- Into the metaverse: Changing “the way we work, play and interact”

- Remembering Apple’s Newton device (30-year anniversary)

- Interstate migration and tax “winners” and “losers”

- A Scandinavian cease-fire in the war on cash

- The Golden State rebrands its war on drugs… Leaving a “golden” legacy… and More!

“COVID-19 changed the way we work, play and interact,” says Paradigm’s science-and-tech expert Ray Blanco.

“COVID-19 changed the way we work, play and interact,” says Paradigm’s science-and-tech expert Ray Blanco.

“Chances are, before the pandemic hit, you never heard much about companies like Zoom, Slack and Teladoc,” he says, but “these relatively young companies helped us cope and stay productive even when stuck at home.

“I’ve since become a daily user of both Zoom and Slack,” Ray notes. “This software has become such a ubiquitous part of my workday I’m not sure how I got along without them previously.

“Virtual reality has been talked about for years,” says Ray.

“Virtual reality has been talked about for years,” says Ray.

“The buzz behind the basic idea of interacting in 3D virtual worlds goes back decades to when some of the earliest, crude (by today’s standards) iterations of the concept debuted.

Courtesy: NBC, Community

“Back in the ’90s, several firms tried to bring the concept of a handheld, touch-screen computer and communications device to fruition. Even Apple tried — and failed — with its Newton device.”

The Newton MessagePad 100, 30 years old this year</P

[Your editor today graduated from high school the same year the Apple Newton debuted. Personally, I don’t remember this device — too wrapped up in coverage of the LA riots, I guess (which should have presaged my future career).

But from what I’ve read — I went down the proverbial rabbit hole — the device was like an early personal digital assistant that, technically, had the ability to interact with other Newton devices. Because of its bugs, however, the Newton wasn’t widely adopted; rather, it was lampooned in popular culture. The brilliant comic strip Doonesbury, for one, trolled Newton’s nonuser-friendly voice-to-text feature.

It seems the device was just ahead of its time, lacking the wireless infrastructure to make it shine. One example? Newton came with software for reading ebooks… 15 years before Amazon’s Kindle launched!

OK, back to our scheduled programming.]

“VR hardware continues to improve,” Ray says, “and if Meta (FB) and Microsoft (MSFT) have any say, things are going to change more still.

“VR hardware continues to improve,” Ray says, “and if Meta (FB) and Microsoft (MSFT) have any say, things are going to change more still.

“Mark Zuckerberg’s company has staked its future on virtual worlds, even changing the name of his company from Facebook to Meta to reflect its focus on the metaverse, a 3D universe where users will one day interact with an uncanny degree of real-world verisimilitude.

“This week, Meta introduced a new version of its VR technology contained in a headset called Meta Quest Pro [which retails for about $1,500].” It’s an “evolution of what Meta’s been working on ever since it bought VR company Oculus back in 2014 for $2 billion.

Courtesy: Oculus website

“It’s lighter and smaller, with improved graphics and comfort, and a suite of sensors that not just capture your physical orientation in real space, but can read and display your facial expressions onto a 3D avatar in virtual space,” says Ray.

“As the name implies, Meta’s new VR device is intended for professional use,” Ray says.

“As the name implies, Meta’s new VR device is intended for professional use,” Ray says.

“And despite [Microsoft] being Meta’s competitor — with its own HoloLens line of devices — Microsoft has partnered with Meta. Workers using the Microsoft Teams software will be able to do some of their remote work together in virtual spaces.

“But it’s not all work and no play,” says Ray. “The Meta Quest Pro headset will be able to pair with Microsoft’s Xbox cloud gaming platform, too.”

Yes, it’s a case of “frenemies” working together. Ray adds: For now, “all the big players in the industry are working to squeeze every bit out of the VR/AR/metaverse space. Google and Apple will soon produce consumer products in the not-too-distant future.

“It’s all part of major changes taking place in tech, changes that will create new markets and big investment opportunities,” Ray closes.

“Virtual reality has been hyped as the next big thing for years… but we are inching toward it finally becoming a technology and market reality. In a few years,” he says, “I might even be talking about how I don’t know how I got through my workday without VR tech — and you might, too.”

