- Suspicious investors line up for AI roller-coaster ride

- Ray Blanco on the real upside of AI

- Can’t fight the Fed (one dinosaur indicator)

- Brazil brokers de-dollarization deal with China

- Free speech sinner or saint?… “The Prudhomme joke” of it all… And more!

It’s just the nature of the times we live in: In the main, we try to kick off our Friday edition on a lighter note, and instead we’re confronted with the following…

It’s just the nature of the times we live in: In the main, we try to kick off our Friday edition on a lighter note, and instead we’re confronted with the following…

Whoda thunk it? “Nuclear-level disaster” discussed under the “Business/Innovation” banner at a major international news outlet!

But that’s where we are with AI now. Stanford University conducted a survey of 327 researchers, all experts in natural language processing — the technology that’s key to the development of chatbots like GPT-4, the latest iteration of ChatGPT.

The upshot is that 73% said AI-made decisions could soon lead to “revolutionary social change” and 36% said they could lead to nuclear-level catastrophe.

Significantly, the survey was released a few days ago, but it was conducted in May and June of last year — well before ChatGPT became an instant cultural phenomenon in December.

Meanwhile, Americans seem far more suspicious of AI than folks in the developing world.

Meanwhile, Americans seem far more suspicious of AI than folks in the developing world.

An IPSOS poll of the general public finds only 35% of Americans agreeing with the proposition that “products and services using AI had more benefits than drawbacks.” That contrasts with 78% of respondents in China, 76% in Saudi Arabia and 71% in India.

But for all those suspicions among Americans, there’s ample interest in AI investments.

But for all those suspicions among Americans, there’s ample interest in AI investments.

There’s maybe a half-dozen buzzy names like C3.ai Inc. — which was first to the post with the desirable ticker symbol AI. They all took off like a rocket with ChatGPT’s release… and they’ve put investors on a roller-coaster ride ever since.

So far, the Paradigm Press editors are playing AI more conservatively.

In Altucher’s Investment Network, James Altucher has recommended one company with a $2.5 billion market cap along with an AI-oriented crypto.

Ray Blanco is playing it even more cautiously in our “PRO” version of Technology Profits Confidential. Ray is on record calling AI “the mother of all innovations,” but he’s not about to suggest putting your precious capital at risk of going to zero in this frenzied atmosphere. (You can learn about his AI strategy right here.)

The upside in AI is real: “As AI tools become faster, more efficient, more powerful and more widely available, more and more companies are going to look to incorporate those tools into their businesses,” Ray says.

The upside in AI is real: “As AI tools become faster, more efficient, more powerful and more widely available, more and more companies are going to look to incorporate those tools into their businesses,” Ray says.

“An AI race has started and some of the household tech names that we all know are at the front, speeding ahead.

“Since generative AI has been one of the most transformative technological advancements in recent years, with the potential to revolutionize virtually every industry, it makes sense that these companies are now in a mad dash to put the tech to use. Companies like Amazon, Microsoft, Google and more have all been launched into an AI race, mainly spurred by ChatGPT.

“The reasons to make the jump toward AI are clear, too,” Ray continues.

“The reasons to make the jump toward AI are clear, too,” Ray continues.

“For starters, efficiency and productivity can both be boosted by AI-powered tools. Simply automating away many routine and time-consuming tasks can free up valuable time and resources for more strategic initiatives.

“As an example, chatbots can handle customer inquiries and support tickets, freeing up customer service representatives to focus on other issues.

“AI can also help streamline supply chain management and improve manufacturing processes, increasing productivity and efficiency.”

Only yesterday, Amazon took a big leap into AI. On the surface it looks like a “me too” thing, but Ray says in reality AMZN is separating itself from the pack.

Only yesterday, Amazon took a big leap into AI. On the surface it looks like a “me too” thing, but Ray says in reality AMZN is separating itself from the pack.

For the moment, Amazon is leaving the consumer segment to the likes of Google and Microsoft. Amazon, through its cloud-computing AWS division, is going after lucrative business customers.

“In addition to new AI tools,” says Ray, “Amazon Web Services is also expanding access to custom-made chips that it claims can run AI software more efficiently and cost-effectively than its competitors.

“With the entire tech industry scrambling to offer AI tools to individual customers, Amazon’s focus on corporate customers could prove to be a lucrative endeavor.”

Nor is Amazon tying itself to any one AI platform — the way Microsoft is all-in on ChatGPT with its $10 billion investment in the chatbot’s creator, OpenAI. “We believe that customers are going to need a lot of different generative AI models for different purposes,” AWS CEO Adam Selipsky tells The Wall Street Journal.

Again, for a glimpse into Ray’s AI investing strategy, give this a look. There’s no long video to watch.

Grrr… This might not be the day gold finally marks a weekly close over $2,000 an ounce.

Grrr… This might not be the day gold finally marks a weekly close over $2,000 an ounce.

