- You are here: It’s been a hell of a year

- Ray Blanco’s tech-sector warning (“Be more choosy”)

- James Altucher weathers another crypto winter

- Capitol Hill’s 4,155-page obscenity

- The Deep State… “A normal country in a normal time” *crickets*… And more!

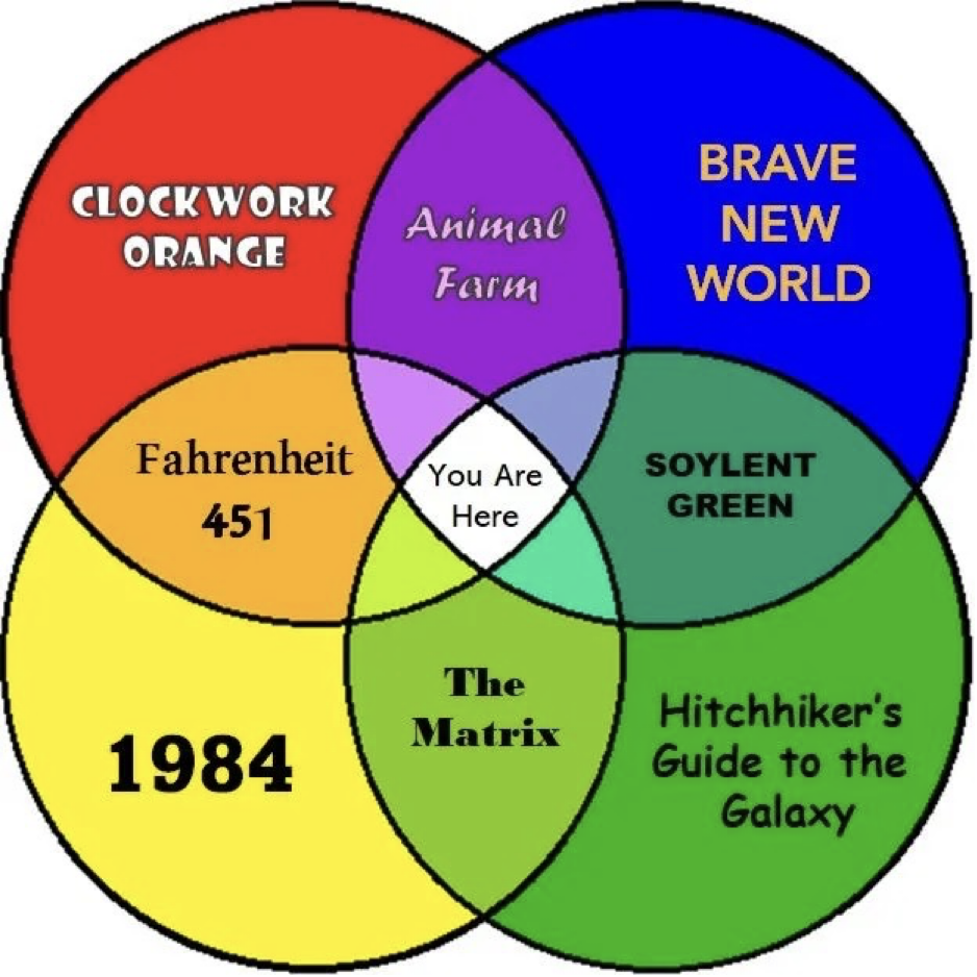

It’s been a hell of a year — even by the standards of George Orwell…

It’s been a hell of a year — even by the standards of George Orwell…

After all, Orwell’s 1984 has stiff competition for the best literary representation of society nowadays…

Anyway, welcome to Day 2 of The 5’s 2022 retrospective — looking back on the Paradigm Press editors’ big calls at the start of the year. Everything is fair game — both the calls they got right and the ones that went awry.

When it comes to technology stocks, “it will pay to be more choosy,” said our tech-and-biotech specialist Ray Blanco on Jan. 4 of this year.

When it comes to technology stocks, “it will pay to be more choosy,” said our tech-and-biotech specialist Ray Blanco on Jan. 4 of this year.

Remember the vibe at the time: The Nasdaq Technology Sector Index leaped 29% in 2021 — outstripping even the Nasdaq Composite’s 21% gain. Work-from-home had made tech seemingly unstoppable.

