- Davos 2023 gets the Keyser Söze treatment

- WEF agenda: More nefarious than the MSM lets on

- Data reveals China’s twin crises

- What if Tesla is… just a car company?

- Stupid virtue-signaling in WY… Readers on J6 best-of issue: “Your info is not aging well”… FBI “plants”… And more!

It was one of the most surreal emails your editor ever read.

It was one of the most surreal emails your editor ever read.

It should have been quite ordinary, and in a way it was: It was yesterday’s edition of the Financial Times’ daily “FirstFT Americas” email. It began like so…

Good morning and as business leaders and policymakers gather for the first day of the World Economic Forum in the Swiss ski resort of Davos there is a warning that the world’s biggest companies are facing multibillion-dollar write-downs on recent acquisitions.

U.S. media and health care companies are among those to have slashed the value of business units in the past few months, and accountants at valuation service Stout are warning that more cuts could be imminent as the annual reporting season gets underway.

Almost as surreal is the start of a Wall Street Journal article, datelined Davos and posted this morning…

The end of the free-money era has put a chill in the Swiss mountain air.

Business leaders and economists gathered here this week for the World Economic Forum’s annual event say they see the world buffeted by inflation and the high interest rates that central banks have pushed through to combat it — and the threat of recession as those rates choke at least some demand. That is leading some of the world’s biggest companies to hold their breath — and their spending — ahead of an uncertain year.

So the English-speaking world’s leading business dailies are both treating this gathering as just another hobnob of “business leaders,” “policymakers” and “economists.”

It’s as if everything about Davos that’s burst into public consciousness during the last three years… just… never… happened.

It’s as if everything about Davos that’s burst into public consciousness during the last three years… just… never… happened.

In a more innocent time — January 2020, at the last in-person, on-schedule Davos gathering — we could still treat Davos in our virtual pages as an object of gentle mockery. We could smirk at the pecking order of the attendees and sympathize with the locals whose lives were upended every year.

Then came the pandemic and lockdowns… talk of a “Great Reset”… and the emergence of WEF founder Klaus Schwab as a much more visible public figure after publication of his book COVID-19: The Great Reset.

“The world must act jointly and swiftly to revamp all aspects of our societies and economies,” Schwab wrote in June 2020 — “from education to social contracts and working conditions.

“The world must act jointly and swiftly to revamp all aspects of our societies and economies,” Schwab wrote in June 2020 — “from education to social contracts and working conditions.

“Every country, from the United States to China, must participate, and every industry, from oil and gas to tech, must be transformed. In short, we need a ‘Great Reset’ of capitalism.”

A lot of musts in there, right?

But you’d expect nothing less from a bunch of “world improvers, empire builders and do-gooders” — to borrow the memorable term Bill Bonner and Addison Wiggin used in their 2006 book Empire of Debt.

Even the WEF slogan leans into the “world-improving” agenda

[Photo from U.S. Embassy, Bern, Switzerland]

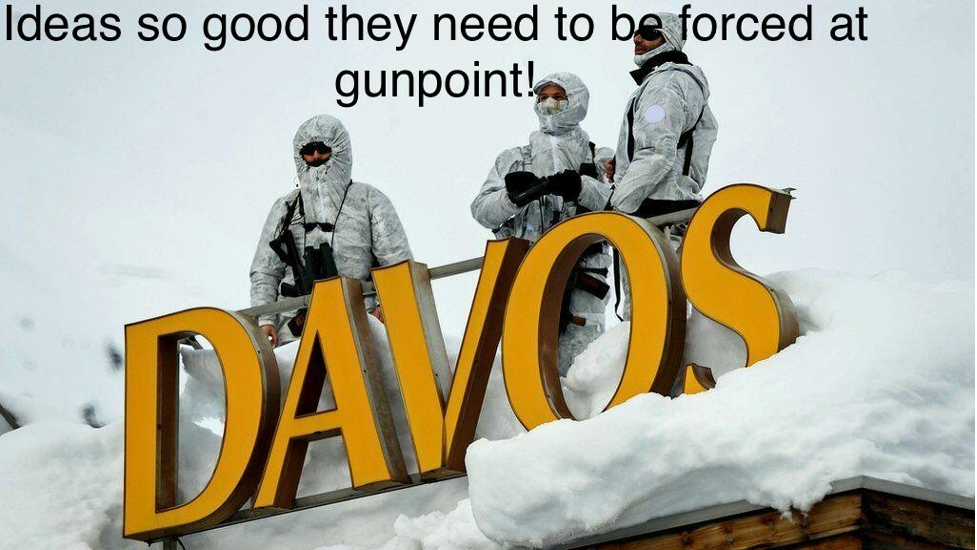

Well, if the FT and the WSJ are determined to whitewash the Great Reset, legions of everyday folks making memes on social media know the score…

Indeed, the Davos 2023 agenda is much more ominous than the financial press is letting on.

