• Inflation, budgeting and keeping cash viable

• Market news from the edge of recession

• Zach Scheidt follows the money (“Inflation Reduction Act”)

• Student loan forgiveness… and sky-high housing prices?

• A truly tone-deaf moment by SF Fed leader

• A reader wonders whether The 5 was censored (as if!)… Redefining recession… “We are the goon squad”… And more!

Eye-opening news from across the pond…

Eye-opening news from across the pond…

Remember when the pandemic prompted folks to conduct more commerce electronically, so they wouldn’t have to contend with germy cash?

No more, at least not in the U.K.: “People are going back to cash to keep tighter control on their spending as living costs soar,” reports the BBC.

In the U.K., the Post Office can perform certain banking services. And the agency noticed a huge jump in cash withdrawals during July — 8% month over month, 20% year over year. Cash deposits rose too, about 2%.

Turns out cash is a better way for many folks to make sure they can cover all their essential expenses. “We’re seeing more and more people increasingly reliant on cash as the tried-and-tested way to manage a budget,” says the Post Office’s banking director Martin Kearsley.

“People will be taking out cash and physically putting it into pots, saying ‘this is what I have for bills, this is what I have for food and this is what’s left’,” adds Natalie Ceeney of a pro-cash organization called Cash Action Group.

“People will be taking out cash and physically putting it into pots, saying ‘this is what I have for bills, this is what I have for food and this is what’s left’,” adds Natalie Ceeney of a pro-cash organization called Cash Action Group.

“We all know that if you pay with a card, it’s so easy to spend money you don’t have and then go overdrawn.”

For Ms. Ceeney, the conclusion is obvious, beyond just the budgeting aspect: “Millions of people don’t have access to computers or smartphones, and so we need to keep cash viable.”

Hmmm… Seems to us that for the control freaks and power trippers, it’s one more argument to create a CBDC, or central bank digital currency.

Hmmm… Seems to us that for the control freaks and power trippers, it’s one more argument to create a CBDC, or central bank digital currency.

No smartphone? Well, just give out cheap ones for free. Hard to budget without cash? No problemo, the government will know every cent you spend. You’ll get notifications anytime you go over budget — and the government will decide how much you can spend on each category anyway.

In this country, “With Biden’s secret surveillance army running the show,” says Jim Rickards, “the anti-freedom implications are almost limitless.

“You want to keep your internal-combustion engine car? Your digital dollars suddenly won’t pay for gas. Instead, you can be forced to buy an electric vehicle.”

Want more hair-raising examples? Jim has plenty for you at this link — along with a plan of defense you can execute before they lower the digital boom.

To the markets, which have a sleepy summertime edge-of-recession vibe.

To the markets, which have a sleepy summertime edge-of-recession vibe.

The major U.S. stock indexes are in the red, but not alarmingly. The Dow is off a third of a percent at 32,718. The S&P 500 is off two-thirds of a percent at 4,114. The Nasdaq is taking it worst, down nearly 1.5% to 12,463.

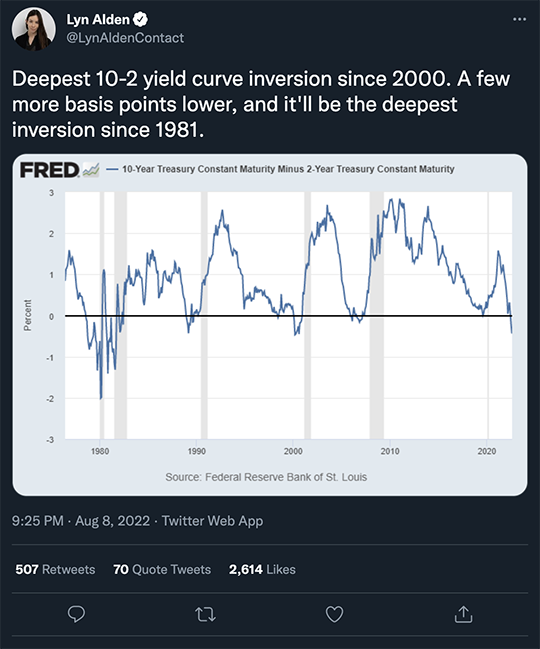

Bonds are selling off, pushing yields higher: The 10-year Treasury note is up to 2.78%… while the 2-year note is at 3.27%.

