- SEC’s brazen low regard for everyday Americans

- Monthly jobs number: Good news is bad news?

- Social Security’s demise has been postponed

- Taxes… and “common sense” ain’t so common anymore

- Manchin takes a page out of MMT playbook

- “You can’t just make stuff up,” a reader accuses… Another defends a “Las Vegas staple”… And more!

We’ve long known that bureaucrats in Washington have a low regard for the intelligence of everyday Americans… but seldom is their contempt so in-your-face.

We’ve long known that bureaucrats in Washington have a low regard for the intelligence of everyday Americans… but seldom is their contempt so in-your-face.

Seriously — check out this new 30-second public service announcement from the Securities and Exchange Commission. It ran on CNBC Wednesday…

“Sometimes investing may look and feel like a game,” the SEC earnestly explains on its website. “Our ‘Investomania’ public service campaign uses a game show concept to educate investors in a playful way that investing is not a game and that they should do their due diligence when making investment decisions.”

Subtle it’s not: A dorky-looking young dude chooses meme stocks from the gameboard’s assortment of investment choices and gets a pie in the face.

“We’ve been carefully observing the Securities and Exchange Commission for the past 37 years,” write Pam Martens and Russ Martens at the Wall Street On Parade site.

“This is the first time that we have ever witnessed the SEC heaping humiliation on the investing public,” the Martenses declare — “the investing public that it is paid by the taxpayers of America to protect from the scams that it has allowed to proliferate.”

“This is the first time that we have ever witnessed the SEC heaping humiliation on the investing public,” the Martenses declare — “the investing public that it is paid by the taxpayers of America to protect from the scams that it has allowed to proliferate.”

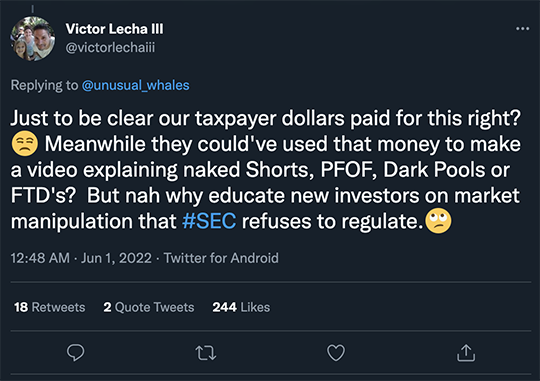

And in the most tone-deaf way imaginable. The “Unusual Whales” Twitter account says the ad “seems to trivialize millions of retail investors, seemingly diminishes one of the most important market movements of 2021 and appears to poke fun at millions of average people joining the market.”

The SEC’s social-media folk seem to know they’ve put their foot in it big-time: The YouTube page where the ad is housed has the comments turned off.

At Ground Zero for the meme-stock movement — Reddit’s WallStreetBets message board — they’re giving back as good as they got.

At Ground Zero for the meme-stock movement — Reddit’s WallStreetBets message board — they’re giving back as good as they got.

As you might recall, it was in early 2021 when WallStreetBets burst on the scene — bidding up the shares of down-and-out firms like GameStop and the AMC theater chain.

Given what we wrote about the phenomenon at the time, the meme-stock bros’ reaction this week is no surprise.

This is a jaded bunch whose formative years were scarred by the 2008 financial crisis and “Great Recession.” Their contempt for Wall Street and its revolving-door regulators knows no bounds. The insulting SEC spot set them over the edge…

It’s at this moment we recall newsletter legend Doug Casey calling the agency the Swindlers Encouragement Commission — heh.

We give the Martenses the last word: “Is the SEC attempting to get out in front of the implosion of these scams by building the narrative that the public should have known better and done their own research? It sure looks that way.”

To the markets — where the monthly job numbers seem to be generating another “good news is bad news” reaction.

To the markets — where the monthly job numbers seem to be generating another “good news is bad news” reaction.

The wonks at the Bureau of Labor Statistics conjured 390,000 new jobs for May. On the big chart from Calculated Risk — depicting the job losses and recoveries from every post-World War II recession — the red line still isn’t back to breakeven. Total employment remains about 440,000 below pre-pandemic levels in February 2020. (Click the chart to embiggen.)

Source: Click to Enlarge

The official unemployment rate held steady at 3.6%. The real-world jobless rate from Shadow Government Statistics — incorporating part-timers who want to work full-time as well as the legions who’ve given up looking for work — ticked up slightly to 24.6%.

But it’s the 390,000 new-job figure that captures the attention of Wall Street and elite media. “Job Growth in U.S. Tops Estimates, Signaling Optimism on Economy,” says Bloomberg. The Financial Times’ take is “U.S. Economy Posts Solid Jobs Growth Despite Tight Labor Market.”