The Midas metal was still trading over $2,040 overnight in Hong Kong… but then came the consumer sentiment numbers from the University of Michigan at midmorning on the East Coast.

We loathe this indicator. To compile the index, the U of M uses the telephone to call all of 400 people each month. As we said last year, it’s dinosaur methodology in this day and age.

Still, we can ill afford to ignore the index; our understanding is that the Federal Reserve keys in on the “inflation expectations” part of the survey in deciding interest-rate policy. And the survey respondents expect 4.6% inflation over the next year — up huge from 3.6% last month, presumably because of rising gasoline prices in recent days.

With that, the probability grows of another quarter-point jump in interest rates by the Federal Reserve on May 3… the dollar index has jumped nearly three-quarters of a percent to 101.7… and gold’s been crushed by over 2%. At last check the bid is $1,995. Silver’s also taken a 2%-plus hit, now at $25.23.

The prospect of rising rates is also weighing on the stock market: All the major U.S. indexes are in the red, although the S&P 500 will likely close the week comfortably over 4,100.

The prospect of rising rates is also weighing on the stock market: All the major U.S. indexes are in the red, although the S&P 500 will likely close the week comfortably over 4,100.

Crude has ticked up 56 cents to $82.72; copper is flat at $4.09. Crypto is steady as she goes with Bitcoin still over $30,000.

Other economic data points of interest today…

- Retail sales slumped 1% in March, a result unforeseen by even the most pessimistic among dozens of Wall Street economists. But much of that can be chalked up to falling gasoline prices during March. Factor that out, and factor out volatile automobile sales, and the drop is a more modest 0.3%

- Industrial production jumped 0.4% in March, but that’s misleading: Within that number, manufacturing fell 0.5% and mining/energy production fell 0.5% as well. The overall jump is entirely the result of an 8.4% surge in utility output thanks to the fact March was colder than February in many places.

Another signpost on the road to de-dollarization…

Another signpost on the road to de-dollarization…

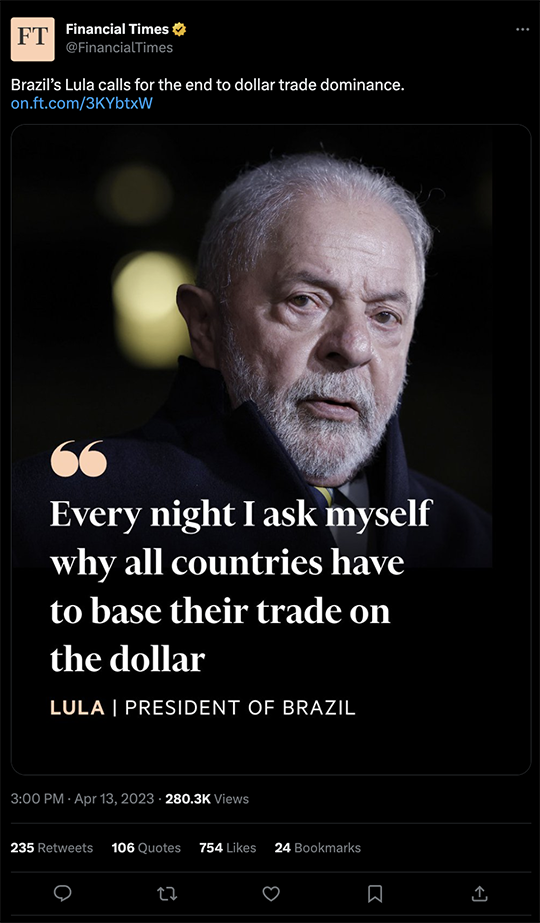

Brazil’s former and once-again current president Luiz Inácio Lula da Silva is on a goodwill trip to China, where he spoke yesterday at the New Development Bank of Shanghai.

“Why can’t we do trade based on our own currencies?” he said, before teeing up a devastating rhetorical question: “Who was it that decided that the dollar was the currency after the disappearance of the gold standard?”

Lula’s visit comes less than three weeks after Brazil and China came to terms on a deal to conduct trade in their own currencies, bypassing the U.S. dollar. China is Brazil’s biggest trade partner and Brazil’s biggest export market.

In August, leaders of all five of the BRICS countries — Brazil, Russia, India, China, South Africa — will meet to scheme on additional ways to get out from under the dollar and the constant threat of U.S. sanctions. If you’re still not up to speed on “de-dollarization” and its implications, you can find our most recent write-ups here and here.

We can’t let the week pass without a definitive answer to the question we posed in December: Is Elon Musk a savior or a fraud?

We can’t let the week pass without a definitive answer to the question we posed in December: Is Elon Musk a savior or a fraud?

Back then, the Twitter Files just started to drop — revealing Twitter’s internal correspondence during the years before Musk bought the company last fall.