Yes, that’s still an inverted yield curve, signaling recession — and not by a little. Note the zero line and the gray recession bars in this chart going back more than 40 years…

Not much movement in precious metals — gold at $1,790 and silver at $20.42. Crude is perking back up, now $91.52 after approaching $88 last week.

No point in complaining about the “Inflation Reduction Act.” Time to follow the money.

No point in complaining about the “Inflation Reduction Act.” Time to follow the money.

The media have appeared to settle on a price tag for the bill — $740 billion, nearly half of that for “climate” and “clean energy” initiatives. Allegedly that spending will be offset with $300 billion in revenue from corporate tax increases and stepped-up IRS enforcement.

“This bill is expected to create roughly 500,000 new jobs in the green energy industry alone,” says our Zach Scheidt. “While that would normally be a good thing, our economy is already dealing with a labor shortage.

“So if the green energy industry hires 500,000 people, those workers will need to come from somewhere. That means more competition from other industries that will have to pay more to attract new hires.”

Gee, and on the heels of a red-hot job report last week — fueling fears of an inflationary “wage-price spiral.” Not much “inflation reduction” there.

Oh, well: “As Washington pours billions into the green energy space,” says Zach, “many stocks in this area are already trending higher.”

Zach likes the iShares Global Clean Energy ETF (ICLN). “This fund invests in a wide range of clean energy stocks. So you can take a diversified position in this industry with one single position.”

Yes, ICLN has jumped a lot in recent days given the news from Washington. Wait for the inevitable pullback and then start nibbling away — “a few shares now, a few shares next week and possibly more next month,” Zach advises. “Over time, this should be a big trend that gives you plenty of profits in the year ahead.”

The 2022 free fall in small-business sentiment has been arrested — at least for now.

The 2022 free fall in small-business sentiment has been arrested — at least for now.

The National Federation of Independent Business is out with its monthly Small Business Optimism Index. Last month, it notched a nine-year low at 89.5. This month, it ticked up slightly to 89.9. That’s still way down from 97.1 only six months ago.

Asked to identify the single most important problem they face, 37% of respondents to the NFIB survey cited inflation — the most since 1979. But good help is still hard to find: “Quality of labor” is in second place at 21%.

➢ Anecdotally, the labor shortage is still horrendous. In your editor’s little corner of the Upper Midwest, a breakfast spot my wife and I favor (it has an NFIB sticker on the door, as it happens) was closed during the last week of July for lack of help. Meanwhile, the regional school bus contractor has parked a bus on a vacant lot along the main drag. On the side of the bus is a banner advertising for drivers.

On the bright side… at least business owners are still looking to hire? “Sales remain supportive of hiring,” write NFIB economists Bill Dunkelberg and Holly Wade.

Problems we hadn’t started to think about yet: Would student loan forgiveness drive sky-high housing prices even higher?

Problems we hadn’t started to think about yet: Would student loan forgiveness drive sky-high housing prices even higher?

It’s not a hypothetical question: Joe Biden has until Aug. 31 to decide whether to once again extend the pause on student loan payments dating back to the early days of the pandemic. Outright forgiveness could give Democrats a midterm election boost.

Last Friday, Ohio politician Nina Turner — a leading figure in Bernie Sanders’ presidential campaigns — tweeted the following question: “What is something you’d do if student debt payments go away?”

Here’s the answer from Kim Iversen, one of the more intriguing lefties on all of Twitter…

We’re all for homeownership and all against the Great Reset… but just imagine this flood of new money coming into the housing market at a time when the supply of homes is still super-tight and builders are still gun-shy after they overbuilt and got stung in the 2007–09 housing crash.

Just something to think about. We’ll keep our eye on it…

Now a tale of bungled public outreach… and strange internet ads.

Now a tale of bungled public outreach… and strange internet ads.

Maybe you saw the story last week: San Francisco Fed President Mary Daly put her foot in it during an interview with Reuters — waving off inflation as no big deal. “I don’t feel the pain of inflation anymore,” she said.