[Ray Blanco is Paradigm’s authority on all things related to science and technology, and one small biotech company is currently on his radar. Ray believes an FDA decision might send this tiny stock soaring.

But you don’t have much time — this opportunity expires Friday, Oct. 21 at midnight. Take a moment to view Ray’s interview here; he’ll fill you in on all the details.]

Turning to the market today, the three major U.S. indexes are struggling in the red… The Nasdaq and S&P 500 are both down 1% at 10,585 and 3,660 respectively. The Dow is faring slightly better — down 0.40% to 30,290.

Turning to the market today, the three major U.S. indexes are struggling in the red… The Nasdaq and S&P 500 are both down 1% at 10,585 and 3,660 respectively. The Dow is faring slightly better — down 0.40% to 30,290.

As for commodities, oil has gained 0.65% to $86.10 for a barrel of WTI. Precious metals? Gold is down 1.3% to $1,632.80 per ounce, but silver is up 1.2% to $18.58.

Taking a glance at the crypto market, Bitcoin is down 1% to $19,000, and the same goes for Ethereum at $1,280.

One economic number of note: Factory activity in the mid-Atlantic is contracting for the fourth month in a row. The Philadelphia Fed manufacturing index turned in a negative number for October, -8.7 versus the -5.0 consensus.

And the National Association of Realtors (NAR) reports September existing-home sales in the U.S. slipped 1.5% from August and almost 24% year over year. Meanwhile, the median existing-home sales price increased 8.4% to $384,800 from the same month last year.

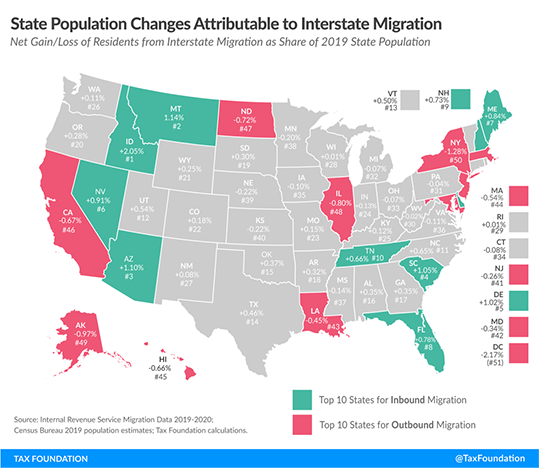

When it comes to interstate migration, which U.S. states have been “winners” and “losers”? According to the Tax Foundation, using 2019–20 IRS data, 29 states saw a net gain of new residents (and taxpayers) while ex-residents peaced out of 21 states, plus D.C.

When it comes to interstate migration, which U.S. states have been “winners” and “losers”? According to the Tax Foundation, using 2019–20 IRS data, 29 states saw a net gain of new residents (and taxpayers) while ex-residents peaced out of 21 states, plus D.C.

And you can easily deduce, just by looking at the map, state taxes played a major role in Americans’ decision to relocate from one state to another…

The top three “inbound” states? Idaho, Montana and Arizona. And of the top 10 states gaining residents, nine “either forgo individual income taxes on wage and salary income, have a flat income tax or are moving to a flat income tax.

“Meanwhile, the states that saw the largest losses of taxpayers with $200,000 or more in [adjusted gross income]… were New York, California, Illinois, Massachusetts and Virginia,” Tax Foundation notes.

“Several of the states losing higher-income taxpayers, especially New York, California and New Jersey, have highly progressive tax codes under which tax liability rises steeply with income.”

The article concludes: “Overall, states with lower taxes and sound tax structures experienced stronger inbound migration than states with higher taxes and more burdensome structures.”

A cease-fire in the war on cash: During a televised interview last week, a Finnish central banker urged Finland’s citizens to keep cash on hand.

A cease-fire in the war on cash: During a televised interview last week, a Finnish central banker urged Finland’s citizens to keep cash on hand.