But Ray entered the year with a much more cautious mindset: “What the Federal Reserve chooses to do in the new year could mute the stock performance of some companies with great prospects but no income.

“That means having a ‘show me’ attitude and sticking with names that are already producing revenues, and not just science projects that will have to wait years to produce their first dollars worth of sales.”

Wise words those were: Celebrity money manager Cathie Wood of Ark Investment Management fame chose to ignore them.

Wise words those were: Celebrity money manager Cathie Wood of Ark Investment Management fame chose to ignore them.

“Cathie Wood’s Ark Investment Management has lost almost $50 billion in assets from its stable of exchange-traded funds since its 2021 peak,” says the Financial Times — citing data from Morningstar.

Wood’s flagship Ark Innovation ETF (ARKK) is down nearly 70% year to date — far worse than the Nasdaq Composite’s loss of about 31%.

“The steep fall highlights how growth investors such as Wood have been wrongfooted this year as the U.S. Federal Reserve and other central banks globally called time on a decade-long period of cheap money with interest rate rises to combat inflation.”

From Ray’s lips to the salmon-colored rag’s ears!

Going into 2022, Ray was keen on electric vehicles as the tech sector with the most potential. Alas, that potential will still take time to manifest.

For any number of reasons, the promise of the Ethereum “Merge” will likely take even more time to manifest.

For any number of reasons, the promise of the Ethereum “Merge” will likely take even more time to manifest.

Going into 2022, our resident crypto evangelist James Altucher couldn’t contain his enthusiasm: “Ethereum will be the next trillion-dollar coin, hitting $100,000 before 2023.”

Unfortunately, checking our screens this morning, Ethereum’s market cap is $142 billion and the price of one coin is under $1,200.

In fairness to James, you don’t get far in the newsletter biz without making big, bold claims. But it can’t be just a lot of arm-waving. Your reasoning has to be airtight. And James made a most compelling case: “There are thousands of potential use cases for Ethereum.

“Decentralized apps (dApps) could run from the Ethereum network. Think: contracts… assets… shareholder agreements… prediction markets… voting systems… domain registries… peer-to-peer finance… derivatives… hedging… insurance… escrows… decentralized online storefronts (censorship-resistant)… smart property… decentralized exchanges… savings accounts… wills… intellectual property… and more.”

All of that potential is still there, even after the Ethereum Merge went through in September.

But another round of “crypto winter” set in during 2022. James has seen his share of them by now — such as the one that started in early 2018.

But another round of “crypto winter” set in during 2022. James has seen his share of them by now — such as the one that started in early 2018.

Crypto prices peaked in late 2021, but the real carnage started last May with the failure of the Terra and Luna stablecoins. That event set off a domino effect that ultimately took down the FTX exchange, exposing an epic fraud still making headlines as we write this morning…

As you might have heard, FTX co-founder Sam Bankman-Fried is back on U.S. soil and has a court date in New York today. His reputed partners in crime — the even more mysterious FTX co-founder Gary Wang and Alameda Research chief Caroline Ellison — have already copped pleas and presumably will get a break on their sentences for narcing on SBF.

[The speed with which all of this is happening makes your editor suspicious about what’s being covered up, although for the moment it’s based on nothing more than intuition…]

In any event, the FTX fiasco has wrecked all manner of trust in the crypto space. Repairing that trust will take years and probably some sort of regulation framework — even though, as we’ve pointed out before, fraud is already illegal.

Once that happens, crypto winter will break and another spring will come.

To the markets… where all of the Dow’s big gains yesterday have vaporized.

To the markets… where all of the Dow’s big gains yesterday have vaporized.

At last check, the Big Board is down more than 500 points or 1.5%, back below 33,000. The S&P 500 is down 2%, clinging to 3,800. The Nasdaq is down nearly 3%, approaching 10,400.

Precious metals are joining in the sell-off, gold back below $1,800 and silver down to $23.60. Crude is steady at $78.30.

Hot money is flowing into bonds, pushing yields down: The yield on a 10-year Treasury note is a hair below 3.67%.

If there’s any catalyst for the selling at all, it’s better-than-expected economic numbers. Weekly jobless claims suggest the labor market remains tight… while the Commerce Department has revised the third-quarter GDP numbers higher.