“I’m not immune to gas prices rising, food prices rising; I sometimes balk at the price of things, but I don’t find myself in a space where I have to make trade-offs, because I have enough. Many, many Americans have enough.”

And the trade-offs people do have to make are no biggie, she added: “You may not be able to go to the vacation you want. You may end up instead camping or doing a staycation.”

Easy for her to say. In her current gig, Daly pulls down $427,000 a year. Granted, San Francisco is expensive, but still…

➢ Which reminds us: Earlier this summer, the well-heeled Garrison Keillor of A Prairie Home Companion fame similarly blew off inflation: “Don’t be disheartened. Deal with the problem. If you’re troubled by inflation, cut back on expenses. Don’t buy sparkling water. Fill up the glass with tap water and if you want bubbles, stick a straw in the water and blow.” For real…

Anyway, it was the most tone-deaf moment by a Fed leader since New York Fed chief Bill Dudley’s edible-iPad moment more than a decade ago.

Now here’s a twist: Three days after Daly’s interview and the inevitable backlash online… up pops a space ad on a financial blog I’m reading…

The ad linked to her bio at the San Francisco Fed website. Huh?! Is this an especially clumsy exercise in damage control, or what?

Granted, no taxpayer money was spent on this ad buy: The regional Fed banks are owned by their member commercial banks. But if I ran, say, a little community bank in Bakersfield or Yakima or Idaho Falls… I’d be mighty ticked off about now.

To the mailbag: “I read yesterday’s 5 expecting prominent mention of one of the most Orwellian examples of recent government censorship/mind control efforts, and was shocked to find it missing.

To the mailbag: “I read yesterday’s 5 expecting prominent mention of one of the most Orwellian examples of recent government censorship/mind control efforts, and was shocked to find it missing.

“That, of course, is the ill-fated attempt to establish the Ministry of Truth, which I suspect the administration hoped to have up and running to help ‘guide’ the current recession discourse. I’ll assume it got censored from your final cut.”

The 5: Heh, no censorship here. As we mentioned last month, Homeland Security scrapped the whole Disinformation Governance Board thing. It was the subject of so much mockery that no one took it seriously.

But as we also said, there’s no shortage of other avenues the feds can pursue to suppress domestic dissent.

That’s why the lawsuit filed by the attorneys general in Missouri and Kansas will be interesting to watch: If the process of pre-trial discovery turns up evidence that the feds issued censorship orders to social media companies targeting specific accounts… that could be an earthquake.

“I’m absolutely against censoring our right to free speech,” writes our next correspondent.

“I’m absolutely against censoring our right to free speech,” writes our next correspondent.

“And I agree that things only seem to be getting worse with invading our privacy, cancelling people and ‘fact-checkers,’ etc.

“However, I don’t have as much angst against this administration redefining the term ‘recession’ as I would have thought. I mean don’t get me wrong, it’s ridiculous. But the way I see it, the economy will likely be weak for so much longer that I’m going to sit back and enjoy the show over the next few quarters to see how much more redefining they have to do.

“And in the meantime, I believe the rest of America will join the growing masses of people who realize this administration is more focused on creating the perception of doing a good job than they are of actually doing a good job.

“Because now that they’ve redefined recession, it’s not like Americans are going to reach into their pockets and magically be able to pull out more money.”

The 5: Word. Swing voters don’t make their decisions on the basis of whether egghead economists invoke the word “recession” or not. They vote on their own personal experience. Same reason we mocked Jeb Bush for trying to inspire a crowd by setting a goal of “4% growth as far as the eye can see.” The whole thing is ridiculous.

“Oh great, more funding for the IRS,” writes one of our regulars — who noted the title of last Friday’s edition.

“Oh great, more funding for the IRS,” writes one of our regulars — who noted the title of last Friday’s edition.

“To quote David Bowie’s song ‘Fashion’: ‘We are the goon squad and we’re coming to town.

Beep-beep.’”

The 5: Awesome Bowie track, with a guest appearance on guitar by King Crimson’s Robert Fripp. And from an awesome album, Scary Monsters — Bowie’s last studio album with RCA.

Then came the ’80s — about which the less said, the better…

Best regards,

Dave Gonigam

The 5 Min. Forecast