The head of the Payment Systems Department and chief cashier at the Bank of Finland, Päivi Heikkinen, raised the specter of a nationwide electronic-payments shutdown; in which case, “cash still plays a very important role here,” she says.

If you recall, Finland applied for NATO membership in July. Since then, the country has been the target of several cyberattacks, including one on Aug. 9 that temporarily inactivated the Finnish Parliament’s website. (Russia, much?)

Now, Heikkinen foresees the potential for a cyberattack on Finland’s vital payment systems, which could shut electronic payments down for several weeks. “I don’t want to paint devils on the wall,” she says, “but now we are talking about more serious disruption than what has been brought up in the past.”

Nick Corbishley at Naked Capitalism says: “The irony is that Finland, like its Scandinavian peers, is among the world’s most cashless economies. According to the Bank of Finland, it is on track to become completely cashless by 2030.”

But Heikkinen might be a day late and a euro short…

According to an April Nosto ATM study, one-third of Finns had already withdrawn (or were planning on withdrawing) extra cash because of the war in Ukraine. “That was before Finland applied for NATO membership,” Corbishley emphasizes.

In other words, perhaps something good has come from the Ukraine war…

“The Golden State promises a progressive, environmentally conscious, labor-friendly” — wait for it — “war on weed,” says an article at Reason.

“The Golden State promises a progressive, environmentally conscious, labor-friendly” — wait for it — “war on weed,” says an article at Reason.

“California Attorney General Rob Bonta has announced nearly a million marijuana plants were eradicated in a multiagency 13-week enforcement effort to stop illegal grow operations across the state.”

Not only that, the enforcement program Campaign Against Marijuana Planting (CAMP) — which has operated in the state since 1983 — will continue its annual three-month raids in perpetuity.

CAMP’s data offers an intriguing look into the war on drugs then and now — even after marijuana became fully legal in California in 2016. For instance, in 1984, CAMP destroyed 158,000 marijuana plants. This year? Almost 974,000 plants were destroyed.

“The numbers show that California has both failed to make a dent in illegal marijuana growth during the drug war that launched CAMP, and it has also failed to make a dent in illegal marijuana growth after the drug was made legal.”

In fact, things have gone so poorly for the legal pot business in California — since it was officially sanctioned in 2018 — that the state stepped in with $100 million in subsidies to struggling dispensaries last year. And don’t get us started on taxes, fees and costly licenses.

One final note: Leave it to California to rebrand a drug task force! CAMP will become EPIC — Eradication and Prevention of Illicit Cannabis.

Not even Hollywood could make this stuff up…

“I share the reader’s frustration… about gold being a lousy investment for the average Joe, like me,” says a longtime reader and contributor.

“I share the reader’s frustration… about gold being a lousy investment for the average Joe, like me,” says a longtime reader and contributor.

“I bought my first junk silver coins and silver dollars for a price not much different from today’s, around the time the Hunt bros. tried to corner the silver market. Shortly thereafter I bought precious metal stocks on their way down into a decades-long slump.

“For the past 40-plus years, I have held onto the coins and bought more, but continued to buy and sell the stocks. I have likely lost money on PM stocks. I’ve lost track.

“I still have all of the coins and won’t sell them because they are meant to serve as a lifeline during hyperinflation or currency collapse. History has shown that precious metals preserve wealth over the decades, which requires a patient, long-term viewpoint — and maybe some appreciative heirs.”

The 5: Which brings to mind something Jim Rogers — co-founder of the legendary Quantum Fund — said during pandemic times in 2020: “If I’m right, gold is going to go much, much, much higher before this is over.

“Gold may well turn into a bubble. I hope it doesn’t, because if it turns into a bubble, I’ll have to sell it and I never want to sell it. I want my children to have my gold and silver someday,” he said.

Not a bad legacy, if you ask me… Also, did you read what the Finnish central banker had to say about having cash on hand? Actually, the euro, in Finland’s case. The euro (let that sink in).

And what’s the oldest currency in the world? Better to have gold and silver on hand, just in case.

Have a good one, and we’ll be back tomorrow with more of The 5…

Best regards,

Emily Clancy

The 5 Min. Forecast