This is once again the classic good-news-is-bad-news reaction of 2022: Decent economic figures are a signal that the Federal Reserve should keep tapping the monetary brake pedal. Expect this twisted phenomenon to continue into early 2023.

The most eye-opening economic number of the day, however, is the one that wasn’t released as expected.

The most eye-opening economic number of the day, however, is the one that wasn’t released as expected.

We keep a keen eye each month on the Chicago Fed National Activity Index — a composite of 85 economic indicators that’s been a reliable harbinger of recessions going back more than 50 years.

Posted on the Chicago Fed website is this curious notice…

Which data series? And why are they missing?

As with the redacted JFK assassination records, it’s the absence of transparency that gives rise to rumors, founded or unfounded. Just sayin’…

Nor does Wall Street find any joy in the news from Capitol Hill: It appears a “partial government shutdown” will be averted with another backroom back-slapping deal — a 4,155-page obscenity known as an “omnibus funding bill.”

Nor does Wall Street find any joy in the news from Capitol Hill: It appears a “partial government shutdown” will be averted with another backroom back-slapping deal — a 4,155-page obscenity known as an “omnibus funding bill.”

Of course there’s no way your congresscritter will, God forbid, read the bill and know the ramifications of everything in it before nonetheless casting a vote.

“For this reason,” Karl Denninger writes on his Tickerguy blog, “the very premise of such a bill is fraudulent and fraud vitiates all agreements including any obligation of the citizens to follow any law whether that law constrains economic or physical acts.”[Emphasis his.]

[How you choose to act on this circumstance is entirely your call. Heh…]

For the record: The power elite is letting it be known months after the fact that there’s no evidence linking Russia to the attack on the Nord Stream pipelines.

For the record: The power elite is letting it be known months after the fact that there’s no evidence linking Russia to the attack on the Nord Stream pipelines.

As you might recall, several Western leaders and most of the liberal Twittersphere pointed their fingers at Russia at the time of the attack in September.

Now that narrative is being walked back. The Washington Post conducted interviews with 23 diplomats and intelligence officials from nine countries. “There is no evidence at this point that Russia was behind the sabotage,” said one European official.

As we said at the time, Moscow had no motive to attack Nord Stream. What’s more, sabotaging Nord Stream had the effect of also sabotaging any prospect of negotiations between Western governments and Russia — at least until the pipelines could be repaired.

That said, there’s no evidence linking Washington or its allies to the attacks, either. Although we can’t resist sharing the meme again, just because it’s funny…

Meanwhile, for the second day in a row, we see a mainstream article suggesting that U.S. sanctions against Russia are backfiring on the U.S. dollar.

Meanwhile, for the second day in a row, we see a mainstream article suggesting that U.S. sanctions against Russia are backfiring on the U.S. dollar.

Yesterday, it was the U.K. Telegraph suggesting it’s sanctions that are driving global central banks to load up on gold.

Today, it’s Bloomberg Businessweek’s turn…

“No one is saying the greenback will be dethroned anytime soon from its reign as the principal medium of exchange,” Bloomberg avers. “But not too long ago it was almost unthinkable for countries to explore payment mechanisms that bypassed the U.S. currency or the SWIFT network that underpins the global financial system.”

Bloomberg even cites longtime newsletter-industry hand John Mauldin: Weaponizing the dollar and the global payment system “will force non-U.S. investors and nations to diversify their holdings outside of the traditional safe haven of the U.S.”

Here at The 5, we’ve been on the “de-dollarization” beat since the spring of 2014 — when Russian and Chinese officials held informal talks on that very subject — with Russian state media even invoking that term.

Here’s another back issue on the subject from 2018. It’s a story with a long arc. We’ll stay on it into 2023, for sure…

“Thank you all so much,” a reader writes, “for your article about the JFK assassination and the less-than-meets-the-eye files released by the current POS (the T and the U purposely omitted there).

“Thank you all so much,” a reader writes, “for your article about the JFK assassination and the less-than-meets-the-eye files released by the current POS (the T and the U purposely omitted there).

“Even as I laud your efforts, I lament the reason for it. As great as it would be for all the documents to be released… well, I doubt I need to finish that thought.”