Indeed, the Davos 2023 agenda is much more ominous than the financial press is letting on.

And it’s not as if the WEF is being secretive about it: It’s all there in its 98-page Global Risks Report 2023.

Writes WEF managing director Saadia Zahidi: “The analysis focuses on a potential ‘polycrisis,’ relating to shortages in natural resources such as food, water and metals and minerals, illustrating the associated socioeconomic and environmental fallout through a set of potential futures.”

The panoply of risks are spelled out in a survey of “1,200 experts across the World Economic Forum’s diverse network”…

If you’ve been following the work of Paradigm’s Jim Rickards for a long time, you’re already familiar with the concept of a polycrisis. It’s “complexity theory” in action — and on steroids.

Jim’s favorite example is the 2011 Fukushima disaster — the shifting of tectonic plates, the movement of ocean waves, the operation of a nuclear reactor and the action of the Tokyo stock market all cascading in a multifaceted disaster. “What we have with Fukushima are four complex systems, each with an individual cascade, cascading into each other.”

Now imagine a potential global debt/liquidity crisis… cascading into societal polarization and inequality… cascading into natural disasters that the power elite inevitably chalks up to “climate change.”

It’s at this moment we recall the guidance of Obama chief of staff (and current U.S. ambassador to Japan) Rahm Emanuel: Never let a crisis go to waste.

It’s at this moment we recall the guidance of Obama chief of staff (and current U.S. ambassador to Japan) Rahm Emanuel: Never let a crisis go to waste.

The WEF report is short on specific policy remedies… but very, very long on ambition. And jargon.

“Averting tipping points,” it says, “requires a combination of conservation efforts, interventions to transform the food system, accelerated and nature-positive climate mitigation strategies and changes to consumption and production patterns. This involves realigning incentives and upgrading governance structures, fueled by better data and tools to capture the interdependencies of food, climate, energy and ecosystems.” [Emphasis ours.]

The part about “eat ze bugs” is merely implied…

The hubris is breathtaking. As Agora founder Bill Bonner writes at his Bonner Private Research site, this year’s list of attendees “includes the usual public policy jackasses… as well as a large group of people in private industry who have become ‘Davos Men’ and are ready to lead the rest of us to the promised land.

“The problem is that when you look more carefully at the land they are promising, it looks more and more like a prison. It is a prison constructed by true believers, who think they know what is best for us.”

We choose, however, to conclude our main topic today on an optimistic note.

We choose, however, to conclude our main topic today on an optimistic note.

As horrendous as the global restructuring of society was during lockdown… Schwab’s even worse follow-up recommendations from 2020 never really got traction. Certainly not at his recommended speed. (Else I wouldn’t have been able to prepare steaks on a propane grill for my wife and me the other night…)

True, the world improvers will keep trying. But the nature of complex, dynamic systems is such that those systems probably won’t respond to the “inputs” of the world improvers as intended.

Within that fact lie many opportunities to hang onto your wealth and freedom as this decade some call “the flaming twenties” progresses. We at Paradigm Press are committed to identifying those opportunities… and showing you how to exploit them.

The stock market is sliding to start the week — no thanks to Goldman Sachs.

The stock market is sliding to start the week — no thanks to Goldman Sachs.

The vampire squid delivered its quarterly numbers today — and fourth-quarter earnings were hurt by a slowdown in dealmaking. Ditto for Morgan Stanley, the other big investment bank.

As we write, Goldman is down 7.5% on the day. Because GS comprises over 7% of the Dow Industrials, the Big Board is down 1%, back below 34,000. In contrast, the S&P 500 is flat — just a shade below 4,000. Likewise for the Nasdaq, still over 11,000.

➢ Can’t say “No one saw it coming”: Last Thursday in Paradigm’s Countdown to Crisis trading service, Jim Rickards and Dan Amoss recommended Goldman put options.

Precious metals are in the red — gold still holding the line on $1,900 but silver slipping below $24. Crude is back above $80 a barrel.

One minor U.S. data point today: The Empire State Index, surveying factory managers in New York state, collapsed in January. At minus 32.9 the figure is the lowest since lockdown in May 2020.

The bigger economic numbers of the day come from China. GDP grew 3% last year — which by Chinese standards is awful, but that’s what a zero-COVID policy will do.

The bigger economic numbers of the day come from China. GDP grew 3% last year — which by Chinese standards is awful, but that’s what a zero-COVID policy will do.

The real milestone, however, is that China registered a small year-over-year decline in population — the first since 1961. The birth rate is now a record low 6.77 births per 1,000 people.

Many experts say it’s only downhill from here. Our own Jim Rickards projects China’s population will fall from the present 1.4 billion to about 800 million by 2070. Other analysts like author Peter Zeihan have an even more stark projection — 700 million by 2050.

