- JPM: First they came for the rap star

- A history of Chase’s abhorrent behavior

- Market’s “pivot” mania

- Jim Rickards on this “nonsense” narrative

- Bureaucracy in action, Down Under edition

- “The reason I read Paradigm”… “Keep-it-simple-stupid people”… and More!

“The idea of banks as moral enforcers is kind of a new one,” quipped the author Walter Kirn during a recent podcast.

“The idea of banks as moral enforcers is kind of a new one,” quipped the author Walter Kirn during a recent podcast.

Kirn was referring to the decision by JPMorgan Chase to “de-bank” the rapper and fashion designer Kanye West — although as we understand it, Kanye now goes by the name “Ye.”

[Maybe we should go the Prince route to avoid confusion? You know, “the artist formerly known as Kanye West”? But we digress…]

“JPMorgan Chase Bank, N.A. (the ‘Bank’) has decided to end its banking relationship with Yeezy LLC and its affiliated entities (collectively, the ‘Company’),” said the official letter. “We ask that you promptly transfer your business to another financial institution before Nov. 21, 2022.”

Now, as you might have heard, “Ye” went on a weird antisemitic rant recently — which, depending on who you want to believe, coincided with a mental health crisis driven by his bipolar disorder.

The letter did not state its reasons for cutting Ye loose. Furthermore, the letter is dated Sept. 20 — before the weird antisemitic rant, and for that matter, before Ye stirred things up with a “White Lives Matter” T-shirt design during Paris Fashion Week.

So the first thing to ponder is that Ye is a bridge too far for JPM — but not a sexual predator like Jeffrey Epstein or an infamous fraudster like Bernie Madoff.

So the first thing to ponder is that Ye is a bridge too far for JPM — but not a sexual predator like Jeffrey Epstein or an infamous fraudster like Bernie Madoff.

From The New York Times, Aug. 8, 2019: “When compliance officers at JPMorgan Chase conducted a sweep of their wealthy clients a decade ago, they recommended that the bank cut its ties to the financier Jeffrey E. Epstein because his accounts posed unacceptable legal and reputational risks.

“Yet Mr. Epstein, who had been charged with sex crimes and pleaded guilty in 2008 to solicitation of prostitution, remained a JPMorgan client until 2013.”

And then there’s Madoff, whose epic Ponzi scheme collapsed in 2008. In 2014, JPM paid a $2.6 billion cost-of-doing-business fine to the U.S. government and Madoff’s victims for its failure to alert the feds to its suspicions that something funky was going on. JPM looked the other way because the fees from Madoff’s business were just too good to pass up.

The second thing to ponder is that JPM’s self-appointed role as “moral enforcer” is not entirely new.

The second thing to ponder is that JPM’s self-appointed role as “moral enforcer” is not entirely new.

Deep in The 5’s voluminous archives is an item from 2014 in which JPM dropped the bank accounts of several porn stars. “I’m just upset and still in shock it’s even happening,” said one named Teagan Presley. “I’m not doing anything illegal.”

The next day, we heard from a reader who told us Chase was closing all five of his business accounts along with his family’s accounts. As he described it, his lines of business were “financial services, a retail store and an affiliate marketing company.”

At the time, the Obama administration had undertaken an effort called Operation Choke Point — in which the feds made life hell for legal businesses that might, hypothetically, have a tie to “money laundering” — payday lenders, firearms merchants, tobacco shops and, apparently, porn stars. Under pressure from the FDIC, banks were shutting down their accounts with next to no warning.

The Trump administration put an end to Operation Choke Point in 2017 — although it had already run into stiff resistance before then in the form of lawsuits filed by targeted businesses against the FDIC.

In the present moment, it’s hard to shake the thought that JPM dumped Ye because he’s got the “wrong” kind of politics — especially when we recall the iconic-yet-farcical moment when CEO Jamie Dimon “took a knee” during the George Floyd protests in 2020…

In the present moment, it’s hard to shake the thought that JPM dumped Ye because he’s got the “wrong” kind of politics — especially when we recall the iconic-yet-farcical moment when CEO Jamie Dimon “took a knee” during the George Floyd protests in 2020…

Then there’s what Chase just did to the National Committee for Religious Freedom.

Then there’s what Chase just did to the National Committee for Religious Freedom.

The NCRF is an organization founded this year by ex-Sen. Sam Brownback (R-Kansas). Its website describes itself as a “political action nonprofit that exists to proactively defend the constitutional rights of religious freedom.”

Three weeks after the NCRF opened its account at Chase, Chase closed the account with no explanation. And the story doesn’t end there.