The 5: As long as you gave us an “in” to revisit the Deep State once more this week…

In 1995, Sen. Daniel Patrick Moynihan — the New York Democrat who was one of the CIA’s most stalwart defenders during the Cold War — proposed abolishing the agency.

The Cold War was over. There was no longer a need for the CIA, he argued.

“Moynihan’s bill was referred to the Senate Intelligence Committee, where it garnered not a single co-sponsor and died a quiet death,” writes CIA whistleblower John Kiriakou in CovertAction Magazine. “Worse than that, the debate over the appropriateness of even having a CIA has ended.”

We knew nothing of Moynihan’s bill until we read about it this morning. It’s striking how his point of view aligned with that of Jeane Kirkpatrick — Ronald Reagan’s U.N. ambassador. She’s the one who argued at the end of the Cold War that America had best return to being “a normal country in a normal time.”

It’s a matter of considerable historical debate whether JFK ever actually said he wanted to “splinter the CIA in a thousand pieces and scatter it to the winds”… but even if he didn’t, one wonders what a 70-something JFK might have had to say on the subject back in the 1990s, no?

Best regards,

Dave Gonigam

The 5 Min. Forecast

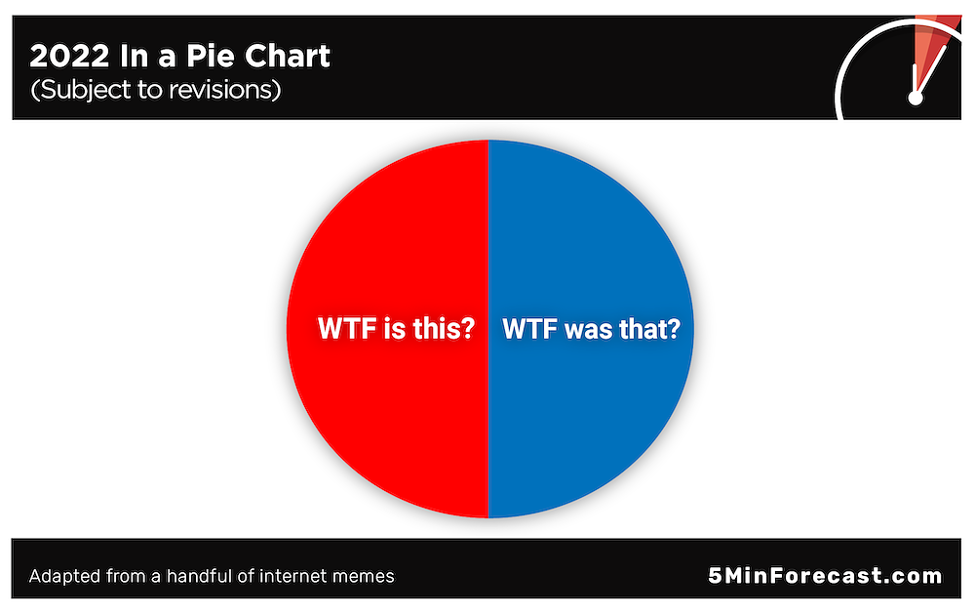

P.S. As we go to virtual press, Sam Bankman-Fried has been released on $250 million bail — which makes for one more data point on our 2022 pie chart from yesterday.

If SBF’s net worth is down from $16 billion to a mere $100,000… where, pray tell, is the money for this bail coming from?

“Bankman-Fried’s parents would put up the equity in their home to partially satisfy bail conditions,” CNBC reports with a straight face. “As part of the release, Bankman-Fried would be released into the custody of his parents’ home.”

We know California real estate values are still sky-high… but come on!

P.P.S. As we mentioned yesterday, Paradigm Press Group and The 5 are going into holiday mode starting tomorrow.

You’ll still get any flash sell alerts as needed from your paid publication(s). The 5, meanwhile, will republish some best-of editions — single-topic deep dives that frequently generate the most passionate reader response.

Starting on Monday, we’ll also bring you The Paradigm Press Holiday Wealth Series — exclusive video briefings from the Paradigm editors, each offering unique insights into his area of specialty. These will arrive in your inbox each day next week at 11:30 a.m. EST.

From me and Emily and the entire Paradigm team, our best wishes to you and your family for happy holidays and a prosperous 2023.