The initial release was something of a disappointment. But subsequent releases proved beyond all doubt that three-letter agencies were leaning hard on Twitter management to censor opinions that didn’t meet with official approval.

Still, we were skeptical of Musk’s professed commitment to free speech. We couldn’t shake the qualms we had last winter: Rather than release the documents for all to see, Musk and his minions released them selectively to independent journalist Matt Taibbi and other writers. What’s more, Musk’s companies are highly dependent on the federal government — Tesla for tax breaks, SpaceX for Pentagon/CIA contracts.

In recent days, Musk’s relationship with Taibbi blew up in spectacular fashion.

In recent days, Musk’s relationship with Taibbi blew up in spectacular fashion.

Like many freethinkers who’ve broken away from corporate media in recent years, Taibbi publishes most of his work on the subscription newsletter platform Substack.

A week ago today, Musk decided to block links to Substack sites. Musk apparently was teed off by Substack’s plans to launch a Twitter-like “Substack Notes” venture — something Taibbi wasn’t even aware of until he noticed Twitter wouldn’t let him link to his own Substack pieces.

Musk told Taibbi if he wanted to use Twitter to post links to his articles, well, he could publish the articles on Twitter and launch a subscription plan there. Taibbi, happy with his Substack relationship, politely declined. A petulant Musk told Taibbi he’d chosen to “support a company that wants to kill Twitter.”

And with that, Taibbi’s own tweets about the Twitter Files were taken down…

“Elon somehow came to believe I was scheming to set aside work on the Twitter Files to pursue my real goal, i.e. helping ‘kill Twitter’ by working with a company a tiny fraction of its size to build a social media app I’d never heard of,” Taibbi writes on his Substack. “I’ve done a lot of drugs and can’t remember ever reaching that level of paranoia.”

And the damage to the free-speech cause? Incalculable.

“In doing all this Elon immolated the last remnants of any reputation he had as a free speech advocate… All can now point to his outbursts of cartoon censorship and argue individual eccentric CEOs are the real danger to free expression, not squads of executives working in oligopolistic secrecy with the FBI, DHS and 10 million Pentagon-funded Centers for Securing Whatever.”

In the end, the Twitter Files were just one more plaything for a narcissistic billionaire with the attention span of a gnat. In a few days he’ll move on to his next shiny object. More’s the pity…

[This just in: “Elon Musk Plans Artificial Intelligence Startup to Rival Open AI,” says the Financial Times.]

“Very disappointed in you, Dave,” says a reader email that came in response to yesterday’s mailbag section.

“Very disappointed in you, Dave,” says a reader email that came in response to yesterday’s mailbag section.

“The reader quite correctly called you out on acreage prices in Tennessee. YOU were the one that brought race into the article. And why? No need to. All races and genders are affected.

“You need to man-up, look in the mirror and admit that YOU introduced race into the conversation. The reader was correctly calling you out on that as well. George Carlin would be disappointed in you also.”

The 5: I feel like David Letterman telling “the Prudhomme joke”…

If you don’t have time to watch, here’s the gist: One night in 1985, Letterman told a lame joke and no one got it. So he told it again the next night, and once more it went over like a lead balloon. He ended up telling it every night for two weeks, hoping for a different result, but finally gave up and delivered a painstaking explanation of the “tried-and-true comedy principles” that went into the joke’s creation.

We’re already into Day Three and trust me, I’m not going to drag this out for two weeks. So here goes, for the last time…

We’re already into Day Three and trust me, I’m not going to drag this out for two weeks. So here goes, for the last time…

As you already know, a value shared by most liberals is the prevention of “climate change” — and support for measures that would supposedly mitigate it, such as electric vehicles.

In addition, as you already know, another value shared by most liberals is “diversity, equity and inclusion” — and support for measures that supposedly would correct historical injustices based on skin color.

In the case of the Tennessee electric truck factory, these two values came into conflict.

That is, liberals faced a choice. One of those values would have to be sacrificed to the other. Which would it be?

Well, a third value shared among liberals is a love of tax revenue. Seeing as there’d be beaucoup tax revenue from the electric truck factory, their choice was obvious: The factory would be built and so would the road to the factory even though the road runs through farmland owned by African-American descendants of slaves who would get lowball offers for their property.

I happened to think there was a great deal of irony in this turn of events, and that’s why I chose to begin my writeup thusly: “The state of Tennessee has made its priorities clear: Green energy takes precedence over Black farmers.”

See what I did there? And see how I couldn’t have possibly spotlighted the hypocrisy of liberals in this instance without introducing skin color into the discussion?

Anyway, the original reader wrote in too… but as soon as he called me “a liberal Jew” there was no reason to keep reading.

We’re done with this discussion now. And if I had it to do over again… well, apart from avoiding the original factual error, I wouldn’t have done anything different.

Have a good weekend,

Dave Gonigam

The 5 Min. Forecast