As Brownback writes for the Washington Examiner, “Someone from Chase eventually reached out to our executive director and informed him that it would be willing to reconsider doing business with the NCRF if we would provide our donor list, a list of political candidates we intended to support and a full explanation of the criteria by which we would endorse and support those candidates.”

You don’t have to support the goals of the NCRF to find Chase’s conduct abhorrent — or to wonder if Chase is somehow doing the government’s bidding, like the social media giants.

You don’t have to support the goals of the NCRF to find Chase’s conduct abhorrent — or to wonder if Chase is somehow doing the government’s bidding, like the social media giants.

Of course, if you’re been keeping up with Paradigm Press’ output for any amount of time, you know our concern is even more acute.

Canceled bank accounts look to us like one more step in the direction of a central bank digital currency — or as our own Jim Rickards labels it, “Biden Bucks.” A CBDC allows for easy weaponization of money against people who might be engaged in wrongthink. Don’t forget an even more serious trial run came earlier this year — when banks froze the accounts of the Canadian trucker protesters.

If you’re already familiar with the Biden Bucks thesis, you know exactly what we’re talking about. If not, well, don’t wait for one of the banking giants to cancel your account before taking action. Start building your defenses with Jim’s “Asset Emancipation” plan right away.

By now it’s apparent Mr. Market is in another manic phase — certain the Federal Reserve will “pivot” toward looser monetary policy at any moment.

By now it’s apparent Mr. Market is in another manic phase — certain the Federal Reserve will “pivot” toward looser monetary policy at any moment.

We saw this last Thursday with the release of worse-than-expected inflation numbers, suggesting the Fed would stick to tight policy for the foreseeable future. The Dow plunged 500 points… but then soared 1,300 points.

“Substantively nothing had changed,” says Jim Rickards, “but a new narrative did take over market psychology. The narrative is a version of the old saying ‘Bad news is good news.’

“Traders said that the more extreme version of Fed tightening expected would kill inflation faster than expected and set the stage for interest rate cuts early next year. Those expected rate cuts would be good for stocks, so it makes sense to buy stocks now!

“This narrative is nonsense for several reasons,” Jim declares.

“This narrative is nonsense for several reasons,” Jim declares.

“The first is that the Fed has made it clear they have no intention of cutting rates anytime soon. Inflation may come down, but the Fed’s target rate is 2% and the current 8.2% is still a long way away.

“The second problem is that if the Fed actually did cut rates early next year, it would not be a sign of success but a sign of dismal failure. It would mean that the economy was in a severe recession, which would be awful for stocks.”

After a big sell-off Friday, the narrative took hold again yesterday.

As we mentioned in real time, the Fed’s Empire State Index of New York manufacturing delivered a punk number. Lo and behold, the Dow rallied another 500 points.

“When crappy economic numbers come out, the stock market doesn’t react negatively,” writes colleague Sean Ring in this morning’s Rude Awakening. “The market leaps for joy as it thinks the Fed will go in and rescue it!”

And the euphoria is carrying into today. At last check, the Dow is up another 400 points or 1.4% to 30,618. The S&P 500 is back above 3,700 and the Nasdaq is over 10,800.

Remarkably, today’s rally comes despite some good economic news: Industrial production jumped 0.4% in September, way more than expected. The important “cap-ute” figure sits at a post-pandemic high; 80.3% of the nation’s industrial capacity was in use last month.

Bond yields are climbing down, the 10-year Treasury just below 4%. Precious metals are little moved — gold at $1,650 and silver at $18.74. Crude has tumbled over 3.5% to $82.41 in the absence of any obvious news.

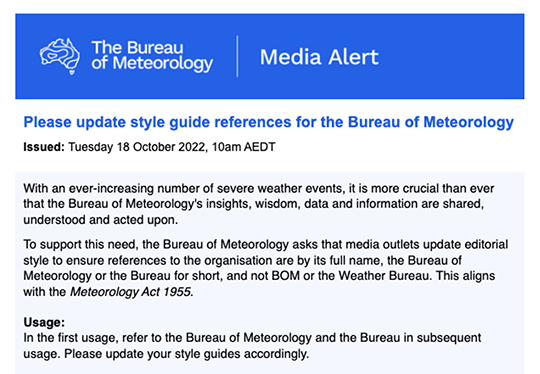

Bureaucracy in action, Down Under edition: The Australian version of the National Weather Service just did a rebrand of sorts — after paying a consultant over $44,000.

Bureaucracy in action, Down Under edition: The Australian version of the National Weather Service just did a rebrand of sorts — after paying a consultant over $44,000.