So as happened after a decent job number a month ago, the stock market is selling off — on the theory that “solid jobs growth” will do nothing to deter the Federal Reserve from raising interest rates and shrinking its balance sheet, thus cutting off Wall Street from its EZ-money heroin.

So as happened after a decent job number a month ago, the stock market is selling off — on the theory that “solid jobs growth” will do nothing to deter the Federal Reserve from raising interest rates and shrinking its balance sheet, thus cutting off Wall Street from its EZ-money heroin.

The Dow is holding up best at last check — down 1.1% to 32,883. The S&P 500 is down 1.75%, clinging to the 4,100 level. The Nasdaq is down 2.7% and back below 12,000.

➢ It doesn’t help that Elon Musk fails to see the “optimism on economy” that Bloomberg does. Indeed, he said he has a “super bad feeling” about the economy in an email just fired off to Tesla executives. He ordered them to “pause all global hiring” and suggested payroll needed to be lopped by 10%. Not surprisingly, TSLA shares are down 9% on the day.

Still, at 4,100 the S&P 500 is 200 points above its low on May 20. “We had lower volume on those last four major new lows,” says our floor-trading veteran Alan Knuckman. “That’s bullish, not bearish.”

Bonds are selling off in sympathy with stocks, pushing yields higher. The yield on a 10-year Treasury note is up to nearly 2.96%, the highest in almost three weeks.

Precious metals aren’t getting any love, either: Gold is down to $1,855 and silver’s back below $22. Crypto, you ask? Also selling off — Bitcoin back below $30,000 and Ethereum under $1,800.

For the record: Social Security’s official day of reckoning has been pushed back by a year.

For the record: Social Security’s official day of reckoning has been pushed back by a year.

The Social Security trustees released their annual report yesterday and it says the program’s reserves will be depleted in 2035. At that point, only current revenue would be available to pay benefits — and benefits would have to be cut about 20%.

Last year, the estimated depletion date was 2034. But since then, payroll tax revenue has come in stronger than expected.

It’s at this point we have to remind you the Social Security trust fund is an accounting fiction.

If you’re paying FICA taxes, that money gets dumped into the general fund along with your income taxes, gasoline taxes and everything else. The money gets spent immediately on everything from farm subsidies to fighter jets.

As the former U.S. Comptroller General David Walker said at a conference our firm sponsored in 2010, the trust fund “can’t be trusted, and isn’t funded.” Just so you know…

Because America’s economic mandarins got inflation so catastrophically wrong last year, some folks will have to pay higher income taxes.

Because America’s economic mandarins got inflation so catastrophically wrong last year, some folks will have to pay higher income taxes.

That’s our thought as the week winds down and we ponder Treasury Secretary Janet Yellen’s admission to CNN on Tuesday that “I was wrong about the path that inflation would take.

“There have been unanticipated and large shocks to the economy that have boosted energy and food prices. And supply bottlenecks that affected our economy badly that I didn’t, at the time, fully understand.”

Of course, Yellen is not alone. Over at the Federal Reserve, Jerome Powell insisted from April through November of last year that inflation would prove to be “transitory.”

Which brings us back to Joe Biden’s Op-Ed in The Wall Street Journal this week. While putting most of the onus on the Fed to get inflation back under control, he also said, “We need to keep reducing the federal deficit, which will help ease price pressures.”

Naturally, the president’s idea of deficit reduction entails “common-sense reforms to the tax code.” That is, higher income tax rates on corporations and wealthy individuals.

Naturally, the president’s idea of deficit reduction entails “common-sense reforms to the tax code.” That is, higher income tax rates on corporations and wealthy individuals.

Now you might recall that those higher rates were originally how Biden was going to pay for his $2 trillion “Build Back Better” spend-a-palooza on education, health care and the environment. But that proposal stalled in the 50-50 Senate last year, largely because West Virginia Sen. Joe Manchin wasn’t on board with his fellow Democrats.

However… Manchin is still willing to play ball on higher taxes. He and Senate Majority Leader Chuck Schumer “have held a series of meetings in recent weeks,” says The Wall Street Journal, “on a package focused on lowering prescription drug costs, raising taxes and bolstering energy production in the U.S.” [Emphasis ours.]

Per the Journal, Manchin believes tax increases “could help curb inflation by pulling money out of the economy.”

Manchin doesn’t realize it — he likes to believe he’s a budget hawk like the “Blue Dog Democrats” of days gone by — but this daft notion comes straight out of the Modern Monetary Theory playbook.

