. Bitcoin is hovering above $19,000, Ethereum over $1,050.

Crude is down slightly after yesterday’s whacking at $95.58 — more or less a three-month low.

Crude is down slightly after yesterday’s whacking at $95.58 — more or less a three-month low.

Perhaps the market is discounting a promise by Saudi Arabia to open up the oil spigots; Biden meets with Crown Prince Mohammed bin Salman this weekend.

Of course, that assumes 1) the crown prince will make such a promise and 2) he’s able to deliver on it.

We’re on the record doubting whether he can deliver. Saudi Arabia’s vaunted “spare capacity” may be much less than advertised; French President Emmanuel Macron said as much to Biden at the recent G7 summit.

As it is, OPEC’s top 10 producers are falling short of their production targets. They pumped out 24.8 million barrels per day in June — a million bpd shy of the mark.

“Even the Saudis were lagging behind their quota for June,” writes Tsvetana Paraskova at Oilprice.com. “Saudi Arabia’s oil production rose by 159,000 bpd to 10.585 million bpd, OPEC said.

“To compare, the Saudi target was 10.663 million bpd, so the Kingdom was 78,000 bpd below its quota last month using secondary-source figures.”

Amazon’s “Prime Day” ought to be labeled “Dump Day” in the estimation of our Zach Scheidt.

Amazon’s “Prime Day” ought to be labeled “Dump Day” in the estimation of our Zach Scheidt.

Amazon’s two-day discount extravaganza ends today. But this year’s version isn’t the same: “Amazon isn’t marking down prices and rolling out specials to try to entice new customers. According to Wall Street reports and many media outlets, Amazon hopes to use Prime Day to unload excess inventory piling up in their warehouses across the country.”

Along with brick-and-mortar names like Target and Kohl’s, Amazon is struggling with excess inventory of select apparel, furniture and electronics — stuff that everybody wanted and couldn’t get a couple years ago during lockdown. Only now is this stuff finally making its way through the supply chain, but now nobody wants it.

Bad news for many retailers, but good news for the discount chains. “Companies like Dollar Tree and Dollar General buy excess merchandise from much larger retailers,” says Zach. “These discount stores typically pay dirt-cheap prices for these items because they buy in bulk and they are willing to buy the stuff that isn’t selling well at traditional locations.”

There was a shortage of such goods during lockdown. “But now that traditional retailers have excess inventory to get rid of, discount retailers can once again find bargains for their customers.”

Zach expects stronger earnings and a rising share price at both Dollar General (DG) and Dollar Tree (DLTR) — and DG might well raise its dividend, currently a stingy 0.9%.

GloboTax is in even more trouble than it was before.

GloboTax is in even more trouble than it was before.

The background: Last fall, representatives of 136 governments and jurisdictions agreed to implement a minimum 15% corporate income tax rate — along with a system to tax large profitable companies based on where their goods and services are sold and not on where company headquarters are located.

But implementation was already running aground last month, according to The New York Times, and this week The Wall Street Journal says, “The new rules, initially promised by mid-2022 as part of a multilateral deal negotiated under the auspices of the Organization for Economic Cooperation and Development, won’t be completed until next year. After that, countries will need to vote to approve them.”

By that time, control of the U.S. Congress might have changed hands. Even now, Democrats can’t get on the same page.

“Negotiators fear the consequences of missing the new 2023 deadline,” the Journal continues. “If talks stall again or it becomes clear that Congress won’t approve an international agreement, the result could be a global free-for-all, in which some governments impose novel, uncoordinated taxes and others respond with trade sanctions.”

Better than the alternative, we say…

It’s a never-ending quest for business — find new ways to generate reliable streams of recurring revenue. But can BMW really get away with this?

It’s a never-ending quest for business — find new ways to generate reliable streams of recurring revenue. But can BMW really get away with this?

Yes, South Koreans, for instance, who want heated seats in their Beemers will have to pay $18 a month for the privilege. And $10 more for a heated steering wheel. Otherwise, BMW will disable the features remotely.

At least you have the choice of buying permanent access — $406 for the heated seats. Let’s see, 406 divided by 18… yeah, you’re better off paying upfront if you plan to keep the car for at least two years.

Or maybe you can go the hacking route: “I can easily see modders figuring out how to jailbreak the system and unlock the option for free,” writes Nico DeMattia at The Drive. “Volkswagen owners have done similar things to older VWs for more than a decade by using simple OBDII-based tools and laptops to unlock lighting modes and window functions, for instance. More recently, Ford Maverick owners learned they can unlock cruise control on entry-level Mavericks, simply by swapping out the steering wheel buttons and using some software.”

[Really? Call your editor a fuddy-duddy, but I object to anything on a vehicle that can be bricked by the manufacturer. Or the government, come to think of it. How about you? Drop us a line: feedback@5minforecast.com]

To the mailbag, and the tragedy of Sri Lanka: “The mistake of the Sri Lankan government was not to ‘go organic,’ but to do it without teaching farmers alternative methods,” a reader writes.

To the mailbag, and the tragedy of Sri Lanka: “The mistake of the Sri Lankan government was not to ‘go organic,’ but to do it without teaching farmers alternative methods,” a reader writes.

“In the 1980s–1990s in Madagascar, the French priest Henri de Laulanié developed the SRI (System of Rice Intensification) system, which is not very different from organic agriculture and gives impressive results: ‘A French project for improving small-scale irrigation systems on the high plateau during this same time period also found that farmers using SRI methods averaged over 8 tons/hectare, compared to 2.5 tons/ha with traditional methods and 3.7 tons/ha with improved methods using fertilizer. A separate evaluation commissioned by the French aid agency also confirmed average SRI yields of 9 tons/ha.’

“According to Wikifarmer, with conventional methods ‘the average yield of rice (seeds) per hectare is 3–6 tons. In some countries like Australia and in Egypt, the yield can increase to an amazing 10–12 tons or more per hectare.’ So in comparison, SRI is pretty efficient because it requires minimal investment.

“Of course, the Sri Lankan government should have taught SRI on a voluntary basis only. It didn’t make sense to ban chemical fertilizers because most farmers had no experience of organic farming.

“This is a sad story because now Big Ag can boast that it ‘feeds the world’ whereas it poisons it with pesticides and chemical fertilizers.”

The 5: As our acquaintance Scott Horton often wonders, is it stupidity… or the plan?

Best regards,

Dave Gonigam

The 5 Min. Forecast