The Bureau of Meteorology has long been known to Australians as the BOM. But this week, the BOM let it be known that henceforth, it wants to be known simply as “the Bureau.” Earlier today, it issued a request to reporters and editors…

The change “has been broadly ridiculed, and criticized for its rollout as many Australians face devastating floods,” reports The Guardian. “One insider said they were made to use the new term, and another said they were treated ‘like naughty schoolchildren’ if they slipped up and referred to the BoM instead.”

And yes, “the Bureau” awarded a nearly $44,000 contract — that’s in U.S. dollars — to a consulting firm for “branding of product naming services” and “brand implementation.”

How many people were involved in this project and how much time did they put in? We suspect the hourly-pay-per-person equivalent would be eye-watering…

“Thanks much for the recent expose on PayPal,” a reader writes. “Since I don’t use social media, I might have missed this otherwise.

“Thanks much for the recent expose on PayPal,” a reader writes. “Since I don’t use social media, I might have missed this otherwise.

“You very correctly assert that despite the walk-back of their new user terms, the ability to reinstate them remains. In fact, they will do exactly that once the furor has calmed. They made it fairly difficult for me to navigate to the ‘close my account’ choice.

“Apple announced in August of 2021 that they will be reviewing iCloud photos for child pornography, but after an uproar, they walked it back — temporarily. They have since integrated it into iOS 15 without announcing it. It will soon become the basis for claims of copyright infringement or subversive photos (a picture of the Pentagon or military base, or a photo from a movie clip, or a photo of a political candidate).

“None of these actions is ever the last step, but the first in an ongoing series aimed at stripping away our freedoms in secret.

“Our Bill of Rights is being circumvented everywhere by companies and individuals who can violate free speech and privacy under the guise of ‘terms of use’ that are purely political. You agree to them the moment you use the service.

“Meanwhile, other rights are being attacked through civil actions, such as the Alex Jones ‘defamation trial’ or the red flag laws that allow anyone to file suit to take away your weapons because they consider you dangerous. By using civil actions, evidentiary rules become almost meaningless and only emotional appeals to carefully chosen jurors obtain. This is already bringing out hysterical claims in Colorado (a man sitting on his front porch with an empty pistol pointing it across the street, for example, or a mother who thinks her son is suicidal). If the Constitution restrains our ability to silence or disarm you, we’ll bankrupt you.

“Every court case becomes precedent for the next step. The Founding Fathers understood that criminals can break the law, but society protects itself when it gives them the presumption of innocence in court rather than vigilantism. The frailty of democracy is that the mob is always wrong because it acts on emotion rather than fact.

“You’re also right about companies choosing to join the narrative or stand up for our freedoms. The reason I read Paradigm is to push aside all the mainstream obfuscation and phony data to what is important. Continue your good efforts.”

“Jim Rickards’ ideas are just more speculation,” a reader complains. “I’ve invested in gold and silver and lost money.

“Jim Rickards’ ideas are just more speculation,” a reader complains. “I’ve invested in gold and silver and lost money.

“Wealthy people can afford this — not your average middle-class citizen. Thus you’re offering us nothing. I’ve heard this information before and it’s been suggested for a few years now. You’re all after wealth — most of us are just KISS, keep-it-simple-stupid, people.”

“Crypto issues are too complicated not simple for average folks as well. I put money there, rode the wave, now lost it all because I let it sit there more like a savings account that didn’t work. Only a few thousand, but only what I could afford — as it was always suggested, never invest more than what you can afford to lose.”

The 5: Crypto is best treated as a speculation — which is how you treated it. Well played.

As for your other concerns: Look, about the only people who’ve made money in 2022 are those who have an outsized allocation to energy in their portfolios. And even those folks are down since June, when commodities peaked.

If you’ve held onto your bullion investments, you’re still better off than the masses who invest in only stocks and bonds. Long-term Treasuries are down a staggering 32% year to date, and the S&P 500 is down about 18%. Gold’s year-to-date drop is a more modest 7%.

Gold is still cushioning the blow, as it was when we last wrote about the relative performance of major asset classes in May.

If indeed the 2020s are shaping up to be a decade analogous to the 1970s, gold will save your portfolio as bonds get crushed and stocks go nowhere (but with huge volatility).

As we wrote last winter, gold languishes when the stock market performs well — and vice versa. Unless you’re counting on a resumption of the 2009–2021 bull market in stocks, you’ll want precious metals in your investment mix for the remainder of this decade.

Best regards,

Dave Gonigam

The 5 Min. Forecast