Manchin doesn’t realize it — he likes to believe he’s a budget hawk like the “Blue Dog Democrats” of days gone by — but this daft notion comes straight out of the Modern Monetary Theory playbook.

MMT is the school of thought that says there’s no need for limits on government spending as long as the government in question issues its own currency. In addition, MMT doctrine holds that inflation almost never becomes a problem — but in the event it does, the solution is to jack up taxes.

And make no mistake, Manchin takes this tax raising seriously. “There’s a responsibility and opportunity that we can do something,” he said recently — at the World Economic Forum in Davos, Switzerland.

A tax increase isn’t a sure thing, but if it’s going to happen it will be sometime this month or next before Congress goes on summer break and members head home to campaign.

It won’t do a thing to curb inflation, but it’ll make the politicians feel good. And so it goes…

“Boy, what a stretch from condemning Sheryl Sandberg for her performance at Meta to a frontal assault on Harvard Business School,” a reader writes about one of the follow-up items we included in yesterday’s edition.

“Boy, what a stretch from condemning Sheryl Sandberg for her performance at Meta to a frontal assault on Harvard Business School,” a reader writes about one of the follow-up items we included in yesterday’s edition.

“I have no opinion one way or the other about Sandberg, but to place her in the same light as plane crashes and scientific limitations on vaccines is quite the jump.

“If you did your homework, I’m guessing that you might find many examples of HBS graduates who have improved the lives of Americans and the world as well. If you have negative information that you would like to share, just do it, it’s your show. You don’t need to justify your opinion by trashing other people and institutions along the way.”

On another follow-up item, the reader continues: “I couldn’t help noticing the similarity between your comments on the Sussmann acquittal and your belief in the Big Lie. Apparently when the courts and natural reason debunk the conspiracy theories, it must be the deep state.

“Is it even possible that Trump actually lost in 2020 and that there was nothing of any significance for Durham to find? No matter how much you want it to be true, you can’t just make stuff up.

“The major difference here is that when Trump knocked off Hillary Clinton in 2016, as disappointed as the Democrats were, they sucked it up and moved on. She blamed herself, not the election process. The truth shall set you free, try it sometime. You will find it liberating.”

The 5: Did you even read the back issue about Harvard Business School to which we were referring? We’d also recommend the Vanity Fair article by Duff McDonald that was the immediate inspiration for our 2018 write-up.

Meanwhile, we’ve never been into the “Big Lie” thing — as would be clear to anyone paying attention to our writings in November 2020.

Having said that… the Dems absolutely did not “suck it up and move on” after the 2016 loss. The Clinton campaign endorsed a madcap scheme to flip 37 members of the Electoral College committed to Trump. When that didn’t work, and when it was obvious the Trump cabinet wouldn’t sign on to a 25th Amendment gambit, we got 2½ years of Russigate that found zero evidence of “collusion” — after which Hillary Clinton told CBS’ Jane Pauley in 2019, “Trump knows he’s an illegitimate president.”

Meanwhile, her 2016 loss was blamed on everyone except the candidate and her campaign that couldn’t bother to show up in Michigan and Wisconsin. It was the Russians, it was the deplorables, it was the Bernie Bros, it was Susan Sarandon!

And of course it was blamed on social media encouraging “hate speech” and “misinformation” — which is how America spiraled down into our present censorship dystopia.

“Elvis-themed weddings have been a Las Vegas staple for decades,” writes one of our regulars on another recent topic.

“Elvis-themed weddings have been a Las Vegas staple for decades,” writes one of our regulars on another recent topic.

“Banning the use of his likeness in wedding ceremonies at this point – especially when they can’t ban it in the much larger market of stage shows – just smacks of pettiness. I don’t see how Authentic Brands Group is being harmed by it or what they have to gain from banning it.

“But it also seems to me the injunction should be easy to get around. In this context, what’s the difference between a live stage show and a wedding ceremony? The way I see it, it’s still a ‘live performance’. The only differences are the audience is smaller and the performance includes a legal wedding ceremony. The wedding party is paying for the performance, just like a ‘live show’ audience.

“Do the Elvis impersonators in the live stage shows pay a royalty to Authentic Brands? If so, couldn’t the wedding chapels do the same?

“Just a thought… Love The 5!”

The 5: That’d almost certainly be too costly for the little storefront chapels.

Curiously, however, per The Associated Press, “Graceland Wedding Chapel, which performs 6,400 Elvis-themed weddings per year, has not been served a warning yet, according to manager Rod Musum.”

Hmmm…

Have a good weekend,

Dave Gonigam

The 5 Min. Forecast

P.S. As long as someone brought it up, the deep state is not a Trump-era thing. It’s been undermining elected presidents going back 75 years now