Now the mainstream deigns to ask: “What if Tesla Is… Just a Car Company?”

Now the mainstream deigns to ask: “What if Tesla Is… Just a Car Company?”

“Rather than looking like one of the world’s fast-growing tech giants, which is how it was valued by investors, it now looks more like a car company,” says The Wall Street Journal.

Well, duh. We’ve been saying as much since at least 2019. It just wasn’t trendy to point out back then that making cars is way more capital-intensive than maintaining a search algorithm or hoovering up your personal data to sell to advertisers. Now it’s safe for the mainstream to say so after TSLA’s share price collapsed by nearly two-thirds last year.

Still, we’re not ready to write off Tesla as a zero: In 2020 our former colleague Robert Williams posited that the real value in the company lies in its autonomous-driving technology.

To Bob’s mind, Elon Musk is merely using Tesla cars as leverage to achieve total dominance in driverless tech… in much the same way Jeff Bezos used selling books as leverage to achieve total dominance in online retail.

We still find it a compelling thesis 2½ years later. Not enough to, you know, actually buy TSLA shares — but definitely enough to keep an eye peeled for further developments.

Speaking of electric vehicles… who says liberals have a monopoly on stupid virtue-signaling stunts?

Speaking of electric vehicles… who says liberals have a monopoly on stupid virtue-signaling stunts?

State lawmakers in Wyoming have introduced a bill that would phase out the sale of EVs in the Cowboy State after 2035.

“The proliferation of electric vehicles at the expense of gas-powered vehicles will have deleterious impacts on Wyoming’s communities,” says the text of the bill, “and will be detrimental to Wyoming’s economy and the ability for the country to efficiently engage in commerce.”

Look, we get it: Bans on the sale of gasoline-powered vehicles — California’s kicks in in 2035 — are shortsighted and tyrannical.

But the proper response is not Anything the libs mandate, we’re gonna prohibit DURRRR.

Seriously, what’s wrong with letting people choose for themselves?

Anyway, aside from maybe a few higher-ed types who just want to tool around Laramie, what demand is there for EVs in Wyoming in the first place? And even if demand were off the charts, a ban in the smallest U.S. state by population wouldn’t move the needle.

It’s just a cheap publicity stunt, an attempt to get the names of the bill’s sponsors into the news. And here in our humble little e-letter, we’re not going to accommodate them…

We got a robust response to our best-of edition yesterday — an instant assessment of the 2021 Capitol riot, published the day after it happened.

We got a robust response to our best-of edition yesterday — an instant assessment of the 2021 Capitol riot, published the day after it happened.

“Your info is not aging well again,” says a reader who adds, “Yes, J6 was an organized coup attempt” and the lack of organization speaks only to Donald Trump’s incompetence. [Well then, isn’t that a good thing?]

Another, from the other side of the aisle: “The mob was so ‘ineffectual’ (your words) that it had to be led by the swamp’s favored FBI elite. I’m figuring we will find out that there were that many FBI ‘plants’ already at the Capitol egging on the crowd (e.g. Ray Epps).”

And finally, a reader took me to task at length for my passing remark, “We’ve seen the claims that the cops ‘let them in.’ We’re not persuaded.”

His gist was this: “Dave Gonigam is either trying waaaaay too hard to straddle the fence in order to keep subscriber numbers up on both sides of the political spectrum or he’s just simply ignorant.”

The 5: Can’t cut me any slack for something first published the day after the event? Harsh.

As it happens, last year on the first anniversary of the riot I wrote: “It’s no longer possible to dismiss the notion that the riot was concocted by the feds. Not after the thorough reporting done by Darren Beattie and colleagues at Revolver.news in recent months… If you know anything about the feds’ long history of infiltrating everyone from the Black Panthers to the KKK, you won’t be surprised. But the details are such that you’ll still be shocked.”

“Dave, thanks for the Yes and ELP props,” writes a fellow fan of ’70s prog rock.

“Dave, thanks for the Yes and ELP props,” writes a fellow fan of ’70s prog rock.

“I did a meet and greet in 2003 and all they talked about was NOT tryin’ to shake Steve’s hand. He couldn’t, it would violate his Lloyd’s of London coverage. One of the true fiascos of the fallacious Rolling Stone ‘greatest’ 100 guitarists list is Steve is NOT on it.”

The 5: Amen. My wife and I have exceptionally fond memories of a solo show he performed at the Park West in Chicago — it was either 2000 or 2001.

The amazing thing about Steve Howe is that he makes any project he’s involved with better than it would be otherwise. For instance, after leaving Asia some years earlier, he contributed a few licks to the first John Payne Asia album in 1992. Lo and behold, it didn’t totally suck!

Best regards,

Dave Gonigam

The 5 Min. Forecast